📊 SENSEX TRADING PLAN — 03 DEC 2025

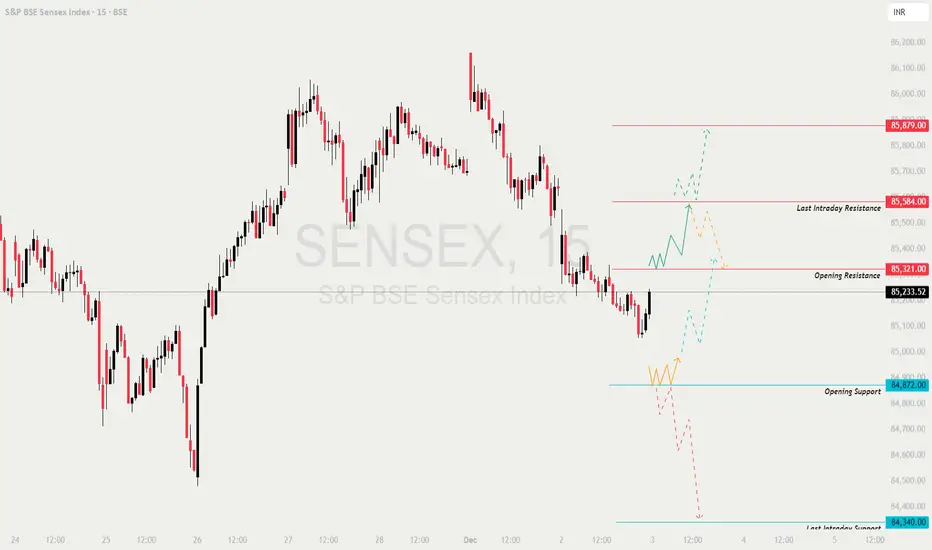

Sensex closed near 85,233, right below the Opening Resistance (85,321).

The structure shows a base at 84,872 and intraday resistance at 85,584, with clear upside and downside liquidity zones.

The opening trend will depend on how the index behaves around 85,321 and 84,872.

🔍 KEY MARKET LEVELS

🟥 Opening Resistance: 85,321

🟥 Last Intraday Resistance: 85,584

🟥 Major Bull Target: 85,879

🟩 Opening Support: 84,872

🟩 Last Intraday Support: 84,340

🟩 Major Bear Target: 84,150 – 84,050

🟢 SCENARIO 1 — GAP-UP OPENING (300+ POINTS)

Expected opening: 85,500–85,600 region (inside or near last intraday resistance)

📘 Educational Insight:

Gap-ups into major resistance are high-risk for longs.

Always wait for either a clean breakout or a clear rejection before acting.

🟧 SCENARIO 2 — FLAT OPENING (Around 85,200–85,300)

Price will open exactly near the Opening Resistance (85,321) — a decision zone.

💡 Educational Note:

Flat openings require patience.

Trend becomes clear after the first 3–4 candles—avoid impulse trades.

🔻 SCENARIO 3 — GAP-DOWN OPENING (300+ POINTS)

Expected opening: 84,800–84,900 zone (near Opening Support)

📘 Educational Note:

Gap-downs into strong support often generate false breakdowns.

Let the retest after the first breakdown decide the direction.

💼 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS 📘⚠️

💡 Pro Tip:

When market enters a “No Trade Zone”, shift focus from trading to observing liquidity behaviour.

📌 SUMMARY

Bullish Above:

✔️ 85,321 → 85,420 → 85,500 → 85,584 → 85,879

Bearish Below:

✔️ 85,150 → 84,990 → 84,872 → 84,600 → 84,340 → 84,150

Critical Zones:

🟥 Major Resistance → 85,584

🟩 Major Support → 84,872, 84,340

Trend Deciders:

🔑 Above 85,321 → Bullish day

🔑 Below 84,872 → Intraday weakness

🔑 Below 84,340 → Trend breakdown

🧾 CONCLUSION

Sensex is at a crucial turning point.

The market tone for 03-Dec will be set by how price behaves around:

✔️ 85,321 on the upside

✔️ 84,872 on the downside

Follow levels, not emotions.

Avoid trades in indecisive ranges and strike only on confirmed breakouts or clean retests.

⚠️ DISCLAIMER

I am not a SEBI-registered analyst.

This analysis is for educational and study purposes only.

Consult a certified financial advisor before investing or trading.

Sensex closed near 85,233, right below the Opening Resistance (85,321).

The structure shows a base at 84,872 and intraday resistance at 85,584, with clear upside and downside liquidity zones.

The opening trend will depend on how the index behaves around 85,321 and 84,872.

🔍 KEY MARKET LEVELS

🟥 Opening Resistance: 85,321

🟥 Last Intraday Resistance: 85,584

🟥 Major Bull Target: 85,879

🟩 Opening Support: 84,872

🟩 Last Intraday Support: 84,340

🟩 Major Bear Target: 84,150 – 84,050

🟢 SCENARIO 1 — GAP-UP OPENING (300+ POINTS)

Expected opening: 85,500–85,600 region (inside or near last intraday resistance)

- []If the market opens above 85,500, it will directly test the 85,584 resistance (supply zone).

[]For long continuation:

✔️ Break above 85,584

✔️ Retest candle with a strong lower wick

🎯 Targets → 85,720 → 85,879

[]If candles show rejection at 85,584 (upper wicks, volume drop):

Expect profit-booking toward:

➡️ 85,450 → 85,321

[]Aggressive short traders may fade the rejection from 85,584, but only with confirmation such as lower highs on 3–5 min charts.

📘 Educational Insight:

Gap-ups into major resistance are high-risk for longs.

Always wait for either a clean breakout or a clear rejection before acting.

🟧 SCENARIO 2 — FLAT OPENING (Around 85,200–85,300)

Price will open exactly near the Opening Resistance (85,321) — a decision zone.

- []Upside trigger for long trades:

✔️ Break + sustain above 85,321

🎯 Targets → 85,420 → 85,500 → 85,584

[]Downside trigger for shorts:

✔️ Break below 85,150

🎯 Targets → 84,990 → 84,872

[]Avoid taking positions inside a tight range around 85,200–85,321 until a clear directional candle closes.

[]Most reliable setups:

— Retest of 85,321 for longs

— Retest of 85,150 breakdown for shorts

💡 Educational Note:

Flat openings require patience.

Trend becomes clear after the first 3–4 candles—avoid impulse trades.

🔻 SCENARIO 3 — GAP-DOWN OPENING (300+ POINTS)

Expected opening: 84,800–84,900 zone (near Opening Support)

- []If price holds 84,872, expect a reversal bounce toward:

➡️ 85,050 → 85,150 → 85,321

[]For safe long reversal entries:

✔️ Support respected for 3–4 candles

✔️ Higher low structure

✔️ Bullish reversal wick at support

[]If breakdown occurs below 84,872 with strength:

Sellers will target → 84,600 → 84,480 → 84,340

[]Major breakdown trigger:

✔️ Sustained trade below 84,340

🎯 Targets → 84,150 → 84,050

📘 Educational Note:

Gap-downs into strong support often generate false breakdowns.

Let the retest after the first breakdown decide the direction.

💼 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS 📘⚠️

- []Trade only after the first 5–10 minutes to avoid trap candles.

[]Use ITM options for momentum trades to reduce theta decay.

[]Keep stop-loss based on chart levels, not random premium numbers.

[]Do not average losing trades — exit and re-enter on new structure.

[]Trail SL after each target hit (especially in strong trends).

[]Avoid naked selling near event days or high VIX. - Stop trading after 2 consecutive losses.

💡 Pro Tip:

When market enters a “No Trade Zone”, shift focus from trading to observing liquidity behaviour.

📌 SUMMARY

Bullish Above:

✔️ 85,321 → 85,420 → 85,500 → 85,584 → 85,879

Bearish Below:

✔️ 85,150 → 84,990 → 84,872 → 84,600 → 84,340 → 84,150

Critical Zones:

🟥 Major Resistance → 85,584

🟩 Major Support → 84,872, 84,340

Trend Deciders:

🔑 Above 85,321 → Bullish day

🔑 Below 84,872 → Intraday weakness

🔑 Below 84,340 → Trend breakdown

🧾 CONCLUSION

Sensex is at a crucial turning point.

The market tone for 03-Dec will be set by how price behaves around:

✔️ 85,321 on the upside

✔️ 84,872 on the downside

Follow levels, not emotions.

Avoid trades in indecisive ranges and strike only on confirmed breakouts or clean retests.

⚠️ DISCLAIMER

I am not a SEBI-registered analyst.

This analysis is for educational and study purposes only.

Consult a certified financial advisor before investing or trading.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.