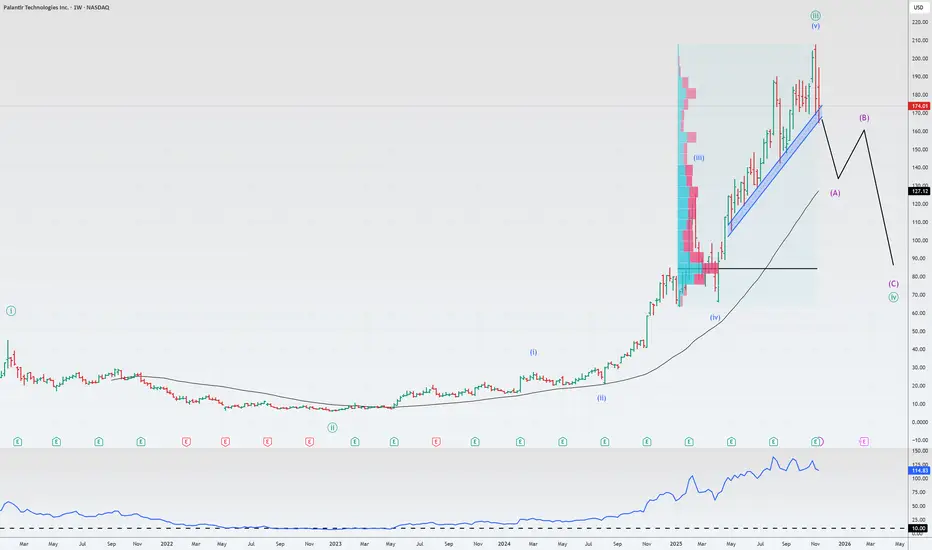

🌎Palantir: Rocket Growth vs. Sky-High Valuation. Which Will Outweigh the Other?

The quarterly results are very strong, but investors face significant risks. Let's break it down.

🚀 Strengths:

Explosive revenue: $1.18 billion (+63% YoY), EPS: $0.21. Both metrics beat expectations.

Brighter-than-expected future: Q4 guidance ($1.33 billion) and 2025 guidance (~$4.4 billion) are significantly higher than consensus.

Commercial: 121% YoY growth in the US. This is the company's main driver.

Sales are strong: Closed contracts worth $2.8 billion. The client base grew to 911 companies (+45%).

Super-efficient: Revenue +63%, while headcount is only up 10%. An operating margin of 51% is fantastic.

AI is the fuel: Products like AIP are accelerating adoption, and customers are switching en masse to the Palantir platform.

⚠️ What's scary: Risks and "buts"

The price is sky-high: A P/S ratio of 110+ is nonsense, even for a growing company. Market cap is growing faster than revenue.

The model predicts a collapse: Under optimistic scenarios (40% annual growth), the fair price could be tens of percent lower than the current one.

Share dilution: Share-based compensation (SBC) eats up 24% of revenue—a huge amount. Insiders are actively selling.

Shorted a billion: The legendary Michael Burry bought put options on 5 million shares, betting against PLTR. He believes the AI sector is inflating.

Vulnerability: Business is concentrated in the US, creating regulatory and macro risks. Europe is experiencing stagnation.

The quarterly results are very strong, but investors face significant risks. Let's break it down.

🚀 Strengths:

Explosive revenue: $1.18 billion (+63% YoY), EPS: $0.21. Both metrics beat expectations.

Brighter-than-expected future: Q4 guidance ($1.33 billion) and 2025 guidance (~$4.4 billion) are significantly higher than consensus.

Commercial: 121% YoY growth in the US. This is the company's main driver.

Sales are strong: Closed contracts worth $2.8 billion. The client base grew to 911 companies (+45%).

Super-efficient: Revenue +63%, while headcount is only up 10%. An operating margin of 51% is fantastic.

AI is the fuel: Products like AIP are accelerating adoption, and customers are switching en masse to the Palantir platform.

⚠️ What's scary: Risks and "buts"

The price is sky-high: A P/S ratio of 110+ is nonsense, even for a growing company. Market cap is growing faster than revenue.

The model predicts a collapse: Under optimistic scenarios (40% annual growth), the fair price could be tens of percent lower than the current one.

Share dilution: Share-based compensation (SBC) eats up 24% of revenue—a huge amount. Insiders are actively selling.

Shorted a billion: The legendary Michael Burry bought put options on 5 million shares, betting against PLTR. He believes the AI sector is inflating.

Vulnerability: Business is concentrated in the US, creating regulatory and macro risks. Europe is experiencing stagnation.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.