NOTE: This is a post on Mindset and emotion. It is NOT a Trade idea or strategy designed to make you money. If anything, I’m posting this to help you preserve your capital, energy and will so you can execute your own trading system with calm, patience and confidence.

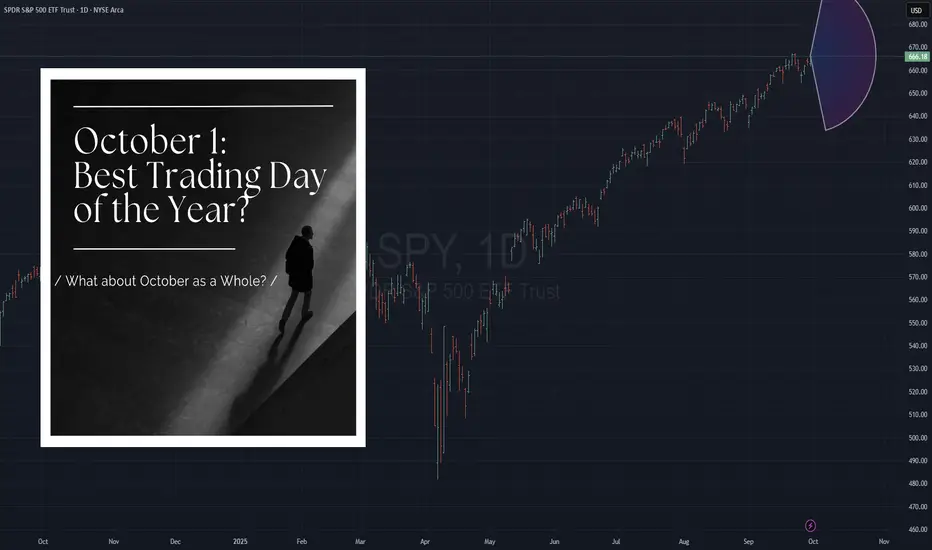

I was told yesterday that October 1 is historically a great trading day.

What does that mean?

That we buy? That we sell?

Or as traders, do we simply lean into the expected volatility in both directions, regardless of how it ends?

Is it really about direction or is it more about volatility itself?

And then I wondered, what about October as a whole?

We’ve just come through a really strong September. That alone puts expectations on edge. Do we continue higher? Or do we fall off in line with October’s reputation?

Because if you ask most people, October is “that scary crash month.”

1929. 1987. 2008.

Big events that seared into collective memory.

But the data tells a different story.

Seasonality studies show October has often been one of the stronger months for the S&P 500.

Yes, it tends to be more volatile with more big moves up and down.

But zoom out and October often finishes in positive territory. Many times it has even marked the end of declines and the start of new rallies.

So why does the “October crash” narrative persist?

Because our brains are wired to latch onto the dramatic, painful events more than steady gains. We remember the sting of a crash, not the quiet consistency of recovery.

That’s the mindset piece here.

Markets are not just numbers, they’re stories. The ones we tell ourselves, and the ones that echo across generations of traders.

If you believe October is dangerous, you’ll find evidence everywhere to confirm it.

If you believe October is an opportunity, you’ll see that too.

What matters is not October itself.

It’s your relationship with volatility and how you meet uncertainty. Both in the markets and in your own mental state.

Your ability to hold perspective in a month where the swings may be larger, the headlines louder and the ghosts of market history come knocking.

I was told yesterday that October 1 is historically a great trading day.

What does that mean?

That we buy? That we sell?

Or as traders, do we simply lean into the expected volatility in both directions, regardless of how it ends?

Is it really about direction or is it more about volatility itself?

And then I wondered, what about October as a whole?

We’ve just come through a really strong September. That alone puts expectations on edge. Do we continue higher? Or do we fall off in line with October’s reputation?

Because if you ask most people, October is “that scary crash month.”

1929. 1987. 2008.

Big events that seared into collective memory.

But the data tells a different story.

Seasonality studies show October has often been one of the stronger months for the S&P 500.

Yes, it tends to be more volatile with more big moves up and down.

But zoom out and October often finishes in positive territory. Many times it has even marked the end of declines and the start of new rallies.

So why does the “October crash” narrative persist?

Because our brains are wired to latch onto the dramatic, painful events more than steady gains. We remember the sting of a crash, not the quiet consistency of recovery.

That’s the mindset piece here.

Markets are not just numbers, they’re stories. The ones we tell ourselves, and the ones that echo across generations of traders.

If you believe October is dangerous, you’ll find evidence everywhere to confirm it.

If you believe October is an opportunity, you’ll see that too.

What matters is not October itself.

It’s your relationship with volatility and how you meet uncertainty. Both in the markets and in your own mental state.

Your ability to hold perspective in a month where the swings may be larger, the headlines louder and the ghosts of market history come knocking.

Helping serious traders & fund managers perform without the emotional cost.

Free Pre-Market Mindset Routine

➝ rfactory.io/pre-market-mindset-reset

Follow me:

➝ rfactory.io/mindset

Free Pre-Market Mindset Routine

➝ rfactory.io/pre-market-mindset-reset

Follow me:

➝ rfactory.io/mindset

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Helping serious traders & fund managers perform without the emotional cost.

Free Pre-Market Mindset Routine

➝ rfactory.io/pre-market-mindset-reset

Follow me:

➝ rfactory.io/mindset

Free Pre-Market Mindset Routine

➝ rfactory.io/pre-market-mindset-reset

Follow me:

➝ rfactory.io/mindset

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.