AWHCL: Signs of Trend ReversalThe stock of AWHCL has shown signs of recovery after a prolonged downtrend that began in September. Recent price action suggests a potential shift in momentum, supported by multiple technical factors across daily and weekly timeframes.

The stock has bounced from a long-term support level marked on the chart. The recent retracement from the swing high and higher low aligns with the 61.8% Fibonacci level, a zone often considered significant for trend continuation, indicating strong bullish momentum.

A bullish MACD crossover occurred on the daily chart last week, and notably, a weekly MACD crossover has been confirmed today. This dual timeframe alignment strengthens the bullish outlook.

The RSI readings support the bullish scenario, reflecting improving momentum without entering extreme overbought territory.

On the daily chart, the stock has managed to close above the 200DEMA, a key indicator of long-term trend strength which also seen by volume growth.

Key Levels to Monitor:

Support Zone: Around ₹417 (critical level for trend validation)

Resistance Zone: Near ₹632, which coincides with the 1.618 Fibonacci extension level, often viewed as a potential target in bullish setups.

Disclaimer: This analysis is intended for educational and informational purposes only. It does not constitute investment advice or a recommendation to buy, sell, or hold any financial instrument. Market participants should conduct independent research and consult a licensed financial advisor before making any investment decisions.

AWHCL

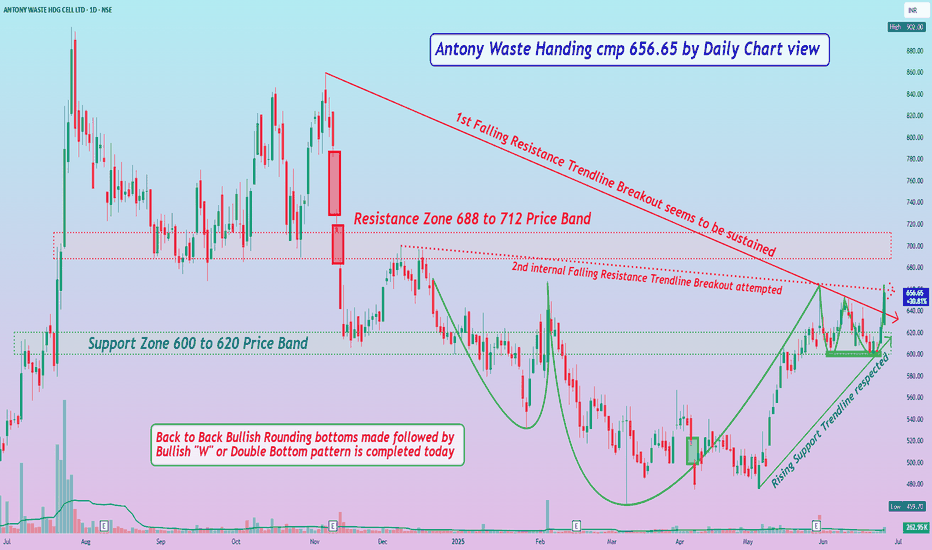

Antony Waste Handing cmp 656.65 by Daily Chart view*Antony Waste Handing cmp 656.65 by Daily Chart view*

- Support Zone 600 to 620 Price Band

- Resistance Zone 688 to 712 Price Band

- Rising Support Trendline seems respected

- 1st Falling Resistance Trendline Breakout seems sustained

- 2nd internal Falling Resistance Trendline Breakout attempted

- Bullish Double Bottom has been made at the 598 to 602 Price Band

- Old Gap Down Openings of Nov 2024 would act as good strong resistance gaps to crossover

- Volumes are seen to be in close sync with the average traded quantity with good spike done today

- Back to Back Bullish Rounding bottoms made followed by Bullish "W" or Double Bottom pattern completed today

Can AWHCL be a multibagger?Anthony waste handling has given a strong weekly closing above 370 after a long consolidation since its IPO listing in 2020.

Stock has support very far at 300-310.

It is better to add on dips till 350 for targets of 450 and then 2x(700).

Only risky investors should be interested in this stock.

Momentum traders can look for targets of 410 in short term.

Idea shared for educational purposes only.

AWHCL : 3 Years Breakout Soon#AWHCL #Breakoutsoon #VCPpattern #Breakoutstocks

AWHCL : 3 Yr Breakout Candidate

Weekly Chart (1-3 Months)

>> VCP Pattern

>> Trending Setup

>> Stock Gaining Strength & Decent Volumes

>> Low Risk High Reward Trade

Swing Traders can lock Profit at 10% & keep trailing for more

Disclaimer : This is not a Trade Recommendations & Charts/ stocks Mentioned are for Learning/Educational Purpose. Do your Own Analysis before Taking positions.

ANTONY WASTE seems right for my investing TASTEPE Ratio is 15.4 vs Industry PE ratio of 82.6.

- Annual Revenue rose 32%, in the last year to Rs 876.6 Crores. Its sector's average revenue growth for the last fiscal year was 26%.

- Annual Net Profit rose 0.3% in the last year to Rs 68.1 Crores. Its sector's average net profit growth for the last fiscal year was 49%.

- Quarterly Revenue fell 5.6% YoY to Rs 227.3 Crores. Its sector's average revenue growth YoY for the quarter was -16.5%.

- Quarterly Net profit fell 21.3% YoY to Rs 18.3 Crores. Its sector's average net profit growth YoY for the quarter was -16.7%.

It is one of the top five players in the Indian municipal waste management industry with a track record of 20 years.

Antony Waste Handling Cell Ltd is engaged in the business of mechanical power sweeping of roads, collection and transportation of waste, waste to energy project and undertake the designing, construction, operation and maintenance of the integrated waste management facility in Kanjurmarg, Mumbai.

During FY22, the Co. increased activity from its new contracts in Varanasi, Noida, Jhansi, New Delhi Municipal Corporation, increasing its geographical presence in 9 states in India through ongoing and completed projects. The Co. is the 2nd largest player in India.

Antony waste AWHCL Swing/Positional AWHCL Prediction for Swing/ Posional Trading

First breakout at entry 1 level. Entry 1 level has retested. You can enter into trade above Entry 2 (505) or at CMP according to intraday level . You can buy more at Entry 1 level if there will a bullish signal after retesting the breakout level.

Sls-385,369,357, or according to you RRR.

Targets- 427,449,472,495,518,540,563,587, …….. (more will be updated later if need )

According to your “STOMACH” book your profit. Always maintain your risk management.

Watch Carefully – The Chart Explains For Itself.

Disclaimer :

I am not a SEBI Registered Analyst. Anything posted here is my own analysis and views. This is created for educational purposes only. Always consult your Financial Advisor before taking any decision or trade.

Happy trading.

About AWHCL –

Antony Waste Handling Cell Ltd. engages in the provision of solid waste management services. Its services include waste collection and transportation, mechanized and non-mechanized sweeping, waste processing and treatment, and waste to energy. The company was founded by Jose Jacob Kallarakal on January 17, 2001 and is headquartered in Thane, India.

EXCITING BULLISH PATTERN1 minute ago

📈 Exciting Bullish Pattern Alert! 🐂

📊 Pattern: Pattern Breakout

📌 Symbol/Asset: AWHCL

🔍 Description: Pattern Breakout.

👉 Remember: Technical patterns are just one piece of the puzzle. Consider conducting further research, consulting with a financial advisor, and managing your risks appropriately

AWHCL - Ichimoku Bullish Breakout Stock Name - Antony Waste Handling Cell Ltd

Ichimoku Cloud Setup :

1). Today's close is above the Conversion Line

2). Future Kumo is Turning Bullish

3). Chikou span is slanting upwards

All these parameters are showing bullishness at Current Market Price

and more bullishness AFTER crossing 360

#This is not Buy and Sell recommendation to any one. This is for education purpose and a helping hand to learn trading in Market.

# Cloud Trading

# Ichimoku Cloud

# Ichimoku Followers

I hope you all like my analysis.

Please do share your thoughts into comment section.

Please give a like, it motivates me to do analysis.

POSITIONAL - FALLING WEDGE PATTERN IN ANTONY WASTE HDG CELL LTD.NSE:AWHCL

AWHCL trading a little above life low and charts are signaling bullish reversal.

it has formed a falling wedge pattern and a breakout with good momentum is done.

now if it breaks the previous consolidated range/ or say previous swing high and managed to close a daily candle above 300 price then we can initiate new long position and the time frame would be 8-12 weeks to get our target levels.

All levels are marked on the chart.

"If you would like any more information feel free to DM me"

if you like this analysis please like and comment on idea.

happy trading & keep learning.

High probability trading : Antony Waste Handling Cell LtdNSE:AWHCL

Antony Waste Handling Cell Ltd:

Fundamentals: Majorly waste management company based in Delhi and NCR region. Swacch Bharat Mission adds up great value to the company.

Technical: Price has given Gap down opening few days before this is due to major investor has sold his position in the company. However,the theory says that the Gap will be closed in further days which we are accepting and taking a long position

MAJOR REASON FOR HIGH PROBABILITY TRADING

EMA: The stock is very close to its 100 days EMA

Stochastics: Stochastic is in an oversold region which shows that we can go long position on this. (Below 20-Oversold)

For all these reasons we consider it as High probability trading.

Long position can behold till 395 and Stop loss is at 340 level with making Risk to Reward Ratio of 2 which is good money management in trading.

watch for W pattern breakoutbuy above 350 @ neckline breakout (little risky)

safe buy above 362

buy can be initiated for both intraday and swing trade

small resistance around 380.

keep sl at 330 for swing trade

For stoploss in Intraday use 5 minute chart and see nearest support.

for target use 5 min chart and fibonacci pivots as i don't keep predefined target.

try to book partially and trail.

Note: this is not a prediction for LONG/SHORT, trade will trigger only on given level as per technical analysis

NOTE: For Gapup or bo before 9:20

If gapup is more than 1% from bo level than avoid completely.

if less than 1% or gives bo before 9:20 than wait for

first 5 minute candle and entry above 5 minute candle

and revised SL below candle Low.