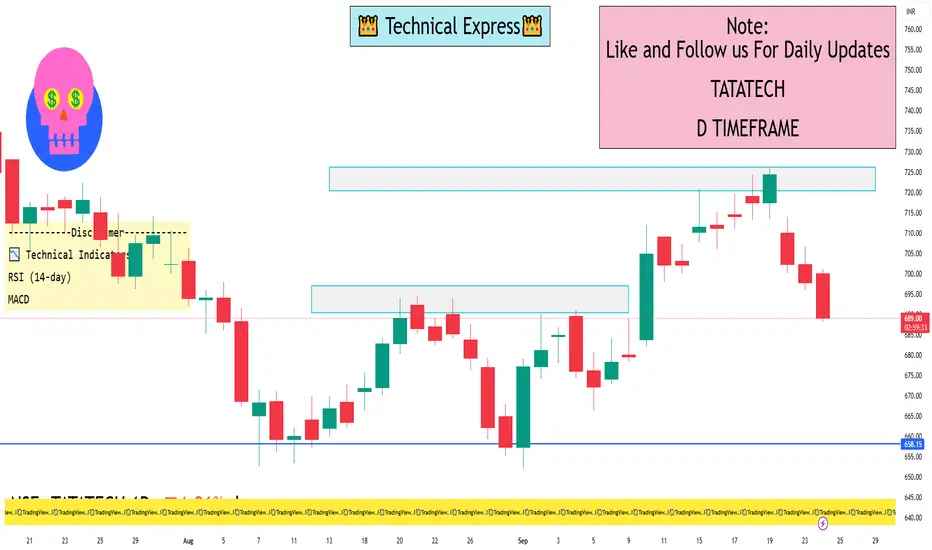

📊 1-Day Technical Analysis

📈 Support and Resistance Levels

Immediate Support: ₹693.90

Immediate Resistance: ₹704.95

📉 Moving Averages

5-Day Moving Average: ₹696.90 (indicating a short-term bearish trend)

50-Day Moving Average: ₹710.72 (suggesting a bearish outlook)

200-Day Moving Average: ₹688.48 (indicating a long-term bullish trend)

📉 RSI (Relative Strength Index)

14-Day RSI: 33.53 (below 35, indicating an oversold condition and potential for a rebound)

📉 MACD (Moving Average Convergence Divergence)

MACD Value: -4.46 (below zero, confirming a bearish trend)

🔄 Overall Technical Indicators

Short-Term Outlook: Bearish

Medium-Term Outlook: Neutral

Long-Term Outlook: Bullish

🔮 Short-Term Forecast

The stock is expected to trade within a range of ₹690.89 to ₹704.61 on September 24, 2025, based on the 14-day Average True Range (ATR)

✅ Summary

Currently, Tata Technologies Ltd. exhibits a bearish short-term trend with potential for a rebound due to oversold conditions. Investors may consider monitoring for signs of stabilization or reversal before making trading decisions.

📈 Support and Resistance Levels

Immediate Support: ₹693.90

Immediate Resistance: ₹704.95

📉 Moving Averages

5-Day Moving Average: ₹696.90 (indicating a short-term bearish trend)

50-Day Moving Average: ₹710.72 (suggesting a bearish outlook)

200-Day Moving Average: ₹688.48 (indicating a long-term bullish trend)

📉 RSI (Relative Strength Index)

14-Day RSI: 33.53 (below 35, indicating an oversold condition and potential for a rebound)

📉 MACD (Moving Average Convergence Divergence)

MACD Value: -4.46 (below zero, confirming a bearish trend)

🔄 Overall Technical Indicators

Short-Term Outlook: Bearish

Medium-Term Outlook: Neutral

Long-Term Outlook: Bullish

🔮 Short-Term Forecast

The stock is expected to trade within a range of ₹690.89 to ₹704.61 on September 24, 2025, based on the 14-day Average True Range (ATR)

✅ Summary

Currently, Tata Technologies Ltd. exhibits a bearish short-term trend with potential for a rebound due to oversold conditions. Investors may consider monitoring for signs of stabilization or reversal before making trading decisions.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.