ALKYLAMINE

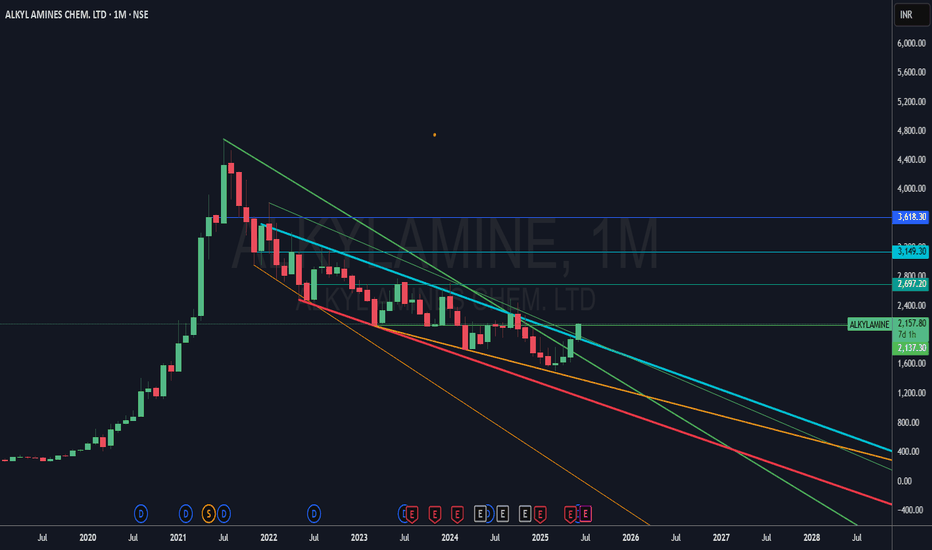

Powerful Monthly Channel | Clean Price Structure Across📉 Description:

-This is a classic example of a broadening falling channel on the Monthly Time Frame (MTF), where the counter-trendline (CT) has just been taken out by a strong bullish candle. Volume confirms the strength

📌What makes this setup particularly interesting:

-MTF structure: Despite a series of lower lows on the monthly, it has respected the broad structure of the falling channel throughout.

-WTF/DTF structure: Weekly and Daily timeframes are making higher lows (HLs),

-Price behavior: Clean reaction to the trendline and no choppiness around breakout — this reflects a well-absorbed selling zone

⚠️ This is not a forecast, not a call or tip — just me charting what I see. Drop any doubts in the comments.

"We add matter to the world"Alkyl Amines Chemicals Ltd - CMP - 1250

About

Incorporated in 1979 by Mr Yogesh Kothari, Alkyl Amines is a leading manufacturer of aliphatic amines in India. Aliphatic amines are products derived from Ammonia (NH3) by displacement of H2 in the Ammonia molecule by other radicals (R) such as Methyl, Ethyl and Propyl.

Key Points

Business Leadership

The co. offers 100+ products, it is a global leader in many products including acetonitrile, DEHA, DMA-HCLA, and Triethylamine.

Product-Wise Revenue Mix

Aliphatic Amines: 47%

Amine Derivatives: 29%

Specialty Chemicals: 24%

Industries Served

The Co. serves several industries such as pharmaceuticals, agro-chemicals, water treatment chemicals, rubber chemicals, mining, foundry chemicals, surfactants, etc.

Geographical Split FY24

Apart from India, It has a global presence in Mexico, USA, UAE, China, Thailand, Spain; Ireland; United Kingdom, etc.

Domestic: 80%

International: 20%

Manufacturing Capabilities

The co. operates over 20 production plants over three manufacturing sites covering over 110 acres of land in the western states of Maharashtra and Gujarat. Capacity utilization was ~55% in H2 FY24.

It also has a Solar Plant at Bhoom, Maharashtra, and another one at Manwath, Maharashtra which was commissioned in Sept 2022.

Expansion Projects

The co. commissioned the ethylamine plant at about Rs. 375 Crs., which commenced commercial production in Oct 2023. It is planning to convert the old ethylamine plant into methylamines in the next 2 years (by FY26). The demand for ethylamines is expected to be 70,000 to 75,000 tons

Capex

Co. spent 120 Crs as Capex in FY24 towards routine maintenance capex and commissioned a solar plant.

In FY25, the co. will spend about Rs 60-80 Crs on capex, focusing on maintenance and debottlenecking.

Focus

The Co. continues to focus on sustainable growth by taking measures to increase its market share of existing products and also introducing new products.

This is just to boost my confidence. No Suggestions for buying. I will keep checking and updating my mistake if last post gone wrong...

Disclosure: I am not SEBI registered. The information provided here is for educational purposes only. I will not be responsible for any of your profit/loss with these suggestions. Consult your financial Adviser before making any decisions.

Early signs of support reversal in Alkyl aminesAlkylamines seems to have bottomed up after a significant correction in the stock from around 4800 levels to 2150 levels.

Currently, stock is on a very strong support from which the previous rally had started.

This high growth stock is a superb pick at this level for swing and positional trade.

However, there is a risk that it can be retracement of next correction wave to follow.

Kindly trade as per your own analysis.

ALKYLAMINEALKYLAMINE:- The stock was moving in a parallel channel, has given a breakout of the parallel channel taking support at 2451 level, watch the stock

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

ALKYLAMINE - Breakout & pullback - Swing TradeThe analysis is done on daily TF hence price may take few days to few weeks in order to reach the targets.

Trade setup is explained in image itself.

The above analysis is purely for educational purpose. Traders must do their own study & follow risk management before entering into any trade

Checkout my other ideas to understand how one can earn from stock markets with simple trade setups. Feel Free to comment below this or connect with me for any query or suggestion regarding this stock or Price Action Analysis.

Alkyl AminesI am sharing my trendlines in this chart so that you can take informed decision accordingly. Alkyl is one of the 2 main listed amines company in India. The company is fundamentally very sound, however, I feel a sharp rise in stock price has lead to a sharper correction in this counter. The whole chemical pack is under pressure currently.

Alkyl Amine showing seller exhaustionAlkyl amine which has been on a downtrend finally seems to have bounced back on its weekly and daily timeframe

Weekly timeframe shows -

1. Support from 50EMA

2. 38% Fibbonaci level support

3. Dragonfly Doji in making

Daily Timeframe shows back-to-back bullish candles on the previous support zone.

Trade with caution

ALKYL AMINES(Bullish wolfe wave)ALKYL AMINES:

Few key points to note:

- A Bullish WOLFE WAVE has been formed

- Waves counting are mentioned

- Tested the Gann Level of Prior Trend

- Recently tested 200 EMA

- RSI Exaggerated Divergence

I expect a bounce from this point for 3578-3630-3849, but we don’t have any reversal signal yet. Once a bullish candle is formed at this level, we can long for the mentioned targets.

CHART & ANALYSIS – ADARSH DEY

ALKYLAMINES short term investmentALKYLAMINES short term investment

Monthly - Weekly-Daily demand zone

Short term investment idea - Holding period 2-3 months

Entry at CMP 3422, 3375 & 3330

SL below 3250 CLBS

Target T1:3610 & T2:3920

Note(*): Please note that we are not a SEBI Registered Investor Adviser/PMS/Broking House. All the contents over here are for educational purposes only and are not investment advice or recommendations offered to any person(s) with respect to the purchase or sale of the stocks / futures and options