Predictions and analysis

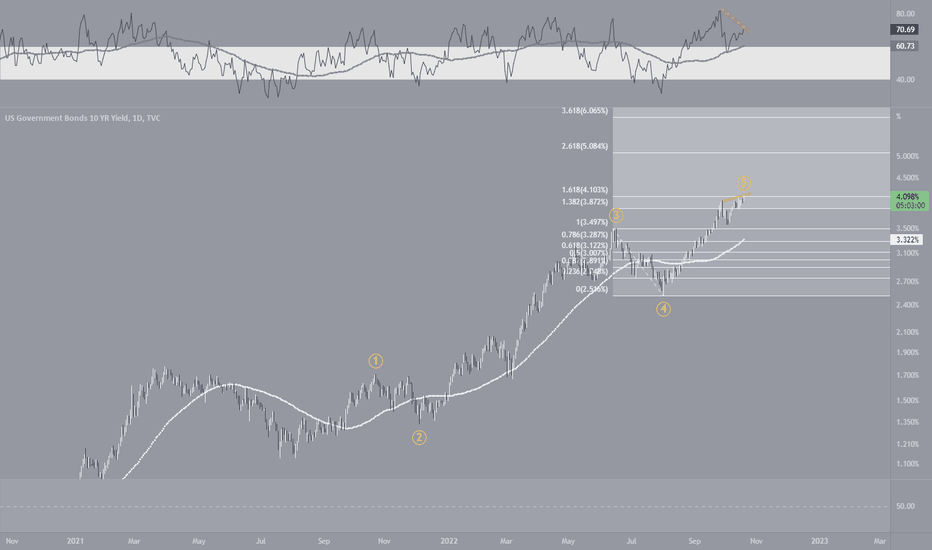

the fall started from 15% in Oct' 1981 until 0.533% in Jul 2020 has formed a parallel channel. Though the rise has been sharp and with very little consolidation. However it may start consolidating from 6-8% retracement from that may not be much, however time correction is needed as bond yield has increase too much in little time.

Slope is indicating more upside for US10Y in coming 6-9 months. Probability of crossing 4.5 is high but it can also attempt for 5 by July 2024. Minor pullback to 3.75 can happen. Disc: It's not an investment advise to buy or sell.

US fed rare hike cycle is near about to end in next 6-9 months or it has already reached to the peak. Reversal in inversion from above 0% level had given signals of stoppages of rate hike cycle in last 3 incidents. 1-2 more hike may come but that's end of upmove in interest rate. Time to lock 10 year bond yield. Disc : It's not an investment advise to buy or sell

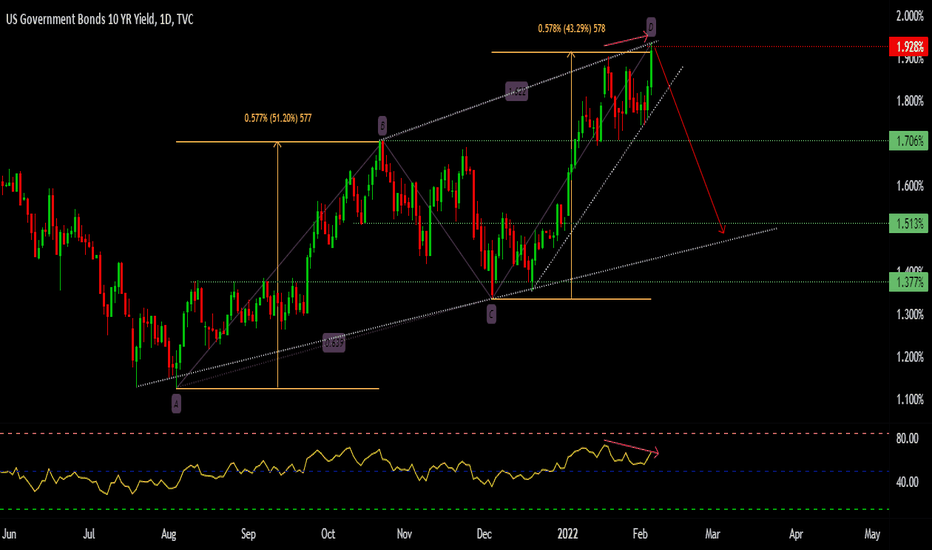

Bond yield looks to have bottomed out at 1.12. Daily close abv 1.38 will start bullish HHHL structure. In such scenario , price may adance to 2.02 (minimum) on conservative slope and 2.34 - 2.60 on steep slope. Minimum deadline as of now is 22nd Jan but if it attempts for 2.60 then deadline could extend to May 2022.

US10Y could be in at its peak in current wave cycle to stary a ABC correction. RSI on daily is also showing divergence indicating topping out sign. The correction in US10 will be good for equities. View will be invalid if the high 4.123 is broken and wave 5 might get extended. User discretion!

As can be seen, Head and shoulders formed on Daily chart of Banknifty. Neckline comes around 37500/450 levels. Total height of formation is 4275 points. Will be break or will give a false breakout. Only time will tell. With bullish formation on US10y yield, quote possible it can break!!! Please share your views too. Happy trading

Charts show breakout of rounding bottom formation on Weekly/Monthly charts of US 10year yields. Already got monthly closing above the breakout line. If sustains above the breakout line minimum target for 10y yield will be around 5.5/6.5 pc. If so, there will bloodbath across all asset classes. Only below 3.4/3.3 negates the idea. Brace! Brace! Brace! If true,...

US 10 YR BOND YIELD at harmonic pattern Maturity levels ready for reversal,, those who are worried about the rise in bond yield be patience its ready for fall..

US10Y has been trending in a downward channel, currently aheading towards its resistance. It acts as a leading indicator to US equity indexes and works in contrast to major benchmarks. Disclaimer: View for Educational purpose only, not to be taken as trading/investment advice.

I do not have the detailed economic understanding of this matter but have observed that a rise in the US 10 year treasury yields leads to a overall feeling of fear and turmoil in the markets. Back in the March and April of 2021, US10Y was continuously making news as it was reaching levels of about 1.75, with commentators discussing how a test of the levels of 2...

At their policy meeting in December, FOMC participants agreed to double down on QE pace to close the same by Mar’22 amid growing concerns about hotter inflation. Fed officials also began discussing at the December meeting about balance sheet (bond holdings), and some policymakers are pushing to start shrinking them sooner and faster than they did after an earlier...

comparing the yields of the US10 and US2 years spread with the EURUSD. So far, we've discovered a negative correlation with the US dollar since traders priced in monetary policy expectations. Bond prices are essentially reactive before then currency or equity

Hey Guys, Fingers crossed!! I Hope this Right shoulder gets complete on monday and again Bonds may get to hell. Reversal in bonds may happen from now on if this pattern gets rightfully completed. So, Monday is a very crucial day to decide what the stock market will be going to perform in the coming week and month. Hope you all would have liked the analysis. Also...

US 10 Y has reached the target anything abv 1.75 and upto 2 will be a supply point for another down move

Rally is likely to extend to 1.64 -1.78 . All EMAs are trending up. Correction is an opportunity to go long in US10y bonds.