Trade ideas

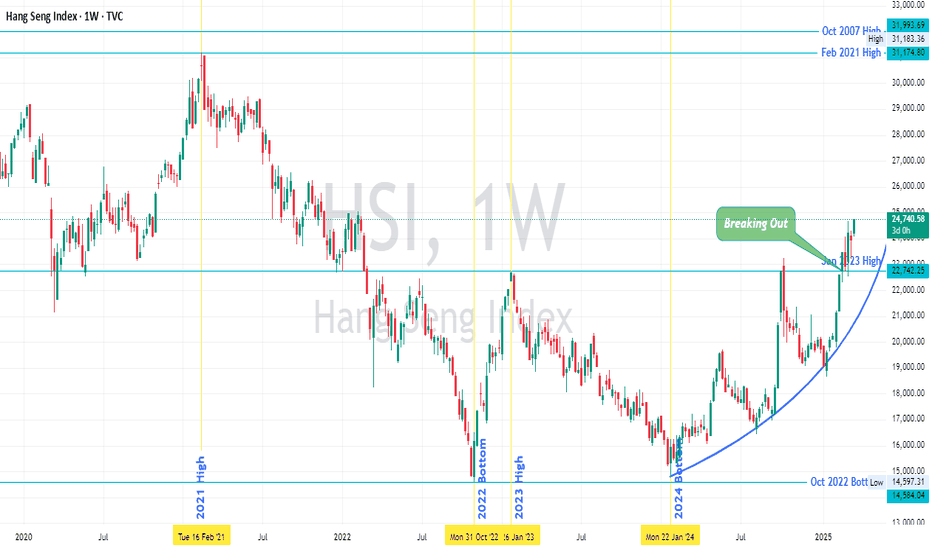

Hang Seng Index (HSI) 's Price Action vis-à-vis Major PivotsHSI seems to have broken out of last year's high (Oct 2024) and Jan 2023 high, and retested it too.

The index is about 67% from Jan 2024 low.

The next major pivot is Feb 2021 High, after that Oct 2007 High and then Jan 2018 High (all are marked on chart).

The price seems to be gaining momentum and moving parabolically, as marked on chart.

It seems price will move higher over months, of course there would be retracements.

As always it won't be as predictable as I have hypothesized above.

Nevertheless at this juncture price action is positive and depending upon price action further into the months the hypothesis will succeed or fail.

Trade Safe

Can Hang Seng Surge 35% from here??

A straightforward analysis of the Hang Seng Index reveals that it has recently crossed the 200 SMA on both weekly and monthly charts, indicating a bullish trend. Additionally, it is crossed horizontal Resistance level on weekly chart

For investors in India, one way to gain exposure to the Hang Seng Index is through the Nippon India Hang Seng ETF. This ETF has a relatively small AUM of around 800 crore INR, making it unsuitable for large lump-sum investments. However, it could be a good idea to invest smaller amounts in 4-5 tranches???

This is NOT an investment advise

The Bullish Surge of Hang Seng: Outperforming Nasdaq and NiftyHang Seng Triumphs: Outpacing Global Markets Since 2024 with Bullish Momentum, While FIIs Stay Away from India"

The Hong Kong Stock Market's Hang Seng Index has shown remarkable strength since 2024. When comparing the performance of the Hang Seng, Nasdaq, and Nifty indices, the Hang Seng emerges as the clear winner since 2024, followed by Nasdaq, with Nifty delivering negative returns.

A straightforward analysis of the Hang Seng Index reveals that it has recently crossed the 200 SMA on both weekly and monthly charts , indicating a bullish trend. Additionally, it is on the verge of a horizontal breakout.

For investors in India, one way to gain exposure to the Hang Seng Index is through the Nippon India Hang Seng ETF. This ETF has a relatively small AUM of around 800 crore INR, making it unsuitable for large lump-sum investments. However, it could be a good idea to invest smaller amounts in 4-5 tranches???

This is NOT an investment advise

Hang Sang indexif you compare the valuation and growth of countries no doughty India has performed exceedingly well in last 4 year after covid and China have under performed growth . But despite underperformance China was not out of the track on growth matrix .So i personally think Hang Sang Index can out beat Nifty returns in coming 4 years starting from 2025 .So investing in hang sang index ETF would be beneficiary form long term prospective .

Heng Seng Index Retrace 61% at SupportHello Everyone,

As china declare stimulus heng seng index over more than 35% from 17000 to 23000 . FIIs started selling from indian market and invvesting to HENG seng market now again from 23000 its retrace to 61% at ema100 and breakout retest and trendline support taking bounce.

RSI adjusted/cooled off so again there is upside possibilities.

Short term rebound for HKEX could pass 22000

1 hour chart

In this strong up trend we see a stop volume 2 times today with W form, whether this rebound is strong enough to gain back the momentum or purely a rebound and will continue its down trend.

The next support will see at 19800 and the 18200-18800

Why had Hong Kong's Stock Market Index Rallied recently? (HK50)2nd October 2024 / 11:15 AM IST

One Question arise whatever situation is arising internationally let's keep it aside ❗

What Technically has happened in Index HK50 that's what I have discussed in here.

30 % in Three Week Time Period

Everything is pinned in Chart ‼️‼️👍

LONG HK50DAILY: uptrend, but price has not confirmed to cut Ma10 up.

4H: the price adjusts for 2 beats and touches the 6.8 fibo zone in the previous up phase.

-price has increased by 10%.

- The buy signal candle has a full candle body and a large volume that crosses above ma10

-MACD confirms cross up.

-act

- Wait for the price confirmation to increase within 10 days before you can enter the order

-buy 4 hours

entry area = 16544

stoloss = 16050

take profit = 17630

HANG SENGHello & welcome to this analysis

HANG SENG is entering the PRZ of two bullish Harmonic Trading Patterns in the monthly time frame, Cypher and Butterfly.

The index has been in a downtrend since 2017, the potential reversal zone is between 14450-13950 would also coincide with a probable parallel channel starting from 2008.

In India the Nippon India ETF Hang Seng Bee (HNGSNGBEES) is listed in BSE. One can look at it from a medium to long term investment perspective since this is a monthly reversal signal coming up.

Happy Investing

HSI Index - No returns in 22 years??Jan 2000 Hong Seng index topped around 18400 and Tested the same level of 18400 1st qtr of 2022. If you are a long term index investor and invested in Jan 2000 you would have made zero return in the last 22 years. Stop blindly following finwits in index investing. Learn and be alert