hi traders

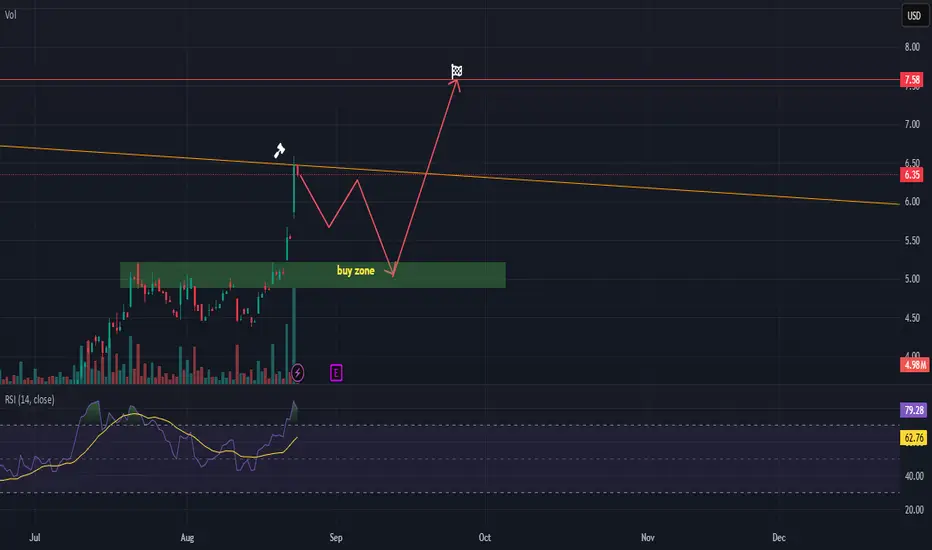

NIO has seen a strong breakout recently, moving sharply higher and now testing the $6.35 resistance level. This rally has been accompanied by a spike in volume, which shows strong momentum behind the move.

However, if you feel like you missed out on this run, don’t FOMO into buying here. The RSI is overbought across multiple timeframes (4h, daily, and weekly), which suggests the stock is due for a cooldown.

The best strategy in these setups is to wait for a healthy pullback. The highlighted buy zone around the $5.20–$5.50 range could offer a better risk/reward entry if price retraces. A bounce from that zone could then lead to another leg higher, with a potential target near $7.58.

In summary:

✅ Strong breakout on high volume.

⚠️ RSI overbought across 4h, daily, and weekly.

🕰 Best to wait for a pullback into the buy zone rather than chase.

NIO has seen a strong breakout recently, moving sharply higher and now testing the $6.35 resistance level. This rally has been accompanied by a spike in volume, which shows strong momentum behind the move.

However, if you feel like you missed out on this run, don’t FOMO into buying here. The RSI is overbought across multiple timeframes (4h, daily, and weekly), which suggests the stock is due for a cooldown.

The best strategy in these setups is to wait for a healthy pullback. The highlighted buy zone around the $5.20–$5.50 range could offer a better risk/reward entry if price retraces. A bounce from that zone could then lead to another leg higher, with a potential target near $7.58.

In summary:

✅ Strong breakout on high volume.

⚠️ RSI overbought across 4h, daily, and weekly.

🕰 Best to wait for a pullback into the buy zone rather than chase.

💥 Free signals and ideas ➡ t.me/vfinvestment

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💥 Free signals and ideas ➡ t.me/vfinvestment

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.