BRENTOIL trade ideas

Will it going to 'BLAST' next chart of the week ???After a strong impulsive move oil has taken trendline ressi. and now its all set and ready to blast in coming few weeks. therefore, its has eventually formed two patterns 1.bullish pennant and 2. descending triangle. we just need to play safe as per chart currently once its reached support zone our buy will going to trigger on 59.5 and SL would be on closing daily basis 57 target would be near to 65-67. these are just my view kindly dont considered as a recommendation before any kind of buy/sell do your own research as well. if u have any kind of doubt regarding chart details then,comment happy to answer all.

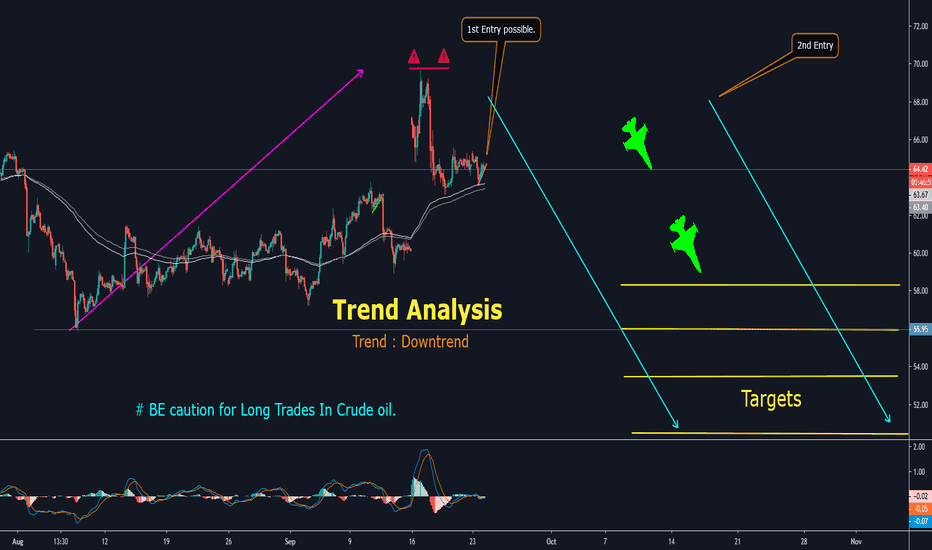

Crude Oil Downtrend & Trade Setup !!TREND ANALYSIS

Follow Chart Instruction.

Do not be Hurry for entry.

Wait for Proper Entry Setup.

Buy/Sell with Best Risk Reward.

Educational Chart Only.

You can Comment and ask the TREND ANALYSIS of any STOCK/SCRIPT/INDEX/FOREX.

Wait for 2nd entry setup, if available then short.

R:R is 8 to 15 times.

Crude Oil Possible Downtrend in Progress !!TREND ANALYSIS

Trade Setup

Follow Chart Instruction.

Do not be Hurry for entry.

Wait for Proper Entry Setup.

Buy/Sell with Best Risk Reward.

Educational Chart Only.

You can Comment and ask the TREND ANALYSIS of any STOCK/SCRIPT/INDEX/FOREX.

R:R is 1:10++

MCX Crude Oil For Indian Commodity Market.

So be Caution On long buildup in Crude Oil.

Crude | Inventory levels driving the Price -Watch EIA data todayOn the back of Crude inventories data released by American Petroleum Institute(API), according to which inventories fell less than expected, the commodity declined sharply citing lower demand. For further confirmation of the same one can watch crude inventories data about to be released by US government's Energy Information Administration (EIA) at 20:00 Hrs IST. Since the expectation is already set on a lower than expected fall in inventory, possibility of further fall in price is minimal as the information is already priced in, unless the data is unexpectedly skewed.

Technically, price drop has dragged Brent to the lower end of the Rising channel pattern and as we could observe, it still holds valid. Evaluating previous price movements we could detect a demand area around 63.60. Besides notice that 64.70 is also an influential level to which the price could react. Interestingly, the range i.e. 63.60-64.70 is also defined by 38% and 50% of Fibonacci levels thus making the space an essential level to be broken for a decisive trend.

Summing up, assuming that EIA does not throw any surprise Brent could undergo a short period of consolidation between the above mentioned range. Subsequent trend will be established in the direction of the breakout.

Trade Plan:

1. Until either of 63.60 or 64.70 is breached, Sell @ 64.70 and Buy @ 63.60 (typical range trading)

2. A close above 64.70: Buy with stop below 63.50 with targets @ 65.70, 66.70 and 67.40 (trail stop loss as we traverse through these levels)

3. A close below 63.60: Short with stop above 65 with targets @ 62.50 and 60 (trail stop loss as we traverse through these levels)

(Note: Expect higher volatility when EIA releases the data at 20:00 Hrs IST. Similar level of fall as per API is not expected to have an impact on price; a comparatively lower drop in inventories could weaken Crude further and alternatively, a comparatively higher drop in inventories will lead Crude to higher levels erasing its losses)

(Disclaimer: Our charts and contents are just for the purpose of analysis, learning and general discussion. Do not consider these as trading tips or investment ideas. Trading in Stocks, Futures and Options carry risk and is not suitable for every investor. Hence it is important to do your own analysis before making any investment or trading decisions based on you personal circumstances and it is always better to take advice from professionals)

Brent Crude | Rising Channel | Retesting prior HighBrent, after breaking through prior high of 66.7 has now pulled back towards the same area. This move could just be a retest of that level and it wouldn't be a surprise if price appreciates from now. Hence long trades are preferable with tight stop below 66; because below which the price could fall to 64 or to the bottom of the Rising channel. On the upside, do notice a significant trendline.

(Disclaimer: Our charts and contents are just for the purpose of analysis, learning and general discussion. Do not consider these as trading tips or investment ideas. Trading in Stocks, Futures and Options carry risk and is not suitable for every investor. Hence it is important to do your own analysis before making any investment or trading decisions based on you personal circumstances and it is always better to take advice from professionals)

Brent Crude | Important levels at 63.60 & 62.30Brent Crude has taken support from a rising trendline. We could also see a "Morning Star" candlestick pattern adding to bullish bias. But 63.60 is an immediate resistance which will test the strength of Bulls. If price manages to break above 63.60, we can well expect crude to move towards 65.50. However, if the upward move gets arrested at 63.60 and manages to fall, immediate support will obviously be at 62.30. In any case if 62.30 is taken out we can expect the price to fall towards 60.40 levels.

(Disclaimer: Our charts and contents are just for the purpose of analysis, learning and general discussion. Do not consider these as trading tips or investment ideas. Trading in Stocks, Futures and Options carry risk and is not suitable for every investor. Hence it is important to do your own analysis before making any investment or trading decisions based on you personal circumstances and it is always better to take advice from professionals)