GRWRHITECH: Descending Triangle Breakout, Chart of the WeekDouble Bottom or Dead Cat Bounce? Why Garware's Next Move Could Make or Break Your Portfolio. From ₹5,378 to ₹2,600:How a 38% Profit Crash and 50% US Tariffs Brought This Market Leader to Its Knees, and what changed now? Let's Understand in the "Chart of the Week"

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Price Action:

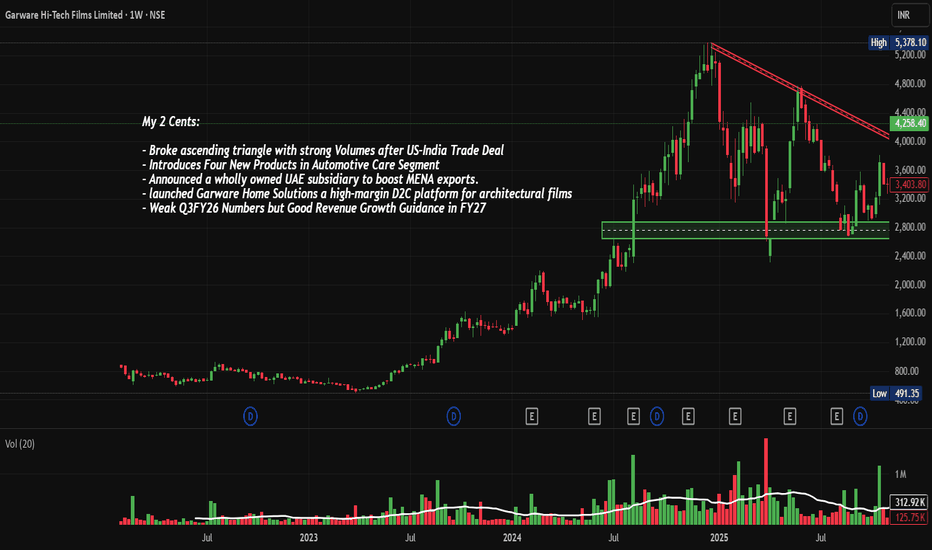

The weekly chart of Garware Hi-Tech Films reveals a dramatic shift from a strong uptrend to a well-defined downtrend. The stock reached an all-time high of ₹5,378.10 before experiencing a severe correction of approximately 50% to current levels around ₹4,258.40.

Key observations:

- Strong ascending triangle pattern formation that broke out with substantial volume support post US-India trade deal announcement

- A clear transition from bullish momentum to bearish trend following the peak in early 2025

- Formation of a descending channel marked by two parallel red trendlines acting as dynamic resistance

- Recent price action showing a potential base formation in the ₹2,600-₹2,800 zone

Base Identification:

Primary Accumulation Base (2023-2024):

A significant consolidation zone between ₹2,600-₹2,800 levels spanning from mid-2024 through early 2025. This horizontal support zone, represents a critical demand area where the stock found support multiple times. This base served as the launchpad for the subsequent rally toward all-time highs.

Current Potential Base Formation:

The stock is currently retesting the same ₹2,600-₹2,800 zone, suggesting the possibility of a double-bottom formation. This level has shown initial signs of buying interest with recent green candles emerging.

Volume Spread Analysis:

Volume patterns reveal critical insights into the stock's price movements:

Breakout Volume Surge:

The ascending triangle breakout was accompanied by exceptional volume spikes (1.45M shares), indicating strong institutional participation and conviction in the upward move. This validates the breakout's legitimacy.

Distribution Phase:

During the rally to all-time highs, volume began to taper off at higher price levels, suggesting waning buying interest and potential distribution by smart money. This is a classic warning sign of trend exhaustion.

Recent Volume Characteristics:

- Volume has been declining during the correction phase, indicating a lack of panic selling

- Recent green candles show renewed volume interest at the support zone (1.45M shares in the latest sessions)

- The 20-day average volume of 384.69K shares is being exceeded during recent trading, suggesting accumulation at lower levels

Delivery Volume Analysis:

Recent reports indicate that delivery volume surged by 226.02% on February 2, 2026, signalling strong investor conviction rather than speculative trading. This is typically a positive sign for medium to long-term holders.

Key Support Levels:

Immediate Support: ₹2,600-₹2,800 (Primary demand zone)

This level represents the previous accumulation base and has demonstrated strong buyer interest historically. The zone has witnessed multiple tests and held firm during the consolidation period.

Secondary Support: ₹2,400

If the primary support fails to hold, the next major support lies around ₹2,400, which aligns with previous consolidation lows from the 2023-2024 period.

Critical Support: ₹2,000

The psychological level of ₹2,000 serves as the last line of defence before the stock could test significantly lower levels.

Key Resistance Levels:

Immediate Resistance: ₹3,200-₹3,400

The first major resistance zone where the stock has faced selling pressure during the recent downtrend. This area corresponds to the breakdown point from the ascending triangle.

Major Resistance: ₹3,800-₹4,000

A significant supply zone where multiple price rejections have occurred during the correction phase. This level also aligns with the 50% Fibonacci retracement of the entire rally.

Strong Resistance: ₹4,600-₹4,800

The descending trendline resistance (upper red line) currently intersects around these levels and represents a formidable barrier to upward movement.

All-Time High Resistance: ₹5,378.10

The psychological barrier where profit-booking intensified and marked the beginning of the current correction.

Technical Pattern Analysis:

Ascending Triangle Breakout (Completed):

The stock formed a well-defined ascending triangle pattern with higher lows and a flat resistance around ₹2,800. The breakout occurred with exceptionally strong volume (visible in the volume bars showing spikes of 1.45M shares), validating the pattern. This breakout was likely triggered by the US-India trade deal announcement.

Potential Double Bottom Formation:

The stock is attempting to form a double bottom pattern at the ₹2,600-₹2,800 support zone. A successful hold at these levels with a subsequent rally above ₹3,400 could validate this reversal pattern.

Critical Technical Levels Summary:

Key Level to Watch: ₹2,600

This is the make-or-break level. A decisive close below this support on heavy volume would signal continuation of the downtrend toward ₹2,400 or lower. Conversely, a strong bounce with volume confirmation could trigger a rally toward ₹3,200-₹3,400.

Reversal Confirmation Levels:

- ₹3,400: Break above would negate the descending channel's lower boundary

- ₹3,800: Reclaim would suggest intermediate trend reversal

- ₹4,200: Breaking this level would confirm the bearish phase is over

Fundamental and Sectoral Backdrop

Company Overview

Business Profile:

Garware Hi-Tech Films Limited is a leading global manufacturer of speciality performance polyester films with fully integrated "chip-to-film" operations. Founded in 1957, the company has transitioned from commodity polyester films to premium, high-margin speciality films.

Core Product Segments:

1. Paint Protection Films (PPF) - Automotive protection against chips and scratches (25% of revenue in Q3 FY26)

2. Sun Control Window Films - For automotive, architectural, and commercial applications

3. BOPET Films - Speciality films for packaging, thermal lamination, insulation

4. Architectural Films - For buildings and commercial spaces

Geographic Presence:

The company exports to over 90 countries across 5 continents, with the USA being the largest market, contributing 77% of revenues. The company has subsidiaries in the USA and the UK to service international clients.

Recent Financial Performance

The Q3 FY26 results (Disappointing) represent the weakest quarterly performance in recent periods, with margins at multi-quarter lows. The 38.87% QoQ profit decline has raised serious concerns about near-term demand dynamics and operational efficiency.

Growth Initiatives and Strategic Developments:

Capacity Expansion:

Paint Protection Film (PPF): The company has doubled its PPF capacity to 60 million square feet by 2026, positioning itself to capture growing demand in the automotive protection segment.

TPU Line: A new Thermoplastic Polyurethane production line is planned for commissioning in October 2026, requiring capex of ₹118 crore.

New Business Initiatives:

Garware Home Solutions: A direct-to-consumer (D2C) platform for architectural films launched with the first studio in Mumbai. This represents a strategic move to tap the domestic consumer market.

UAE Subsidiary: The board approved the establishment of a wholly-owned subsidiary in the UAE to strengthen export capabilities in the MENA region and expand international market presence.

Global Application Studios: Two new studios opened in the Middle East to enhance customer engagement and provide tailored solutions.

Product Launches:

The company introduced four new products in the automotive care segment, though specific details are not publicly disclosed in recent announcements.

Management Guidance and Outlook:

Forward-Looking Targets:

Revenue CAGR: 15-20% for FY26 and beyond

EBITDA Margins: Target range of 22-25%

Export Share: Increase to over 70% of total revenue

Value-Added Products: Aim for 85%+ contribution to overall sales

Strategic Focus Areas:

1. Increasing penetration in the US PPF market, particularly given the opportunity arising from XPEL's supplier realignment

2. Building the Indian PPF market through applicator training and studio expansion

3. Expanding the architectural films business, targeting ₹500 crore revenue within 3 years

4. Growing non-US markets by approximately 20% to reduce geographical concentration risk

Sectoral Context:

Industry Segment:

Garware operates in the Plastic Products - Industrial sector, specifically within the speciality films and packaging segment.

Sector Performance:

The packaging segment has shown moderate strength, gaining 9.07% recently, indicating sectoral tailwinds. However, the speciality films industry faces challenges from:

- Raw material price volatility (petrochemical derivatives linked to crude oil)

- Intense competition from global manufacturers

- Product commoditization in certain segments

- Regulatory changes affecting automotive and architectural applications

Market Position:

Garware is recognized as the world's No.1 vertically integrated "chip-to-film" manufacturing company. In India, it is the only manufacturer of Paint Protection Films, giving it a monopolistic advantage in the domestic market.

The speciality films market is experiencing growth driven by:

- Increasing automotive sales and premiumization

- Growing awareness about vehicle protection

- Rising demand for energy-efficient building solutions

- Expansion of packaging applications

Key Business Risks and Challenges:

US Tariff Impact:

The company faces significant headwinds from increased US tariffs (mentioned as rising to 50% in earnings calls). The PPF segment, contributing 25% of revenues, is most impacted due to high per-unit prices that amplify tariff effects.

Management Strategy: The company is managing this by sharing costs with customers while absorbing portions internally, and exploring supply chain diversification options outside the US.

Geographic Concentration:

With 77% of revenues from exports and the USA being the dominant market, the company faces concentration risk from:

- US economic slowdowns

- Trade policy changes

- Currency fluctuations

- Competitive pressures in key markets

Raw Material Volatility:

As petrochemical derivatives form the raw material base, any sharp increase in crude oil prices can compress gross margins, particularly in the commodity-linked Industrial Products Division (IPD).

Weak Q3 Performance:

The latest quarter showed alarming deterioration:

- Lowest revenue and operating profit in recent quarters

- Margin compression to multi-quarter lows

- Earnings declining 28.70% versus the previous four-quarter average

- Volume and demand pressures across segments

Competitive Advantages:

Vertical Integration:

The complete "chip-to-film" integration provides cost advantages, quality control, and supply chain resilience that competitors lacking this capability cannot match.

Technology Leadership:

Proprietary nano-dispersion technology and continuous R&D investment enable differentiated products with higher margins. The company holds technology leadership in dyed polyester films globally.

Distribution Network:

Established presence in 90+ countries with subsidiaries in key markets (USA, UK) and new expansion in the UAE provides strong distribution capabilities.

Domestic Market Monopoly:

Being India's only PPF manufacturer provides pricing power and first-mover advantage in the rapidly growing domestic automotive protection market.

Strong Balance Sheet:

Zero debt position (as per some reports) provides financial flexibility for growth investments and capacity expansion without leverage concerns.

Recent Stock Price Volatility Drivers:

Upper Circuit Hits:

On February 3, 2026, the stock hit a 20% upper circuit at ₹3,908.6, demonstrating extreme speculative interest. This followed similar sharp moves on January 22 (7.92% surge) and February 1 (8.1% gain), creating a two-day cumulative return of 32.34%. On Back of US-India Trade Deal News

My 2 Cents:

The technical chart tells a story of euphoria followed by harsh reality. The ascending triangle breakout captured optimism around growth initiatives and the US market opportunity, but the subsequent 50% correction reflects deteriorating fundamentals becoming apparent through weak Q3 results. But again Guidance is Strong and Trade Deal is Done.

Critical Questions for Investors:

1. Does the ₹2,600-₹2,800 support a genuine accumulation zone or a temporary pause before further decline?

2. Can management execute the turnaround needed to achieve 22-25% EBITDA margins given current headwinds?

3. Will the tariff situation stabilize or continue pressuring the crucial US market?

4. Are the recent circuit moves indicating smart money accumulation or retail speculation?

Scenarios to Monitor:

Bull Case Scenario:

- Operating margins recover toward 18-19% levels

- New capacity comes online successfully with a strong order book

- Stock holds ₹2,600 support and breaks above ₹3,400 with volume

- Technical pattern shifts from descending channel to ascending structure

Bear Case Scenario:

- Margins remain compressed below 16-17%

- US tariff pressures may intensify, impacting the PPF segment further

- Stock breaks below ₹2,600 support decisively

- Volumes remain elevated on the downside, confirming distribution

Base Case Scenario:

- Consolidation continues in ₹2,600-₹3,400 range for several quarters

- Gradual margin improvement but no sharp recovery

- Mixed quarterly results creating volatility

- Technical pattern remains range-bound until a clear fundamental catalyst emerges

Key Events and Data Points to Watch:

Immediate Term:

- Price action at ₹2,600 support zone - hold or break?

- Volume characteristics during any breakout attempt

- Q4 FY26 results (expected May 2026)

Medium Term:

- TPU line commissioning (October 2026)

- UAE subsidiary operational metrics

- Architectural films segment revenue trajectory toward ₹500 crore target

- Management commentary on US tariff mitigation strategies

Long Term:

- Achievement of 15-20% revenue CAGR guidance

- Margin expansion to 22-25% range

- Export share increasing to 70%+

- Value-added products reaching 85%+ contribution

For New Investors:

The current juncture offers a risk-reward scenario heavily dependent on one's conviction in management's turnaround ability. The technical setup suggests waiting for:

- Decisive break above ₹3,400 with volume for trend reversal confirmation

- Q4 results showing tangible improvement before committing capital

- Stabilization of support at ₹2,600 with multiple successful tests

For Existing Holders:

Those sitting on long-term gains should consider the deteriorating fundamentals seriously. The 38.87% quarterly profit decline and margin compression to multi-quarter lows suggest the worst may not be over. Risk management suggests:

- Partial profit booking at rallies toward ₹3,200-₹3,400

- Strict stop-loss below ₹2,500 to protect capital

- Reassessing holdings post Q4 FY26 results

So, Garware Hi-Tech Films presents a fascinating case study of a fundamentally strong business facing near-term headwinds. The technical chart reflects this dichotomy - a powerful long-term wealth creator now grappling with serious operational challenges.

The ₹2,600-₹2,800 support zone represents a critical decision point. If this level holds with improving fundamentals in Q4, the stock could stage a meaningful recovery. However, failure to defend this support or continued fundamental deterioration could trigger a deeper correction toward ₹2,000 or below.

The company's strategic initiatives (capacity expansion, geographic diversification, D2C platform) are directionally correct, but execution against the backdrop of US tariff pressures and margin compression will determine whether the current support becomes a launchpad or a false floor.

Given the high-risk, high-reward nature of the current setup, investors should approach with caution, maintain strict risk management discipline, and wait for clearer signals - both technical and fundamental - before making significant allocation decisions.

The coming quarter's results and price action at the ₹2,600 level will likely determine whether this speciality films giant can reclaim its former glory or faces an extended period of consolidation and repair.

Full Coverage on my Mid-Week Newsletter coming Wednesday.

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Automotive

Big Bull stockMahindra CIE Automotive is engaged in the Business of Production and sale of automotive components to original equipment manufacturing and other customers in india and overseas. which means they supply to TATA motors, Ashok leyland, TVS, Maruti etc.

Share holding pattern

Investors :- 72.19

FII :- 10.45 (-1%)

DII :- 7.84 (+1.8%)

Pubic :- 9.52 (+0.8%)

RSI :- Above 60 is promising

Volume indicator :- Slowly accumulating for big blast.

All the levels are given in the chart.

Any quires/clarifications required

Kindly revert back in the comment section.

Note :- The analysis is made for study purpose only. Nowhere author is suggesting to buy/sell.

Before taking any position it is advised to consult your financial advisor.

MLong

automotive axleNote:

1. Views are personal and for educational purposes only. Recheck and take the trade as per your RR.

2. Always remember SL is your lifeline, not the big target...

3. Follow us for more patterns and like, share so that we feel it is helpful to many and share more patterns...

3. Views given here is not a tip rather it is for educational purpose... Aftermarket opens, the condition might change so learn to handle different conditions...

4. To learn more about patterns, Psychology behind the trade, and price action trading... contact us... Thanks...

Keep an eye ladies and gentlemen. Cheers and Happy Trading

Motherson Sumi Monthly Chart AnalysisMotherson Sumi as per monthly, weekly and daily chart analaysis its in consolidation phase and once it breaks above 260 level then its a multi year break out and target 270 level.

M

MAHINDCIE Keep an eye out for BO!MAHINDCIE trading close to 52wk high!

Keep it on your radar for a possible breakout as auto sector is doing good!

Buy above high on closing basis.

Target 300/320

Please do your own analysis before making any decisions and also let me know if I missed something.

Let's learn together.

MLong

Tata Motors: Another tata stock exhibiting clear upmoveHello Traders,

Tata Motors has exhibited clear upmove graph. Post Inverse head and Shoulders formation it has given a breakout. Now I am certainly entering the trade with following strategy.

If stock continues non-stop upmove:-

Then I will enter the trade when it crosses above 329 around 330

If the stock consolidates:-

And takes a rejection at 9 EMA or 21 EMA in 75 minute then I will enter the trade at that price somewhere around 318

SL: 299

First target: 350

Second target: 377

MOTHERSUMI, Swing/Positional/Long TermMothersumi has taken support from the resistance turned support at 235 and the uptrend line to form a pole and flag pattern. Watch out for a break above the upper edge of the flag and the 52 week high for a target of fibonacci pivot.

Note: Please do not follow my idea blindly, analyze yourself as well. I just share my idea so that people can build upon the same. The idea I share is open to healthy criticism and feedback :)

MLong

AMARAJABAT Important Chart Pattern.An Inverted Head and Shoulders has formed in the stock chart in the small time frame.

Recently there has also been a slight increase in volume.

A

AMARAJABAT Short Formed a head and shoulders pattern right on 200 days moving average.

Broken the neckline.

Approaching the neckline again for a retest.

After retest, it can give a big downside or upside.

Downside target 1 - 929

Downside target 2 - 905

If after retest buying starts and the stock moves up, then it can give

Upside target 1 - 963

Upside target 2 - 970

* For educational purpose only *

A

Price Action Hero -TATA MOTORS - GUNSGETTINGREADY - Chart#3 20211.Price Action Hero -Tata motors.

2. Respecting multi year resistances and following the horizontal trend lines beautifully.

3. Watch your self how beautifully the price action is respected . Once it broke the 153 hurdle it went all the way and came back to 153 and going to blast the shorters in a session.

4. It is going to face stiff resistance at 200 level and next levels are marked for further targets purpose.

5. This is not a buy/sell call but definitely a stock which is going to raise in case the management sticks to what it is committed.

6. Dec auto sales rose to 84% yoy -2020

7. Tata gravitas launch on Jan 26th.

8.All guns are getting ready for blaze.

#Education Only

EICHER MOTORS(Daily) : Curbed by resistance..!EICHER MOTORS (Daily) posted a strong rally into strong Fibonacci cluster resistance around 19200 has curtailed the upmove. The immediate downward reaction and inability to move higher is attracting some selling interest once again. Momentum is showing signs of weakness adding to the developing bearish bias. Any move below 17600 could be an invitation for more downside in the coming week.

Idea Sourced From

NeoTrader

trade.chartadvise.com