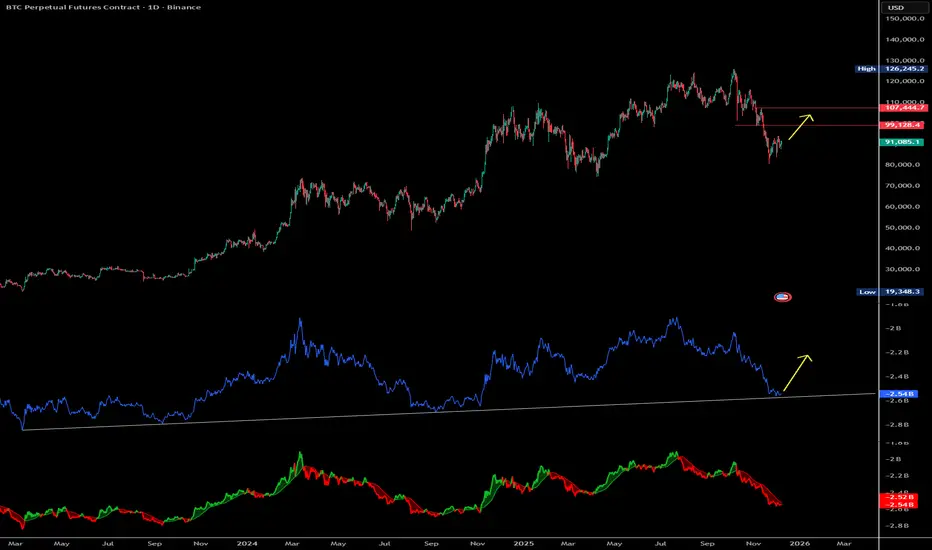

Bitcoin is moving into a critical liquidity window where the market is shifting its expectations aggressively ahead of the upcoming FOMC meeting. When I observe the daily chart, one thing stands out clearly—OBV has taken a clean bounce from a long-term trendline, a level that has historically triggered sharp liquidity expansions. This behaviour usually appears when the market is preparing for a major sweep.

The liquidity pool between 101K and 107K remains heavily loaded, with late shorters entering every minor pullback. These positions are sitting exactly where market makers prefer to hunt liquidity—just above previous local tops. Until this zone is taken out, Bitcoin cannot complete its next structural move. Beyond that, the 110K liquidity pocket still remains untouched and is likely to act as the secondary sweep if bullish pressure accelerates.

However, before that upper-side cleanup, the market still has unfinished business on the downside. Based on the current market structure, I am expecting a potential revisit to the 98–99K region, especially before the Fed meeting concludes in the next 48 hours. This is where deeper liquidity sits and where trapped long positions from last week lie unprotected. A downward wick into this zone can trigger a textbook liquidity grab before price expands upward again.

A lot of traders are aggressively shorting late, expecting immediate breakdowns, but historically, these setups often reverse violently. This is a phase where liquidity hunting overrides sentiment, and price moves not because of narrative, but because of imbalance. Market expectations of rate cuts are extremely high, and before the event, volatility usually compresses and then releases through sharp sweeps on both sides.

Given the OBV trendline reaction, the liquidity pockets above 101K, and the unmitigated zone near 98–99K, Bitcoin is entering a high-probability volatility window. Expect wick-based moves, expect liquidity manipulation, and expect sentiment-driven exaggeration around the Fed announcement. I am treating this as a liquidity event rather than a trend continuation or reversal signal—patience and precision matter more than direction here.

The liquidity pool between 101K and 107K remains heavily loaded, with late shorters entering every minor pullback. These positions are sitting exactly where market makers prefer to hunt liquidity—just above previous local tops. Until this zone is taken out, Bitcoin cannot complete its next structural move. Beyond that, the 110K liquidity pocket still remains untouched and is likely to act as the secondary sweep if bullish pressure accelerates.

However, before that upper-side cleanup, the market still has unfinished business on the downside. Based on the current market structure, I am expecting a potential revisit to the 98–99K region, especially before the Fed meeting concludes in the next 48 hours. This is where deeper liquidity sits and where trapped long positions from last week lie unprotected. A downward wick into this zone can trigger a textbook liquidity grab before price expands upward again.

A lot of traders are aggressively shorting late, expecting immediate breakdowns, but historically, these setups often reverse violently. This is a phase where liquidity hunting overrides sentiment, and price moves not because of narrative, but because of imbalance. Market expectations of rate cuts are extremely high, and before the event, volatility usually compresses and then releases through sharp sweeps on both sides.

Given the OBV trendline reaction, the liquidity pockets above 101K, and the unmitigated zone near 98–99K, Bitcoin is entering a high-probability volatility window. Expect wick-based moves, expect liquidity manipulation, and expect sentiment-driven exaggeration around the Fed announcement. I am treating this as a liquidity event rather than a trend continuation or reversal signal—patience and precision matter more than direction here.

FOLLOW MY TELEGRAM CHANNEL FOR FREE : bit.ly/3JfrpgV

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

FOLLOW MY TELEGRAM CHANNEL FOR FREE : bit.ly/3JfrpgV

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.