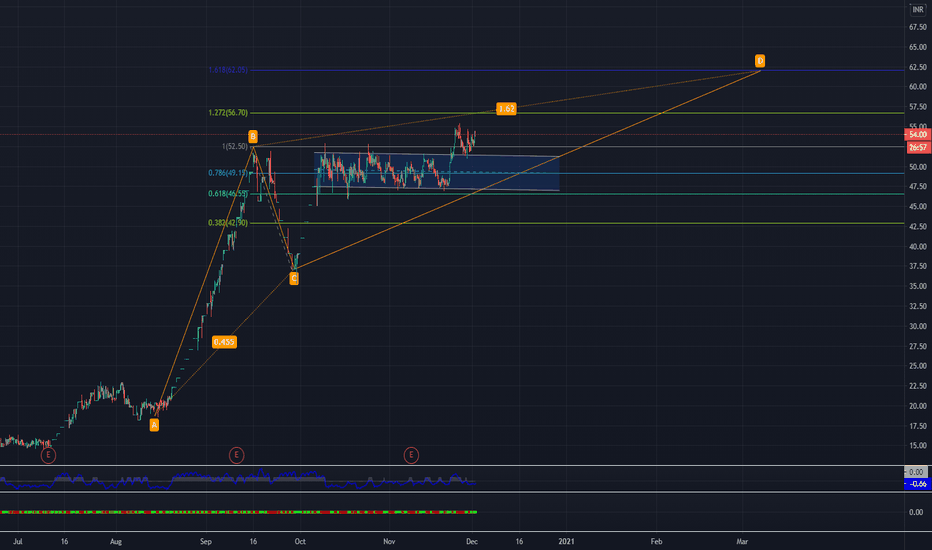

AB=CD

NIFTY Trading levels for the daylevels clearly mentioned in the chart

nifty opened gap uply & nifty was consolidated yesterday.

today can see a breakout or breakdown

there is chance for gap filling but note that after the gap filling can see a sudden recovery in nifty.

so short sellers beaware..

any way i am bullish on nifty for the day.

and I expecting sell side only below 14990

thanku

Multiple Harmonic Pattern in Gold - Bullish There are multiple harmonic patterns in Gold, bullish ones

SL and Target mentioned in the chart

For ones who trade in gold may be a good opportunity

For Traders who trade in the Indian index Nifty / Bank Nifty, they may take a cue from this as Gold and the Indian index are usually inversely proportional.i.e., if gold increases nifty decreases and vice versa

Every analysis is a hypothesis based on certain conditions. If SL condition triggers - hypothesis would be deemed wrong

Happy Trading

MSK

Bat pattern that is going to form on NIFTY.Focusing on the entire range of the PRZ(14100-14188) . However, the price falling, therefore our next target 2AB = CD 14188 and BC projection 14128.

Short sellers should be very careful at Potential Reversal Zone if the tail is detec ted.

I hope that you have checked out my previous nifty update.:

BTCUSD Corrective harmonic wave BTCUSD is in the built of a "Harmonic Deep Crab Pattern".

It seems the demand and supply of the asset have been in a very volatile zone.

If the asset breaks 30500 then the probability of the price to reach PRZ will be very high.

Now, this PRZ will work as a supply zone for a short period or create momentum to boost the asset to the given bullish target.

Tata Motors - Will it go to the moon or fall to ground?Having reversed from harmonic ABCD and strictly following the dynamic support line, price is now 180.

Key level to watch is 200 - .786 Fib of ABCD + psychological level + multi month resistance.

20% move can be seen on either side of 200 depending on how it behaves around it.

Above 200 will look for 240, 240-250 would be profit booking, and strictly above 250 for 280.

On downside, if 200 acts resistance, would look for 170 and below that 150 as targets.

TCS, BUY opportunity @ 2920Reasons to LOOK for Buy:

1) Clearly in an uptrend.

2) In the pullback phase to hit the previous support zone.

3) Support zone contains 50% retracement line.

4) Price may also hit 20MA in the zone (thus considering 20MA as support)

Look for buying opportunity in lower timeframe

SL @2882 as per Risk.

Position sizing as per Risk.

TP @2980

Triveni is looking bullish This is a fundamentally strong Script.

Though this stock is over valued for time being but one can accumulate at 63.45 level and some more at 59.25 level if you are a lucky one.

I can see a possible 1st target of around 83 and further ahead 88.40/ 95.15/ 103.7

Technically it is creating harmonic ABCD pattern ,where BC leg is in formation as a retracement of AB it may be 0.618 or 0.786 level.

Stop loss - 55