Chart Analysis and Observations

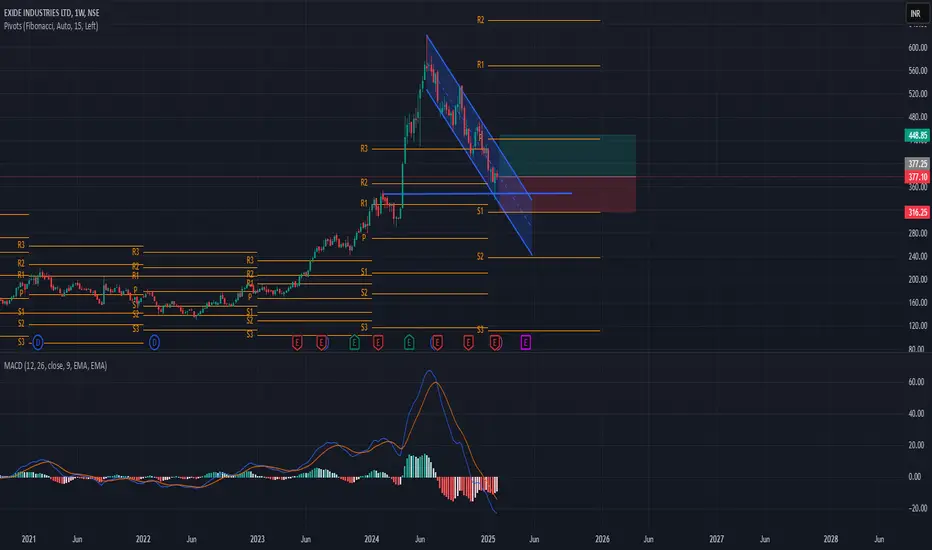

Descending Channel Pattern:

The price is trending downward within a clearly defined descending channel.

The lower highs and lower lows indicate sustained bearish momentum, with immediate resistance forming along the upper boundary of the channel.

Support and Resistance Levels (Pivot Points):

Immediate Support: ₹348 (S1 level, acting as a crucial defense zone).3

Major Support: ₹316 (S2 level and psychological support).

Immediate Resistance: ₹448 (R1 level and Fibonacci resistance).

Major Resistance: ₹488 (top of the descending channel).

MACD Analysis:

The MACD is in negative territory, with the MACD line below the signal line, confirming bearish momentum.

However, the histogram shows signs of reducing bearish pressure, indicating a potential trend reversal or consolidation phase.

Fibonacci Levels:

Fibonacci pivot levels align well with the major support and resistance zones, giving traders additional confidence in entry and exit points.

The stock is hovering near ₹377, close to the S1 level, where a bounce might occur.

Potential Trading Setups

Bullish Reversal Scenario:

If the stock manages to break out of the descending channel and close above ₹448, it could target the ₹488 level in the short term.

Entry Point: ₹380–₹390 (after confirming a bounce).

Stop-Loss: ₹348.

Target 1: ₹448.

Target 2: ₹488.

Risk-Reward Ratio: Favorable if volume supports the breakout.

Bearish Continuation Scenario:

A breakdown below ₹348 would signal further downside, with the next target at ₹316.

Entry Point: ₹345–₹350 (after confirming breakdown).

Stop-Loss: ₹370.

Target 1: ₹316.

Risk-Reward Ratio: Moderate, given the proximity to strong support.

Key Takeaways

Short-Term Outlook:

The stock remains in a bearish zone unless it breaks out of the descending channel. The ₹348 level is critical, and a break below it could trigger further downside.

Long-Term Outlook:

The overall trend for Exide Industries remains weak, but signs of decreasing bearish momentum suggest that a reversal might be on the horizon.

Trading Strategy:

Range-bound strategies can work well while the stock remains in the channel.

Wait for a breakout or breakdown for directional moves.

Conclusion

Exide Industries is at a pivotal juncture, with critical levels to watch at ₹348 and ₹448. Traders should closely monitor price action and volume for signs of a breakout or breakdown. While the bearish trend dominates, reduced momentum indicates potential reversal opportunities for long-term investors. Use proper risk management to navigate the current volatility effectively.

Descending Channel Pattern:

The price is trending downward within a clearly defined descending channel.

The lower highs and lower lows indicate sustained bearish momentum, with immediate resistance forming along the upper boundary of the channel.

Support and Resistance Levels (Pivot Points):

Immediate Support: ₹348 (S1 level, acting as a crucial defense zone).3

Major Support: ₹316 (S2 level and psychological support).

Immediate Resistance: ₹448 (R1 level and Fibonacci resistance).

Major Resistance: ₹488 (top of the descending channel).

MACD Analysis:

The MACD is in negative territory, with the MACD line below the signal line, confirming bearish momentum.

However, the histogram shows signs of reducing bearish pressure, indicating a potential trend reversal or consolidation phase.

Fibonacci Levels:

Fibonacci pivot levels align well with the major support and resistance zones, giving traders additional confidence in entry and exit points.

The stock is hovering near ₹377, close to the S1 level, where a bounce might occur.

Potential Trading Setups

Bullish Reversal Scenario:

If the stock manages to break out of the descending channel and close above ₹448, it could target the ₹488 level in the short term.

Entry Point: ₹380–₹390 (after confirming a bounce).

Stop-Loss: ₹348.

Target 1: ₹448.

Target 2: ₹488.

Risk-Reward Ratio: Favorable if volume supports the breakout.

Bearish Continuation Scenario:

A breakdown below ₹348 would signal further downside, with the next target at ₹316.

Entry Point: ₹345–₹350 (after confirming breakdown).

Stop-Loss: ₹370.

Target 1: ₹316.

Risk-Reward Ratio: Moderate, given the proximity to strong support.

Key Takeaways

Short-Term Outlook:

The stock remains in a bearish zone unless it breaks out of the descending channel. The ₹348 level is critical, and a break below it could trigger further downside.

Long-Term Outlook:

The overall trend for Exide Industries remains weak, but signs of decreasing bearish momentum suggest that a reversal might be on the horizon.

Trading Strategy:

Range-bound strategies can work well while the stock remains in the channel.

Wait for a breakout or breakdown for directional moves.

Conclusion

Exide Industries is at a pivotal juncture, with critical levels to watch at ₹348 and ₹448. Traders should closely monitor price action and volume for signs of a breakout or breakdown. While the bearish trend dominates, reduced momentum indicates potential reversal opportunities for long-term investors. Use proper risk management to navigate the current volatility effectively.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.