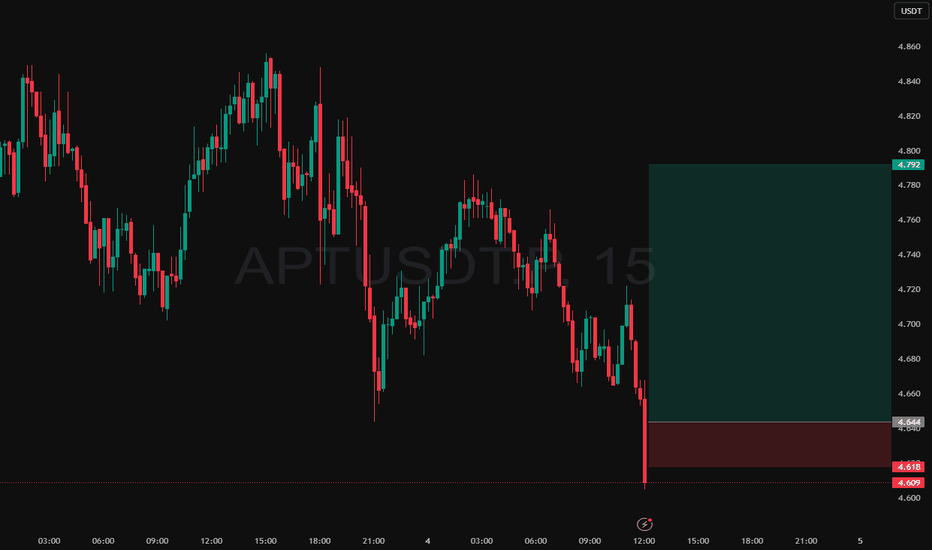

Intraday Long Setup | July 4th 2025 | Valid Until Daily ClosePrice retraced to a strong pivot zone.

Structure remains bullish with potential for continuation after pullback.

Tight risk control.

Watch for price reaction within the red zone. Entry only if confirmation appears

The setup expires at end of the daily candle close.

APT

APTOS (APT) PRICE ANALYSIS APT is currently approaching upper boundary of descending channel which acts as huge resistance for more than 100 days. Expect a mini pullback first before breakout and then gain momentum.

If breakout is successful then targets could be 7.8, 9.5, 12.

We need to wait for successful breakout, entry zone will be from 7.0 to 8.0

#Aptos Price Analysis: From Symmetrical Triangle to $100 APT/USDT Technical Analysis Update

➡️ Current Situation:

APT price was recently rejected at the resistance level of its previous all-time high. Observations on the higher time frame (HTF) charts indicate the formation of a symmetrical triangle. After a breakout, the price is currently retesting at the support level.

➡️ Key Support Zone:

The strong support zone and recommended entry levels are between $9 and $7.50 (spot trading). This provides a favorable risk-reward setup for potential entries.

➡️ Long-Term Outlook:

In my opinion, Aptos (APT) holds the potential to reach $100 in the long term. This makes my long-term target for APT a solid $100.

➡️ Short-Term Targets:

$18

$30

$48

These targets are set based on current market dynamics and breakout patterns observed in the chart.

➡️ Risk Management - Exit Strategy:

It's crucial to manage risks by setting an exit point. If the price breaks down below the red trend line, currently around $6.50, consider exiting to preserve capital.

➡️ Market Sentiment:

The overall sentiment will need to be monitored closely, particularly how the price reacts at the current support level. Maintaining a flexible approach will be key as market conditions evolve.

➡️ Remember:

Always do your own research (DYOR) and consider your risk tolerance when trading.

Stay Updated:

Follow for more updates and insights on cryptocurrency trading and market analysis.

1 $APT = 1 Apartment

Looking to add some Aptos around $12.0. The noticeable Massive Rounding Bottom pattern on the weekly chart signals a bullish market trend, indicating a big pump in the upcoming months, potentially reaching $50.

- Parallel execution of transactions

- AptosBFT consensus mechanism

- Scalability, security, and reliability

As the alt season is on the horizon, it could be the right opportunity to put your money in AMEX:APT . Let's stride ahead!

Aptos Trade Idea Setup Aptos can easily make your capital go double

- Watch out Aptos this can soon shoot up 20$ or even more

- Aptos can be bought in every dip you see around 10-11$

- Make sure that you hold Aptos if you are already holding it for a long time

- From a Trading Perspective watch out for 12$

APTUSDT Long: High Timeframe Breakout and RetestLooking for a big push from APT to range highs after a significant breakout and then a flush, forming this retest. This is after a period of long consolidation.

TP1 is set at 10.937 offering a conservative exit at the local highs. TP2 is at higher timeframe resistance and liquidity zone

APT/Aptos Swing Setup Aptos is a Layer 1 Proof-of-Stake (PoS)

- Layer 1 usually moves once you see a decent infusion of money in Major Alts

- Aptos recently spiked up to 10.7$ yielding a gain of 13% in a day

- 9-9.4$ can be the zone where you all can think about accumulating Aptos for long-term

- I am very bullish on Aptos in the long run

APT Analysis: Testing Resistance with Bearish Bias

💎 APT is currently testing the resistance trendline of a descending channel. Additionally, a closer look at the candles reveals that red candles are larger than green ones, suggesting a higher likelihood of a bearish trend.

💎The price is also indicating CHoCH, and it's currently at the bearish OB, coinciding with the Fibonacci 0.618 level and the resistance trendline of the descending channel. These factors collectively support a bearish outlook for APT at this level.

💎For confirmation of the bearish scenario, we would ideally need to see a bearish engulfing candlestick pattern. Previous price action has shown bearish reversals following such patterns at every low-high point.

💎However, if the price manages to break above the bearish OB, we may witness a bullish movement. Still, it's important to exercise caution as such moves can be deceptive. Therefore, I would advise against considering bullish scenarios for APTUSD at this juncture.

Aptos Swing Long Update - Aptos swing has currently achieved all my targets.

- I have entered this again at the current prize, I will add more size in the next retracement and look to size up more once I see a retracement

- From a swing perspective Aptos has completed a huge accumulation and now it's out of its base

- I will prefer holding APTOS for the next quarter as a huge mid-term swing my first potential target would be 20$

- This position and call-out involves patience if you don't have it better not enter it

- Manage risk invalidation below 7.5$

APT moves in FALLING Wedge PatternAPT 1-day Chart Analysis

As per daily basis chart Analysis of APTOS is moving into Falling Wedge Pattern, from January after launching of this Token, means continue in Downtrend, but as par falling wedge bullish signals, after July it will be start moving again in Bullish mode, before that it will goes under Bearish Zone in July with Last Lower-Low Cut-off point at $3.8 to $4.2 approx.

Always #DYOR before investing in Crypto.

Trade Wisely with using of #StopLoss always.

also must LIKE, COMMENT &SHARE

APT/USDT Set to Skyrocket?!!👀 TRU Today Analysis💎 Paradisers, take note! APT/USDT is currently nestled in a robust support zone, signaling a considerable level of buying interest in the market.

💎 Moreover, it has found a foothold at the lower boundary of a clearly defined channel, hinting at a possible price rebound.

💎 The intersection of these support levels amplifies the probability of a bullish move on the horizon.

💎 Traders and investors should keep a close eye on the price action as it nears the support zone and the lower boundary of the channel.

💎 A surge above these levels, backed by sustained buying pressure, could act as a bullish confirmation and spark a significant upward move.

💎 It's crucial to keep a close watch on the price movement and volume dynamics to assess the strength of the potential upswing.

💎 Market participants should consider setting suitable entry and exit points, as well as risk management strategies, to take advantage of the potential opportunity.

💎 As always, it's advisable to conduct thorough research and analysis, and consult with financial professionals, before making any investment decisions. Stay tuned, Paradisers!

APTUSDT slight high and then shortAPTUSDT is currently in abc pattern in downside. If previous high is not broken then there are very high chances that it will start coming down. I am personally not taking any positions in this right now but will enter in right time for sure. Keep watching this one. Happy Trading.

"Learn with Nikhil"

APT/USD - Weekly OverviewThe technical chart of Aptos (APT) token reflects the initial buying volume gathered which led to its new all-time high. However, since then, the coin has faced significant selling sentiment at regular intervals which eventually led to a downfall below the 0.236 FIB level. Since then, the price level was not able to have a positive breakout above the Fibonacci level.

Considering the technical indicators, it could be noticed the RSI level had a hard time sustaining above the level of 50 which implies that APT had not received constant buying volume from investors. The same goes for the MACD level which barely spent time above the histogram. However, considering the current trend, green bars have started to formulate on the histogram which could provide Aptos some positive momentum in the near term.

Overall, the price level needs to have a positive breakout above the resistance levels of $5.00 and $6.00. On the contrary, if it faces further downfall, support levels can be placed at $4.00 and $3.00.

APTOS, let it build.APT, Huge airdrop just like UNI gave its airdrop in 2020, APT recreates the sme feels in 2022.

We will be looking in 1hr and 4hr TFs as its a recent listing.

The upper downtrend line is in 1Hr and the lower downtrend line is in 4Hr.

The best support range in this chart lies around sub 7$ ( upto 3% till 6.80$).

Let it build, will take a position soon.

In my opinion, APT is a little beast fundamentally which must give a decent 3-5x in upcoming months if BTC fanges sideways or is not bearish.