Market analysis from Dhan

Every trader wants to know one thing where are the real buyers and sellers stepping in? While support and resistance levels help, they can sometimes feel subjective. That’s why volume-based tools like Anchored VWAP (Volume Weighted Average Price) have become popular. But markets are dynamic, and so should be our tools. Enter Adaptive Anchored VWAP (AAVWAP) a...

Build a strong foundation with these must-know tools. Starting out in technical analysis can feel overwhelming. With hundreds of indicators available on platforms like TradingView, where do you begin? The truth is, you don’t need dozens of tools just a few reliable, beginner-friendly indicators that help you understand market trends, momentum, and entry/exit...

Volatility is often seen as a trader’s worst enemy or greatest ally. Knowing how to measure it accurately can give you an edge in both planning entries and managing risk. That’s where the Average True Range (ATR) comes into play. It doesn’t tell you the direction of the market—but it does tell you how much the market is moving. And that makes all the difference in...

Master the quiet before the move. Not every market moves in strong trends. In fact, many stocks spend a lot of time trading sideways moving within a defined range without making a clear move up or down. While this can frustrate trend-following traders, sideways phases actually offer great setups if you know what to look for. Understanding how to identify...

Breakouts are one of the most exciting moments in a chart—they often signal the beginning of a strong move, whether upward or downward. But not every breakout is real. Some fizzle out. Others turn into fakeouts. So how do you improve your odds? The key lies in combining chart patterns with volume analysis. When used together, they help you spot breakout...

Trading stocks successfully isn’t just about spotting a pattern or reading a signal—it’s about understanding the bigger picture. That’s where Multi-Timeframe Analysis (MTFA) becomes one of the most useful tools in your trading toolkit. Whether you’re an intraday trader or a swing trader, looking at multiple timeframes helps you confirm trends, reduce false...

If you're into scalping, you already know how important timing is. One of the most common questions that pops up among scalpers is—should I use a 1-minute chart or a 5-minute chart? While both charts are designed for short-term trading, the experience of using them is quite different. The 1-minute chart is all about speed. It shows price action in real-time,...

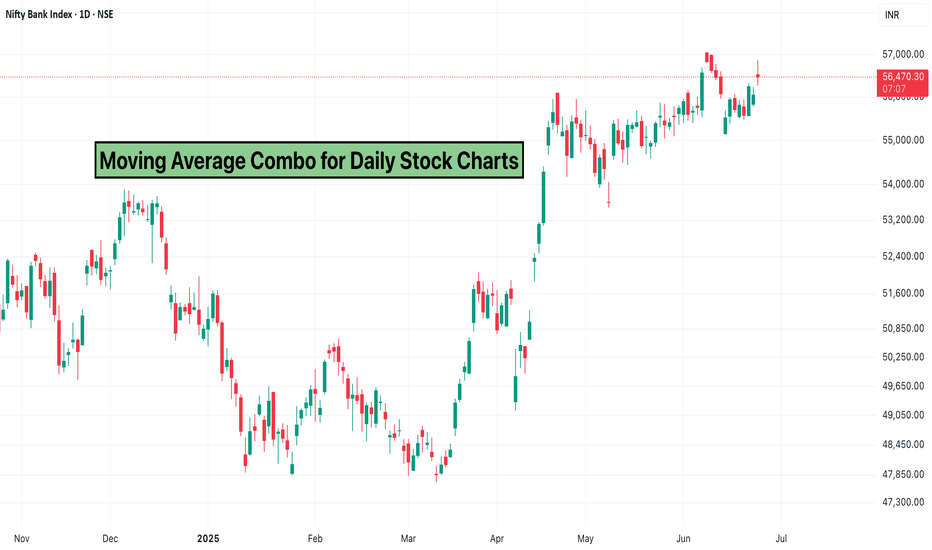

Moving averages are one of the most fundamental tools in technical analysis, and combining them can give you a clearer picture of trend direction, support/resistance, and momentum. On daily stock charts, the right moving average combo can help traders identify both short-term and long-term opportunities with more confidence. Why Use Moving Averages? Moving...

The Volume Weighted Average Price (VWAP) is one of the most trusted tools for intraday traders. Used by institutional and retail traders alike, VWAP helps identify fair value during the trading day and can act as both a dynamic support/resistance and trend guide. What is VWAP? VWAP stands for Volume Weighted Average Price. It gives the average price a security...

For traders who prefer clarity over noise, combining Heikin Ashi candles with the Relative Strength Index (RSI) can help reveal clean trend setups and momentum confirmations. This duo is especially effective on TradingView for identifying smoother entries and exits. What is Heikin Ashi? Heikin Ashi is a chart type that modifies how candles are calculated: ...

If you’re looking for a powerful combo to detect breakout opportunities, pairing Bollinger Bands with the Relative Strength Index (RSI) is a smart move. This strategy merges volatility tracking with momentum analysis, helping you confirm high-probability entries on TradingView charts. What Are Bollinger Bands? Bollinger Bands consist of: A 20-period...

Pivot Points are a favorite among traders for identifying key support and resistance levels. Used widely in day trading and swing trading, these levels are calculated based on previous price action and are easy to apply on platforms. But should you rely on daily or weekly Pivot Points? Here’s how to decide. What Are Pivot Points? Pivot Points are calculated...

When it comes to momentum indicators on TradingView, both RSI and Stochastic RSI offer valuable insights but they operate differently and serve slightly different purposes. What is RSI? The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and magnitude of recent price changes. It ranges from 0 to 100: RSI above 70 suggests...

Bollinger Bands are one of the most popular tools used by traders to assess market volatility and potential price action. Created by John Bollinger, this indicator consists of a middle band (a simple moving average) and two outer bands that represent standard deviations away from the average. When markets get quiet or volatile, Bollinger Bands visually show the...

When it comes to intraday trading, precision matters. That’s where VWAP—the Volume Weighted Average Price comes in. Used by retail traders, institutional players, and algo systems alike, VWAP helps you understand the average price of a security throughout the day, weighted by volume. It's one of the most important indicators for intraday decision-making on...

When it comes to identifying strong trading setups, combining indicators can offer a more complete picture of market behavior. One popular and effective combination used by traders on platforms like TradingView is the Relative Strength Index (RSI) and the Exponential Moving Average (EMA). Together, these tools balance momentum with trend-following signals,...

Candlestick patterns are one of the most widely used tools in technical analysis. They visually represent price movements and offer insights into market sentiment, potential reversals, and continuation patterns. Whether you're a beginner or an experienced trader, understanding the most common candlestick patterns can significantly improve your chart-reading...

Candlestick patterns have long been a favorite among technical traders. From engulfing candles to dojis and hammers, these formations aim to predict market direction based on price action. But with so many patterns and interpretations floating around, it’s important to ask: which candlestick patterns truly work—and which are overhyped? The Promise of...