⚡ EXC: Massive Hidden Buying in 400K Volume - Bears Trapped

The Market Participant Battle:

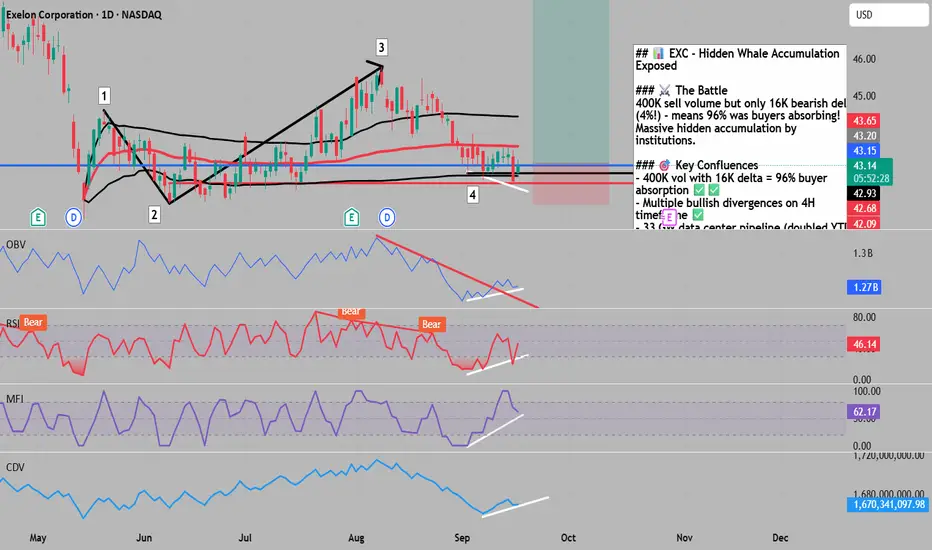

The 4-hour volume footprint reveals an extraordinary deception: Despite 400K volume on the previous massive sell bar, only 16K was actually bearish delta - meaning 384K volume was BUYERS absorbing the selling! This represents one of the most extreme cases of hidden accumulation, where institutional buyers have been aggressively absorbing every attempt to push price lower. The big red bar to the left also shows bullish delta divergence, confirming that what appears as selling is actually massive buying in disguise. Bears who think they're winning are actually being systematically trapped by smart money accumulation.

Confluences:

Confluence 1: Extreme Bullish Delta Divergence (400K vs 16K)

The footprint data exposes the truth: Out of 400K total volume on the major sell bar, only 16K (4%) was actual bearish delta. This means 96% of the volume was buyers stepping in to absorb the selling pressure. This is an extraordinarily rare setup showing massive institutional accumulation disguised as selling. The delta numbers don't lie - buyers are in complete control despite the red candles.

Confluence 2: Multiple Bullish Divergences Across Timeframes

The big red bar to the left shows another bullish delta divergence, confirming this is a systematic pattern of accumulation. Multiple divergences stacking up on the 4-hour timeframe indicate this isn't random - it's coordinated institutional buying at specific price levels. The consistency of these divergences across multiple bars confirms smart money is building a massive position.

Confluence 3: Data Center Mega-Catalyst at Triple Support

Exelon's data center pipeline has exploded to 33 GW (doubled from 17 GW), representing unprecedented growth opportunity. With AI driving insatiable power demand and Exelon positioned in key markets, the company is at the epicenter of a multi-decade growth story. The stock is sitting at crucial support levels while fundamental catalysts are accelerating.

Web Research Findings:

- Technical Analysis: Current sentiment is Neutral with Fear & Greed Index at 39 (Fear), suggesting oversold conditions ripe for reversal

- Recent News/Earnings: Data center pipeline at 33 GW with 17 GW already connected, expecting 10% online by 2028, 33% by 2030, and 75% by 2034

- Analyst Sentiment: 11 Wall Street analysts average target $48.30 (9.80% upside) with high target $52.00, showing strong institutional conviction

- Data Releases & Economic Calendar: Fed expected to cut rates Wednesday, first cut of 2025, with potential for additional cuts given weak labor market

- Interest Rate Impact: Utilities advanced 10% since September 2024 rate cut, trading near record highs as bond proxy investments gain favor

Layman's Summary:

Think of this like watching a tug-of-war where it looks like one side is winning, but secretly the "losing" side is just letting out rope while getting stronger. The volume data shows that when sellers tried to push the stock down with 400,000 shares, buyers absorbed 384,000 of them (96%!). This is like a whale quietly accumulating shares while making it look like selling. The company is seeing explosive growth from AI data centers needing massive power, and the Fed is about to cut rates which historically sends utility stocks higher. Wall Street analysts see 10-20% upside from here.

Machine Derived Information:

- 4H Volume Footprint: 400K volume with only 16K bearish delta (4%) - Significance: Extreme hidden accumulation with 96% buyer absorption - STRONGLY AGREES ✔✔

- Left Red Bar: Shows additional bullish delta divergence - Significance: Confirms systematic accumulation pattern across multiple periods - AGREES ✔

- Delta Totals: Multiple zones showing positive delta on down bars - Significance: Institutional buyers defending every dip aggressively - AGREES ✔

Actionable Machine Summary:

The 4-hour footprint reveals one of the most extreme accumulation patterns possible - massive volume with minimal bearish delta proves institutions are absorbing every share offered. The 96% buyer absorption rate on 400K volume is extraordinarily bullish. Multiple divergences confirm this isn't coincidence but coordinated accumulation. This setup suggests an explosive move higher once selling exhausts and trapped shorts are forced to cover.

Conclusion:

Trade Prediction: SUCCESS

Confidence: Very High

This is an exceptional setup where the volume footprint exposes massive hidden buying that's invisible on regular charts. The 400K volume with only 16K bearish delta is a smoking gun of institutional accumulation. Combined with data center growth catalysts and imminent Fed rate cuts, this creates a perfect storm for upside. The risk/reward is outstanding with such strong buyer support proven by the delta data.

The Market Participant Battle:

The 4-hour volume footprint reveals an extraordinary deception: Despite 400K volume on the previous massive sell bar, only 16K was actually bearish delta - meaning 384K volume was BUYERS absorbing the selling! This represents one of the most extreme cases of hidden accumulation, where institutional buyers have been aggressively absorbing every attempt to push price lower. The big red bar to the left also shows bullish delta divergence, confirming that what appears as selling is actually massive buying in disguise. Bears who think they're winning are actually being systematically trapped by smart money accumulation.

Confluences:

Confluence 1: Extreme Bullish Delta Divergence (400K vs 16K)

The footprint data exposes the truth: Out of 400K total volume on the major sell bar, only 16K (4%) was actual bearish delta. This means 96% of the volume was buyers stepping in to absorb the selling pressure. This is an extraordinarily rare setup showing massive institutional accumulation disguised as selling. The delta numbers don't lie - buyers are in complete control despite the red candles.

Confluence 2: Multiple Bullish Divergences Across Timeframes

The big red bar to the left shows another bullish delta divergence, confirming this is a systematic pattern of accumulation. Multiple divergences stacking up on the 4-hour timeframe indicate this isn't random - it's coordinated institutional buying at specific price levels. The consistency of these divergences across multiple bars confirms smart money is building a massive position.

Confluence 3: Data Center Mega-Catalyst at Triple Support

Exelon's data center pipeline has exploded to 33 GW (doubled from 17 GW), representing unprecedented growth opportunity. With AI driving insatiable power demand and Exelon positioned in key markets, the company is at the epicenter of a multi-decade growth story. The stock is sitting at crucial support levels while fundamental catalysts are accelerating.

Web Research Findings:

- Technical Analysis: Current sentiment is Neutral with Fear & Greed Index at 39 (Fear), suggesting oversold conditions ripe for reversal

- Recent News/Earnings: Data center pipeline at 33 GW with 17 GW already connected, expecting 10% online by 2028, 33% by 2030, and 75% by 2034

- Analyst Sentiment: 11 Wall Street analysts average target $48.30 (9.80% upside) with high target $52.00, showing strong institutional conviction

- Data Releases & Economic Calendar: Fed expected to cut rates Wednesday, first cut of 2025, with potential for additional cuts given weak labor market

- Interest Rate Impact: Utilities advanced 10% since September 2024 rate cut, trading near record highs as bond proxy investments gain favor

Layman's Summary:

Think of this like watching a tug-of-war where it looks like one side is winning, but secretly the "losing" side is just letting out rope while getting stronger. The volume data shows that when sellers tried to push the stock down with 400,000 shares, buyers absorbed 384,000 of them (96%!). This is like a whale quietly accumulating shares while making it look like selling. The company is seeing explosive growth from AI data centers needing massive power, and the Fed is about to cut rates which historically sends utility stocks higher. Wall Street analysts see 10-20% upside from here.

Machine Derived Information:

- 4H Volume Footprint: 400K volume with only 16K bearish delta (4%) - Significance: Extreme hidden accumulation with 96% buyer absorption - STRONGLY AGREES ✔✔

- Left Red Bar: Shows additional bullish delta divergence - Significance: Confirms systematic accumulation pattern across multiple periods - AGREES ✔

- Delta Totals: Multiple zones showing positive delta on down bars - Significance: Institutional buyers defending every dip aggressively - AGREES ✔

Actionable Machine Summary:

The 4-hour footprint reveals one of the most extreme accumulation patterns possible - massive volume with minimal bearish delta proves institutions are absorbing every share offered. The 96% buyer absorption rate on 400K volume is extraordinarily bullish. Multiple divergences confirm this isn't coincidence but coordinated accumulation. This setup suggests an explosive move higher once selling exhausts and trapped shorts are forced to cover.

Conclusion:

Trade Prediction: SUCCESS

Confidence: Very High

This is an exceptional setup where the volume footprint exposes massive hidden buying that's invisible on regular charts. The 400K volume with only 16K bearish delta is a smoking gun of institutional accumulation. Combined with data center growth catalysts and imminent Fed rate cuts, this creates a perfect storm for upside. The risk/reward is outstanding with such strong buyer support proven by the delta data.

for trading mentorship and community, message me on telegram : jacesabr_real

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

for trading mentorship and community, message me on telegram : jacesabr_real

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.