Nifty Spot is currently at 19526, trading within a range of 18646 to 19991. 18646 serves as a strong support level, while 19991 acts as a robust resistance. If Nifty fails to sustain 19518, it may experience a decline of 100-200 points. Traders should closely monitor these levels for potential trading opportunities. T1 is 19320 Thank you @Money_Dictators

Howdy Traders, We can see that Bitcoin has been trading in a range for several days. This means that the buyer and seller are satisfied within this range. Bitcoin tried to break this range but failed and it was a fake breakout and many buyers were trapped in this breakout. Looking at this fake breakout, I feel that the market may go down a bit. Target: ...

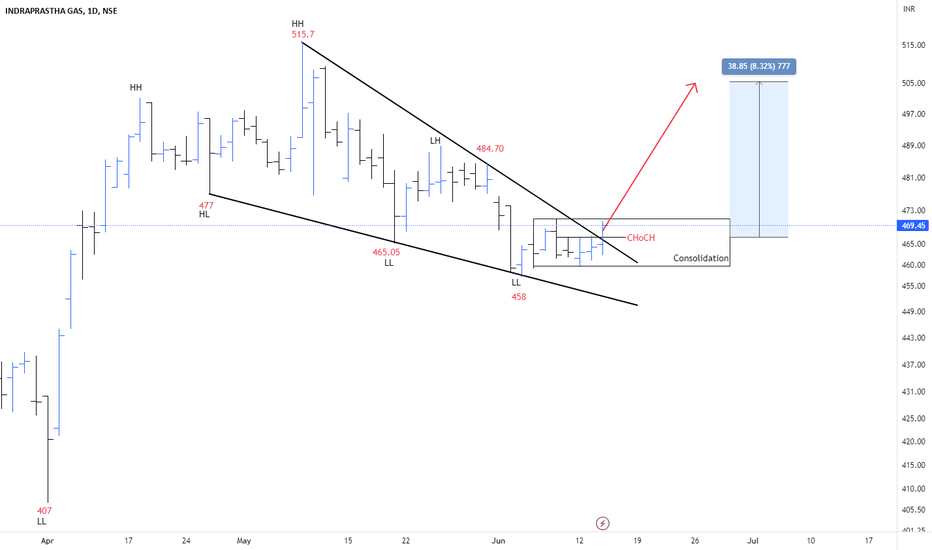

IGL has constructed a falling wedge on the 1-day chart in which it has made continuous lower lows and lower highs. The trend can change from bearish to bullish after the breakout of the resistance trendline. Buyers can expect a bullish move with the following targets: 483 & 504 . IGL Is Bearish below 458 . Buyers have to break and stay above 504 to increase...

Howdy Traders, Raymond Ltd is exhibiting a triangle pattern, accompanied by a value area that helps maintain a balanced supply and demand dynamic. The level of 1610 holds significant importance for bullish investors. A successful breakout above this level is expected to propel the price toward new highs. Traders may consider setting their target price as high...

howdy Traders, Much of the power of bullish investors is found in Tata Communications. If seen inside the chart, higher high and lower low is shown in parallel channels. 1429 level was a strong resistance level but now it is a support. If the market sustains above the 1429 level then a bullish market can be seen and 1480 is the target.

Howdy Traders, I feel that the market may give a little negative I because the doji candlestick pattern is seen at the higher highs followed immediately by a black candlestick, indicating that the market may provide a little negative move. Note = If the market stays below the level of 1249 then Target- 1231.90

Howdy traders, The market is bullish on ultra-tech cement, but the market may retest a little. The market needs to go up to 7972 t o get retested. If the market does not go up to 7972 to retest then a good bullish rally can be seen in the market.

The business cycle describes how the economy expands and contracts over time. It is an upward and downward movement of the gross domestic product along with its long-term growth rate. The business cycle consists of 6 phases/stages : 1. Expansion 2. Peak 3. Recession 4. Depression 5. Trough 6. Recovery 1) Expansion : Sectors Affected: Technology, Consumer...

Intro: In the dynamic world of financial markets, trading strategies have evolved significantly over the years. With advancements in technology and the rise of artificial intelligence (AI), algorithmic trading, also known as algo trading, has gained immense popularity. Algo trading utilizes complex algorithms and automated systems to execute trades swiftly and...

Hello traders, It is a quick update about Asian paints. Security has made a downward channel. After the rectangle breakout, it made another rectangle pattern. The 3033 level is an essential support level to keep an eye on. A breakout will intensify the bearish atmosphere. We can expect a new low based on the price action of the second rectangle pattern If...

A new resistance has come through ICICI Bank and the price has moved downwards from there. A good bullish move was seen in the market when the resistance was broken by the market. A good move to the downside can be seen if the market breaks the 915 level. Strong resistance currently acts as strong support. If the market cannot break the level of 915 then the...

TF - Monthly - Aditya Birla capital had broken out descending trendline at 80 . But, due to supply pressure, it couldn't make a new high again. It ends up making the same high(double top). AB CAPITAL has made a monthly consolidation range of 139 - 95 As per the monthly chart, AB CAPITAL can take support from 78.05 . Three reasons to consider this level:...

Recession is a scary word for any country An economic recession occurs when the economy shrinks. During recessions, even businesses close their doors. Even an individual can see these things with his own eyes: 1. People lose their jobs 2. Investment lose their value 3. Business suffers losses Note: The recession is part of an economic cycle. If you haven't read...

BPCL looks bearish as it falls below 399 support and goes back 5 days. BPCL made a big belt candle and started falling. According to past performance, if the trend is weak, the price will make a bunch of bearish candles. The swing dealer can wait for the T1 356 to break. But if the market breaks the level of 399 , there may be a bullish movement in the...

BEL has completed impulsive wave 5 at 258 and started declining for corrective formation. BEL has completed corrective wave 5 of C of B at 250 . Now, BEL is forming lower degree's waves of wave C. If it sustains below 245 , BEL can fall for following support levels: 235 - 224 - 215. Wave C can complete near 100 of wave A at 215 . It is called A=B . I...

WTI has been forming a flat A-B-C correction. According to Elliott's wave projection, the oil future looks bearish. Oil Future has accomplished wave A at 193.17 , and sub-wave (c) of wave ((B)) is creating an ending diagonal. The ending diagonal is a formation of five waves. WTI is to occur in wave 5 of an ending diagonal. If you are a safe trader, you can...

What are derivatives? Basic interpretation : something which is based on another source. A derivative is a contract or product whose value derives from the value of the base asset. The base asset is called the underlying asset. i.e., Sugar prices will rise if sugarcane prices increase due to low production. It means sugarcane is the underlying asset of sugar...

Asian paints have completed three red crowd patterns and started small corrections. Asian paints strong support is 3052. and I think if the market breaks support it can go up to 2936. If the support is not broken, the market will move to the 3150 level. T1= 3150 ( if the market will not break support ) T1=2936 ( if the market will break support) Thank...