Just A View - LODHA📊 Script: LODHA

📊 Sector: Construction

📊 Industry: Construction

Key highlights: 💡⚡

📈 Script is trading near at resistance level which is 1225 keep an eye on stock we may see some rally.

⏱️ C.M.P 📑💰- 1127

🟢 Target 🎯🏆 - 1293

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow

16.90INR

4.87 BINR

94.70 BINR

271.76 M

About MACROTECH DEVELOPERS LIMITED

Sector

Industry

CEO

Abhishek Mangal P. Lodha

Website

Headquarters

Mumbai

Employees (FY)

17.01 K

Founded

1995

ISIN

INE670K01029

FIGI

BBG000V15XY7

Macrotech Developers Ltd. engages in the real estate development business. Its core business is residential real estate developments with a focus on affordable and mid-income housing. The company was founded on September 25, 1995 and is headquartered in Mumbai, India.

LODHA bullish; above 1255 ? - Tuesday 23-Apr.The above information does not constitute investment/trading recommendation and it is purely for educational purpose. Please check the Strategy below...

SWING Trading Strategy:

Position is created, only upon stock closing above the entry price on day closing basis and is held on for 5-10 trad

LODHA ( MACROTECH DEVELOPERS) ANYTIME MAKE REVERSAL Life high is 767 but its reverse from 740 level and in down trend now.

sharp Entry with condition : When a daily candle closed above previous day daily candle then make entry.

Or

Support entry : at 565 level

This counter is belongs from Real Estate sector and this sector is bullish now. So yo

INVERSE HEAD AND SHOULDER PATTERN SPOTTEDPATTERN- an inverse head and shoulder pattern is formed in macrotech developers which was in formation since november 21 and now it has come to it ' s final phase and potential breakout can be given from this level

TARGET- The stock can make lifetime high and enter into new terrorities which is the

Marvelous Volume in Breakout...MACROTECHDEVELLOPERS.Why to trade? for long term only

1. Break out pattern

2. Heavy volume at Breakout

Thanks for Day Trader Telugu and other masters for helping me to learn Market.

I am not a SEBI registered Adviser,

please do your own analysis or consult

financial adviser for Entry, stop loss or

Target.

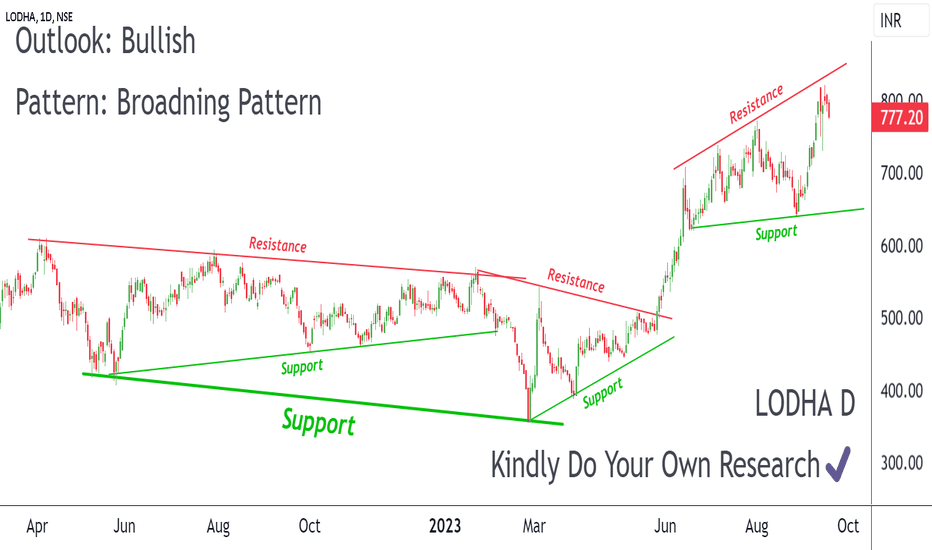

📈 Exciting Bullish Pattern Alert! 🐂📈 Exciting Bullish Pattern Alert! 🐂

📊 Pattern: Broadning Pattern

📌 Symbol/Asset: LODHA

🔍 Description: Stock is in a broadning pattern and may touch lower support of the pattern.

👉 Disclosure: We are not SEBI registered analysts, this is not a buy or sell recommendation. Technical patterns are j

See all ideas

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.

Frequently Asked Questions

The current price of LODHA is 1213.30 INR — it has decreased by 3.05% in the past 24 hours.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange MACROTECH DEVELOPERS LIMITED stocks are traded under the ticker LODHA.

MACROTECH DEVELOPERS LIMITED is going to release the next earnings report on Jul 25, 2024. Keep track of upcoming events with our Earnings Calendar.

LODHA stock is 9.71% volatile and has beta coefficient of 2.24. Check out the list of the most volatile stocks — is MACROTECH DEVELOPERS LIMITED there?

LODHA earnings for the last quarter are 5.20 INR per share, whereas the estimation was 5.25 INR resulting in a −0.86% surprise. The estimated earnings for the next quarter are 5.25 INR per share. See more details about MACROTECH DEVELOPERS LIMITED earnings.

MACROTECH DEVELOPERS LIMITED revenue for the last quarter amounts to 29.59 B INR despite the estimated figure of 22.80 B INR. In the next quarter revenue is expected to reach 35.32 B INR.

Yes, you can track MACROTECH DEVELOPERS LIMITED financials in yearly and quarterly reports right on TradingView.

LODHA stock has risen by 1.23% compared to the previous week, the month change is a 4.92% rise, over the last year MACROTECH DEVELOPERS LIMITED has showed a 172.62% increase.

LODHA net income for the last quarter is 6.66 B INR, while the quarter before that showed 5.03 B INR of net income which accounts for 32.23% change. Track more MACROTECH DEVELOPERS LIMITED financial stats to get the full picture.

Today MACROTECH DEVELOPERS LIMITED has the market capitalization of 1.24 T, it has increased by 3.10% over the last week.

Yes, LODHA dividends are paid annually. The last dividend per share was 1.00 INR. As of today, Dividend Yield (TTM)% is 0.08%. Tracking MACROTECH DEVELOPERS LIMITED dividends might help you take more informed decisions.

Like other stocks, LODHA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MACROTECH DEVELOPERS LIMITED stock right from TradingView charts — choose your broker and connect to your account.

As of Apr 25, 2024, the company has 17.01 K employees. See our rating of the largest employees — is MACROTECH DEVELOPERS LIMITED on this list?

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MACROTECH DEVELOPERS LIMITED technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MACROTECH DEVELOPERS LIMITED stock shows the buy signal. See more of MACROTECH DEVELOPERS LIMITED technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.

We've gathered analysts' opinions on MACROTECH DEVELOPERS LIMITED future price: according to them, LODHA price has a max estimate of 1500.00 INR and a min estimate of 705.00 INR. Read a more detailed MACROTECH DEVELOPERS LIMITED forecast: see what analysts think of MACROTECH DEVELOPERS LIMITED and suggest that you do with its stocks.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MACROTECH DEVELOPERS LIMITED EBITDA is 26.76 B INR, and current EBITDA margin is 25.94%. See more stats in MACROTECH DEVELOPERS LIMITED financial statements.