The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

Investing:Nifty IT is looking good for long term accumulation!If you have been following the tech related news lately, it has been about the new AI "revolutionary" tool named Anthropic.

And the same is visible on charts of Nifty IT.

TCS is available at a price at which it was trading in December 2020.

Infy has just broke a crucial support.

Wipro has always b

INDUS TOWER ANALYSISTHIS IS MY CHART OF THE WEEK PICK

FOR LEARNING PURPOSE

INDUS TOWER- The current price of INDUS TOWER is 466.60 rupees

I am going to buy this stock because of the reasons as follows-

1. It is making a new high by breaking the resistance of last 9 years ( we often call this Multi year brea

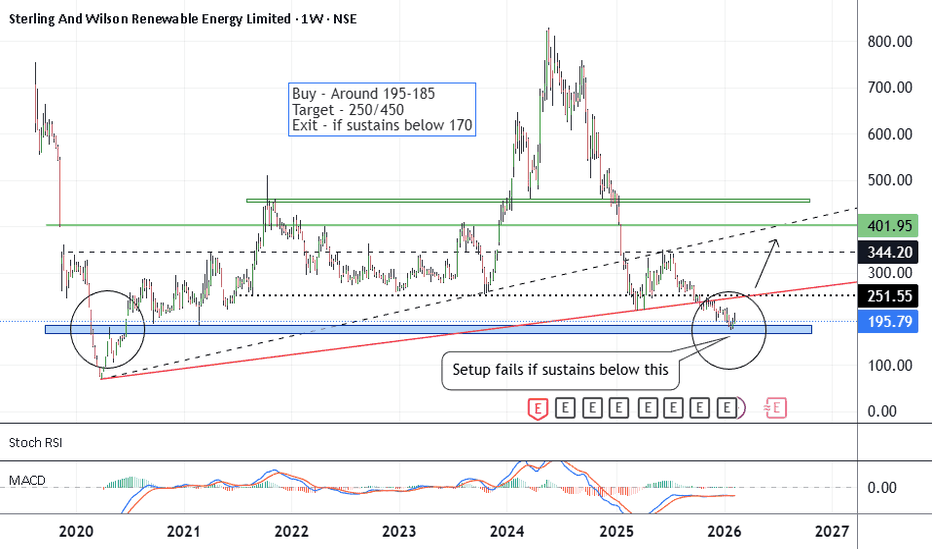

SW Solar - Bottom FishingCMP 195 on 14.02.26

As can be seen on the chart. There has been a big correction in the stock price in the past months. Presently trading near the lowest prices. If a reversal takes place, may go into a bullish phase ahead.

Possible targets may be 250/450.

The setup fails if it sustains below 170.

#Nifty Weekly 16-02-26 to 20-02-26#Nifty Weekly 16-02-26 to 20-02-26

25450-25650 is the sideways range for next week.

25800 will act as Resistance for next week.

Wait for above range to break on either side for a trending move.

Long level is above 25650 for the targets of 25780/25900.

Short level is below 25450 for the targets of 25

What to do in TCS if we are Holding?What to do in TCS if we are Holding?

Market Sentiment :

- Extremely week: Due to AI disruption Theory

Technical:

- Extremely Week: Daily, Weekly, Monthly Lower Lows formation

Should We Enter at this Level?

- No New Entry suggested unless we see Daily close above 20EMA

But I am already Hold

SILVER 1HRSWING TRADE

SILVER (XAGUSD) Looking good for Downside..

When it break level 73.77 and sustain.. it will go Downside...

SELL @ 73.77

Target

1st 63.89

2nd 56.48

Enjoy trading traders.. Keep add this STOCK in your watch list..

Big Investor are welcome..

Like this Post??? Hit like button..!!!

Foll

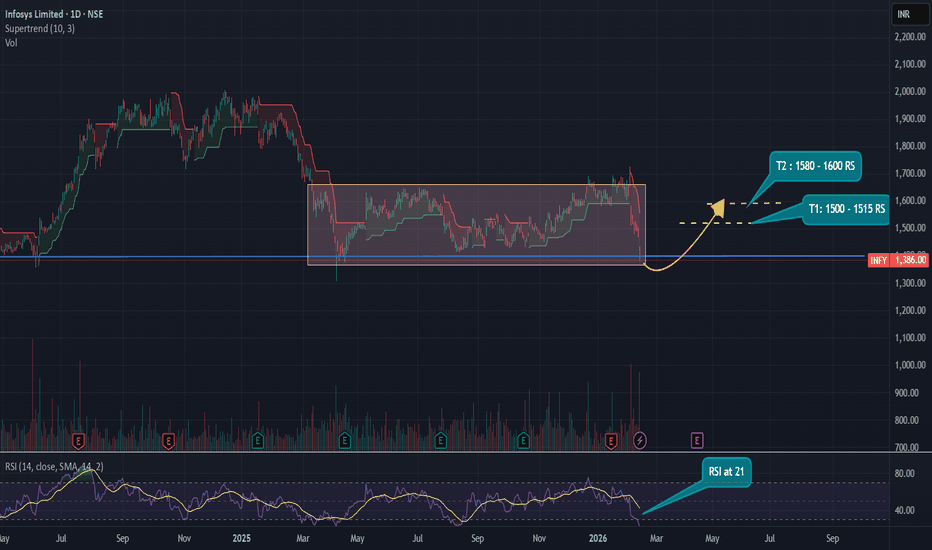

Infosys LimitedInfosys Technical Outlook :

Infosys has been consolidating within the ₹1400–₹1700 range over the past year. Currently, the stock is in the oversold zone, with the RSI at 21, and is testing a strong support level around ₹1400.

From a mid-term perspective, the setup looks attractive:

- Target 1: ₹1500

$ETH has officially lost the 2000–2020 base CRYPTOCAP:ETH has officially lost the 2000–2020 base we highlighted on the 1H chart.

Triple-top rejection (Top 1 → Top 2 → Top 3) played out perfectly — buyers failed at the 2140–2160 supply zone, and breakdown followed.

📍 First reaction target (1980–1950) ✅ Hit

That’s roughly a 2.6–3% move from

Hindustan Unilever : Prepared for Upside Hindustan Unilever – Failed Head & Shoulders Turning Bullish (Daily Chart)

On the daily timeframe, Hindustan Unilever was forming a well-structured Head & Shoulders pattern. The left shoulder, head, and right shoulder were clearly visible, with a defined neckline acting as support.

However, instea

See all editors' picks ideas

Peak Trading Activity Graphs [LuxAlgo]The Peak Trading Activity Graphs displays four graphs that allow traders to see at a glance the times of the highest and lowest volume and volatility for any month, day of the month, day of the week, or hour of the day. By default, it plots the median values of the selected data for each period. T

Smart Trader, Episode 03, by Ata Sabanci, Candles and TradelinesA volume-based multi-block analysis system designed for educational purposes. This indicator helps traders understand their current market situation through aggregated block analysis, volumetric calculations, trend detection, and an AI-style narrative engine.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Asset Drift ModelThis Asset Drift Model is a statistical tool designed to detect whether an asset exhibits a systematic directional tendency in its historical returns. Unlike traditional momentum indicators that react to price movements, this indicator performs a formal hypothesis test to determine if the observed d

Hyperfork Matrix🔱 Hyperfork Matrix 🔱 A manual Andrews Pitchfork tool with action/reaction propagation lines and lattice matrix functionality. This indicator extends Dr. Alan Andrews' and Patrick Mikula's median line methodology by automating the projection of reaction and action lines at equidistant intervals, cr

Arbitrage Matrix [LuxAlgo]The Arbitrage Matrix is a follow-up to our Arbitrage Detector that compares the spreads in price and volume between all the major crypto exchanges and forex brokers for any given asset.

It provides traders with a comprehensive view of the entire marketplace, revealing hidden relationships among d

Wyckoff Schematic by Kingshuk GhoshThe "Wyckoff Schematic" is a Pine Script indicator that automatically detects and visualizes Wyckoff Method accumulation and distribution patterns in real-time. This professional tool helps traders identify smart money movements, phase transitions, and critical market structure points.

Key Features

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

See all indicators and strategies

Community trends

BUY TODAY SELL TOMORROW for 5% DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed t

Stock set for a correctionONGC CMP 270.65

Exit this counter.

Trendline- stock taking resistance from under the trendline is very negative. Its a good reason to sell the counter. Since it is on the monthly chart. The impact will be big.

Volume - huge volume near the highs is capitulation.

Oscillator- Composite is givin

Divgi TorqTransfer Systems cmp 744.55 Weekly Chart since listedDivgi TorqTransfer Systems cmp 744.55 by Weekly Chart view since listed

- Support Zone 475 to 575 Price Band

- Resistance Zone 760 to 860 Price Band

- Falling Resistance Trendline Breakout well sustained

- Bullish Head & Shoulders formed under the Resistance Zone

- Heavy Volumes spike plus good syn

TVSSCS: Trendline Breakout Post Strong Q3FY26, Chart of the WeekTVS Supply Chain Solutions Just Broke Out on 12x Volume After Hitting Rock Bottom; Technical Reversal Meets a ₹6,300 Crore Order Pipeline. This Breakout Could Define TVS Supply's Next 12 Months. Let's Understand in "Chart of the Week"

As per the Latest SEBI Mandate, this isn't a Trading/Investm

Long or Short ? BSEDuring the recent past, we have observed that BSE has remained highly volatile, yet the price action continues to move within a well-defined range.

Today, the stock is approaching the lower end of this range, which opens a potential opportunity to consider Long positions based on the current struct

INDUS TOWER ANALYSISTHIS IS MY CHART OF THE WEEK PICK

FOR LEARNING PURPOSE

INDUS TOWER- The current price of INDUS TOWER is 466.60 rupees

I am going to buy this stock because of the reasons as follows-

1. It is making a new high by breaking the resistance of last 9 years ( we often call this Multi year brea

Tata Power at Decision Zone — Breakdown or Breakout Loading?Price has been trading inside a clear descending channel, respecting both resistance and support trendlines with precision.

Recently, the stock bounced from lower channel support with strong buying interest and is now approaching the upper supply trendline, which historically acted as rejection zone

See all stocks ideas

Tomorrow

AGSTRAAGS Transact Technologies Ltd.

Actual

—

Estimate

—

Feb 19

SANOFICONRSanofi Consumer Healthcare India Limited

Actual

—

Estimate

—

Feb 19

CIEINDIACIE Automotive India Ltd

Actual

—

Estimate

5.40

INR

Feb 19

ABBABB India Limited

Actual

—

Estimate

20.78

INR

Feb 19

VESUVIUSVesuvius India Ltd

Actual

—

Estimate

—

Feb 24

SCHAEFFLERSchaeffler India Ltd

Actual

—

Estimate

19.40

INR

Feb 25

FLFLFuture Lifestyle Fashions Ltd.

Actual

—

Estimate

—

Feb 26

KSBKSB Ltd.

Actual

—

Estimate

4.40

INR

See more events

Community trends

IS UNI/USDT THE GENERATIONAL BUY BEFORE 1,500% RALLY?BME:UNI DROPPED -93% FROM ATH: IS THIS THE GENERATIONAL BUY BEFORE 1,500% RALLY?

#UNI Is Currently Testing A Multi-Year Descending Channel Support That Has Held Since 2022, A Rare, High-Timeframe, Cycle-Level Structure.

The Last Time This Setup Formed, UNI Delivered:

2020: +2,400% (24x From Oct 2

Range Accumulation After Sell-Off, Bullish Breakout in ProgressMarket Overview

On the 1H timeframe, BTCUSD shows a clear transition from a strong bearish impulse into a structured accumulation phase, followed by an early-stage bullish breakout attempt.

Phase 1: Distribution & Breakdown

Price formed a distribution range near the 76,000–78,000 zone.

Multiple

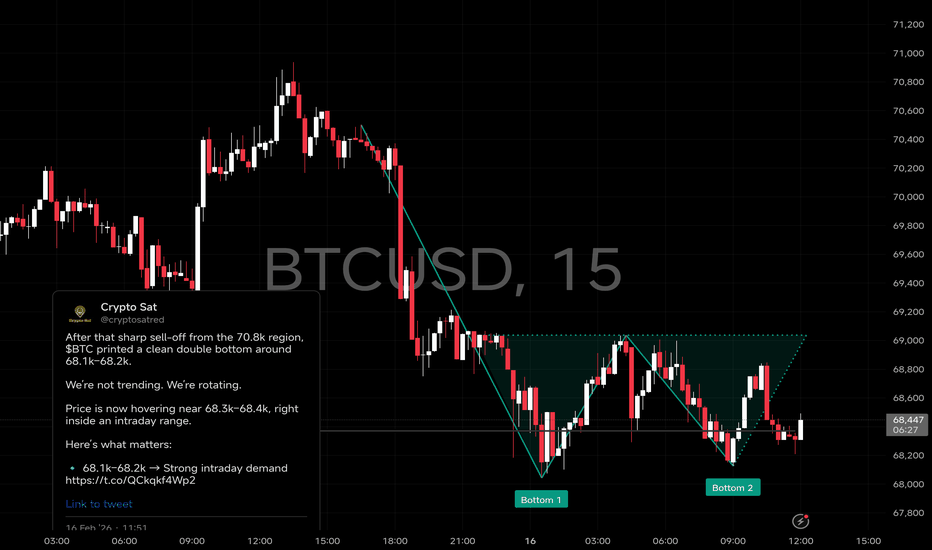

$BTC printed a clean double bottom around 68.1k–68.2k.After that sharp sell-off from the 70.8k region, CRYPTOCAP:BTC printed a clean double bottom around 68.1k–68.2k.

We’re not trending. We’re rotating.

Price is now hovering near 68.3k–68.4k, right inside an intraday range.

Here’s what matters:

🔹 68.1k–68.2k → Strong intraday demand (defended twi

BTC 1H🧠 Market Context

Bitcoin has just completed a liquidity sweep after an extended move, tapping into a high-timeframe supply/demand reaction zone. Price action is currently compressing, signaling that we’re approaching a decision point where momentum traders and HTF participants collide.

The recent

Analysis – Demand Zone Bounce Toward Key Resistance🔎 Market Overview

On the 1-hour timeframe, BTCUSDT (Bybit) shows a strong bullish reaction after forming a short-term bottom near the 65,000 area. Price has broken structure to the upside and is now consolidating above a marked demand zone, suggesting buyers are in control for the short term.

🟢 Key

Weekly Analysis with buy/Sell scenarios in BTC👋👋👋 Friends, What's your view on BTC???

Last week, Bitcoin (BTC) traded with high volatility and a corrective bias, briefly dropping toward the critical $60,000 support zone before staging a sharp rebound toward $68,000–$70,000, but failing to sustain above $70K and closing the week slightly negat

Will Bitcoin Recover or continue to perishBTC/USD Analysis (Weekly Chart)

- Bitcoin's primary trend is bullish, although on a weekly chart, the prices, which were trending with a rising wedge, gave a bearish breakout.

- However, the prices are retracing higher after testing the lower order block (black zone).

- Currently, prices are rest

What Are Reserves and Why Are They Important?1. Financial Security and Stability

One of the most important reasons reserves are necessary is to provide financial security. Businesses and individuals face uncertainties such as economic downturns, sudden expenses, or unexpected losses. Having reserves ensures that operations can continue even d

See all crypto ideas

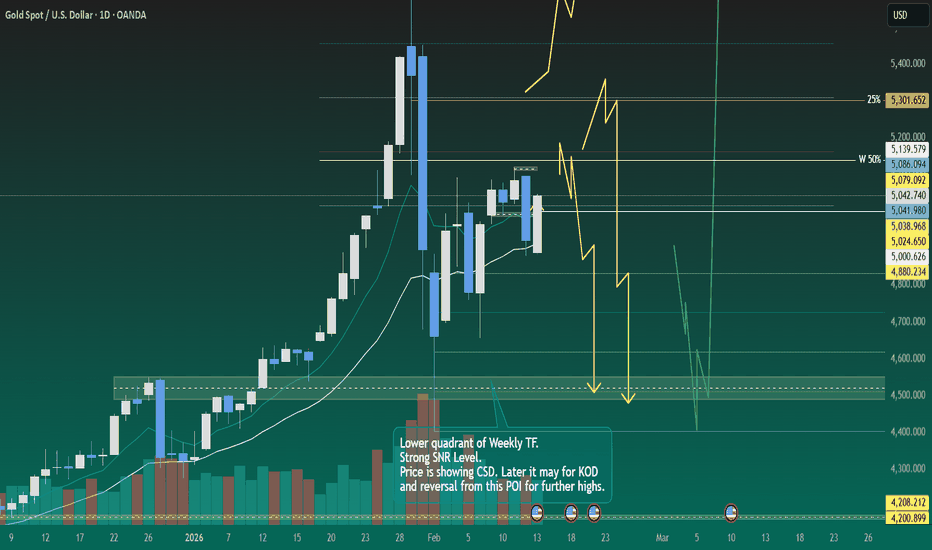

Weekly Analysis with buy/Sell scenarios in Gold/XAUUSD👋👋👋 Friends, What's your view on Gold???

Last week, global gold prices showed a volatile but upward bias, with spot gold recovering after a dip and ending the week with gains of roughly 1–2%, holding near the $5,000–$5,050 zone;

As per the current scenario we may further expect consolidation in t

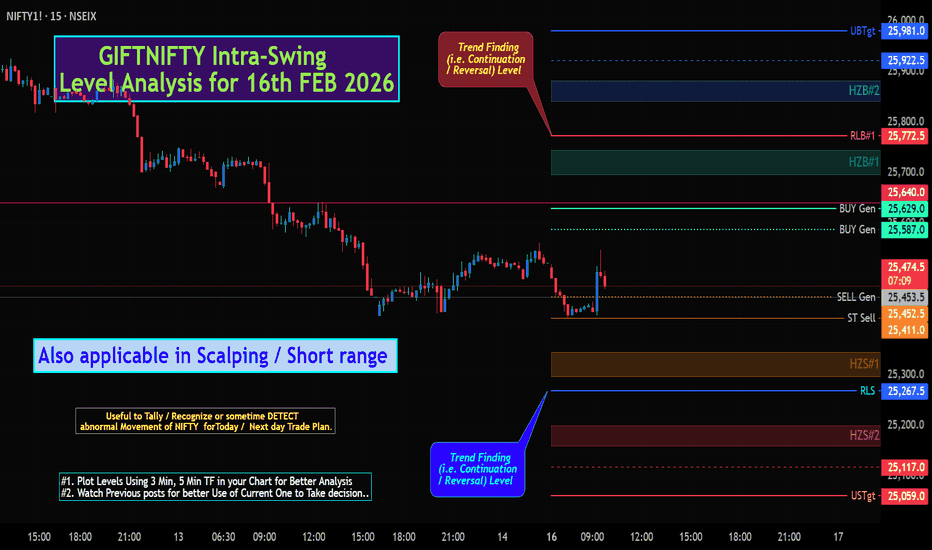

GIFTNIFTY Intra-Swing Level Analysis for 16th FEB 2026GIFTNIFTY Intra-Swing Level Analysis for 16th FEB 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

⚪Weekly PCR Analysis:

17 Feb 2026 EXP. Weekly Basis =>

PCR: 0.66 Trend Strength: 🛑 Bearish.

Intraday Change in Weekly Basis Data =>

Change OI PCR: 2.2

Gold Trading Strategy for 16th February 2026📊 Intraday Trading Setup

🟢 BUY Setup – Breakout Strategy

👉 Condition:

Buy only if the 30-minute candle closes above $5050

🔹 Entry: Above the high of the 30-min candle close above $5050

🔹 Confirmation: Strong bullish candle close with good volume

🎯 Targets:

Target 1: $5065 💰

Target 2: $5078 💰💰

Ta

Gold Pullback Into Structure Support – Trend Continuation SetupGold has pulled back into a rising structure support zone after completing a strong upside move. Price is now retesting the trendline while holding above previous higher lows.

This type of setup is important because strong trends usually offer pullbacks before continuation. As long as price holds a

NIFTY LOOKS UPToday was quite a turnaround session for the Indian markets. After a weak opening that saw the Nifty slip below 25,400, a strong late-day rally led by the banking and energy sectors helped indices snap a losing streak.

## Market Performance (Feb 16, 2026)

Nifty 50: Ended at 25,682.75, up 211.65 po

Gold Trading Strategy for Next Monday✅ The gold market is currently showing signs of short-term bullish momentum recovery. On the 4-hour chart, price has rebounded to the 5050 area, breaking above MA10 and MA20, which confirms the restoration of the short-term bullish structure. The Bollinger Bands’ middle and upper bands are turning u

XAUUSD – Weekly Outlook: ConsolidationXAUUSD – Weekly Outlook: Consolidation Before Expansion? | Lana ✨

Gold is entering the new week in a clear consolidation phase around the 4,960–5,000 region after defending the mid-range support and completing a corrective pullback from previous highs. On the 3H structure, price continues to respec

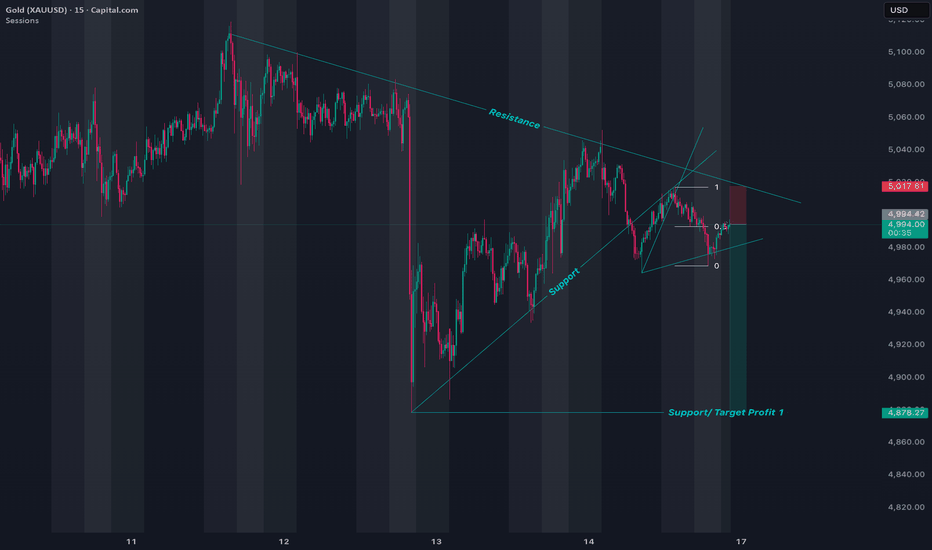

Short Setup From Resistance to Support Overview

Timeframe: 45-minute

Instrument: Gold vs USD (XAU/USD)

The chart shows a recent strong bearish impulse (large red candle drop), followed by a rebound.

Price is now retracing upward into a previously established resistance zone.

2️⃣ Key Levels Identified

🟢 Resistance Zone: ~5,040 – 5,0

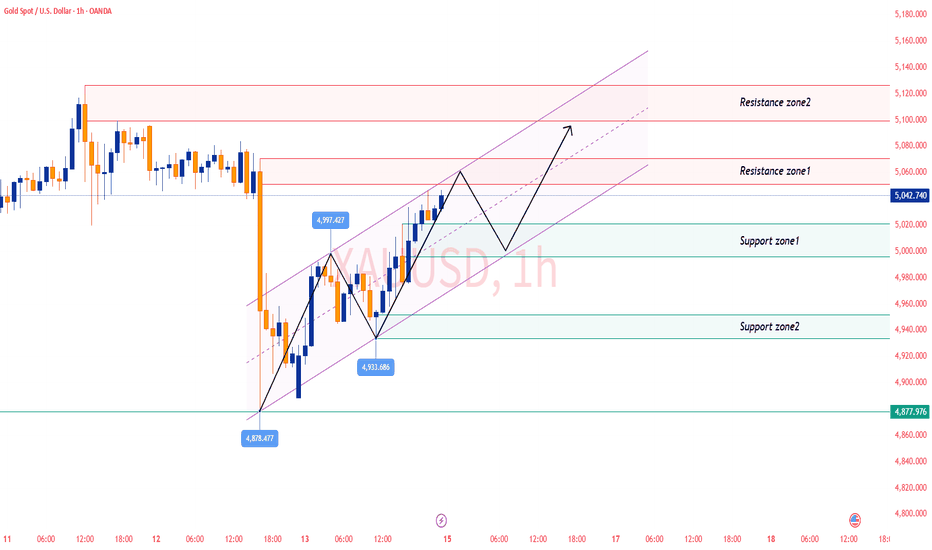

Chart Analysis – Bullish Reversal Toward Resistance

The 1-hour chart of Gold vs US Dollar (XAU/USD) shows a strong bullish recovery after a sharp sell-off. Price has reclaimed a key demand zone and is now pushing toward a major resistance level.

🟢 1. Demand Zone Holding (Bullish Structure Intact)

Price sharply dropped into the 4,880–4,920 support

See all futures ideas

USDJPY ANALYSIS OVER H1 CHART.USDJPY is reacting well from the demand zone highlighted on my TradingView chart. Price is holding above support and starting to build a base, which keeps the bullish bias intact as long as this level holds.

I’m staying long from 153.500, targeting 154.700 → 156.200 → 157.650, with risk clearly pro

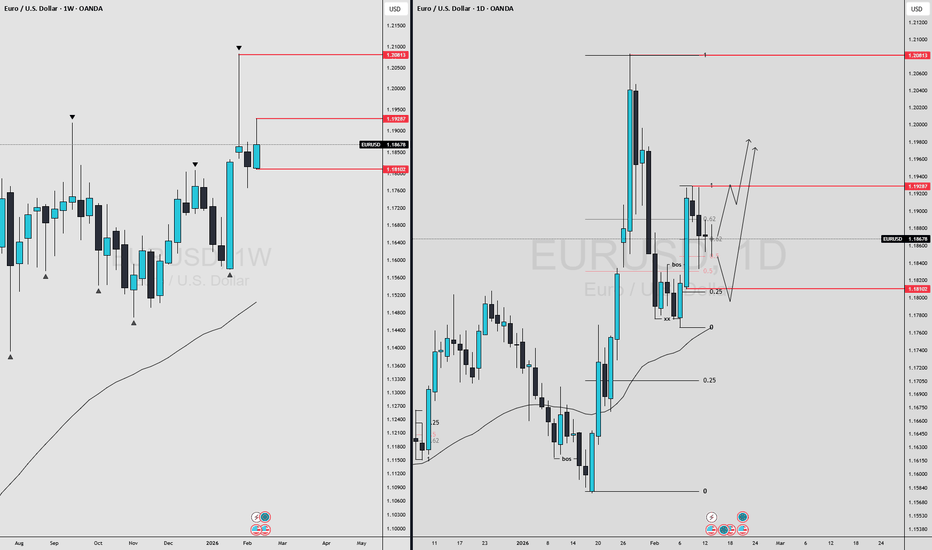

EURUSD Looks Weak on Monthly ChartEURUSD Analysis (Monthly Chart)

* The pair is trending within a descending wedge pattern, and prices have failed to breach its upper trendline multiple times in recent months.

* During Jan, the pair breached the wedge, tested the supply order block, then retraced lower.

* The month of Feb also fai

FOREX "PAIRS IN PLAY" Session 33 15 02 26Scanning multiple forex pairs to filter high-quality trade setups. No trades are forced—only structure-based opportunities.

Note: There may be a delay in this video due to upload processing time.

Disclaimer: FX trading involves high leverage and substantial risk, and losses can exceed your initial

EURUSD BUY Breakout + Retest Entry

➡️ Break & Buy Above: 1.18956

When price decisively breaks above key resistance and holds, this signals bullish continuation.

📌 Stop-Loss: 1.1372

📌 Targets:

• TP1: 1.20888

• TP2: 1.21500

Why this works: Breakouts that retest previous resistance as support can unleash strong up moves.

AUDJPY – Bullish Reversal From Trendline SupportAUDJPY is reacting strongly from a major ascending trendline support on the 1H timeframe. Price swept liquidity below the structure, tapped into the demand zone, and immediately rejected — signaling buyer strength.

we entered long around 108.180, which aligns perfectly with the technicals.

📈 Why T

See all forex ideas

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.