My nifty intraday trend analisys 27/06/2025Pattern: Nifty is forming a Bottleneck Pattern, which generally supports bullish continuation after a tight consolidation.

Today’s View:

Market may open near 25600

Can test 25625 (1st Resistance)

Then may jump to 25700 if consolidation sustains

Due to Bottleneck, major correction unlikely

📊 Sideways Area – Where is the Range?

✅ Sideways Range (Today)

👉 When Nifty is between resistance and support zones without breakout:

🔸 From 🔸 To 🔄 Status

25460 25625 📉 Sideways Zone

25460 = Immediate support

25625 = First major resistance

Between these levels, Nifty may consolidate to build momentum before breakout.

🔐 Key Levels (Support & Resistance)

Support Resistance

25460 (strong) 25625 (primary)

25389 (backup) 25700 (target)

25300 (fail-safe) 25789 (extreme)

🎯 Strategy Suggestion

Market Condition Action Strategy

In Sideways (25460–25625) Wait / Scalping Low risk trades

Breaks 25625 & sustains Buy (BOD) Target: 25700–25789

Breaks below 25460 Use SOR cautiously SL tight

📌 Trading Tips:

Use 1-hour candle body-to-body

Observe Volume + Price Action + 15min candle close for breakout confirmation.

Analisys

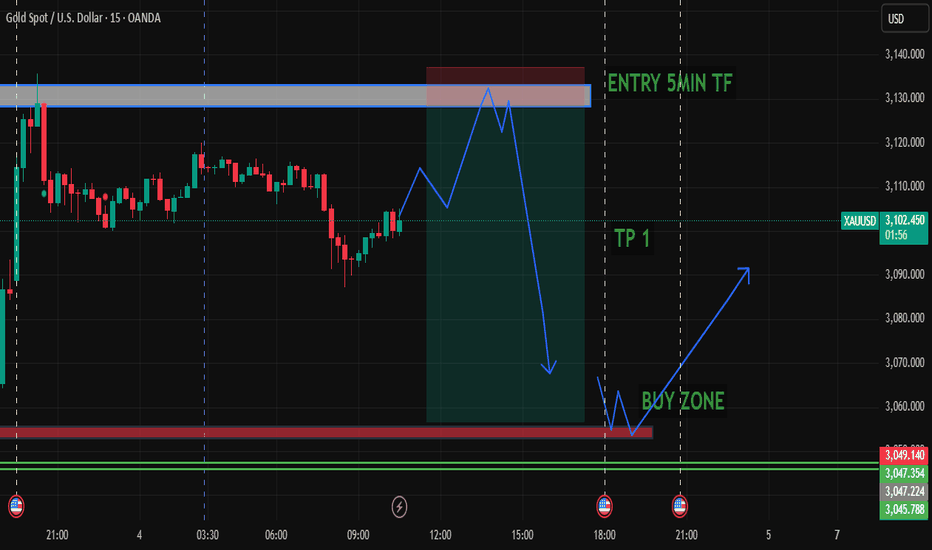

GOLD LONG/SHORT POTENTIAL TRADE SETUPS WITH GOOD R:RHigh Volatility & Price Sensitivity

Historical price action shows aggressive rejections from these levels, confirming their importance.

These zones act as magnetic levels where price either reverses or experiences momentum-based breakouts.

Zone Bounce & Breakout Strategies

Zone Bounce: Entry is planned when price touches the demand zone for buying or the supply zone for selling, expecting a reversal.

Fresh Zone Breakout: If price breaks above a fresh demand zone with volume confirmation, it signals bullish continuation. The opposite applies to supply zones.

Entry & Execution (5-Minute Timeframe)

The 5-minute timeframe allows precision-based entries with minimal drawdown.

Candlestick confirmation, such as pin bars, engulfing patterns, or wicks rejecting the zone, enhances trade validity.

Risk Management & Stop-Loss Placement

Stop-losses are placed slightly beyond the zone to account for false breakouts.

Take-profit targets are set at the nearest structural level or swing high/low for optimal risk-reward management. Happy Trading