Predictions and analysis

Custom index created by top M.cap companies in gas distribution sector with Adani total gas, GAIL, Gujgas, IGL, Petronet. Trendline breakout. Petronet already made ATH.

IGL has shown positive momentum and broke last few weeks Range Let's Track the next movement, if it shows more upside rise or comeback into prev range again * For Education Purpose Practice and Learn price action setups

IGL (1W TF) - Swing Trade Analysis given on 6th April, 2024 Pattern: SYMMETRICAL TRIANGLE - Volume buildup at Resistance - Done ✓ - Trendline Resistance Breakout - In Progress - Demand Zone Retest & Consolidation - In Progress #IGL #ENERGY

Hello traders, Thanks for your support and love. Recently I got some questions on IGL, some of them are interested in bottom fishing and others want to accumulate at these levels. Before we start our analysis I like to declare that "I am holding this stock (IGL) in my personal portfolio.". Let's start our technical analysis. Time frame: Daily Chart type :...

- IGL is a stock which has a decent or sluggish movement - Less volatility which also can reduce some volatile moves in your Portfolio - From a positional perspective keep a stop loss of 390 if you entered around 403 with me - I think this time the retracement can be a little small and demand-driven - Enter partially at 406-408 keep your 50% fiat to enter...

IGL is currently trading at a filtered demand zone - From a Mid-Term perspective I am very bullish on this - Accumulation Zones - 380-395 - SL shouldn't be more than 2-4%

reversal shown on chart with minimal SL for 10% and 20% gains in 6 months time frame

Elliott Wave Analysis:- In Correction wave a) wave took place and for retracement b) wave and still a little more correction was pending it seems to be. and the fall is expected from there. i am not a SEBI registered advisor. Before taking a trade do your own analysis or consult a financial advisor. I share chart for education purpose only. I share my...

- Long only if it breaks trendline and moves above inside bar high - Entered demand zone and is currently indecisive, so Mon/Tue - if there is enough volume then it can break the trendline - Respect Stop loss - new demand will be created if it breaks the stop loss

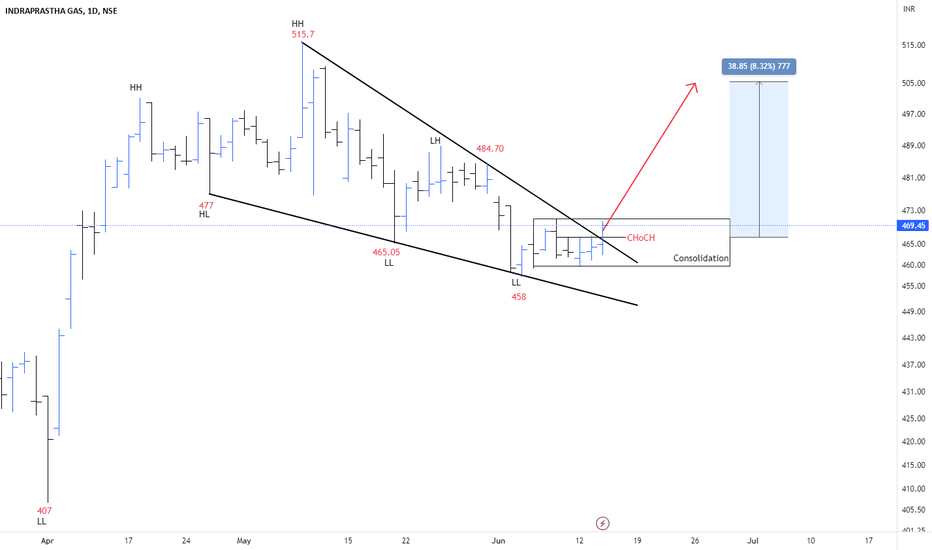

IGL has constructed a falling wedge on the 1-day chart in which it has made continuous lower lows and lower highs. The trend can change from bearish to bullish after the breakout of the resistance trendline. Buyers can expect a bullish move with the following targets: 483 & 504 . IGL Is Bearish below 458 . Buyers have to break and stay above 504 to increase...

IGL Daily Chart shows new Upmove breakout with 10% upside in next 20-30 days LTP 479 SL 470 Target 545+ Timeframe 20-30 Days

#IGL (Daily) CMP 506 Flag pattern with Huge Volumes Support- 490 Resistance- 525/535/550

IGL:- Ascending triangle pattern has formed, wait for a proper breakout, till then keep an eye on the stock Hello traders, As always, simple and neat charts so everyone can understand and not make it too complicated. rest details mentioned in the chart. will be posting more such ideas like this. Until that, like share and follow :) check my other ideas to get...

Consolidating in a narrow range after giving a strong impulsive move. It would be interesting to see if it directly continues higher OR comes back to the demand zone before moving back up. In any case, it should move higher in the coming weeks. Disclaimer: This is NOT investment advice. This post is meant for learning purposes only. Invest your capital at...

GAIL in the past couple of sessions, made multiple attempts to kick out the resistance zone of 105-110 it failed will it be successful now? and make a move towards 140?

Chart -> IGL Weekly A wonderful ascending triangle pattern emerged and a breakout happened this week with a long, bullish candle. CMP: 462 Good range: Around 440 Targets: 510 and 580 SL: 415 weekly close Disclaimer: This is for educational purposes only, not any recommendations to buy or sell. As I am not SEBI registered, please consult your financial advisor...

Stock is facing resistance at marked zone, keep in radar for BO, Yesterday good move with volume seen.

BUY - INDRAPRASTHA GAS LIMITED CMP - Rs. 431 Target - 1: Rs. 511 Target - 2: Rs. 580 . . . Technicals - Harmonic Patterns Ascending Triangles . . . Targets have been set using previous resistance zones. . Follow me for more! . . . This chart is for educational purposes only.

![[POSITIONAL] IGL - LONG ABOVE 391 IGL: [POSITIONAL] IGL - LONG ABOVE 391](https://s3.tradingview.com/q/qmyvYwki_mid.png)