Ambuja Cements Ltd – Inverted Head & Shoulder Breakout in ProgreAmbuja Cements is displaying a classic Inverted Head & Shoulder pattern on the weekly timeframe, signaling a potential medium-term trend reversal. The neckline breakout zone around ₹560–₹580 is being tested again, and the price has shown a strong rebound from this area, confirming buyer strength.

The stock had earlier broken out of a falling wedge pattern, further strengthening the bullish bias. A sustained move above ₹580 with volume could confirm the breakout and pave the way for higher targets.

🎯 Key Levels:

CMP: ₹577.20 (+2.09%)

Pattern: Inverted Head & Shoulder + Falling Wedge

Neckline Zone: ₹560 – ₹580

Target-1: ₹630 – ₹640

Target-2: ₹690 – ₹710

Stop-Loss (Weekly Close): ₹540

📊 Technical View:

Price breaking out from a falling wedge after forming a reversal base.

EMA alignment turning positive – 20 EMA attempting to cross above 50 EMA.

Volume spikes seen near breakout areas indicate accumulation.

Sustaining above ₹580 may lead to a rally toward ₹640 and then ₹700+.

🧠 View:

Ambuja Cements shows early signs of a trend reversal backed by a strong chart structure. A weekly close above ₹580 would confirm the breakout, opening potential upside targets of ₹640 and ₹700 in the medium term.

AMBUJACEM

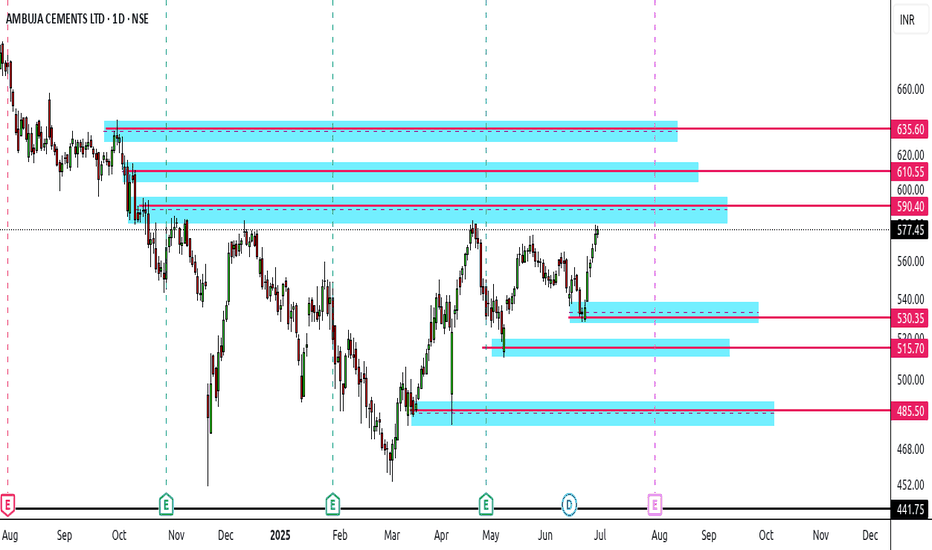

Ambuja Cements - Levels to watchAs market mood is choppy and result season is approaching soon

Its important to note the upcoming important levels for Ambuja Cements

Recently the stock gave a good rally but is now approaching towards its first strong resistance level of 590

Post that it has 2 more strong upside resistance at 610 and 635

Downside right now the nearest and strongest support levels are at 530 - 515 - 485

Take confirmation bias from lower Tf before entering any trade & play accordingly

*Ambuja Cement cmp 634 by Monthly Chart views since listed* *Ambuja Cement cmp 634 by Monthly Chart views since listed*

- Add the stock to your watchlist and Keep it on radar for new ATH Milestone in the making process

- *A Blast from the past to ponder upon. Is it like History going to repeat itself with the Rising Parallel Price Channel continuation ?*

MACD Crossover Swing Trade📊 Script: NESTLEIND

📊 Nifty50 Stock: YES

📊 Sector: FMCG

📊 Industry: Food - Processing - MNC

⏱️ C.M.P 📑💰- 2622

🟢 Target 🎯🏆 - 2769

⚠️ Stoploss ☠️🚫 - 2560

📊 Script: ADANIPORTS

📊 Nifty50 Stock: YES

📊 Sector: Marine Port & Services

📊 Industry: Miscellaneous

⏱️ C.M.P 📑💰- 1341

🟢 Target 🎯🏆 - 1426

⚠️ Stoploss ☠️🚫 - 1293

📊 Script: HEROMOTOCO

📊 Nifty50 Stock: YES

📊 Sector: Automobile

📊 Industry: Automobiles - Motorcycles / Mopeds

⏱️ C.M.P 📑💰- 4722

🟢 Target 🎯🏆 - 4949

⚠️ Stoploss ☠️🚫 - 4597

📊 Script: AMBUJACEM

📊 Nifty50 Stock: NO

📊 Sector: Cement

📊 Industry: Cement - North India

⏱️ C.M.P 📑💰- 612

🟢 Target 🎯🏆 - 650

⚠️ Stoploss ☠️🚫 - 592

📊 Script: BERGEPAINT

📊 Nifty50 Stock: NO

📊 Sector: Paints/Varnish

📊 Industry: Paints / Varnishes

⏱️ C.M.P 📑💰- 573

🟢 Target 🎯🏆 - 603

⚠️ Stoploss ☠️🚫 - 558

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

AMBUJA CEMENT - Swing Trade Analysis - 28th January #stocksAMBUJA CEMENTS (1D TF) - Swing Trade Analysis given on 28th Jan, 2024

Pattern: RECTANGLE BOX BREAKOUT

- Breakout - Done ✓

- Volume Spike at Resistance - Done ✓

- Retest & Consolidation - In Progress

#stocks #swingtrade #chartanalysis #priceaction #traderyte #ambujacem

Ambuja Cement : About to give huge breakout 📈 Exciting Bullish Pattern Alert! 🐂

📊 Pattern: Broadening Pattern

📌 Symbol/Asset: AMBUJACEM

🔍 Description: Stock has formed Broadening Pattern and its around the resistance of the pattern.

We can see huge momentum if stock is able to cross 530-540 levels on the upside.

👉 Disclosure: We are not SEBI registered analysts, this is not a buy or sell recommendation.

AMBUJACEM - Bullish Swing ReversalNSE: AMBUJACEM is closing with a bullish swing reversal candle supported with volumes.

Today's volumes and candlestick formation indicates strong demand and stock should move to previous swing highs in the coming days.

The stock has been moving along the horizontal support for the past few days which is indicating demand.

One can look for a 8% to 12% gain on deployed capital in this swing trade.

The view is to be discarded in the event of the stock breaking previous swing low.

#NSEindia #Trading #StockMarketindia #Tradingview #SwingTrade

Short Ambuja Cement below 425Short Ambuja Cement below 425, Target 405 SL 443. Reason for trade, Trendline is broken, Price trading below 20 EMA which is sloping downward RSI is also weak and nearest psychological level is 400.

Please note, I am not SEBI registered advisor, this is just my view and is for educational purpose. Please consult your financial advisor before taking trade.

If you think this idea is use full

please like and share and follow

thank you for reading my idea

AMBUJACEM Analysis(Ascending Triangle)!NSE:AMBUJACEM Analysis!

Ascending Triangle Pattern in AMBUJACEM on Daily Timeframe!

AMBUJACEM Retesting it's support level!

Ambuja Cements has made Ascending Triangle Pattern on Daily Timeframe. It has given a decent breakout with average high volume. After it retested it's support level. It has made a s pinning bottom candle on it's support level. We are expecting a bullish move in Ambuja Cements. RSI is in sync with price, it is also trending upwards for an additional confirmation we have taken RSI Analysis. Rest of all analysis you can find on chart.

Thank You!

Entry = Entry would be at current levels

Stop Loss =Stop Loss below 395.75 which is it's recent swing level. If it breaks the price may fall down.

Target = 548.60 but 485.25 is a probable resistance level kindly observe price behaviour at this level. If strong bearish candle formed(Bwarish Engulfing, Bearish Marubozu etc.) at this level we will exit.

Disclaimer = All my analysis are for Educational Purpose only. Before entering into any trade - 1) Educate Yourself 2) Do your own research and analysis 3) Define your Risk to Reward ratio 4) Don't trade with full capital

AMBUJACEMAMBUJACEM:- Ascending triangle pattern forming, if breakout occurs, upside rally may be seen, keep an eye on the stock

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

AMBUJACEM- Bearish Harmonic SELL!Attached: Ambuja Cements Hourly Chart as of 21st April 2023

Price is heading Down on its Way to Meet the Harmonic Pattern Targets (SELF EXPLANATORY just see Chart for levels)

Some other Points to also note are as follows:

- Hourly MACD in Sell and below 0 line

- Hourly RSI below 30 and Oversold (as it should be in a Bear Trend)

- 20 Hour EMA below 50 Hour EMA and in Sell Mode (blue and red ma)

- Price has broken below 200 Hour EMA (black ma)

All these are characteristics of a Bear Trend

Cement Stocks in DANGER!🩸Attached: Custom Cement Index/ Nifty 50 Daily Chart as of 21st April 2023

(Note: The above Chart is my Custom Cement Index made up of all the F&O Cement Stocks and this is the Ratio/ Relative Strength Chart version of it, against Index Nifty 50. This gives us an idea of the Relative Strength of the Cement Stocks and used to find out whether they are likely to Outperform or Underperform.)

Observations as follows:

Price based:

- A Clear Double Top Breakdown on the Ratio Chart with Break of Support accompanied by Bearish Power Candles!🩸

- The Ratio was in a Down Trend prior to the Range that formed. Presently the Ratio has rejected from the High of the Range and can head to the Low of the Range

- If you Zoom Out on this Chart or go to the Weekly TF, a Bear Flag/ Wedge Pattern is also visible

Indicator based:

- Daily RSI is now in Oversold (below 30) territory indicating a Strong Bear

- Daily MACD which was already in Sell has crossed below the 0 line

- DMI is in Sell and ADX may start to turn up

All the above Observations signal that the Cement Stock Basket is likely to Underperform🐻/ are Potential Short Candidates📉 !

Some names that have Short Setups are: ACC, AMBUJACEM (already shared in my Related Ideas), ULTRACEMCO, GRASIM, JKCEMENT

AMBUJACEM- Relative Strength says SELL!Attached: Ambuja Cements/ Nifty 50 Daily Chart as of 19th April 2023

A Classic Triangle Setup is visible in the above Ratio Chart

The Breakdown of this Triangle would result in the Ratio Selling Off (AMBUJACEM accelerating its Underperformance vs. Index Nifty 50)

Hence this makes the Stock a Sell Candidate based on Weakness

Well if you also look at the Price Chart which I have not shared here but it also has a Classic Triangle Setup with a Bearish Bias just like its Ratio Chart