Institutional Objectives in Options Trading🔷 What Are Institutions in the Market?

Before diving into their objectives, let’s first understand who institutions are:

Institutions are large, professional organizations that trade in the financial markets using massive amounts of capital. These include:

Mutual Funds

Hedge Funds

Pension Funds

British Pound / U.S. Dollar

1.33485USDR

−0.00036−0.03%

As of today at 11:26 GMT

USD

No trades

Key data points

About British Pound / U.S. Dollar

GBPUSD, often referred to as “The Cable”, a foreign exchange term used to describe the British pound vs the US dollar, is one of the oldest traded currency pairs. In July of 1866, after an earlier failed attempt, the first reliable exchange rate between the British pound and the US dollar was transmitted between the London and New York Exchanges. Optic fibre cables accompanied by satellites handle the Transatlantic communications today.

No news here

Looks like there's nothing to report right now

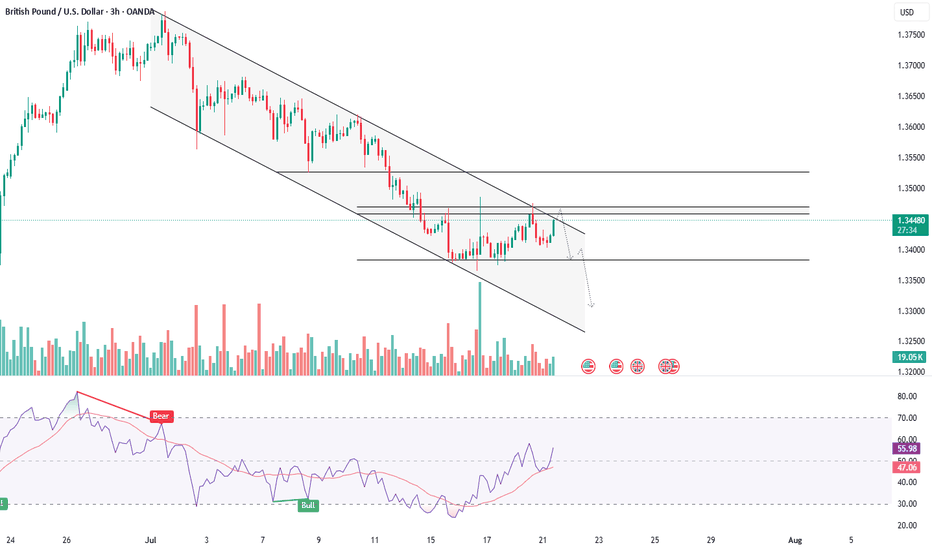

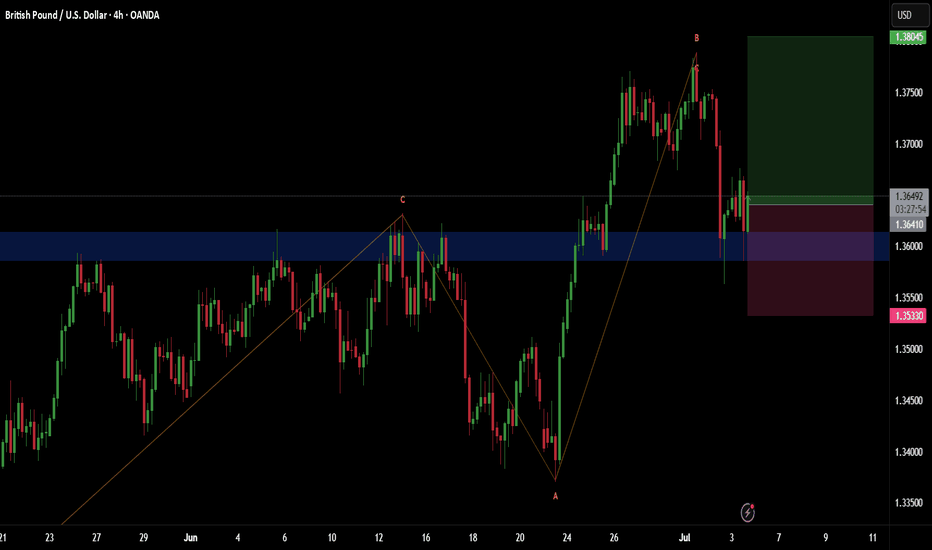

GBPUSD - NEAR RESISTANCE, BEARISH CONTINUATION IN SIGHTSymbol - GBPUSD

CMP - 1.3460

The GBPUSD currency pair is currently undergoing a countertrend correction, aligning with a broader retracement in the US dollar. This movement presents an opportunity for the pair to test the prevailing trend resistance and consolidate within a key liquidity zone. Mar

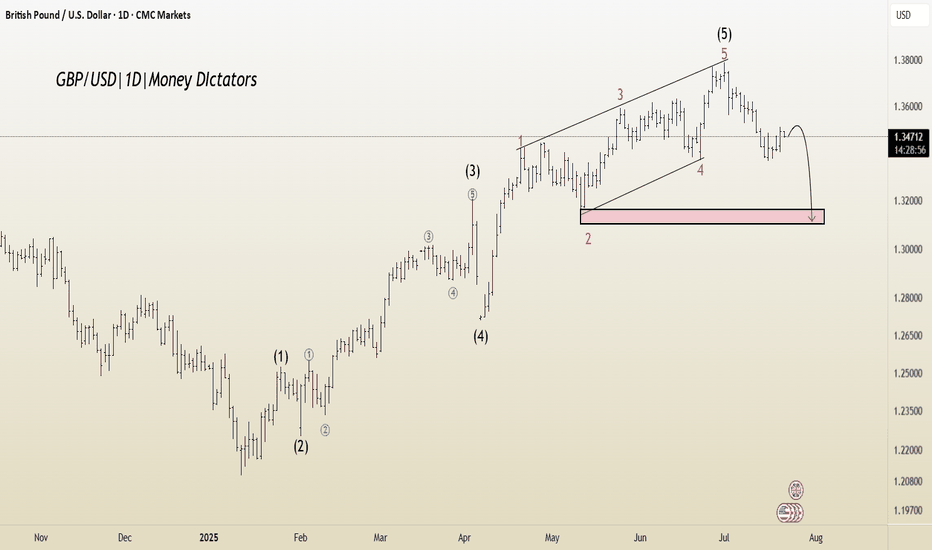

GBP/USD: Post-Impulse Sell Setup from Ending DiagonalThe chart depicts a completed 5-wave impulsive structure, culminating at the top of wave (5). The internal wave structure of the final fifth wave forms a classic ending diagonal pattern, typically signaling a trend reversal or deep correction.

After this extended fifth wave, the price has started r

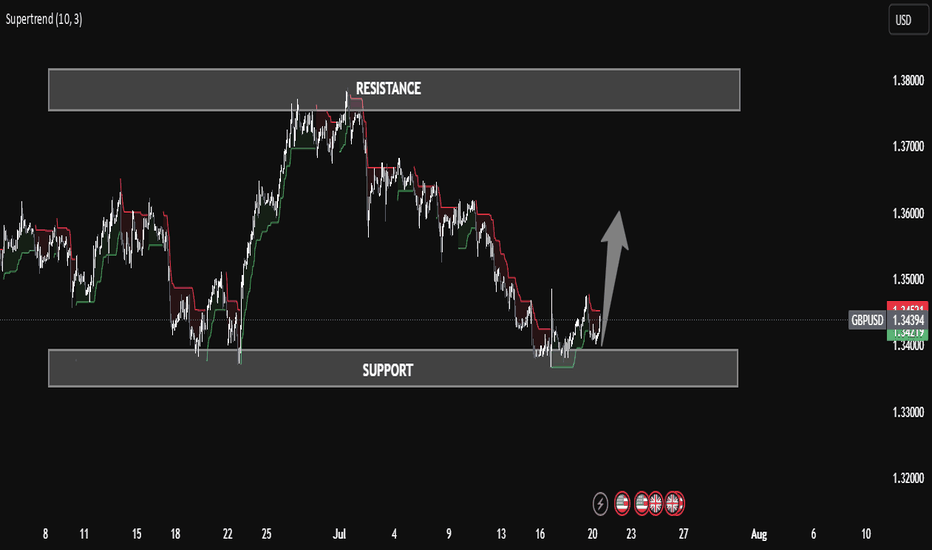

GBP/USD Technical Insight – Reversal Opportunity from Demand GBP/USD Technical Insight – Reversal Opportunity from Demand Zone

The GBP/USD chart showcases a classic liquidity sweep and bullish reaction from a clearly defined support zone (1.3360 – 1.3400). After an extended bearish move, price entered the demand area, rejected strongly, and formed a potentia

GBPUSD BUY LONG!!!!!As per my view,

Price retrace to 0.618 area and shows good support from that area.

So the upside liquidity areas are 1.3729 and 1.3789.

Plan your trade according to this with your own risk.

Bonus point ----- if today candle close bullish means then the target will definitely reach.

LAST POST GOOD BYE INSTITUTIONAL TRADER Why i am posting trade = improve my self and strategy

why iam not posting = kyuki mai yaha pe improve karne aaya hu na ki kisi ko dekhane ki mai kaisa trade karta hu

ab mujhe lagta hai ki improve jo karna hai wo mai kar liya hu

mujhe youtube trader nahi banana hai

aapka bahut support mila dil

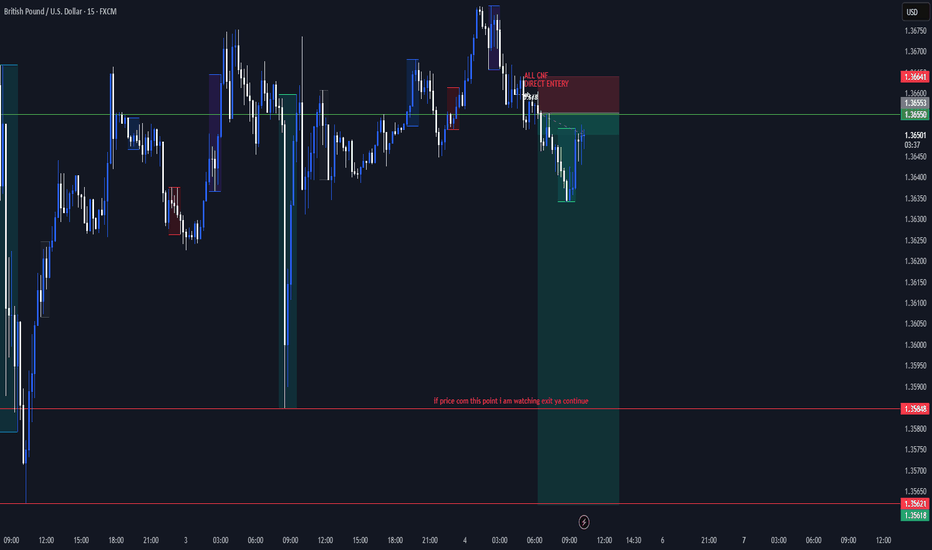

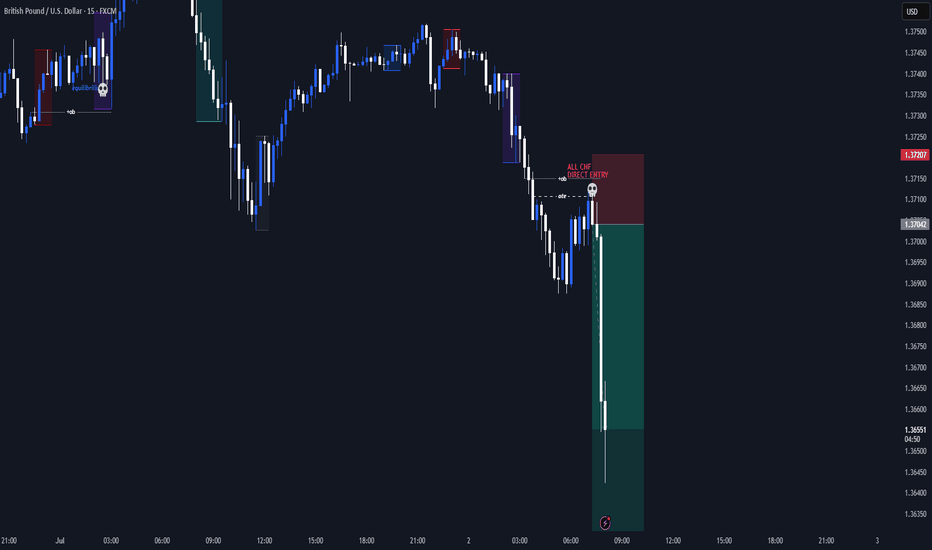

GOOD EVENING INSTITUTIONAL TRADERDATE 04-07-2025

USD= HOLIDAY

Direct entery trade but msrket goes to consolidation because of no liquid in market

USD HOLIDAY

NOT A GOOD TRADE BUT I CONSIDERED

EVERY TRADE IS UNICQ AND BEST TRADE IN MY LIFE 😂🤣

Let's see what happen in future

SL= BREAK EVEN

TP = YOU CAN SEE MY TP ON CHART

HA

Buy Trade - GBP/USDGreetings to everyone!

You can place a buy trade on GBP/USD and check out my chart for the ideal entry, stop-loss & target placement.

Remember :-

* Move your SL to breakeven once the trade reaches 1:1 R.

* Aim for a minimum reward of 1:1.5 R.

* Don't risk more than 3% of your total margin.

GOOD EVENING INSTUTIONAL TRADER date-02-07-2025

iNSTUTIONAL previous you can large liquidity pool

and after apike small leg = manupulation

SL= BREAK EVEN

TP = THIS IS NOT EXACT TP SOME POINT HAVE SOME DOUBT LET SEE

PREVIOUS MANULATION LEG HAVE SETUP BUT TUESDAY DONT HAVE INTERNET

LET'S SEE WHAT HAPPEN IN FUTURE

I WILL UPDATE

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of GBPUSD is 1.33486 USD — it has decreased by −0.03% in the past 24 hours. See more of GBPUSD rate dynamics on the detailed chart.

The value of the GBPUSD pair is quoted as 1 GBP per x USD. For example, if the pair is trading at 1.50, it means it takes 1.5 USD to buy 1 GBP.

The term volatility describes the risk related to the changes in an asset's value. GBPUSD has the volatility rating of 0.35%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The GBPUSD showed a −0.98% fall over the past week, the month change is a −2.69% fall, and over the last year it has increased by 3.86%. Track live rate changes on the GBPUSD chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

GBPUSD is a major currency pair, i.e. a popular currency paired with USD.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade GBPUSD right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with GBPUSD technical analysis. The technical rating for the pair is sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the GBPUSD shows the buy signal, and 1 month rating is buy. See more of GBPUSD technicals for a more comprehensive analysis.