BAJAJCON

Boond Boond mein poshan!Bajaj Consumer Care Ltd

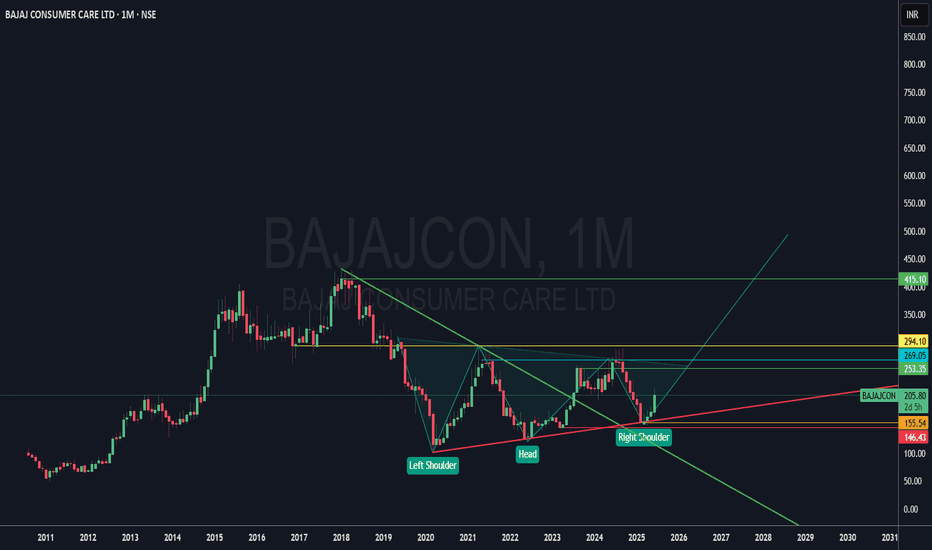

Risk to reward ratio looks good. Strong support 150. Made proper inverse head and shoulder pattern.

About

Bajaj Consumer Care is engaged in the business of cosmetics, toiletries and other personal care products. The Company has presence in both domestic and international markets.(Source : 201903 Annual Report Page No: 98)

Key Points

Product Portfolio

a) Hair Care Products

The segment is led by its flagship product, Bajaj Almond Drops Hair Oil (ADHO) — a premium, non-sticky oil that commands strong brand recognition. The Almond Drops brand has diversified into shampoos, conditioners, serums, and a cooling variant. The other products include Ayurvedic and functional oils like Brahmi Amla, Amla Aloe Vera, Sarson Amla, and Coco Onion. Their 100% Pure Coconut Oil has shown notable growth (19% in FY25), capturing a 2% all-India market share, with 6–10% shares in key states.

b)Skin Care Products

Bajaj extended its Almond Drops equity into personal care with products like Almond Drops Lotion, Soap, and Serum. It also offers the Nomarks range — known for its anti-marks positioning — including creams, face washes, and soaps, targeting consumers with skin blemish concerns.

c) Digital First & Premium Brands

The segment caters to evolving, health-conscious consumers. The Bajaj 100% Pure Series features chemical-free, cold-pressed oils like Castor, Olive, Jojoba, and Virgin Coconut, sold primarily online. Natyv Soul, a premium brand, sources exotic ingredients globally — offering Argan Oil products, enriched hair oils (with Marula, Rosehip, Apple Seed), and specialized serums and masks using ingredients from Peru, Brazil, and France.

Source: Screener.in

Leadership Changes at the Top:

The surge followed an exchange filing announcing key management changes by Bajaj Consumer:

Naveen Pandey has been appointed Managing Director with effect from July 1, 2025, subject to the approval of the members at the ensuing 19th Annual General Meeting. He succeeds Jaideep Nandi, whose tenure concludes on June 30.

Mr. Pandey previously served as Managing Director at Marico Bangladesh Ltd from 2016-2018, and currently as CEO of Unibic Foods India Pvt Ltd.

He brings over 20 years of experience across sales, strategic planning, and category innovation in the FMCG space.

The company also appointed Aakash Gupta as Head - Finance, replacing Richard D’Souza on the same date.

What Investors Need to Know:

The sharp rise in share price appears to be driven more by sentiment than by any change in business fundamentals.

While Naveen Pandey brings strong FMCG experience from companies like Marico and Unibic, there is no clarity yet on his specific plans or priorities for Bajaj Consumer. The company has not outlined any new strategy or directional change since his appointment.

For now, the stock seems to be reacting to the potential for leadership-driven change, not actual financial improvement. Investors may wait to see if the new MD introduces initiatives that can improve growth, expand margins, or revive demand in core categories.

Until real performance indicators emerge, this remains a speculative re-rating.

Conclusion:

The 20% jump in Bajaj Consumer’s share price was triggered by a leadership change, not by a shift in fundamentals. While the new MD brings relevant FMCG experience, the company’s recent performance remains weak, with declining profit and muted revenue growth. There’s been no strategic update or operational shift yet. For now, the rally looks like a sentiment-driven move. Whether it sustains will depend on what direction the new leadership takes and how soon the business sees a pickup. Until then, the core story remains unchanged.

Source: Indmoney.com

📝 Chart Purpose & Disclaimer:

This chart is shared purely for educational and personal tracking purposes. I use this space to record my views and improve decision-making over time.

Investment Style:

All stocks posted are for long-term investment or minimum positional trades only. No intraday or speculative trades are intended.

⚠️ Disclaimer:

I am not a SEBI registered advisor. These are not buy/sell recommendations. Please consult a qualified financial advisor before taking any investment decision. I do not take responsibility for any profit or loss incurred based on this content.

Bajaj Consumer Care Ltd - Breakout Setup, Move is ON...#BAJAJCON trading above Resistance of 272

Next Resistance is at 320

Support is at 212

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Bajaj Consumer Care Ltd - Long Setup, Move is ON...#BAJAJCON trading above Resistance of 212

Next Resistance is at 272

Support is at 177

Here is previous chart:

Chart is self explanatory. Entry, Resistances and Support are mentioned on the chart.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

BAJAJCON - keep an eye for BO above 250NSE:BAJAJCON

cmp 243

watchout for BO above 250

will likely run against some resistance around 280, but overall, should do well over 250

The objective of this analysis is knowledge sharing and education. There isn't any buy or sell advise in this article. Every stock is held for a short to medium amount of time and is positional.

It is expected of each person to carry out independent research and evaluation to ascertain whether my perspective is consistent with your studies.

BAJAJCONBAJAJCON:- Stock Consolidation since last 5 months, ready to breakout. keep on eye.

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

Expecting a Bullish Move in BAJAJCONAs per the 2 Hour Chart of BAJAJCON, we have witnessed a Formation of a “HAMMER” Pattern on the downside levels.

Therefore, we are expecting to witness a bullish momentum in the stock in the upcoming trading sessions. Wherein it is being expected to face a resistance initially at around the levels of 163.40, 167.25, and 174.20. Whereas, on the other hand, on the downside levels, the stock may face a support at the level of 155, on closing basis.

Closing Price (as on 07.03.22) : 159

Disclaimer: No financial information whatsoever published here, should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is purely for Educational and Information purposes only and under no circumstances should be used for making investment decisions. Viewers must consult their personal financial advisor before making any actual investment decisions, based on information published here. Any Investor or Trader taking decisions based on any information published here, does so entirely at its own risk. Investors and Traders should bear in mind that any investment in Stock Market is subject to unpredictable market-related risks.