PATANJALI

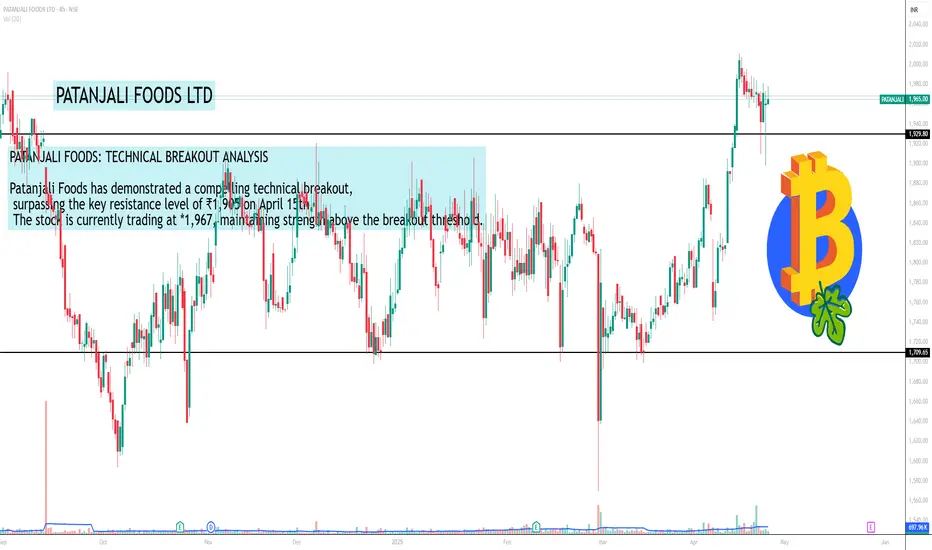

PATANJALI FOODS: TECHNICAL BREAKOUT ANALYSIS

Patanjali Foods has demonstrated a compelling technical breakout, surpassing the key resistance level of ₹1,905 on April 15th. The stock is currently trading at *1,967, maintaining strength above the breakout threshold.

I've deliberately delayed sharing this analysis for 10 days to confirm pattern validity. During this period, the stock has established credibility through:

Consistent rejection tests with long lower wicks at upper price levels

Sustained buying pressure despite pullbacks

Healthy accumulation of new institutional positions

Based on current technical indicators, Patanjali Foods shows potential to reach a target of *2,100.

Investors should consider the following approach:

Watch for behavior at the psychological resistance of *2,000

Validate this analysis with your own technical assessment before entering Consider implementing strategic entry positions once confirming the trend continuation

This structured opportunity presents an attractive risk-reward scenario for those monitoring technical breakouts in the consumer goods sector. Retry Claude can make mistakes.

Please double-check responses. 3.7 Sonnet Chat controls 3.7 Sonnet Our most intelligent model yet Learn more Content

PATANJALI FOODS: TECHNICAL BREAKOUT ANALYSIS

Patanjali Foods has demonstrated a compelling technical breakout, surpassing the key resistance level of ₹1,905 on April 15th. The stock is currently trading at *1,967, maintaining strength above the breakout threshold.

I've deliberately delayed sharing this analysis for 10 days to confirm pattern validity. During this period, the stock has established credibility through:

Consistent rejection tests with long lower wicks at upper price levels

Sustained buying pressure despite pullbacks

Healthy accumulation of new institutional positions

Based on current technical indicators, Patanjali Foods shows potential to reach a target of *2,100.

Investors should consider the following approach:

Watch for behavior at the psychological resistance of *2,000

Validate this analysis with your own technical assessment before entering Consider implementing strategic entry positions once confirming the trend continuation

This structured opportunity presents an attractive risk-reward scenario for those monitoring technical breakouts in the consumer goods sector. Retry Claude can make mistakes.

Please double-check responses. 3.7 Sonnet Chat controls 3.7 Sonnet Our most intelligent model yet Learn more Content

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.