## 🚀 IONQ Earnings Call Play – High-Risk, High-Reward Setup (Aug 6)

**Quantum Alert: Will IonQ Surprise After Amazon Stake News?**

### 💡 Core Thesis:

Despite weak historical execution, **analysts are turning bullish** on IONQ ahead of earnings—backed by **strong sector sentiment, elevated options activity, and macro tailwinds** in tech.

---

### 🧠 Earnings Breakdown

| Metric | Status | Insight |

| -------------------- | ------------ | ----------------------------------------- |

| 📉 Revenue Growth | -0.2% | Flat growth in a high-expectation sector. |

| 🔥 Gross Margin | 50.7% | Solid base for future profitability. |

| ❌ Surprise Avg. | -38% | Historical underperformance. |

| 💬 Analyst Consensus | ⭐ Strong Buy | Amazon’s recent stake boosts sentiment. |

🧮 **Fundamental Score**: 5/10

⚠️ Weak execution vs. strong institutional interest.

---

### 🔍 Options Flow Snapshot

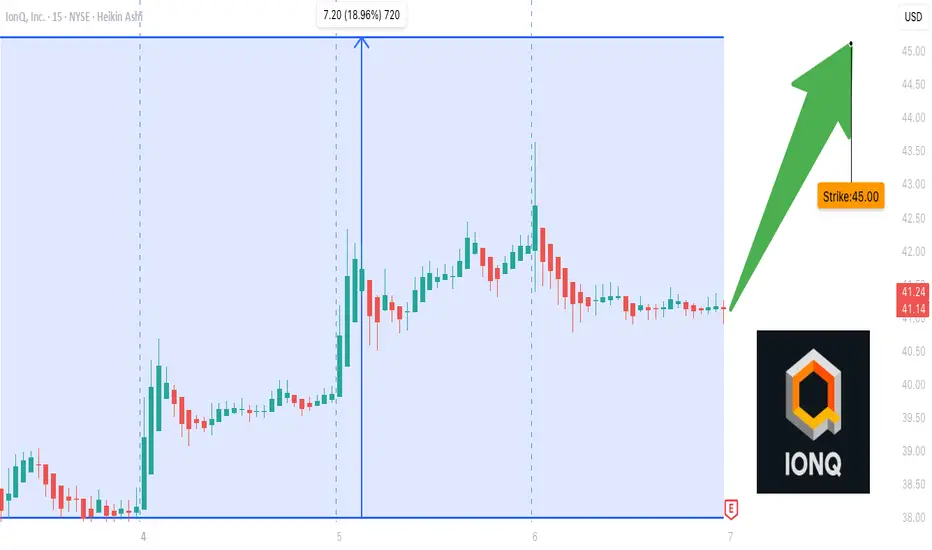

* 💥 **Bullish Divergence** on Calls (especially \$45.00 strike)

* 📈 Elevated IV (Rank 0.75)

* 🔀 High OI on both calls/puts suggests hedged anticipation

* 📊 Expected Move: \~8%

📊 **Options Flow Score**: 7/10

🚨 Smart money leaning **bullish**, but cautious.

---

### 📈 Technical Landscape

* 💤 Low volume pre-earnings

* 🧍 Hovering near support (\~\$40)

* 🚧 Resistance: \$43.55

* ⚠️ No strong trend detected

📉 **Technical Score**: 4/10

🧊 Cold tape, needs a catalyst to ignite.

---

### 🌐 Macro & Sector Context

* 💡 Quantum computing getting big headlines

* 🛒 Tech rotation underway

* 💰 Government & institutional support growing

🌍 **Macro Score**: 7/10

📢 Sector momentum can carry IONQ, if earnings surprise.

---

### 🔐 Trade Setup (Options Play)

| 🎯 Strategy | Long Call |

| --------------- | --------- |

| 📌 Strike | \$45.00 |

| 📆 Expiry | Aug 08 |

| 💵 Entry | \$0.98 |

| 🏁 Target | \$2.94 |

| 🛑 Stop Loss | \$0.49 |

| ⚖️ Risk\:Reward | 1:3 |

| 📈 Confidence | 66% |

📊 **Expected Move**: ±8.0%

📈 **IV Rank**: 0.75

🕰 **Timing**: Enter before close on Aug 6

📆 **Earnings Report**: Aug 6 (AMC)

---

### 📉 Exit Strategy:

* 🎯 **Profit Target**: \$2.94

* 🛑 **Stop Loss**: \$0.49

* ⏱ **Time Exit**: Close position within 2 hours post-earnings if no movement

---

### ⚠️ Bottom Line:

> **This is a speculative, high-volatility earnings trade** with asymmetric upside potential. Analyst upgrades and the Amazon effect provide tailwinds—but historical miss rate is real. Trade small, trade smart.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.