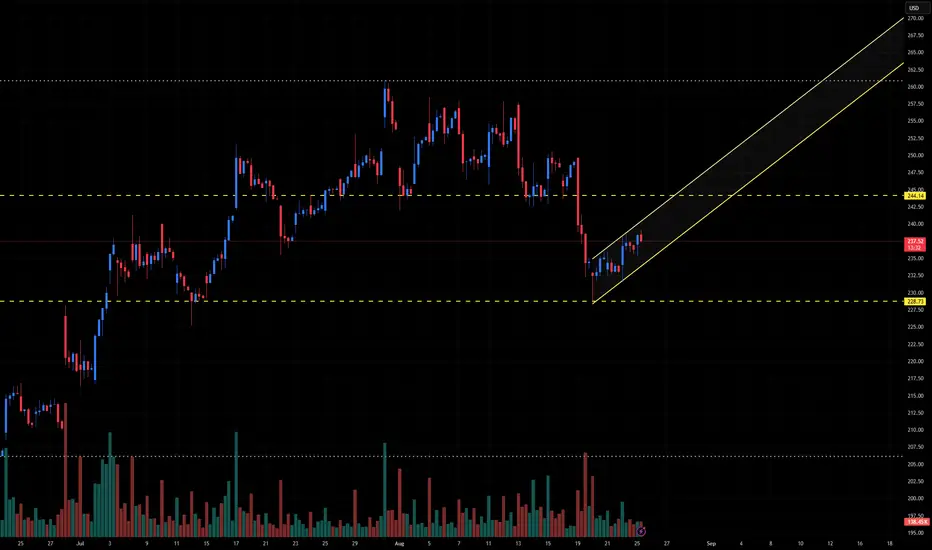

🖥️ ORCL Technical Outlook – Rebound Within Rising Channel

Ticker: ORCL (Oracle Corp.)

Timeframe: 30-minute candles

🔍 Current Setup

ORCL recently sold off from the 245–246 resistance zone, dropping sharply before finding support near 229. From there, price has begun to rebound, carving out a rising channel.

Immediate support: ~229

Immediate resistance: ~244–246

Current price: ~237.50, climbing within the channel.

This suggests ORCL is in a short-term recovery phase, but it must break back above 244–246 to resume its broader uptrend.

📊 Breakout Levels

🚀 Upside (Bullish Scenario)

Trigger: Break and close above 244–246.

Intermediate Targets:

252–255 → Next resistance cluster.

260–262 → Extension zone.

Measured Move Target: ~265–267 (channel projection).

🔻 Downside (Bearish Scenario)

Trigger: Break below 229, which would invalidate the rising channel.

Intermediate Supports:

225–223 → Minor support.

218–215 → Stronger base.

Measured Move Target: ~210–212 (retracement target).

📈 Volume Analysis

Selling volume spiked on the drop to 229, showing heavy liquidation.

Current rebound is on lighter, steady volume, consistent with a relief rally.

A breakout above 246 requires a surge in volume to confirm bullish intent.

⚖️ Probability Bias

The short-term structure favors a rebound toward 244–246.

However, this level is the line in the sand — failure to reclaim it would likely result in renewed selling pressure.

✅ Takeaway

ORCL is in a channel recovery after its sharp sell-off:

Bullish Break > 246: Targets 252 → 260 → 265–267

Bearish Break < 229: Targets 225 → 218 → 210

The battle at 246 will decide whether ORCL resumes its uptrend or continues lower.

Ticker: ORCL (Oracle Corp.)

Timeframe: 30-minute candles

🔍 Current Setup

ORCL recently sold off from the 245–246 resistance zone, dropping sharply before finding support near 229. From there, price has begun to rebound, carving out a rising channel.

Immediate support: ~229

Immediate resistance: ~244–246

Current price: ~237.50, climbing within the channel.

This suggests ORCL is in a short-term recovery phase, but it must break back above 244–246 to resume its broader uptrend.

📊 Breakout Levels

🚀 Upside (Bullish Scenario)

Trigger: Break and close above 244–246.

Intermediate Targets:

252–255 → Next resistance cluster.

260–262 → Extension zone.

Measured Move Target: ~265–267 (channel projection).

🔻 Downside (Bearish Scenario)

Trigger: Break below 229, which would invalidate the rising channel.

Intermediate Supports:

225–223 → Minor support.

218–215 → Stronger base.

Measured Move Target: ~210–212 (retracement target).

📈 Volume Analysis

Selling volume spiked on the drop to 229, showing heavy liquidation.

Current rebound is on lighter, steady volume, consistent with a relief rally.

A breakout above 246 requires a surge in volume to confirm bullish intent.

⚖️ Probability Bias

The short-term structure favors a rebound toward 244–246.

However, this level is the line in the sand — failure to reclaim it would likely result in renewed selling pressure.

✅ Takeaway

ORCL is in a channel recovery after its sharp sell-off:

Bullish Break > 246: Targets 252 → 260 → 265–267

Bearish Break < 229: Targets 225 → 218 → 210

The battle at 246 will decide whether ORCL resumes its uptrend or continues lower.

Trade active

MASSIVE WIN TO OVER $300Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.