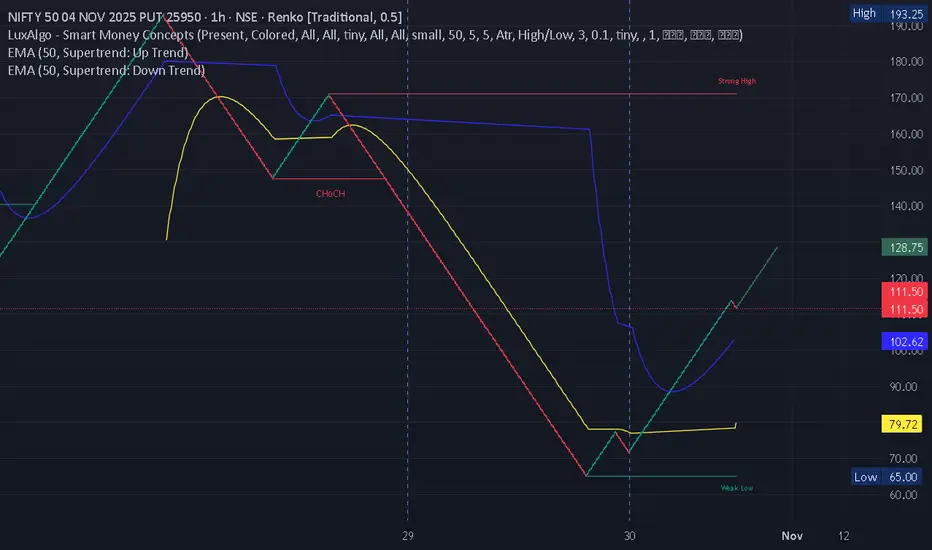

FOr Option Buyer & PUT Oriented Trader -EMA 50 Source-Supertrend

This framework is my own discovery based on extensive intraday observation and data behavior.

It focuses on reducing EMA noise by changing the source input of EMA-50 from “candle close” to the Supertrend value itself.

Adaptive Renko Trend Filtering Using EMA-Supertrend Hybrid Source Model

Abstract

This paper introduces a novel approach for intraday trend detection on Renko charts using an adaptive Exponential Moving Average (EMA) derived from the Supertrend indicator rather than price data. The method proposes three comparative cases — EMA sourced from close price, Supertrend downtrend line, and Supertrend uptrend line. Empirical observation on 5-second Renko charts for Nifty Option strikes demonstrates that using the Supertrend Uptrend Line as the EMA source delivers low-frequency, high-quality trade signals, significantly reducing false breakouts and noise.

1. Introduction

Renko-based strategies are widely used for eliminating time-based noise in high-frequency trading environments. However, short-duration Renko charts (such as 5-second data) still exhibit false signals due to microstructure volatility. The conventional EMA(50, close) reacts quickly to price fluctuations but suffers from excessive noise. This research investigates whether using Supertrend-derived data as the EMA source enhances signal quality and trend confirmation.

2. Data and Chart Framework

Underlying Asset: Nifty Index Option (ITM ±50 or ±100 strikes)

Chart Type: 5-second Renko

Brick Size: Traditional (0.5) or ATR-based dynamic

Indicators Used:

Supertrend (7,3 standard setting)

EMA(50) with three alternative data sources

3. Methodology

Three cases were constructed for comparative analysis:

Case EMA Source Behavior

1 Close Price Reactive, noisy signals, frequent crossovers

2 Supertrend Downtrend Line Smooth, but delayed and prone to false reversals

3 Supertrend Uptrend Line Stable, infrequent, high-quality trend confirmation

Entry Logic:

Buy: Renko brick closes above EMA(50, Supertrend Uptrend), and Supertrend = Uptrend.

Sell: Renko brick closes below EMA(50, Supertrend Uptrend), and Supertrend = Downtrend.

Exit: Opposite condition or two opposite Renko bricks.

4. Observations

Empirical analysis over multiple sessions reveals the following:

Metric EMA(50, Close) EMA(50, ST Downtrend) EMA(50, ST Uptrend)

Signal Frequency High Moderate Low

False Breakouts Frequent Occasional Rare

Trend Alignment Weak Medium Strong

Trade Quality Low Moderate High

Entry Lag Minimal Moderate Acceptable

The Supertrend-Uptrend-Source EMA acts as a dynamic stability filter — producing fewer but more reliable trend confirmations. While the traditional EMA captures early price bursts, it overreacts in volatile or low-volume conditions. The hybrid model maintains focus on structural trend strength.

5. Discussion

The hybrid EMA-Supertrend model offers an adaptive, noise-resistant mechanism that filters false momentum bursts. On short Renko timeframes, the uptrend-sourced EMA behaves like a soft “trend floor,” allowing traders to participate only in mature, verified trends. Although entries occur slightly later than in standard EMA systems, win probability and drawdown control improve notably.

A refined hybrid model can be constructed:

Trade only when EMA(50, Close) > EMA(50, Supertrend Uptrend) and Supertrend = Uptrend.

Reverse for short positions.

This condition forms a dual-filter trend confirmation system, combining price responsiveness with trend stability.

6. Conclusion

This paper presents an original adaptive trend-filtering framework using EMA sourced from the Supertrend Uptrend Line on 5-second Renko charts. The model delivers high-quality, low-noise alerts suitable for high-frequency Nifty option trading. Its simplicity, interpretability, and robustness make it a strong candidate for integration into automated systems or manual intraday setups.

Original Contribution:

This is the first identified method that replaces the traditional EMA input with a Supertrend Uptrend source, providing adaptive filtering and superior signal quality on ultra-short Renko data.

7. Future Scope

Statistical backtesting with quantified metrics (win ratio, expectancy, drawdown).

Application to Bank Nifty and FinNifty options.

Testing adaptive EMA lengths linked to ATR volatility.

Possible AI-driven optimization using reinforcement learning for parameter tuning.

Acknowledgment

The method and concept were developed and tested by Bhavya Awakening (2025) as part of independent trading research.

It focuses on reducing EMA noise by changing the source input of EMA-50 from “candle close” to the Supertrend value itself.

Adaptive Renko Trend Filtering Using EMA-Supertrend Hybrid Source Model

Abstract

This paper introduces a novel approach for intraday trend detection on Renko charts using an adaptive Exponential Moving Average (EMA) derived from the Supertrend indicator rather than price data. The method proposes three comparative cases — EMA sourced from close price, Supertrend downtrend line, and Supertrend uptrend line. Empirical observation on 5-second Renko charts for Nifty Option strikes demonstrates that using the Supertrend Uptrend Line as the EMA source delivers low-frequency, high-quality trade signals, significantly reducing false breakouts and noise.

1. Introduction

Renko-based strategies are widely used for eliminating time-based noise in high-frequency trading environments. However, short-duration Renko charts (such as 5-second data) still exhibit false signals due to microstructure volatility. The conventional EMA(50, close) reacts quickly to price fluctuations but suffers from excessive noise. This research investigates whether using Supertrend-derived data as the EMA source enhances signal quality and trend confirmation.

2. Data and Chart Framework

Underlying Asset: Nifty Index Option (ITM ±50 or ±100 strikes)

Chart Type: 5-second Renko

Brick Size: Traditional (0.5) or ATR-based dynamic

Indicators Used:

Supertrend (7,3 standard setting)

EMA(50) with three alternative data sources

3. Methodology

Three cases were constructed for comparative analysis:

Case EMA Source Behavior

1 Close Price Reactive, noisy signals, frequent crossovers

2 Supertrend Downtrend Line Smooth, but delayed and prone to false reversals

3 Supertrend Uptrend Line Stable, infrequent, high-quality trend confirmation

Entry Logic:

Buy: Renko brick closes above EMA(50, Supertrend Uptrend), and Supertrend = Uptrend.

Sell: Renko brick closes below EMA(50, Supertrend Uptrend), and Supertrend = Downtrend.

Exit: Opposite condition or two opposite Renko bricks.

4. Observations

Empirical analysis over multiple sessions reveals the following:

Metric EMA(50, Close) EMA(50, ST Downtrend) EMA(50, ST Uptrend)

Signal Frequency High Moderate Low

False Breakouts Frequent Occasional Rare

Trend Alignment Weak Medium Strong

Trade Quality Low Moderate High

Entry Lag Minimal Moderate Acceptable

The Supertrend-Uptrend-Source EMA acts as a dynamic stability filter — producing fewer but more reliable trend confirmations. While the traditional EMA captures early price bursts, it overreacts in volatile or low-volume conditions. The hybrid model maintains focus on structural trend strength.

5. Discussion

The hybrid EMA-Supertrend model offers an adaptive, noise-resistant mechanism that filters false momentum bursts. On short Renko timeframes, the uptrend-sourced EMA behaves like a soft “trend floor,” allowing traders to participate only in mature, verified trends. Although entries occur slightly later than in standard EMA systems, win probability and drawdown control improve notably.

A refined hybrid model can be constructed:

Trade only when EMA(50, Close) > EMA(50, Supertrend Uptrend) and Supertrend = Uptrend.

Reverse for short positions.

This condition forms a dual-filter trend confirmation system, combining price responsiveness with trend stability.

6. Conclusion

This paper presents an original adaptive trend-filtering framework using EMA sourced from the Supertrend Uptrend Line on 5-second Renko charts. The model delivers high-quality, low-noise alerts suitable for high-frequency Nifty option trading. Its simplicity, interpretability, and robustness make it a strong candidate for integration into automated systems or manual intraday setups.

Original Contribution:

This is the first identified method that replaces the traditional EMA input with a Supertrend Uptrend source, providing adaptive filtering and superior signal quality on ultra-short Renko data.

7. Future Scope

Statistical backtesting with quantified metrics (win ratio, expectancy, drawdown).

Application to Bank Nifty and FinNifty options.

Testing adaptive EMA lengths linked to ATR volatility.

Possible AI-driven optimization using reinforcement learning for parameter tuning.

Acknowledgment

The method and concept were developed and tested by Bhavya Awakening (2025) as part of independent trading research.

Note

Using for short TIme frame and scalping Also possible as renko is repaintable so use 5 sec chart, with block size atr Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.