BTC short term Semi Triangle Bearish Structure BTC keeps creating a bearish semi-triangle after recovery from 59.7k, suggesting bearish momentum is still in place. In order to create a bullish divergence btc needs to go down one more round, let's say around 57k, and print bullish RSI onthe daily, that will Create a chance for rellief Rally. Which might cover the CME gap around 80k.

1. Bias - Bearish

2. Price Target 59.8k - 57.8k

3. Current Structure - Semitriangle Formation

4. Probability - 60%

Community ideas

Gold (XAUUSD) – 1H Technical Analysis

Gold has broken a major ascending trendline, signaling a short-term shift from bullish structure to corrective/bearish.

🔎 Market Structure

Clear trendline breakdown after multiple higher lows. Strong bearish impulse from the 5080–5100 resistance zone. Price currently attempting a pullback after sharp rejection

📉 Key Resistance Levels

5000–5030 → Immediate selling zone

5040 (0.786 Fibonacci)

5100–5140 → Major supply zone

📈 Key Support Levels

4980 (0.5 Fibonacci)

4920

4880 → Major support base

📌 Outlook

Below 5000–5030, selling pressure may persist. Pullbacks into resistance zones could provide short-term selling setups. A sustained break and hold above 5030 would weaken the bearish bias.

⚠️ Momentum is corrective after a strong dump — expect volatility and structured pullbacks.

Trade with confirmation and proper risk management.

What Most Traders Still Don’t Understand About Market CyclesMarket Cycle Logic Most People Miss

1) Core Idea

The market follows a simple macro chain:

Income visibility ↓ → Confidence ↓ → Spending ↓ → Credit quality ↓ → Cyclical sectors weaken

This is not theory — this is how institutional macro models actually work.

In economic terms, this phase is called a demand-compression stage of the business cycle.

2) How the Effect Spreads Across Sectors

Banks — Early Signal Sector

When job security weakens, people delay EMIs.

When businesses slow down, working capital stress rises.

Result → credit costs rise and loan growth slows.

Banks usually underperform quietly first, before any big fall.

Autos — Confidence Indicator

Auto buying depends on confidence and credit.

Weak sentiment → people postpone purchases.

High rates → affordability drops.

Dealers cut inventory.

Auto stocks usually weaken before sales numbers fall.

Housing / Realty — Rate + Confidence Sensitive

Housing needs:

long-term confidence

stable income

reasonable interest rates

If uncertainty rises → buyers delay decisions → real estate slows.

Luxury & Travel — Sentiment Barometers

These are the first expenses people cut.

When uncertainty rises, spending shifts from:

Wants → Needs

So discretionary sectors weaken early.

Insurance — Often Misunderstood Sector

Insurance inflows depend on:

disposable income

savings surplus

agent productivity

When cash flow tightens → new policy buying slows.

3) The Missing Piece Most People Ignore

Professional investors track three macro forces:

Factor Why It Matters

Interest Rates Higher rates reduce liquidity

Liquidity Liquidity drives risk assets

Dollar Strength Controls global capital flow

When all three tighten together → risk-off environment

4) How Market Cycles Actually Work

Formal economic cycle:

Expansion → Peak → Contraction → Trough → Expansion

Trader version:

Liquidity → Euphoria → Tightening → Panic → Reset → Liquidity

Markets don’t move because of news.

They move because of liquidity cycles.

News is usually just a narrative built around the move.

5) Geopolitics Example

Events like discussions about countries shifting currency systems are not random headlines.

They signal:

global trade realignment

currency stability attempts

geopolitical repositioning

Markets interpret this as:

“Capital flows may change.”

And capital flow is what moves markets.

6) Important Rule Professionals Follow

Leading sectors weaken first. Lagging sectors later.

Typical slowdown order:

Tech → Financials → Cyclicals → Consumption → Defensives last

When defensive sectors also start falling, it often signals the cycle is near its bottom.

7) Final Takeaway

Market Truth Most People Ignore

When income visibility falls → confidence falls

When confidence falls → spending falls

When spending falls → credit stress rises

And when credit stress rises — cyclical sectors weaken first:

Banks, Autos, Realty, Luxury, Travel, Insurance

Markets don’t run on headlines.

They run on liquidity cycles.

Boom → Slowdown → Fear → Reset → Boom

Smart money doesn’t chase stories.

It tracks cycles.

Part 5 Option Trading Strategies Key Components of Option Trading

- Underlying Asset: The security (stock, index, commodity, etc.) the option is based on.

- Strike Price: Fixed price to buy/sell the asset.

- Expiry Date: Last day the option can be exercised.

- Premium: Price paid for the option contract.

- Lot Size: Number of shares/contracts per lot.

- Option Type: Call (buy) or Put (sell).

Sensex - Expiry day analysis Feb 11This week, the price moved in a narrow range daily and did not give good trading opportunities for option buyers. Yesterday and today, the movement happened within the range of 84000 to 84500. 84000 is acting as a strong support, and 84500 is acting as a strong resistance.

Buy above 84100 with the stop loss of 83960 for the targets 84220, 84360, 84480 and 84600.

Sell below 83800 with the stop loss of 83940 for the targets 83780, 83640, 83520, 83400 and 83260.

Expected expiry day range is 83600 to 84400.

Always do your analysis before taking any trade.

Gold Trading Strategy for 13th Feb 2026🟡 GOLD TRADING SETUP

📈 BUY SETUP (Bullish Breakout)

🔔 Condition:

Buy only if price breaks and closes above the High of the 1-Hour Candle and sustains above 5003

✅ Entry: Above 5003 after proper candle close

🎯 Targets:

• 🎯 T1 – 5015

• 🎯 T2 – 5028

• 🎯 T3 – 5045

🛡 Stop Loss: Below the breakout candle low (or based on your risk management strategy)

📌 Strategy Logic:

A strong 1-hour candle close above resistance indicates bullish momentum continuation. Volume confirmation strengthens the breakout reliability.

📉 SELL SETUP (Bearish Breakdown)

🔔 Condition:

Sell only if price breaks and closes below the Low of the 15-Minute Candle and sustains below 4945

✅ Entry: Below 4945 after proper candle close

🎯 Targets:

• 🎯 T1 – 4930

• 🎯 T2 – 4915

• 🎯 T3 – 4899

🛡 Stop Loss: Above the breakdown candle high (or as per your risk management)

📌 Strategy Logic:

A confirmed 15-minute breakdown below support suggests short-term bearish pressure and potential continuation move downward.

⚠️ RISK MANAGEMENT RULES

💰 Risk only 1–2% of capital per trade

📊 Avoid trading during major high-impact news

⏳ Wait for proper candle close confirmation

📉 Trail stop loss once first target hits

Part 2 Intraday Institutional Trading Strategies Basic Strategies

- Long Call: Buying a call option, bet on price ↑.

- Long Put: Buying a put option, bet on price ↓.

- Covered Call: Selling a call on stock you own, generate income.

- Protective Put: Buying a put on stock you own, hedge downside risk.

Advanced Strategies

- Straddle: Buying a call and put at the same strike, profit from big moves.

- Strangle: Buying a call and put at different strikes, profit from big moves.

- Iron Condor: Selling a call and put, buying further OTM call and put, profit from low volatility.

- Butterfly Spread: Buying and selling calls/puts at different strikes, profit from price staying within range.

Part 1 Intraday Institutional Trading Strategies Types of Options Trading

Options trading involves various strategies and types, catering to different market views and risk appetites. Here's a comprehensive overview:

1. Call Option- Right to Buy: Gives the buyer the right to buy the underlying asset at the strike price.

- Use Case: Bullish on the market, expecting the price to rise.

- Profit: If the underlying price > strike price + premium paid.

2. Put Option- Right to Sell: Gives the buyer the right to sell the underlying asset at the strike price.

- Use Case: Bearish on the market, expecting the price to fall.

- Profit: If the underlying price < strike price - premium paid.

Part 2 Technical Analysis Vs. Institutional Option TradingDirectional Intraday Strategy: ATM/ITM Option Buying

Best when:

✔ Strong momentum

✔ Trend day

✔ Breakout or breakdown

How it works

Identify trend using 5-min chart

Use VWAP + 20 EMA confirmation

Enter ATM or ITM option

Keep tight SL based on premium

Why it works

ITM/ATM options have better delta (0.5–0.7), giving faster premium movement.

Risk

Time decay hurts if market stays flat.

Part 3 Technical Analysis Vs. Institutional Option TradingBreakout Strategy (Options Buying)

Perfect during:

✔ High volatility

✔ News-driven moves

✔ Index breakout/breakdown

Setup

Mark key levels: yesterday high/low, intraday range

Wait for high-volume breakout

Buy ATM call for upside, ATM put for downside

Benefits

Best RR ratio. Trend moves explode premiums quickly.

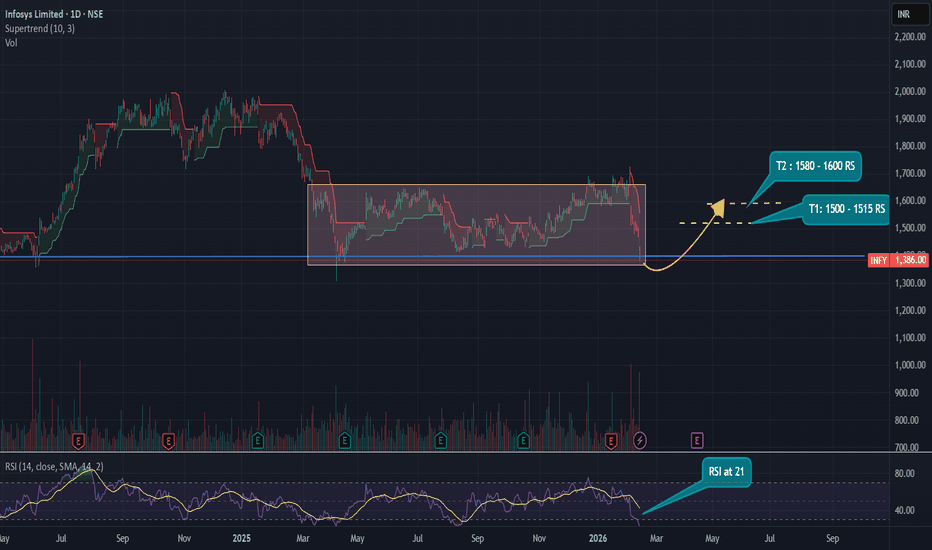

Infosys LimitedInfosys Technical Outlook :

Infosys has been consolidating within the ₹1400–₹1700 range over the past year. Currently, the stock is in the oversold zone, with the RSI at 21, and is testing a strong support level around ₹1400.

From a mid-term perspective, the setup looks attractive:

- Target 1: ₹1500–₹1515

- Target 2: ₹1580–₹1600

This implies a potential return of 9–12% from current levels, provided the support holds.

Disclaimer : The Above shared Content is for information and education purposes only and should not be treated as investment or trading advice. Im not SEBI registered, Contact your financial advisor before any investment.

NIFTY: detailed Trading levels and Plan for 13-Feb-2026📅 Nifty 50 Trading Plan: 13-Feb-2026

Current Context: Nifty closed at 25,796.15 on Feb 12. The index is currently testing a "make-or-break" support zone between 25,700 and 25,782.

🟢 Scenario 1: Gap Up Opening (Above 25,900)

A Gap Up of 100+ points would place Nifty above the crucial 25,900 mark, which was Thursday's "open-equals-high" resistance.

🔸 Plan Action:

Wait for Confirmation: Do not jump into longs immediately. Wait for the first 15-minute candle to sustain above 25,907.

Bullish Case: If price holds above 25,900, the next target is 26,000, followed by 26,077 (Last Intraday Resistance).

Educational Logic: Reclaiming 25,900 signifies that bulls have neutralized the previous day's selling pressure. However, 26,000 has heavy call writing, making it a "profit-booking" zone rather than a "buy-and-hold" zone.

🟡 Scenario 2: Flat Opening (Range 25,750 - 25,850)

A flat opening suggests indecision and potential consolidation within the Opening Support/Resistance zones shown on your chart.

🔸 Plan Action:

Range Bound Play: Avoid big directional bets. Look for reversals at 25,750 (Support) or 25,880 (Resistance).

Breakout Strategy: A decisive move above 25,850 with volume could lead to a test of 25,953. Conversely, staying below 25,800 keeps the bias slightly bearish.

Educational Logic: Flat openings after a distribution day (like Feb 12) often result in "sideways to volatile" movement as the market digests the previous sell-off.

🔴 Scenario 3: Gap Down Opening (Below 25,700)

A Gap Down of 100+ points would push Nifty below the 25,700 support level, which is a major red flag.

🔸 Plan Action:

Bearish Case: If the market opens below 25,700 and fails to recover quickly, the next major support is the 20-day Moving Average at 25,479 or the Last Intraday Support at 25,602.

Panic Selling: Watch for high volume. If the 25,700 zone is broken, "Put Unwinding" could accelerate the decline.

Educational Logic: Opening below a confluence of supports (50-DMA and previous gap areas) typically triggers a "Sell-on-Rise" sentiment. Traders should look for resistance at the Gap Fill area (25,750-25,780) to initiate shorts.

🛡️ Risk Management Tips for Options Trading

🔹 Capital Protection: Never risk more than 2-5% of your total trading capital on a single option trade.

🔹 The 9:30 AM Rule: Avoid trading in the first 15 minutes. Let the "opening volatility" settle to identify the true trend.

🔹 Avoid Naked Options: In high volatility, use Spreads (like Bull Call or Bear Put) to cap your maximum loss.

🔹 Stop Loss is Non-Negotiable: For Nifty options, keep a strict SL based on index levels. If Nifty breaks your support/resistance level, exit the option immediately regardless of the premium price.

🔹 Mind the IV: High Implied Volatility (IV) inflates premiums. Buying options when IV is peaking can lead to losses even if the direction is right.

📝 Summary & Conclusion

The Nifty 50 is currently at a critical junction. The 25,700 - 25,782 zone is the "Lakshman Rekha" for bulls. A sustained move above 25,907 is required to revive bullish momentum. Until then, the market structure remains "Sell on Rise" due to the lower-high, lower-low formation on the daily chart. Stay disciplined and prioritize capital preservation over high-risk profits.

⚠️ Disclaimer: I am not a SEBI registered analyst. This post is for educational purposes only. Trading in equities and derivatives involves high risk. Please consult a certified financial advisor before making any investment decisions.

XAUUSD (H1) – Structural Breakdown ActiveXAUUSD (H1) – Structural Breakdown Still Active | Medium-Term Sell Continuation Into Weekend

Gold is attempting to stabilize after a sharp downside expansion, but the H1 structure still points to sell-side control. The latest bounce is corrective and is currently rotating back into former support that has flipped into supply. Until price reclaims that supply with clear acceptance, the higher-probability path remains a continuation lower into liquidity.

Market Structure

After topping out, price delivered a decisive bearish impulse, breaking prior intraday support and printing a deep displacement leg. That move typically leaves two things behind:

Unfilled supply / imbalance above (where sellers first stepped in)

Sell-side liquidity magnets below (where the market tends to rebalance)

The current rebound looks like a standard retest phase, not a confirmed reversal. H1 is now vulnerable to printing lower highs unless price can regain the broken structure.

Key Zones To Watch (from the chart)

1) Primary Sell Zone (support flip + Fibonacci 0.382)

5,020 – 5,060

This is the most important area for bearish continuation. It combines a support-to-resistance flip and the 0.382 retracement zone. If price revisits this range and shows rejection (weak closes / long upper wicks / failure to hold above), it favors the next leg down.

2) Retest / Reaction Band

4,960 – 4,980

This is a lower supply pocket where price can stall intraday. Acceptance below this band strengthens the bearish path and keeps the market “heavy”.

3) First Downside Magnet (liquidity buy scalping zone)

4,830 – 4,860

This is the nearest liquidity pool below. If the sell setup triggers from supply, this zone is the first logical objective for the market to test and clear.

4) Medium-Term “Reset” Zone (deeper liquidity)

4,720 – 4,750

If 4,830–4,860 fails to hold or gets swept clean, the structure allows for a deeper slide into this zone. This is where a more meaningful reaction can occur, but only after liquidity is collected.

Medium-Term Bias (Into Weekend)

The chart is currently pricing a bearish sequence: impulse down → corrective bounce → continuation risk. For the bearish idea to remain valid, price must stay capped below 5,060. If that cap holds, the market can continue rotating lower to clear sell-side liquidity into the weekend.

Bullish invalidation condition: A clean H1 reclaim and acceptance above 5,060 would weaken the bearish continuation thesis and open room for a broader recovery.

Execution Notes

Avoid buying in the middle of the retracement. The market is still inside supply territory.

The cleanest read is at the levels: wait for rejection at 5,020–5,060 or confirmation of acceptance above it.

Into weekend sessions, liquidity sweeps are common. Let price hit the zone first, then react.

Bottom Line

As long as gold trades below 5,020–5,060, the move up is still corrective and the market remains positioned for another downside rotation toward 4,860, potentially 4,750 if liquidity opens.

Follow structure. Trade levels. Ignore noise.

XAUUSD (Gold) | BEST TRADING SETUP | 13th Feb'2026Gold is trading near 4957 with short-term bearish pressure, while the higher timeframe trend remains bullish.

Lower timeframes show selling momentum, indicating a possible correction. However, the overall structure on Daily & Weekly charts still supports buying on dips.

Key Levels

Resistance: 4975 | 5000–5015

Support: 4930 | 4917 | 4889

Scenarios

🔼 Bullish: Break & sustain above 5000 → 5035+

🔻 Bearish: Breakdown below 4930 → 4917 → 4889

Volatility remains high — trade with proper risk management.

⚠️ Disclaimer:

This analysis is for educational purposes only and not financial advice. Trading in Forex/Commodities involves high risk. Please consult your financial advisor before taking any trade.

A-Book vs B-Book: What Every Retail Trader Needs to KnowMost retail CFD traders have never even heard the terms “A-Book” and “B-Book,” yet almost all of them are directly affected by how these models work. Your broker’s choice between the two can change the prices you see, how your orders are filled, and even whether your stop loss gets hit. Let’s break it down so you know exactly what’s going on behind the scenes.

█ What is A-Book?

An A-Book broker routes your orders straight to external liquidity providers, such as banks, market makers, or directly to an exchange in the case of futures or spot markets. Your broker is essentially the middleman, passing your trade along and matching it with a real counterparty.

⚪ How they make money:

Spreads (the difference between the bid and ask prices).

Commissions on each trade.

Occasionally a small markup on the feed.

Because they don’t profit when you lose, an A-Book broker’s ideal client is a trader who trades frequently and consistently, your activity is their revenue stream.

█ What is B-Book?

A B-Book broker keeps your trades “in-house,” meaning they take the other side of your position. If you buy, they sell; if you sell, they buy, but all within their own system. Your trades don’t reach the real market at all.

⚪ How they make money:

Your losses are their profits.

They may still earn on spreads and commissions, but the main income is the net loss of their client base.

AUDJPY – Bullish Reversal From Trendline SupportAUDJPY is reacting strongly from a major ascending trendline support on the 1H timeframe. Price swept liquidity below the structure, tapped into the demand zone, and immediately rejected — signaling buyer strength.

we entered long around 108.180, which aligns perfectly with the technicals.

📈 Why This Is a Bullish Setup

Price tapped the HTF trendline and respected it

Multiple liquidity sweeps beneath the zone, trapping sellers

Formation of a bullish rejection wick right at support

Price is still inside a discount area, ideal for longs

Recent bearish attempts failde to close below the trendline

Strong probability of a bullish push toward 109.20 – 109.50 liquidity zones

This is a classic trendline + demand + liquidity sweep confluence setup.

📋 Trade Parameters

Entry: 108.180 (executed)

Stop-Loss: ~55 pips (below liquidity sweep + structure low)

Take-Profit: ~110 pips (towards upper liquidity & imbalance zones)

Risk-to-Reward: ~1:2

XAUUSD – Trendline Break and RetestXAUUSD – Trendline Break & Retest: Bearish Signals Emerging | Lana ✨

Gold is showing early signs of structural weakness after breaking below the ascending trendline. The recent rebound appears corrective rather than impulsive, with price now retesting a key sell-side FVG zone near the former trendline support.

This shift suggests short-term momentum is tilting bearish unless buyers quickly reclaim higher ground.

📌 Technical Overview

Trendline breakdown: The rising structure has been invalidated, shifting short-term bias toward corrective-bearish conditions.

FVG sell retest: Price is reacting around the imbalance zone aligned with the broken trendline — a classic supply confirmation area.

Liquidity below: Sell-side liquidity remains uncollected beneath current levels, increasing the probability of a downside sweep before any sustainable recovery.

🔍 Key Levels to Watch

5,000 – 5,020: Immediate sell zone and retest area. Rejection here reinforces bearish continuation.

4,870 – 4,900: First liquidity objective and potential reaction zone.

4,790 – 4,793: Deeper FVG buy zone. A key demand area if selling accelerates.

4,600 – 4,620: Major liquidity pool and stronger higher-timeframe support.

📉 Scenario Outlook

Scenario A – Bearish Continuation (Preferred)

If price rejects the 5,000–5,020 zone, downside expansion toward liquidity levels remains the higher-probability path.

Targets: 4,900 → 4,870 → 4,793 → 4,620.

Scenario B – Corrective Bounce

If price sweeps liquidity around 4,790 and shows strong bullish reaction, a recovery toward 4,900–5,000 is possible. However, this would remain corrective unless 5,020 is decisively reclaimed.

🧠 Market Perspective

A break of trendline structure often leads to a retest before continuation. Unless gold regains the 5,020 area with strength, current consolidation looks like preparation for a liquidity-driven move lower.

✨ Stay patient, respect structure, and let price confirm direction before committing risk.

gold spot or silver update at the time of cpi datagold spot overview-- usa cpi data today at 7 pm at that time eyes on level----- gold spot hurdle 4986--91$ if market sustain above after cpi data than expect to up side 5035--5060--5080$ again hurdle 5110$ till no sustain above or close market revert--------- where support 4900-4890$ if market sustain blow than down side move 496-4930 expect---------- silver spot eyes on 77.86$ if market sustain above up side 79--80$+++ or if hold blow market soon 74--72$--70$ cmp 76.60$---- if market come up77.20--77.50 near can make short side with hurdle sl 77.86$-- yes its chance to short position or only risky player or mini trader can make @ market entry with sl

Commodities and Alternative Assets1. Commodities

Definition

Commodities are raw materials or primary agricultural products that can be bought and sold. They are standardized and interchangeable, meaning one unit is essentially the same as another unit of the same grade. For example, one barrel of crude oil is equivalent to another barrel of the same type and quality.

Commodities are typically traded on exchanges such as the Chicago Mercantile Exchange (CME) or the London Metal Exchange (LME).

Types of Commodities

1. Energy Commodities

Crude oil

Natural gas

Coal

Gasoline

Energy commodities are highly sensitive to geopolitical events, supply disruptions, and global demand cycles.

2. Precious Metals

Gold

Silver

Platinum

Palladium

Gold is often viewed as a “safe haven” asset during economic uncertainty or inflationary periods.

3. Industrial Metals

Copper

Aluminum

Nickel

Zinc

These are closely tied to industrial production and infrastructure development.

4. Agricultural Commodities

Wheat

Corn

Soybeans

Coffee

Sugar

Cotton

Prices are affected by weather patterns, seasonal cycles, and global consumption trends.

Ways to Invest in Commodities

Physical Ownership

Buying physical gold, silver, or other tangible goods.

Futures Contracts

Agreements to buy or sell a commodity at a future date at a predetermined price. Futures are highly leveraged and commonly used by traders and hedgers.

Exchange-Traded Funds (ETFs)

Commodity-based ETFs track the price of a specific commodity or a basket of commodities.

Commodity Stocks

Investing in companies that produce commodities (e.g., oil companies, mining firms).

Mutual Funds and Index Funds

Provide diversified exposure to commodity markets.

Characteristics of Commodities

Inflation Hedge: Commodities often rise in price when inflation increases.

Low Correlation with Stocks/Bonds: They can reduce portfolio volatility.

High Volatility: Prices fluctuate due to global supply-demand imbalances.

Cyclical Nature: Prices move in long-term cycles tied to economic expansion and contraction.

Advantages of Commodities

Portfolio diversification

Protection against inflation

Opportunity for high returns during commodity booms

Hedge against currency depreciation

Risks of Commodities

Price volatility

Geopolitical risk

Weather risk (agriculture)

Storage and transportation costs (for physical commodities)

Leverage risk in futures trading

2. Alternative Assets

Definition

Alternative assets are financial assets that do not fall into traditional categories like stocks, bonds, or cash. They often require specialized knowledge and may be less liquid than conventional investments.

Alternative investments are commonly used by institutional investors, hedge funds, and high-net-worth individuals.

Major Types of Alternative Assets

1. Real Estate

Includes residential, commercial, and industrial properties. Investors may earn income through rent and capital appreciation.

Direct property ownership

Real Estate Investment Trusts (REITs)

Real estate funds

2. Private Equity

Investment in private companies or buyouts of public companies. Investors aim to improve operations and sell at a profit.

Venture capital

Growth capital

Leveraged buyouts

3. Hedge Funds

Actively managed investment funds using complex strategies:

Long/short equity

Arbitrage

Global macro

Event-driven strategies

4. Infrastructure

Investments in public assets such as:

Airports

Toll roads

Utilities

Renewable energy projects

These provide stable, long-term cash flows.

5. Commodities (as Alternatives)

Though commodities are their own asset class, they are often categorized under alternative investments.

6. Collectibles and Tangible Assets

Art

Rare coins

Wine

Classic cars

Antiques

Value depends on rarity, condition, and demand.

7. Cryptocurrencies

Digital assets like Bitcoin and Ethereum. Highly volatile but increasingly considered an alternative investment class.

Characteristics of Alternative Assets

Low Liquidity: Harder to buy and sell quickly.

Higher Return Potential: Often target above-market returns.

Higher Risk: Complexity and lack of regulation in some areas.

Less Transparency: Valuations may not be daily or publicly available.

Advantages of Alternative Assets

Diversification

Lower correlation with traditional markets.

Inflation Protection

Real estate and infrastructure often adjust with inflation.

Higher Yield Potential

Private equity and hedge funds can outperform public markets.

Access to Unique Opportunities

Investment in emerging industries and innovation.

Risks of Alternative Assets

Illiquidity risk

High fees (management and performance fees)

Valuation risk

Regulatory risk

Complexity and limited transparency

Role in Portfolio Management

Modern portfolio theory suggests diversification reduces overall risk. Commodities and alternative assets improve diversification because they behave differently from traditional equities and bonds.

Institutional investors such as pension funds often allocate:

5–15% to commodities

10–30% to alternative investments

The actual allocation depends on:

Risk tolerance

Investment horizon

Liquidity needs

Economic outlook

Conclusion

Commodities and alternative assets have become increasingly important components of modern investment portfolios. Commodities provide exposure to tangible goods essential to the global economy and offer inflation protection and diversification benefits. However, they are subject to high volatility and global economic forces.

Alternative assets encompass a wide range of investments including real estate, private equity, hedge funds, infrastructure, collectibles, and digital assets. These investments often provide opportunities for enhanced returns and risk diversification but come with challenges such as illiquidity, complexity, and higher fees.

For investors seeking to move beyond traditional stocks and bonds, commodities and alternative assets can enhance portfolio resilience and return potential. However, careful analysis, risk assessment, and strategic allocation are essential to successfully integrate them into a long-term investment strategy.