QQQ QuantSignals V3 0DTE 2025-11-01

QQQ 0DTE Signal | 2025-11-01

• Direction: BUY PUTS | Confidence: 65%

• Expiry: 2025-11-03 (same-day)

• Strike Focus: $626.00

• Entry Range: $4.60

• Target 1: $9.00

• Stop Loss: $2.25

• Gamma Risk: Low

• Flow Intel: Bearish (High P/C Ratio) | PCR 3.95

• Price vs VWAP: -0.16%

• ⚠️ MODERATE RISK WARNING: Consider reducing position size due to moderate confidence level.

⚖️ Compliance: Educational 0DTE commentary for QS Premium. Not financial advice.

🎯 TRADE RECOMMENDATION

Direction: BUY PUTS

Confidence: 65%

Conviction Level: MEDIUM

🧠 ANALYSIS SUMMARY

Katy AI Signal: NEUTRAL with 50% confidence - The AI shows no clear directional bias, making this a cautious play based on secondary indicators rather than strong AI conviction.

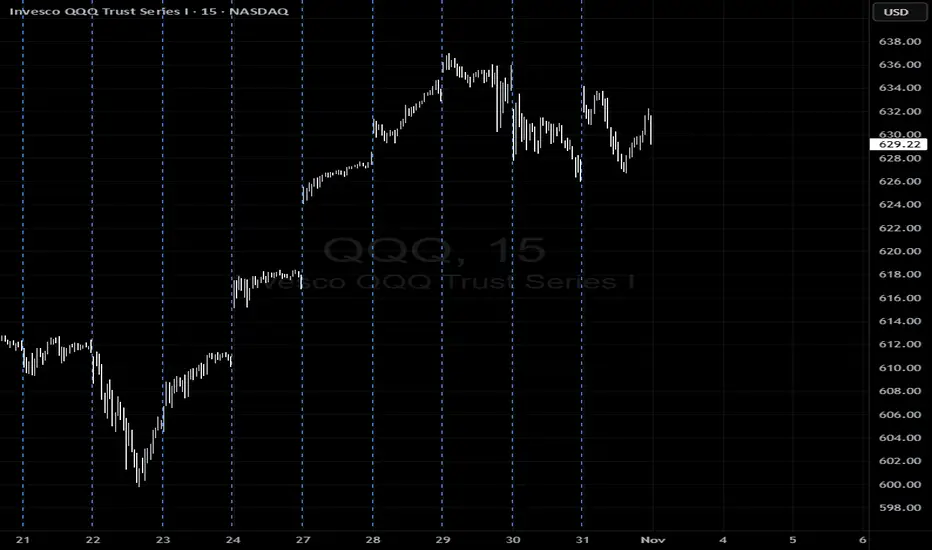

Technical Analysis: Price at $629.05 is below VWAP ($630.07, -0.16%), session change down -0.46%, and trading in a tight range ($626.69-$633.75). Low volume (0.0x average) suggests weak participation, potentially unreliable signals. BREAKOUT SETUP detected could lead to explosive move.

News Sentiment: Mixed but leaning positive with Nasdaq 100 rebound, Amazon up 10% on earnings, and Wall Street entering strongest month historically. However, these are background catalysts (27+ hours old) with limited immediate impact.

Options Flow: STRONGLY BEARISH - Put/Call Ratio of 3.95 indicates heavy put buying, unusual activity at $654 put strike. Max pain at $620.00 (-1.4% from spot) suggests downward pressure. Gamma risk low, allowing for cleaner moves.

Risk Level: MODERATE-HIGH - Katy AI neutrality combined with low volume creates uncertainty. Strong put flow provides counterbalance to mildly positive news backdrop.

💰 TRADE SETUP

Expiry Date: 2025-11-03

Recommended Strike: $626.00

Entry Price: $4.50 - $4.70

Target 1: $9.00 (100% gain from entry)

Target 2: $13.50 (200% gain from entry)

Stop Loss: $2.25 (50% loss from entry)

Image

QS Analyst

APP

— Yesterday at 8:47 PM

Position Size: 2% of portfolio

⚡ COMPETITIVE EDGE

Why This Trade: Strong institutional put flow (PCR 3.95) outweighs Katy's neutral signal, providing edge against retail sentiment. Max pain at $620 suggests gravitational pull downward.

Timing Advantage: Afternoon session (1:30-4:00 ET) offers gamma ramp opportunities with tight stops. Current price below VWAP supports bearish momentum continuation.

Risk Mitigation: Conservative delta selection (-0.4 to -0.5 range), tight 50% stop loss, and small position size compensate for Katy AI's lack of directional conviction.

🚨 IMPORTANT NOTES

⚠️ Katy AI shows NEUTRAL 50% confidence - this trade relies heavily on options flow analysis rather than primary AI signal

⚠️ Low volume (0.0x average) may lead to erratic price action and false breakouts

⚠️ Recent positive earnings news (Amazon +10%) could create counter-trend rallies

⚠️ Monitor VIX (17.44, rising) for volatility spikes that could impact option pricing

📊 TRADE DETAILS 📊

🎯 Instrument: QQQ

🔀 Direction: PUT (SHORT)

🎯 Strike: 626.00

💵 Entry Price: 4.60

🎯 Profit Target: 9.00

🛑 Stop Loss: 2.25

📅 Expiry: 2025-11-03

📏 Size: 2.0

📈 Confidence: 65%

⏰ Entry Timing: N/A

🕒 Signal Time: 2025-11-01 23:47:35 EDT

⚠️ MODERATE RISK WARNING: Consider reducing position size due to moderate confidence level.

QQQ 0DTE Signal | 2025-11-01

• Direction: BUY PUTS | Confidence: 65%

• Expiry: 2025-11-03 (same-day)

• Strike Focus: $626.00

• Entry Range: $4.60

• Target 1: $9.00

• Stop Loss: $2.25

• Gamma Risk: Low

• Flow Intel: Bearish (High P/C Ratio) | PCR 3.95

• Price vs VWAP: -0.16%

• ⚠️ MODERATE RISK WARNING: Consider reducing position size due to moderate confidence level.

⚖️ Compliance: Educational 0DTE commentary for QS Premium. Not financial advice.

🎯 TRADE RECOMMENDATION

Direction: BUY PUTS

Confidence: 65%

Conviction Level: MEDIUM

🧠 ANALYSIS SUMMARY

Katy AI Signal: NEUTRAL with 50% confidence - The AI shows no clear directional bias, making this a cautious play based on secondary indicators rather than strong AI conviction.

Technical Analysis: Price at $629.05 is below VWAP ($630.07, -0.16%), session change down -0.46%, and trading in a tight range ($626.69-$633.75). Low volume (0.0x average) suggests weak participation, potentially unreliable signals. BREAKOUT SETUP detected could lead to explosive move.

News Sentiment: Mixed but leaning positive with Nasdaq 100 rebound, Amazon up 10% on earnings, and Wall Street entering strongest month historically. However, these are background catalysts (27+ hours old) with limited immediate impact.

Options Flow: STRONGLY BEARISH - Put/Call Ratio of 3.95 indicates heavy put buying, unusual activity at $654 put strike. Max pain at $620.00 (-1.4% from spot) suggests downward pressure. Gamma risk low, allowing for cleaner moves.

Risk Level: MODERATE-HIGH - Katy AI neutrality combined with low volume creates uncertainty. Strong put flow provides counterbalance to mildly positive news backdrop.

💰 TRADE SETUP

Expiry Date: 2025-11-03

Recommended Strike: $626.00

Entry Price: $4.50 - $4.70

Target 1: $9.00 (100% gain from entry)

Target 2: $13.50 (200% gain from entry)

Stop Loss: $2.25 (50% loss from entry)

Image

QS Analyst

APP

— Yesterday at 8:47 PM

Position Size: 2% of portfolio

⚡ COMPETITIVE EDGE

Why This Trade: Strong institutional put flow (PCR 3.95) outweighs Katy's neutral signal, providing edge against retail sentiment. Max pain at $620 suggests gravitational pull downward.

Timing Advantage: Afternoon session (1:30-4:00 ET) offers gamma ramp opportunities with tight stops. Current price below VWAP supports bearish momentum continuation.

Risk Mitigation: Conservative delta selection (-0.4 to -0.5 range), tight 50% stop loss, and small position size compensate for Katy AI's lack of directional conviction.

🚨 IMPORTANT NOTES

⚠️ Katy AI shows NEUTRAL 50% confidence - this trade relies heavily on options flow analysis rather than primary AI signal

⚠️ Low volume (0.0x average) may lead to erratic price action and false breakouts

⚠️ Recent positive earnings news (Amazon +10%) could create counter-trend rallies

⚠️ Monitor VIX (17.44, rising) for volatility spikes that could impact option pricing

📊 TRADE DETAILS 📊

🎯 Instrument: QQQ

🔀 Direction: PUT (SHORT)

🎯 Strike: 626.00

💵 Entry Price: 4.60

🎯 Profit Target: 9.00

🛑 Stop Loss: 2.25

📅 Expiry: 2025-11-03

📏 Size: 2.0

📈 Confidence: 65%

⏰ Entry Timing: N/A

🕒 Signal Time: 2025-11-01 23:47:35 EDT

⚠️ MODERATE RISK WARNING: Consider reducing position size due to moderate confidence level.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.