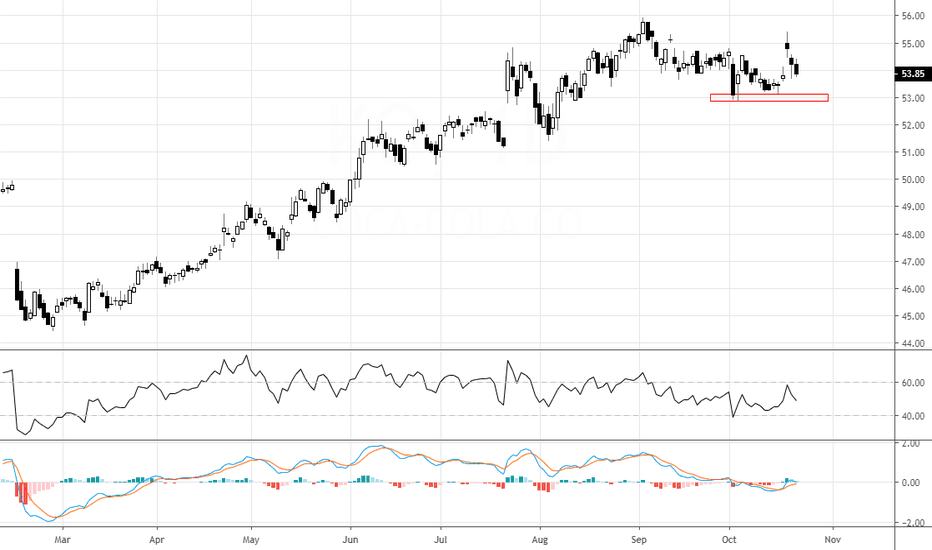

KO : Closed position at around breakevenClosed the position for a profit of about 1.79% on the invested capital. However, I consider this trade only as a breakeven trade.

I took the initial entry when it was technically undervalued. However, later, the market shifted into bear mode and the pattern evolved. I added to the position, increa

2.086CHF

9.02 BCHF

38.59 BCHF

4.28 B

About COCA-COLA CO

Sector

CEO

James Quincey

Headquarters

Atlanta

Website

Employees (FY)

79.1 K

Founded

1886

ISIN

US1912161007

FIGI

BBG006M6Y876

The Coca-Cola Co. engages in the manufacturing and marketing of non-alcoholic beverages. It operates through the following segments: Europe, Middle East and Africa, Latin America, North America, Asia Pacific, Global Ventures, and Bottling Investments. The company was founded by Asa Griggs Candler on May 8, 1886 and is headquartered in Atlanta, GA.

Concept of Pair Trading What is a Pair Trading ?

- Pair Trading is a market-neutral trading strategy that involves the simultaneous buying and selling of two correlated or related financial instruments.

- Traders identify two assets that historically move in tandem and take positions based on the expectation that the spre

COCO- COLA - Case Study - Only for Learning Purpose Already gCOCO- COLA - Case Study - Only for Learning Purpose

Already given sell signal on 16t-June 2021- the Bullish Channel is broken on 16th June with a bearish Marubozu

Technically it was weak in last week already given sell signal (shooting Star on weekly CHART)

Shorting levels - 54.5 -56$

Stop

Coca Cola may get bitter here!The stock is in a dominant trend up. Recently a lower high and lower low price pattern has been noticed on the daily charts. The RSI also seems to have shifted the range from bullish 80-40 zones to neutral 60-40 zones in the past few weeks. Important support levels are marked on the charts. Breaking

See all ideas

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.

Curated watchlists where CCC3 is featured.

Frequently Asked Questions

The current price of CCC3 is 53.147 CHF — it has increased by 0.28% in the past 24 hours.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange COCA-COLA CO stocks are traded under the ticker CCC3.

COCA-COLA CO is going to release the next earnings report on Apr 30, 2024. Keep track of upcoming events with our Earnings Calendar.

CCC3 stock is 0.68% volatile and has beta coefficient of 0.26. Check out the list of the most volatile stocks — is COCA-COLA CO there?

One year price forecast for COCA-COLA CO has a max estimate of 67.685 CHF and a min estimate of 54.880 CHF.

CCC3 earnings for the last quarter are 0.68 CHF whereas the estimation was 0.64 CHF which accounts for 6.59% surprise. Estimated earnings for the next quarter are 0.41 CHF. See more details about COCA-COLA CO earnings.

COCA-COLA CO revenue for the last quarter amounts to 10.94 B CHF despite the estimated figure of 10.47 B CHF. In the next quarter revenue is expected to reach 8.99 B CHF.

Yes, you can track COCA-COLA CO financials in yearly and quarterly reports right on TradingView.

CCC3 stock has fallen by 1.69% compared to the previous week, the month change is a 0.08% rise, over the last year COCA-COLA CO has showed a 6.84% decrease.

CCC3 net income for the last quarter is 1.66 B CHF, while the quarter before that showed 2.83 B CHF of net income which accounts for −41.22% change. Track more COCA-COLA CO financial stats to get the full picture.

Today COCA-COLA CO has the market capitalization of 229.95 B, it has decreased by 1.74% over the last week.

Yes, CCC3 dividends are paid quarterly. The last dividend per share was 0.43 CHF. As of today, Dividend Yield (TTM)% is 3.19%. Tracking COCA-COLA CO dividends might help you take more informed decisions.

COCA-COLA CO dividend yield was 3.12% in 2023, and payout ratio reached 74.52%. The year before the numbers were 2.77% and 80.23% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

Like other stocks, CCC3 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade COCA-COLA CO stock right from TradingView charts — choose your broker and connect to your account.

As of Apr 18, 2024, the company has 79.10 K employees. See our rating of the largest employees — is COCA-COLA CO on this list?

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So COCA-COLA CO technincal analysis shows the neutral today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating COCA-COLA CO stock shows the sell signal. See more of COCA-COLA CO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.

We've gathered analysts' opinions on COCA-COLA CO future price: according to them, CCC3 price has a max estimate of 67.68 CHF and a min estimate of 54.88 CHF. Read a more detailed COCA-COLA CO forecast: see what analysts think of COCA-COLA CO and suggest that you do with its stocks.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. COCA-COLA CO EBITDA is 11.83 B CHF, and current EBITDA margin is 27.45%. See more stats in COCA-COLA CO financial statements.