Indicators, Strategies and Libraries

Example of how to input multiple symbols at once using a CSV list of ticker IDs. The input list is extracted into individual ticker IDs which are then each used within an example screener function that calculates their rate of change. The results for each of the rate of changes are then plotted. For code brevity this example only demonstrates using up to 4...

An example of how to limit the input number of allowed signals using a function containing a condition counter with a reset.

As a colorblind trader, I think accessibility is a big deal. This script auto detects the chart background color and optimizes text color based on luminance. Luminance detection is based on pine script new chart.bg_color feature, allowing lines, tables, etc to be optimized. Thanks to TV team for releasing this in the latest update/blog post today! This makes it...

Higher TimeFrame using custom source function for toggling traditional Candle sources or Heikin-Ashi sources on a traditional Candles chart. Thanks to PineCoders for rounding method: www.pinecoders.com Thanks to @LucF and @RicardoSantos for their advice and enlightenment as always. NOTICE: This is an example script and not meant to be used as an actual...

Example of various methods to show dashed or solid vertical lines on chart based on using either session or time. Credit for line method goes to midtownsk8rguy -> Credit for plot method goes to PineCoders -> www.pinecoders.com Special thanks to LucF, midtownsk8rguy, and PineCoders for permission to use their work. NOTICE: This is an example script and not...

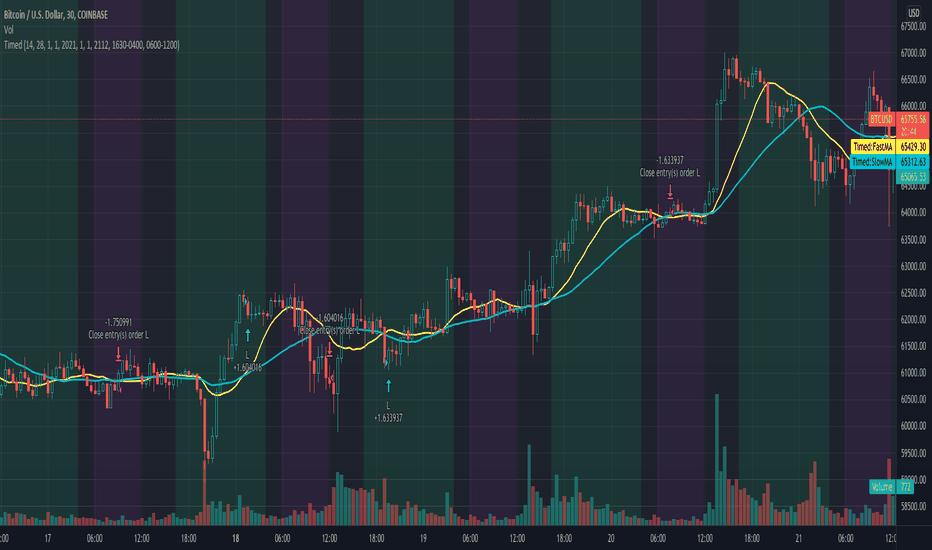

Example how to limit the number of round trips per day. If entry condition is never met logic will force a round trip at end of day. Set chart to a timeframe that is lower than 1 Day period. NOTICE: This is an example script and not meant to be used as an actual strategy. By using this script or any portion thereof, you acknowledge that you have read and...

Custom source function for toggling traditional Candle sources or Heikin-Ashi sources on a traditional Candles chart. Thanks to PineCoders for rounding method: www.pinecoders.com Thanks to @LucF and @RicardoSantos for their advice and enlightenment as always. NOTICE: This is an example script and not meant to be used as an actual strategy. By using this script or...

Example how to overlay the first lower timeframe bar of the day across the entire day. Set chart to a timeframe that is lower than 1 Day period. Also included option for coloring wick pressure of that bar. NOTICE: This is an example script and not meant to be used as an actual strategy. By using this script or any portion thereof, you acknowledge that you have...

Example how to color patterns of 3 bodies growing or waning by percentage with or without trend. Also included option for alert triggers. The yellow triangles on the chart denote where the alert triggers will fire. • Choose Pattern Of Filter: shows bodies growing or waning or both. • Sample Lengths Of AvgBar: number of recent bars to use for average size. •...

Example how to set the time range window to be backtested for both entries and exits. Additional examples are also included showing how to set the date range and toggle plot visibility. By incorporating this code with your own strategy's logic, it will allow you to backtest various time windows. Much gratitude to @LucF and @a.tesla2018 for help with including...

Example how to color the trigger bar of the condition and n-1 prior bars using only 1 barcolor() function. Currently when offsets are used in barcolor(), bgcolor(), plot(), plotarrow(), plotchar(), or plotshape(), the offset only works with a simple (static) integer. If series (dynamic) integers are used instead, there is not an error, but the series values are...

This script is for a triple moving average indicator where the user can select from different types of moving averages, price sources, lookback periods and resolutions. Features: - 3 Moving Averages with variable MA types, periods, price sources, resolutions and the ability to disable each individually - Crossovers are plotted on the chart with detailed...

Simple script to view Heiken-Ashi candles below a normal candles chart. Could also be useful for using HA calcs in strategy scripts on normal candles chart for proper backtesting. I adapted this to v4 from original v2 script by @samtsui. If you like please remember to give him a Thumbs Up for his original version! ->

Example how to backtest specific date(s) which can be useful for testing seasonality strategy ideas such as "Sell in May", etc. If using Daily period with wild card dates it will not trade on 1st day of month. If market is closed will trade on next open day. Works only with Daily or lower timeframes. When using on Daily timeframe set dates 1 day earlier to...

This script is for a triple moving average indicator where the user can select from different types of moving averages and periods. This script improves upon tutorial 3 by adding source selection for MAs and another option for an MA that is not built-in, the HMA . It is meant as an educational script with well formatted styling, and references for specific functions.

This script is for a triple moving average indicator where the user can select from different types of moving averages and periods. This script improves upon tutorial 3 by adding source selection for MAs and another option for an MA that is not built-in, the HMA. It is meant as an educational script with well formatted styling, and references for specific functions.

This script is for a triple moving average indicator where the user can select from different types of moving averages. It is meant as an educational script with well formatted styling, and references for specific functions.

This script is for a triple exponential moving average indicator. It is meant as an educational script with well formatted styling, and references for specific functions.

![How To Limit n Round Trips Per Day [Alerts] BTCUSD: How To Limit n Round Trips Per Day [Alerts]](https://s3.tradingview.com/o/O4sQWJaT_mid.png)

![Growing or Waning Patterns [Alerts] BTCUSD: Growing or Waning Patterns [Alerts]](https://s3.tradingview.com/n/NA3Zgw2G_mid.png)