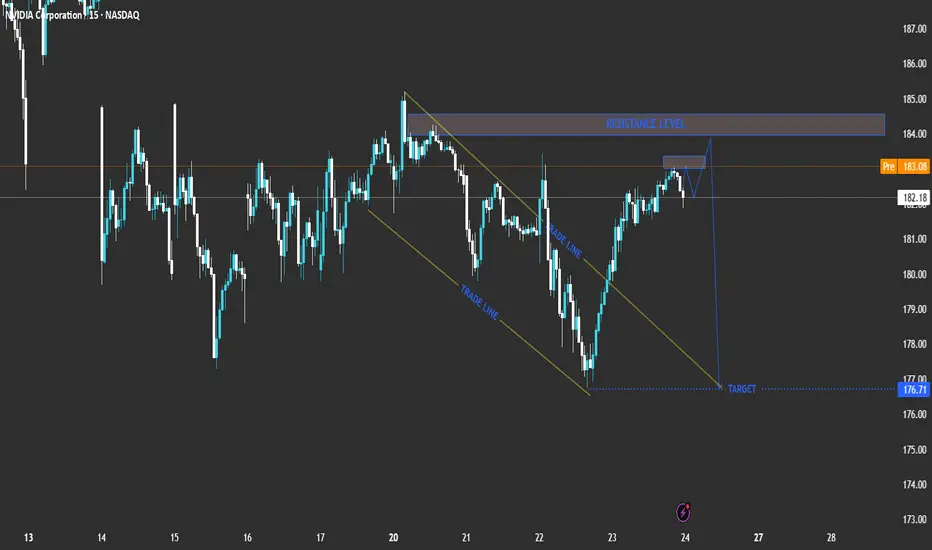

Current Price: 182.18

Pre-Market Price: 183.21

Trend: Short-term bullish recovery inside a broader corrective phase.

Technical Breakdown

Descending Channel (Trade Line)

NVDA recently traded inside a downward-sloping channel, showing controlled selling pressure.

The breakout above the upper trade line suggests a short-term bullish correction phase.

Resistance Zone

A strong resistance level lies between 183.00 and 184.00.

This zone aligns with previous highs and may act as a reversal area if the price fails to break above it.

Expected Move

The chart projection shows a potential rejection near the resistance level, followed by a pullback towards the 176.71 target area.

This indicates that the current upward move might be corrective before another bearish swing.

Trade Scenarios

📉 Bearish Reversal Scenario (Primary Setup)

Entry Zone: 183.00 – 184.00 (resistance area)

Confirmation: Bearish rejection candlestick pattern or a failed breakout.

Target: 176.71

Stop Loss: Above 184.50

Comment: Ideal short setup if price rejects resistance.

📈 Bullish Breakout Scenario (Alternative)

Entry: Above 184.50 with strong bullish momentum.

Target: 186.50 – 187.00

Comment: A breakout and hold above resistance would invalidate the short setup and indicate further upside.

Summary Table

Bias Key Level Confirmation Target Notes

Bearish (Primary) 183 – 184 Rejection candle 176.71 Short setup

Bullish (Alternative) Above 184.50 Breakout candle 186.5 – 187 Upside continuation

Conclusion

NVIDIA (NVDA) is approaching a crucial resistance level. The most probable scenario is a bearish reversal from the 183–184 zone, targeting 176.71. However, a confirmed breakout above 184.50 would signal bullish continuation toward 187.00. KBCA

KBCA  UMI

UMI  AZE

AZE  KBC

KBC  ABI

ABI  GBLB

GBLB  LOTB

LOTB  NYXH

NYXH  PROX

PROX  SIP

SIP  ABO

ABO  AGFB

AGFB  SAP

SAP  NSE

NSE  CON

CON  HCL

HCL  BREA

BREA

Pre-Market Price: 183.21

Trend: Short-term bullish recovery inside a broader corrective phase.

Technical Breakdown

Descending Channel (Trade Line)

NVDA recently traded inside a downward-sloping channel, showing controlled selling pressure.

The breakout above the upper trade line suggests a short-term bullish correction phase.

Resistance Zone

A strong resistance level lies between 183.00 and 184.00.

This zone aligns with previous highs and may act as a reversal area if the price fails to break above it.

Expected Move

The chart projection shows a potential rejection near the resistance level, followed by a pullback towards the 176.71 target area.

This indicates that the current upward move might be corrective before another bearish swing.

Trade Scenarios

📉 Bearish Reversal Scenario (Primary Setup)

Entry Zone: 183.00 – 184.00 (resistance area)

Confirmation: Bearish rejection candlestick pattern or a failed breakout.

Target: 176.71

Stop Loss: Above 184.50

Comment: Ideal short setup if price rejects resistance.

📈 Bullish Breakout Scenario (Alternative)

Entry: Above 184.50 with strong bullish momentum.

Target: 186.50 – 187.00

Comment: A breakout and hold above resistance would invalidate the short setup and indicate further upside.

Summary Table

Bias Key Level Confirmation Target Notes

Bearish (Primary) 183 – 184 Rejection candle 176.71 Short setup

Bullish (Alternative) Above 184.50 Breakout candle 186.5 – 187 Upside continuation

Conclusion

NVIDIA (NVDA) is approaching a crucial resistance level. The most probable scenario is a bearish reversal from the 183–184 zone, targeting 176.71. However, a confirmed breakout above 184.50 would signal bullish continuation toward 187.00.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.