Netweb Volume distribution Technical -

Clear distribution chart , retail heavily trap show on volume, now that area work as

Trap resistance,

3 step distribution happened

1st, break out base ( Trending stock on social media ai hot sector)

2nd break out time volume that attracts retails

3nd after institute sell to retail , clear sign ( small candle show high buyer sellers active)

& Last distribution confirm low volume big red candle ( no one like to purchase that why vol big body candle confirm distribution sign)

Also harmonic pattern type 2 crab( historical pattern)

Fundamentals -

Stock trading 8 time peg ratio , 1 pEG ratio is consider fair but here it 8X

Also compared to us stock like nvidia, this stock overpriced

Also result declared that show poor

Maybe this thing tell stock created top here.......

How volume distribution looklike:

AI

AI Trading Profits: Unlocking the Future of Smart Market Gains1. Understanding AI Trading

AI trading refers to the use of machine learning, natural language processing, and advanced algorithms to make trading decisions. Unlike traditional trading, which relies on human intuition, AI trading analyzes massive datasets in real-time, identifies patterns, and executes trades with precision. AI systems are capable of learning from historical data, adapting to changing market conditions, and continuously improving their performance.

Key components include:

Data acquisition: Collecting historical and real-time financial data.

Pattern recognition: Using machine learning to identify profitable trends.

Execution algorithms: Automatically placing trades based on AI predictions.

Risk management: Monitoring positions and adjusting strategies dynamically.

2. Sources of AI Trading Profits

AI trading profits come from multiple sources, often simultaneously:

a. Arbitrage Opportunities

AI can identify price discrepancies across markets faster than humans. For example, slight differences in currency pairs or stock prices between exchanges can be exploited within milliseconds, yielding small but highly consistent profits.

b. Predictive Market Analysis

AI models can forecast price movements using historical data, news sentiment, macroeconomic indicators, and social media trends. By predicting short-term or long-term trends, traders can enter and exit positions at optimal moments.

c. High-Frequency Trading (HFT)

AI enables high-frequency trading, executing thousands of trades per second. This leverages micro-movements in asset prices to generate cumulative profits over time.

d. Sentiment Analysis

Modern AI models analyze news articles, social media, and financial reports to gauge market sentiment. Positive or negative sentiment can trigger AI-based trading strategies that anticipate market reactions.

3. AI Trading Strategies That Drive Profits

AI trading profits are heavily influenced by the strategies employed:

Trend-Following Algorithms: AI detects upward or downward price trends and automatically adjusts positions.

Mean Reversion Models: Identifying when an asset is overbought or oversold and betting on a return to the mean.

Reinforcement Learning Systems: AI learns optimal trading actions through trial-and-error simulations.

Neural Network Predictive Models: Deep learning models analyze complex data patterns to predict future price movements.

Portfolio Optimization Algorithms: AI balances risk and return by continuously reallocating assets across diverse instruments.

4. Advantages of AI in Trading Profits

Speed and Accuracy: AI can analyze vast data in milliseconds, far faster than human traders.

Emotionless Trading: AI removes emotional biases that often lead to trading mistakes.

24/7 Market Monitoring: AI can operate continuously in global markets.

Adaptive Learning: Machine learning models improve over time, refining strategies.

Scalability: AI can simultaneously trade multiple markets and instruments.

5. Challenges and Risks in AI Trading

While AI offers significant profit potential, risks remain:

Data Quality Issues: Poor or biased data can lead to incorrect predictions.

Overfitting: AI models may perform well in simulations but fail in live markets.

Market Volatility: Sudden market shocks can overwhelm AI systems.

Regulatory Constraints: Certain jurisdictions impose rules on automated trading.

Ethical Concerns: AI-driven market manipulation risks exist if not properly monitored.

6. Case Studies of AI Trading Profits

Hedge Funds: Quantitative hedge funds like Renaissance Technologies and Two Sigma generate billions annually using AI-driven strategies.

Retail Traders: Platforms using AI-assisted trading tools allow retail traders to capture profitable signals.

Cryptocurrency Markets: AI is used extensively in crypto trading to exploit high volatility and sentiment-driven price swings.

7. Future Outlook of AI Trading Profits

The future of AI trading promises even greater profitability as technology advances:

Integration of Alternative Data: Satellite imagery, social trends, and IoT data will refine AI predictions.

AI-Driven Risk Management: Advanced AI models will optimize risk-adjusted returns.

Global Market Connectivity: AI will seamlessly trade across borders, currencies, and asset classes.

Hybrid Human-AI Models: Traders will increasingly use AI as an assistant, combining human intuition with machine precision.

Conclusion

AI trading profits represent a paradigm shift in financial markets. By leveraging speed, accuracy, predictive capabilities, and advanced strategies, AI transforms how profits are generated. However, success depends on high-quality data, robust algorithms, and continuous monitoring. For traders, institutions, and investors, AI is no longer optional—it is the key to achieving consistent, scalable, and intelligent market gains.

BYD Company Limited (BYDDY) AnalysisCompany Overview:

BYD Company Limited OTC:BYDDY is a Chinese EV and battery manufacturing leader, investing CNY 100B to dominate the intelligent EV market with AI-driven systems and advanced driver assistance—offered at no extra cost to consumers.

Key Catalysts:

Product Expansion & Global Reach 🌍

2024 saw the launch of flagship EV models across multiple segments.

New market entries in Colombia and Oman are accelerating international sales.

Vertical Integration Advantage 🏭

BYD’s fully integrated supply chain covers everything from battery production to final assembly.

This enables cost control, rapid innovation, and resilience against supply chain disruptions.

AI & Smart Mobility Leadership 🤖

Intelligent vehicle systems enhance driving experience and safety.

Strategic investment positions BYD as a global disruptor in next-gen mobility.

Investment Outlook:

Bullish Case: We are bullish on BYDDY above $12.00–$13.00, supported by global expansion, vertical integration, and AI-driven innovation.

Upside Potential: Price target: $20.00–$22.00, reflecting market share gains and technological leadership.

📢 BYD—Driving the Future with AI, Global Reach, and Vertical Strength. #BYD #EVs #ElectricVehicles #AI #Batteries

AI-Powered Algorithmic Trading 1. Introduction: The Fusion of AI and Algorithmic Trading

Algorithmic trading (or algo trading) refers to the use of computer programs to execute trading orders based on pre-defined rules. These rules can be based on timing, price, quantity, or any mathematical model.

Traditionally, algorithms were static—they executed strategies exactly as they were coded, without adapting to market changes in real time.

AI-powered algorithmic trading is different.

It integrates machine learning (ML) and artificial intelligence (AI) into trading systems, making them dynamic, adaptive, and self-improving.

Instead of blindly following a fixed script, an AI algorithm can:

Learn from historical market data

Identify evolving patterns

Adjust strategies based on changing conditions

Predict potential price movements

Manage risk dynamically

The result?

Trading systems that behave more like experienced human traders—except they operate at lightning speed and can process massive datasets in real time.

2. Why AI is Revolutionizing Algorithmic Trading

Before AI, algorithmic trading was powerful but rigid. If market conditions changed drastically—say, during a financial crisis or a geopolitical shock—the system might fail, simply because it was designed for "normal" conditions.

AI changes that by:

Pattern recognition: Detecting non-obvious market correlations.

Natural language processing (NLP): Interpreting news, earnings reports, and even social media sentiment in real-time.

Reinforcement learning: Learning from past trades and improving performance over time.

Adaptability: Shifting strategies instantly when volatility spikes or liquidity dries up.

In essence, AI empowers trading algorithms to think, not just follow orders.

3. Core Components of AI-Powered Algorithmic Trading Systems

To understand how these systems work, let’s break down the core building blocks:

3.1 Data Collection and Preprocessing

AI thrives on data—without quality data, even the most advanced AI model will fail.

Sources include:

Historical price data (open, high, low, close, volume)

Order book data (bid/ask depth)

News headlines & articles

Social media (Twitter, Reddit, StockTwits sentiment)

Macroeconomic indicators (interest rates, GDP growth, inflation)

Alternative data (satellite images, credit card transactions, shipping data)

Data preprocessing involves:

Cleaning: Removing errors or irrelevant information

Normalization: Scaling data for AI models

Feature engineering: Creating meaningful variables from raw data (e.g., moving averages, RSI, volatility)

3.2 Machine Learning Models

The heart of AI trading lies in ML models. Some popular ones include:

Supervised learning: Models like linear regression, random forests, or neural networks that predict future prices based on labeled historical data.

Unsupervised learning: Clustering methods to find patterns in unlabeled data (e.g., grouping similar trading days).

Reinforcement learning (RL): The AI learns optimal strategies through trial and error, receiving rewards for profitable trades.

Deep learning: Advanced neural networks (CNNs, LSTMs, Transformers) to handle complex time-series data and sentiment analysis.

3.3 Trading Strategy Generation

AI models help generate or refine strategies such as:

Trend-following (moving average crossovers)

Mean reversion (buying dips, selling rallies)

Statistical arbitrage (pairs trading, cointegration strategies)

Market making (providing liquidity and profiting from the bid-ask spread)

Event-driven (earnings surprises, mergers, economic announcements)

AI adds a twist—it can:

Adjust parameters dynamically

Identify optimal holding periods

Combine multiple strategies for diversification

3.4 Execution Algorithms

Once a trading signal is generated, execution algorithms ensure it’s carried out efficiently:

VWAP (Volume-Weighted Average Price) – Executes to match market volume patterns

TWAP (Time-Weighted Average Price) – Executes evenly over time

Implementation Shortfall – Balances execution cost vs. risk

Sniper/Stealth Orders – Hide large orders to avoid moving the market

AI improves execution by:

Predicting short-term order book dynamics

Avoiding periods of low liquidity

Detecting spoofing or manipulation

3.5 Risk Management

Risk is the biggest enemy in trading. AI systems incorporate:

Dynamic position sizing – Adjusting trade size based on volatility

Stop-loss adaptation – Moving stops based on changing conditions

Portfolio optimization – Balancing risk across multiple assets

Stress testing – Simulating extreme scenarios

AI models can predict drawdowns before they happen and adjust exposure accordingly.

4. Advantages of AI-Powered Algorithmic Trading

Speed: Executes trades in milliseconds.

Scalability: Can trade hundreds of assets simultaneously.

Objectivity: Removes human emotions like fear and greed.

Complex analysis: Processes terabytes of data that humans cannot.

Adaptability: Learns and evolves in real-time.

5. Challenges and Risks

AI isn’t a magic bullet—it comes with challenges:

Overfitting: AI may perform well on historical data but fail in real markets.

Black box problem: Deep learning models can be hard to interpret.

Data quality risk: Garbage in = garbage out.

Market regime shifts: AI models may fail in unprecedented situations.

Regulatory concerns: AI-driven trading must comply with strict financial regulations.

6. AI in Action – Real-World Use Cases

6.1 Hedge Funds

Firms like Renaissance Technologies and Two Sigma leverage AI for predictive modeling, order execution, and portfolio optimization.

6.2 High-Frequency Trading (HFT)

Firms deploy AI to detect microsecond price inefficiencies and exploit them before competitors.

6.3 Retail Trading Platforms

AI bots now help retail traders (e.g., Trade Ideas, TrendSpider) identify high-probability setups.

6.4 Sentiment-Driven Trading

AI scans Twitter, news feeds, and even Reddit forums to detect shifts in sentiment and trade accordingly.

7. Future Trends in AI-Powered Algorithmic Trading

Explainable AI (XAI): Making AI decisions transparent for regulators and traders.

Quantum computing integration: For lightning-fast optimization.

AI + Blockchain: Decentralized trading strategies and data verification.

Autonomous trading ecosystems: Fully self-managing portfolios with zero human intervention.

Cross-market intelligence: AI detecting correlations between equities, forex, commodities, and crypto in real-time.

8. Building Your Own AI-Powered Trading System – Step-by-Step

For traders who want to experiment:

Data sourcing: Choose reliable APIs (e.g., Alpha Vantage, Polygon.io, Quandl).

Choose a framework: Python (TensorFlow, PyTorch, scikit-learn) or R.

Feature engineering: Create technical and sentiment-based indicators.

Model training: Use supervised learning for prediction or reinforcement learning for strategy optimization.

Backtesting: Test strategies on historical data with realistic transaction costs.

Paper trading: Simulate live markets without risking real money.

Live deployment: Start with small capital and scale gradually.

Continuous learning: Update models with new data frequently.

9. Ethical & Regulatory Considerations

AI can cause market disruptions if misused:

Flash crashes: Rapid, AI-triggered selling can collapse prices.

Market manipulation: AI could unintentionally engage in manipulative patterns.

Bias in models: If training data is biased, trading decisions could be skewed.

Regulatory oversight: Authorities like SEBI (India), SEC (USA), and ESMA (Europe) monitor algorithmic trading closely.

10. Final Thoughts

AI-powered algorithmic trading is not just a technological leap—it’s a paradigm shift in how markets operate.

The combination of speed, intelligence, and adaptability makes AI an indispensable tool for modern traders and institutions.

However, successful deployment requires:

Robust data pipelines

Sound risk management

Ongoing monitoring and adaptation

In the right hands, AI can be a consistent alpha generator. In the wrong hands, it can be a high-speed path to losses.

The future will likely see more human-AI collaboration, where AI handles data-driven decisions and humans provide oversight, creativity, and strategic vision.

IonQ, Inc. (IONQ) – Engineering the Future of Quantum Advantage Company Snapshot:

IonQ NYSE:IONQ is at the forefront of quantum computing, leveraging trapped-ion technology and cutting-edge system design to push toward error-tolerant, commercially viable quantum systems.

Key Catalysts:

Breakthrough Hardware Milestone 🎯

2025 goal: >99.9% fidelity in two-qubit gates

Critical threshold for building error-corrected, scalable quantum systems

Unlocks use cases in logistics, cryptography, finance, and AI

Photonic Interconnects = Modular Scaling 🔗

Enables quantum modularity, allowing distributed systems to act as one

Tackles scalability bottlenecks inherent in current quantum architectures

Prepares IonQ for enterprise-scale applications beyond research labs

Global Expansion via Strategic Partnerships 🌍

Tapping into Asia and Europe through partnerships like Intellian

Expands footprint while diversifying revenue streams

Positions IonQ for recurring enterprise contracts and national defense engagements

Sector Leadership + Deep IP Moat 📚

Leading patent portfolio in trapped-ion quantum architecture

Early mover advantage in commercial quantum cloud offerings via AWS, Microsoft Azure, Google Cloud

Investment Outlook:

✅ Bullish Above: $21.00–$22.00

🚀 Upside Target: $45.00–$47.00

🔑 Thesis: Hardware breakthroughs + modular scale + global commercialization = long-term quantum upside

📢 IONQ: Converting quantum potential into practical, profitable systems.

#QuantumComputing #IONQ #DeepTech #AI #AdvancedComputing #CommercialQuantum

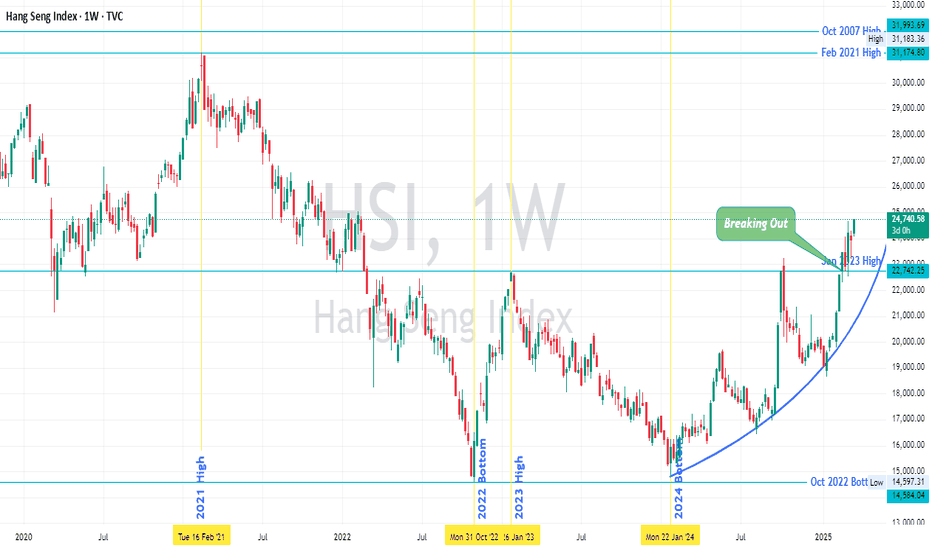

Hang Seng Index (HSI) 's Price Action vis-à-vis Major PivotsHSI seems to have broken out of last year's high (Oct 2024) and Jan 2023 high, and retested it too.

The index is about 67% from Jan 2024 low.

The next major pivot is Feb 2021 High, after that Oct 2007 High and then Jan 2018 High (all are marked on chart).

The price seems to be gaining momentum and moving parabolically, as marked on chart.

It seems price will move higher over months, of course there would be retracements.

As always it won't be as predictable as I have hypothesized above.

Nevertheless at this juncture price action is positive and depending upon price action further into the months the hypothesis will succeed or fail.

Trade Safe

Silver Futures: Navigating the Bullish Breakout

The Silver Futures chart presents a compelling picture, but as we know, navigating the market demands more than just technical analysis. Let's break down what we see:

Bullish Signals: The decisive breakout above the VWAP, coupled with the series of green Heikin Ashi candles, paints a bullish picture. The recent breach of the Base Camp level further strengthens this positive outlook.

VWAP as a Guide: The VWAP is now acting as dynamic support, offering potential buying opportunities on dips. However, remember that even in a bullish scenario, the market can be unpredictable.

Beyond the Chart: While technicals are promising, external factors can sway silver prices. Keep an eye on global economic indicators, geopolitical tensions, and any news that might impact precious metals.

Applying the Wisdom:

Don't Get Complacent: Even with a bullish setup, risk management is paramount. Set stop-losses to protect your capital in case of unexpected reversals.

Stay Informed: Technical analysis is valuable, but it's only one piece of the puzzle. Stay updated on fundamental factors that can influence silver's price trajectory.

Avoid Blind Faith in Tips: This bullish setup might attract stock tips, but remember, no one can predict the market with certainty. Do your own research and make informed decisions.

In Conclusion:

The Silver Futures chart is signaling a potential bullish trend. However, successful trading involves more than just following signals. Combine technical analysis with a keen understanding of market dynamics, risk management, and a healthy dose of skepticism towards "hot tips." This approach will increase your chances of navigating the market successfully, even when faced with its inherent unpredictability.

Disclaimer: This is an analysis, not financial advice. Trading involves risk; conduct your own research and consider your risk tolerance before making any investment decisions

🚀 AI Breaks Out of Channel, Forms Bullish Cup and Handle!💎 Paradisers, #AI has broken out of the descending channel and formed a cup and handle pattern, which increases the likelihood of a bullish move.

💎 If #AIUSDT breaks above the resistance level, we can expect a bullish move up to the next resistance level.

💎 In the case of a pullback, we can anticipate a potential triple bottom pattern from the demand level, so be cautious here. It can provide a good risk-reward (RR) long setup from this point.

💎 However, in the case of a breakdown of the demand level, it will invalidate all the bullish signs. In that case, it would be better to wait for more favorable price action to develop.

TCS - Swing Trade - 22nd February #stocksTCS (1D TF) - Swing Trade Analysis given on 22nd Feb, 2024

Pattern: FALLING WEDGE

- Pullback candle at Support - Done ✓

- Volume spike at Support - Done ✓

- Trendline Resistance Breakout - In Progress

- Retest & Consolidation - In Progress

#stocks #swingtrade #chartanalysis #priceaction #traderyte #TCS #stockmarket #sharemarket #viral #sharemarketindia #StockMarketindia

Ocean Protocol (OCEAN) Price Prediction 2024, 2025–2030Ocean Protocol (OCEAN) Price Prediction 2024, 2025–2030

A symmetrical triangle is a chart pattern that shows two converging trend lines that connect a series of sequential peaks and troughs. The trend lines should converge at a roughly equal slope.

Ocean Protocol price prediction 2025

The Ocean Protocol price prediction for 2025 is currently between $ 0.409910 on the lower end and $ 1.921728 on the high end. Compared to today’s price, Ocean Protocol could gain 362.55% by 2025 if OCEAN reaches the upper price target.

Ocean Protocol price prediction 2030

The Ocean Protocol price prediction for 2030 is currently between $ 0.884510 on the lower end and $ 2.71 on the high end. Compared to today’s price, Ocean Protocol could gain 551.37% by 2030 if it reaches the upper price target.

LAI/USDT: This is 20x Potential in Bull Market but Why ?LAYERAI/USDT Technical and Fundamental Analysis:

#LAYERAI - Unlocking the Power of AI and Taking Control of Your Data

Technical and Fundamental Analysis: Strong

10x-20x Potential Gem

Breaking Resistance Levels

Best Accumulation Zone: $0.008-$0.009

Why Invest in #LAYERAI?

Layer AI is an innovative AI-based project that empowers individuals to reclaim control over their online data. Monetize and sell your data to tech giants like Google, Amazon, and Meta, unlocking the true value that belongs to you.

How to Get Started:

Accumulate Smartly: Start accumulating in the best zone of $0.008-$0.009.

Risk Management: Invest a small fund due to the critical role of risk-reward in cryptocurrency.

Follow us for More crypto quality analysis.

Thank you

UMA (UMA): AI coin is underpriced by the market – Time to buy?The start of 2023, the broader crypto market is bullish and its positive sentiment at the current bullish momentum could see UMA prices bounce higher.

Can the UMA token price regain momentum and test new highs this year? Let's perform an analysis of the price of the UMA coin, but first like, share and comment.

The UMA/USDT price is trading on the 4H chart inside a bullish channel (green lines) and close to the resistance just above it at § 2,173 (purple line), which once broken, projects a rise in the UMA prices up to the next resistance at the $3,045 range (purple line), with some correction in UMA prices on the way to gain momentum before breaking through the resistances above. On the other hand, if UMA prices miss the lower line of the bullish channel (green lines) it should test the support at $1,648 (purple line).

The technical indicator of blue line and yellow line moving averages are supporting the UMA price action in favor of the direction of the uptrend in the very short term. Please read the warning below before making any decision.

ALERT: As this analysis is public and market knowledge, it is easy for the market and the big manipulators to play against this analysis, if it is not convenient for the market, so that it can be misconfigured and invalidated, therefore the analysis price is always constantly updated, and can change in a matter of minutes, depending on which way the market manipulates the price.