BAJEL

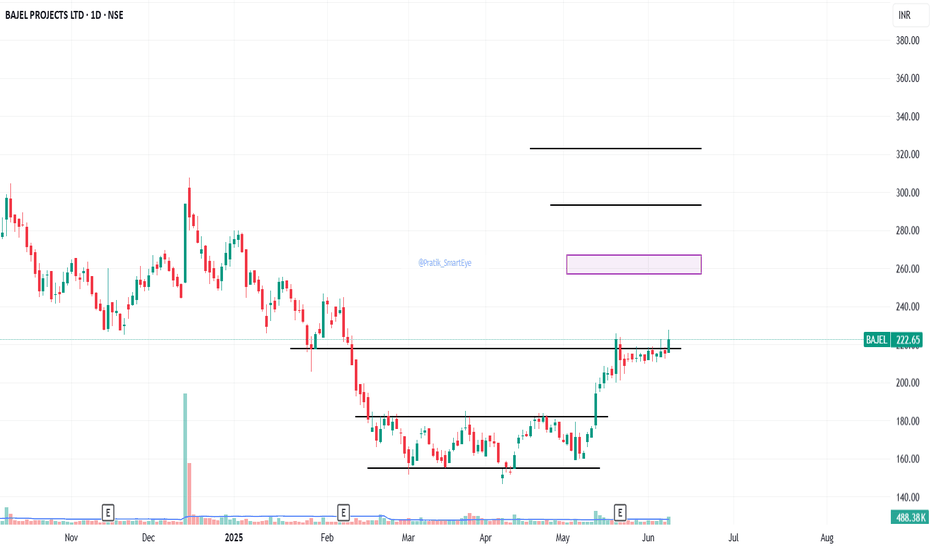

BAJEL -inverse head and shoulders- Good Volume -BreakoutThe chart **Bajel Projects Ltd.** (BAJEL) on the **NSE**.

Key observations:

1. **Pattern:**

- A clear **inverse head and shoulders** pattern. This is typically considered a bullish reversal pattern.

2. **Breakout:**

- The price has broken above the neckline resistance 267 (yellow trendline), with significant bullish momentum.

3. **Measured Move Target:**

- The projected target, calculated from the breakout point to the height of the pattern, is shown as **42.10 points** or approximately **15.72%**.

4. **Key Levels:**

- **Support Levels:**

- **233.36:** A major support level aligning with the pattern's base.

- **267.00:** Previously resistance, now acting as support post-breakout.

- **Resistance Levels:**

- **306.80:** A key resistance level after the breakout.

5. **Volume Analysis:**

- A spike in **volume** confirms strong buying interest during the breakout, supporting the bullish move.

BAJEL - falling wedge Breakout - DailyThe chart of **Bajaj Electricals (BAJEL)**, as shown in the uploaded image, displays a well-defined technical pattern.

### Key Observations:

1. **Uptrend Channel**: The price action is contained within an ascending channel, marked by parallel yellow trendlines. This signifies an ongoing uptrend, with the stock making higher highs and higher lows.

2. **Breakout**: The stock has broken out from the downtrend or consolidation pattern that formed between Oct 1st 2024. This breakout suggests a possible continuation of the uptrend, which is also supported by increased volume near the breakout point.

4. **Price Targets**:

- The stock is currently near the 286 INR level, and the next potential resistance level appears to be near **324.70 INR**, which is derived from the channel and measured moves.

- The stock has shown a percentage price change of **23.65%** from the breakout, with potential to test higher levels.

5. **Support**: The stock has found solid support around the **236 INR** level, making this a key level to watch in case of any pullback or retracement.

6. **Relative Strength Index (RSI)**: The RSI indicator at the bottom shows a strong upward movement, indicating that the stock is gaining momentum. If it reaches overbought levels (above 70), some consolidation may occur.

This overall analysis shows a **bullish outlook** for BAJEL, particularly given the channel breakout and technical pattern formations. The next levels to watch would be the **324.70 INR** resistance and possible retesting of support levels around **236 INR** if a pullback happens.

BAJEL PROJECTSIncorporated in 2022, Bajel Projects Ltd is in the business of Engineering, Procurement and Construction Bajel Projects Limited (BPL) is a carved out legal entity from Bajaj Electricals Ltd. It's EPC segment comprises of Power Transmission & Power Distribution. BPL provides end to end solutions ranging from inhouse design, testing, procurement, manufacturing, installation & commissioning of the projects.

BPL is a part of the Bajaj group. It deals in Engineering, Procurement and Construction business.

BAJEL - Ichimoku Breakout📈 Stock Name - BAJEL

🌐 Ichimoku Cloud Setup:

1️⃣ Today's close is above the Conversion Line.

2️⃣ Future Kumo is Turning Bullish.

3️⃣ Chikou span is slanting upwards.

All these parameters are shouting BULLISH at the Current Market Price and even more bullishness anticipated AFTER crossing 260.

🚨Disclaimer: This is not a Buy or Sell recommendation. It's for educational purposes and a guiding light to learn trading in the market.

#CloudTrading

#IchimokuCloud

#IchimokuFollowers

#Ichimokuexpert

Excited about this analysis? Share your thoughts in the comments below!

👍 Like, Share, and Subscribe for daily market insights! 🚀

#StockAnalysis #MarketWatch #TradingEducation #ichimoku #midcap

BAJEL Analysis & PredictionThis is the analysis of BAJEL in the Weekly Time Frame. Watch carefully. The chart explains itself.

If it sustains above the previous resistance level, it is good for the stock.

There are some prediction levels. These Levels act as Support and Resistance according to position of price. You have to trade according to level breakout or breakdown.

Always maintain your risk management.

Book your profit according to your “STOMACH”.

Disclaimer:

This is not investment advice. I am not a SEBI Registered Analyst. Anything posted here is my own analysis and views. This is created for educational purposes only. Always consult your Financial Advisor before taking any decision or trade.

Happy trading.

About BAJEL :

Bajel Projects Ltd. operates as a power infrastructure company. It engages in the engineering, procurement, and construction business in the power transmission and power distribution sector. The company offers in-house design, testing, procurement, manufacturing, installation and commissioning of the projects. Bajel Projects was founded on January 19, 2022 and is headquartered in Mumbai, India.