New idea update: Long time consolidation coming to end, it seems. Entry: Weekly close above 6200 SL: Below 5400 Target: 8100+ Time Horizon: 3-6 months

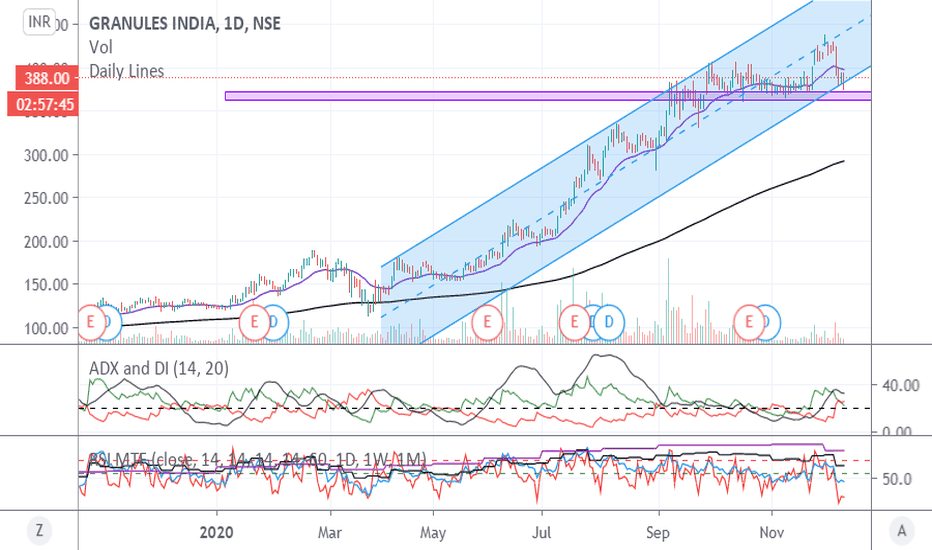

Pyramiding opportunity: Entry: 350-380 SL: below 330 Target: 3X

What a powerful structure! #Monthly chart Entry range: 3100 to 3300 SL: Below 2800 Target: 2X Time horizon: Long term pick (3 years)

Key highlight: P/B is 0.6, P/E is 12.73 (Industry P/E is 19.73), Technical breakout and successful retest. Entry range: 110-130 SL (Deep): Below 99 Target: at least 2X Time Horizon: 6 months to 1 year Keep an eye!

One good trade in the making: Entry range: 1145-1200 SL: 1000 T1: 1350, T2: 1550 Time horizon: 3-6 months

Breakout retest, Triangle pattern formation with the tip in breakout zone, drastic volume compression. It's no brainer, what is highly likely to happen. Keep an eye.

New idea update: Perfect breakout and retest. Perfect parallel channel movement as well Entry: 240 to 250 SL: 225 (weekly closing basis) T1: 300, T2: ATH Time Horizon: 1-3 months

A very very risky bet (turnaround story) with a potential to be 15X from here. Planning to hold for long term. Entering with my party money today @ CMP: Rs 10 Strict stop loss: Rs 8.20 Target: 150+ Time horizon: Immaterial. Holding indefinitely as long as trend is intact Let's see!

New idea update: Bounced back from 200 EMA and previous breakout point. Entry zone: 4000-4700 SL: Below 3400 T1: 6000+ and then, sabka malik ek! Time frame: 2-3 months

Another update: If crosses and closes above 265 on weekly charts, it will become actionable. Entry range after breakout and retest: 250-270 T1: 350, T2: 420, T3: Sabka malik ek! SL: Below 200 Timframe: 6-12 months Beautifully honoring its lower trendline since 2013.

Broke out of its resistance zone this week. Could shoot up this week. This one is getting Ex Bonus after Christmas. As a result, this could see significant volumes this week. Let's see!

Turned actionable last week. Trading above a major support zone. Could move very fast from here.

Amazing one side move. Long term trend reversal possible. Wait for a couple more days for confirmation to enter. Could retest its recent high. Disc. I have been adding this as an SIP and my avg cost is now around 185.

Our all time favorite monopoly business stock witnessed a fresh breakout this week. Can be accumulated for long term. This is one of the safest stocks in market these days.

After a long phase of consolidation, it has bounced back from its lower trend line levels. Already trading above a strong resistance. If it breaks the above resistance, can see 800 levels soon.

Nobody is talking about this grossly undervalued, on the verge of breakout, gem. I am holding since below 300.

Entered this gem at Rs 52 couple of years back, when I was a new entrant in stock markets. But having met and read about Mr Vaidyanathan, I had strong conviction about this bank and it has not dwindled even 1 bit. I averaged it heavily to bring my cost price to under 30. Now this is at a very crucial level from the technical standpoint and a long term entry can be...