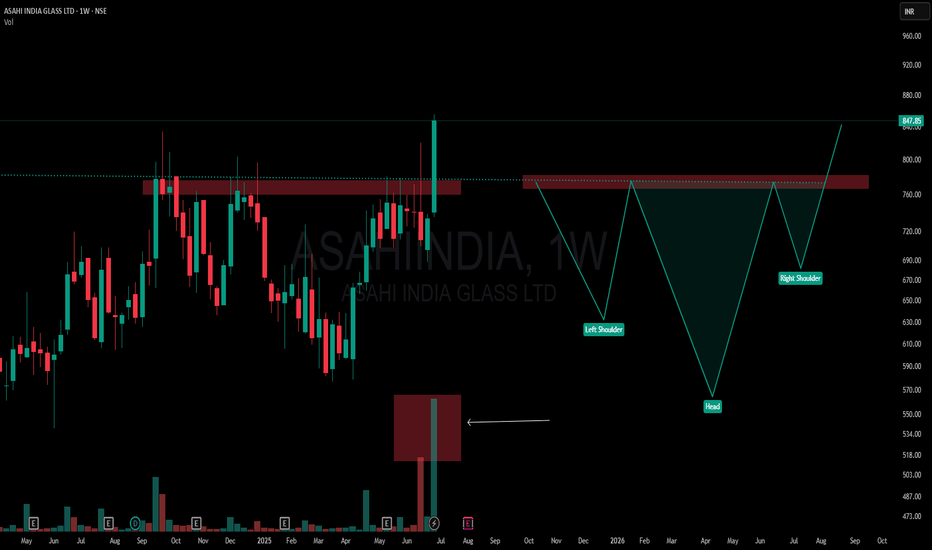

When Textbook Meets Extremes: Perfect Inverted Head and Shoulder📌 ASAHI INDIA GLASS | Weekly Timeframe

🧩 Pattern Breakdown (from a textbook lens):

-Left Shoulder: Formed after the Sept–Nov 2024 rejection

-Head: Created around Feb–May 2025 with a deeper dip

-Right Shoulder: Built through June 2025

-Neckline: ₹750–₹760 zone, tested multiple times

-Breakout Candle: High conviction — wide-bodied, strong close, with 17.61M volume

📘 According to classical technical analysis, Inverted Head & Shoulders patterns often signal a trend reversal. What's notable here is the context — the structure has developed after a sustained move upward, not from a bear phase.

🎯 The candle breaks above a long-standing supply zone with size, volume, and conviction — yet its location at the top makes it structurally interesting and unusual when viewed through traditional pattern psychology.

🚫 This is not a tip, call, or directional bias — just a visual log of structure and volume behavior.

💬 Chart interpretations welcome in comments.

ASAHIINDIA

Asahi India Glass cmp 701.30 by Weekly Chart viewAsahi India Glass cmp 701.30 by Weekly Chart view

- Support Zone at 600 to 625 Price Band

- Resistance Zone at 705 to 722 ATH Price Band

- Weekly basis Support at 625 > 535 > 445 with the Resistance only at ATH 722

- Stock traded within 445 to 645 price range for close to 2 1/2 years before taking volumes based breakout above current Support Zone

ASAHI INDIA GLASSAsahi India Glass Ltd. (AIS) is India’s leading value-added and integrated glass solutions company and a dominant player both in the automotive and architectural glass segments. Established in 1984, It was formed as a Joint Venture between The Labroo Family, Asahi Glass Co. of Japan and Maruti Udyog Ltd (now Maruti Suzuki India Ltd).

AIS provides end to end solutions in the entire glass value chain - from the manufacturing of

float glass, processing, fabrication to installation services. As a sand-to-solutions company, AIS

offers varied types of glass products and services to its customers in India and across the globe.

Short Term Trading Idea in Asahi India Glass for > 10% Upside Hi,

NSE:ASAHIINDIA has given a Bullish Flag Breakout on Daily charts with very good volume.

MACD is also on the bullish side on daily and weekly time frames. RSI is also on the bullish side on daily and weekly time frames.

In the current market scenario, I am expecting that the bullish momentum will continue.

Complete price projection like entry, stop loss and targets mentioned on the charts for educational purpose.

Don't Forget to Follow me to get all the updates .

Please share your feedback or any queries on the study.

Disclaimer: Please consult your financial advisor before making any investment decision.

Asahi Glass-Breakout done, finally?Asahi Glass has been consolidating in cup & handle pattern since few years.

Finally, stock has given daily closing above neckline.

A weekly closing above 615 will confirm breakout.

This breakout will bring momentum in stock and we can see 800 very soon.

Breakout traders can keep this stock in watchlist.

MACD Crossover Swing Trade📊 Script: GODREJPROP

📊 Sector: Realty

📊 Industry: Construction

⏱️ C.M.P 📑💰- 2842

🟢 Target 🎯🏆 - 3009

⚠️ Stoploss ☠️🚫 - 2756

📊 Script: ASAHIINDIA

📊 Sector: Glass & Glass Products

📊 Industry: Glass & Glass Products

⏱️ C.M.P 📑💰- 640

🟢 Target 🎯🏆 - 671

⚠️ Stoploss ☠️🚫 - 621

📊 Script: NH

📊 Sector: Healthcare

📊 Industry: Healthcare

⏱️ C.M.P 📑💰- 1265

🟢 Target 🎯🏆 - 1343

⚠️ Stoploss ☠️🚫 - 1247

📊 Script: TRITURBINE

📊 Sector: Capital Goods - Electrical Equipment

📊 Industry: Electric Equipment

⏱️ C.M.P 📑💰- 569

🟢 Target 🎯🏆 - 609

⚠️ Stoploss ☠️🚫 - 563

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

ASAHIINDIA ASAHIINDIA

Red is 20EMA

Green is 200EMA

Market is still in Downtrend only Above 200EMA will it be UPtrend

Take Support in Trendline

So Entry - 445-455

SL- candle close below trendline (or)- 440

TGT-498,530,652,690

EXIT

1ST TGT With SL

TGT 498 is 200 EMA Resistance if strong Green Candle Close Above 200 EMA than Aim TGT-2,3,4

Wait for 2ND TGT With SL Cost to Cost or Trail

ASAHIINDIAASAHIINDIA:- Head and shoulders pattern forming, keep an eye on it

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

MIDCAP may be on FireNSE:CNXMIDCAP NSE:ASHOKLEY NSE:ASAHIINDIA NSE:BAJAJHLDNG NSE:GRAVITA NSE:IEX NSE:PIIND NSE:POLYCAB

Good to keep on the radar

Always respect SL & position sizing

========================

Trade Secrets By Pratik

========================

Disclaimer

SEBI UNREGISTERED

This is our personal view and this analysis

is only for educational purposes

Please consult your advisor before

investing or trading

You are solely responsible for any decisions

you take on basis of our research.

Asahi India Glass - Long Setup, Move is ON...#ASAHIINDIA gave an entry at 429.20 on breakout.

Has moved from 429.20 to 694 levels.

It is now trading above Resistance 1 of 634.

Next Resistance 2 is at 954.

Here is previous chart:

Chart is self explanatory. Entry, Resistances and Support are mentioned on the chart.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

YR 2022 Idea #157: Long on ASAHIINDIAThis is a public swing trade idea and is only for Learning and observational purpose. Please understand your risk and take full responsibility of your actions. I might trail my stoploss after I get an entry but even if my original Stoploss hits, i exit the trade with pre-planned loss (risk). At target, I book usually 75% positions and trail stoploss for rest. Our objective to help anyone who wants to learn technical analysis using charts by demonstrating my real trade entries. You can post your queries in comment section here and we will try to answer them asap.

ASAHINDIA - VOLUME BREAKOUT + MACD CROSSOVER + SMA CROSSOVER 📊 Script: ASAHIINDIA (ASAHI INDIA GLASS LIMITED)

📊 Nifty50 Stock: NO

📊 Sectoral Index: NIFTY AUTO / NIFY 500 / NIFTY SMALLCAP

📊 Sector: Automobile and Auto Components

📊 Industry: Auto Components

Key highlights: 💡⚡

📈 Script is trading at upper band of Bollinger Bands (BB) and giving breakout of it.

📈 MACD is giving crossover.

📈 Crossover in Double Moving Averages.

📈 todays volume is much greater then previous trading session volume which indicates volume breakout.

📈 Current RSI is around 65.

📈 One can go for Swing Trade.

⏱️ C.M.P 📑💰- 624

🟢 Target 🎯🏆 - 676

⚠️ Stoploss ☠️🚫 - 604

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat🔁

Happy learning with trading. Cheers!🥂

Asahi India Glass Breakout 1. Buy or Sell at your own risk

2. Don't risk more than 1%-2% of your capital as stop loss

3. Position Size formula:- Stop Loss Amount/(Buy Price-Initial Stop Loss Price)

4. Sell on RSI close below 30 (or use any other method of your liking)

5. Some other ways to sell stocks can be

a. 25% or 50% up in three weeks or less

b. Weekly tailing tops with high volume

c. Exhaustion gaps

d. Heavy daily volume without further upside

e. Largest one day price drop

After a consolidation since January 2022, NSE:ASAHIINDIA has given a breakout today. Buy with a stop just below ₹555. (One can use the low of the previous bar/supertrend indicator/previous support point/fixed percentage from the buy price as stop loss also)

ASAHIINDIA | Good for 10%+ ??NSE:ASAHIINDIA

Cmp : 537.80

Entry : CMP OR on a pullback of 534

Stop Loss: According to one's Risk Reward ratio

#Study, Learn & Earn.

If you love this post please like and comment your thoughts below. That will be a great motivation for me to post similar ideas ahead.

Disclaimer: All the information posting on this page are for the educational purpose only, we are not SEBI registered financial advisor. We wont recommend any BUY/SELL of stocks. Contact your financial advisor before taking any action