Bankniftyanalysis

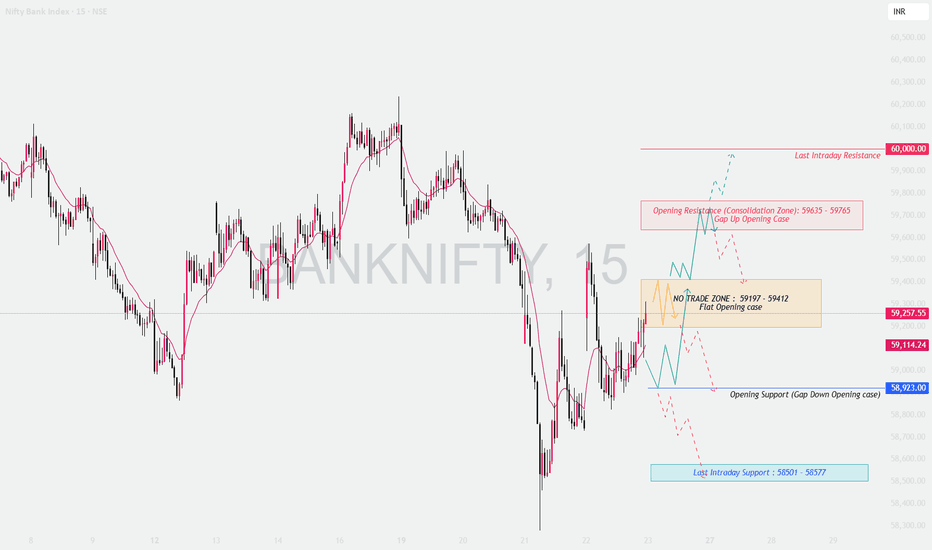

BANKNIFTY : Intraday Trading levels and Plan for 23-Jan-2026📘 BANK NIFTY Trading Plan – 23 Jan 2026

Timeframe: 15-Minute

Gap Consideration: 100+ points

Market Structure: Short-term pullback within a volatile range, key decision zones clearly defined

🔼 SCENARIO 1: GAP UP OPENING (100+ points) 🚀

If Bank Nifty opens above the previous close with a strong gap-up, price action near resistance becomes crucial.

Opening Resistance / Consolidation Zone: 59,635 – 59,765

This zone may act as supply as it aligns with prior rejection and intraday selling pressure.

Bullish Continuation:

Sustained 15-min close above 59,765 signals strength → upside extension towards 60,000.

Rejection Setup:

Failure to hold above 59,635 may lead to pullback towards the flat opening range.

Options Strategy:

Bull Call Spread (Buy ATM CE + Sell OTM CE) to reduce theta risk.

➡️ SCENARIO 2: FLAT / RANGE OPENING ⚖️

A flat open indicates indecision; patience is key.

No-Trade / Chop Zone: 59,197 – 59,412

Expect whipsaws and option premium decay.

Bullish Bias:

Acceptance above 59,412 → targets 59,635 → 59,765.

Bearish Bias:

Breakdown below 59,197 → drift towards 58,923.

Options Strategy:

Short Strangle / Iron Condor only if price remains inside range with strict SL.

🔽 SCENARIO 3: GAP DOWN OPENING (100+ points) 📉

A gap-down open tests buyer strength immediately.

Opening Support (Gap Down Case): 58,923

First reaction zone for buyers.

Intraday Support Breakdown:

Below 58,923 → increased probability of move towards 58,501 – 58,577.

Pullback Short Setup:

If price retests 59,197 and rejects, short continuation trades are favored.

Options Strategy:

Bear Put Spread (Buy ATM PE + Sell lower strike PE) to cap risk.

🛡️ OPTIONS RISK MANAGEMENT TIPS 🧠

Avoid naked option buying near no-trade zones.

Use spreads to control theta decay.

Risk only 1–2% of capital per trade.

Book partial profits quickly in volatile markets.

No revenge trades after SL hit.

📌 SUMMARY & CONCLUSION ✨

59,197 – 59,412 remains the key decision zone.

Directional trades only after clear acceptance or rejection.

Gap days demand discipline, not aggression.

Let price confirm, then execute with defined risk.

⚠️ DISCLAIMER

This analysis is for educational purposes only. I am not a SEBI registered analyst. Markets are risky, and trades can go wrong. Please consult your financial advisor before trading. 🙏

DO OR DIE ZONE – BANDHAN BANK

Timeframe: Weekly

Current Price: ~₹145

Primary Trend: Long-term downtrend transitioning into a potential base formation

🔍 Chart Pattern & Market Structure

Bandhan Bank has been trading inside a long-term falling channel, respecting both upper and lower trendline boundaries.

The price structure reflects a 5-wave Elliott decline (Wave 1–5), with Wave 5 likely completed near the lower channel support.

Post Wave 5, the stock is attempting a trendline resistance breakout, followed by a pullback into a Golden Retracement Zone (50%–78.6%), which is technically healthy.

📌 Key Technical Observations:

Golden Retracement Zone:

50% retracement: ~₹160

78.6% retracement: ~₹141

Price is currently holding above 78.6% retracement, suggesting buyers are still defending structure.

₹133–135 zone is marked as a “Do or Die” level, where a weekly close below would invalidate the bullish recovery thesis.

🟢 Swing Trading Strategy (Medium-Term)

✅ Swing Buy Zone:

₹142 – ₹150 (on pullbacks with price stabilization)

🎯 Swing Targets:

Target 1: ₹175

Target 2: ₹200

Extended Swing Target: ₹225–₹240 (only if momentum sustains)

🛑 Swing Stop Loss (Strict):

₹133 (Weekly close basis)

📐 Risk–Reward (Approx.):

Risk: ~₹12

Reward: ₹30–₹90

Risk–Reward Ratio: 1:2.5 to 1:7 (favorable if SL respected)

🔵 Investment Strategy (Positional / Long-Term)

📌 Investment Thesis:

Completion of a multi-year corrective cycle improves the probability of a structural mean reversion.

If price sustains above the broken trendline and holds the golden retracement zone, Bandhan Bank may enter a larger corrective Wave 4 (3-to-4 retracement).

🎯 Investment Upside Zones (Based on Fibonacci Extension):

113% Extension: ~₹282

127% Extension: ~₹302

These levels are long-term objectives, achievable only if the stock builds higher highs and higher lows above ₹200.

🛑 Investment Stop Loss:

₹133 (Weekly close below)

Conservative investors may use ₹125 as a hard capital protection level.

⚠️ Caution & Concerns

The broader trend is still technically bearish until the stock:

Sustains above ₹175–₹180

Breaks and holds above the falling channel decisively

Banking stocks remain sensitive to:

Asset quality concerns

Credit cycle shifts

Macro interest rate dynamics

Failure to hold ₹133 on a weekly closing basis would signal:

Loss of buyer interest

Possible continuation of the long-term downtrend

🚀 Opportunities & Positive Triggers

Successful defense of the Golden Retracement Zone indicates:

Strong hands accumulating

Reduced downside risk

A weekly close above ₹175 can act as a trend reversal confirmation.

The current price structure offers:

Defined risk

Asymmetric upside

Clear invalidation point

📌 Conclusion

Bandhan Bank is at a critical inflection point. While the long-term trend remains cautious, the completion of Wave 5 and support at the golden retracement zone present a high-quality risk-defined opportunity for swing traders and patient investors. Discipline around stop loss will be key.

⚠️ Disclaimer

This analysis is for educational purposes only. I am not a SEBI-registered analyst. Please consult your financial advisor and manage risk responsibly.

[INTRADAY] #BANKNIFTY PE & CE Levels(16/01/2026)A flat opening is expected in Bank Nifty, with the index trading near the 59,550–59,600 zone, which continues to act as a key intraday balance area. Price action shows consolidation within yesterday’s range, indicating that the market is still indecisive and waiting for a directional trigger. No major changes are observed in the overall structure compared to the previous session.

On the upside, a sustained move above 59,550–59,600 will be important for bullish continuation. If Bank Nifty holds above this zone, long trades (CE positions) can be considered with upside targets at 59,750, 59,850, and 59,950+. A breakout above 59,950 may further strengthen bullish momentum toward higher resistance levels.

On the downside, failure to hold the 59,450–59,400 support zone may invite fresh selling pressure. In such a scenario, short trades (PE positions) can be considered with downside targets at 59,250, 59,150, and 59,050, where strong demand is expected. Until a clear breakout or breakdown occurs, traders should continue with range-based strategies, maintain strict stop-loss discipline, and avoid aggressive positions in the early part of the session.

[INTRADAY] #BANKNIFTY PE & CE Levels(13/01/2026)A flat opening is expected in Bank Nifty, with the index trading near the 59,500–59,550 zone, which is acting as an important intraday pivot area. Price action suggests continued consolidation after the recent sharp recovery from lower levels, indicating balanced participation from both buyers and sellers. The overall structure remains range-bound, and a decisive move beyond key levels is required for clear direction.

On the upside, a sustained move above 59,550 will be the key trigger for bullish momentum. Holding above this level can open the door for long trades, with upside targets placed at 59,750, 59,850, and 59,950+. A strong breakout above the 59,950 resistance may further accelerate upside toward higher zones.

On the downside, if Bank Nifty fails to hold the 59,450–59,400 support, selling pressure may re-emerge. In such a scenario, short positions can be considered with downside targets at 59,250, 59,150, and 59,050-. Until a clear breakout occurs on either side, traders are advised to stick to range-based trading, maintain strict stop-loss discipline, and avoid aggressive directional positions.

Bank Nifty Swing Trading Setup - RRR 1:4Bank Nifty forming ending diagonal wave 3 is running (C- c2) so go long at around 59000 and target is 60200-60500 risk around 300 points ( swing low) reward 1200 points RRR is around 1:4 it's good strategy follow risk management strictly happy trading journey ...

BANKBARODA Weekly Bullish Flag Breakout | Multiple Targets to 34BANKBARODA (Bank of Baroda Limited) – Weekly Analysis

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 TECHNICAL SETUP

Current Price: 305.05 (+1.43%)

Timeframe: Weekly (1W)

Symbol: BANKBARODA (Bank of Baroda Limited)

Exchange: NSE

Category: Stock / PSU Banking Sector

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 PATTERN ANALYSIS

BANKBARODA demonstrates a STRONG WEEKLY BULLISH FLAG BREAKOUT pattern:

✅ Flag Structure: Clear flagpole followed by tight consolidation in the 295–305 range

✅ Breakout Confirmation: Price decisively breaking above upper flag boundary on strong weekly candles

✅ Support Levels: Strong support identified at 299.80 with SL at 278.00 for risk management

✅ Volume Profile: Visible volume participation on the breakout confirming institutional interest

✅ Momentum: Sustained bullish momentum with stock now trading above consolidation levels

✅ Risk/Reward: Well-defined multi-target setup with excellent risk-reward ratio and extended upside potential

The stock shows textbook uptrend characteristics with proper support/resistance relationships, confirming the bullish flag breakout is a continuation pattern with multiple profit-taking opportunities.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📈 PRICE TARGETS (Progressive Levels)

1st Target: 302.35 (-0.8% from current - immediate resistance)

2nd Target: 308.90 (+1.3% from current)

3rd Target: 312.45 (+2.4% from current)

4th Target: 322.00 (+5.5% from current)

5th Target: 328.55 (+7.7% from current)

6th Target: 335.10 (+9.9% from current)

7th Target: 341.70 (+12.0% from current)

Final Target: 346.75 (+13.6% from current)

These progressive targets represent key resistance zones and profit-taking levels along the uptrend trajectory. Each target should be treated as a potential decision point for scaling profits while maintaining exposure to further upside. The extended target structure suggests strong upside potential with multiple stepping stones for systematic profit realization.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🛡️ RISK MANAGEMENT

Entry Zone: 299.80 (Breakout confirmation point - primary entry level after flag breakout)

Stoploss: 278.00 (Weekly support - critical invalidation level marked as "SL on WCB")

Risk/Reward Ratio:

Risk (299.80 to 278.00) = 21.80 points

Reward (299.80 to 346.75) = 46.95 points

R:R Ratio = 1:2.15 (Excellent)

Position Sizing: Risk only 1-2% of capital per trade

Stoploss is placed BELOW major weekly support level to ensure proper risk containment.

Consider scaling in on dips toward the 299.80 entry zone for better average entries.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📍 KEY SUPPORT & RESISTANCE

Immediate Support: 299.80 (Breakout/Buy zone - initial entry opportunity)

Secondary Support: 278.00 (Stoploss / Major weekly support - invalidation zone)

Resistance 1: 302.35 (1st Target - immediate resistance)

Resistance 2: 312.45 (3rd Target - mid-term resistance)

Resistance 3: 328.55 (5th Target)

Major Resistance: 346.75 (Final Target / Extended upside potential)

Intermediate Levels: Multiple targets provide stepping stones for profit realization at each resistance level, allowing systematic position management and partial profit booking throughout the uptrend.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔍 FUNDAMENTAL BACKDROP – PSU BANKING STRENGTH

BANKBARODA benefits from strong macro tailwinds in PSU banking:

✅ Deposit Growth: PSU banks showing solid deposit growth momentum with CASA ratios stabilizing and improving

✅ Cost of Deposits: Lower-cost deposit mobilization supporting margin expansion opportunities across the sector

✅ Asset Quality: Improving asset quality metrics with NPA reduction initiatives showing consistent progress

✅ Dividend Support: PSU bank dividend yields provide downside cushion and attractive income support

✅ Policy Tailwinds: Government support for PSU banking system and continued credit expansion initiatives

✅ Valuation Appeal: Trading at attractive valuations relative to private sector banks with strong dividend yield support

✅ Credit Growth: Benefiting from broader credit growth acceleration and economic expansion across industries

This macro backdrop combined with strong technical structure reinforces bullish conviction for trend-following strategies on dips.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎉 TECHNICAL OBSERVATIONS

Weekly uptrend remains intact with clear higher highs and higher lows forming

Flag breakout on volume confirms institutional participation and buying strength

Stock breaking above consolidation levels — a classic sign of strength in PSU banking space

Breakout from a tight consolidation pattern shows disciplined buying entering the stock

Multiple targets (8 levels) suggest strong extended upside with multiple resistance zones ahead

Proper risk/reward of 1:2.15 offers excellent entry/exit structure for positional traders

Support at 278.00 provides good risk management anchor with well-defined stop placement

Stock positions itself well for continued upside exploration across multiple target levels

Volume profile supports the breakout move on the technical structure

Extended target range indicates potential for multi-week uptrend

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 TRADING STRATEGY NOTES

✓ Wait for weekly close above 299.80 before committing to fresh positions (confirmation is key)

✓ Consider scaling entries — don't go all-in at once; build position gradually on any dips

✓ Trail stoploss after each target level is achieved and confirmed on weekly basis

✓ Take partial profits at each resistance level — especially at 2nd, 4th, 6th, and final targets

✓ Preserve capital: Use strict position sizing and risk management (1-2% risk per trade)

✓ Monitor weekly closes carefully — price action at week-end is crucial for momentum confirmation

✓ Watch for gaps and opening levels — sudden reversals or news-driven moves can invalidate pattern

✓ BANKBARODA is a PSU bank with strong dividend yield — suitable for positional traders and value-conscious investors

✓ The extended target range suggests patience may be rewarded with multi-week uptrend potential

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ CRITICAL DISCLAIMER

🔴 THIS IS TECHNICAL ANALYSIS FOR EDUCATIONAL PURPOSES ONLY

🔴 THIS IS NOT FINANCIAL ADVICE OR AN INVESTMENT RECOMMENDATION

This analysis:

Is based on historical price patterns and technical indicators

Does NOT constitute investment advice or a buy/sell recommendation

Is a personal observation and technical analysis only

Should NOT be the sole basis for any investment decision

Stock performance depends on multiple macroeconomic factors and banking sector dynamics

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ IMPORTANT RISKS TO UNDERSTAND

✓ Past performance does NOT guarantee future results

✓ Technical patterns can FAIL and trends can reverse suddenly

✓ Market conditions can change rapidly without warning

✓ This analysis is based on historical data only

✓ Stock investments carry significant risk of loss

✓ You may lose your ENTIRE investment amount

✓ This is a technical observation, NOT a guaranteed strategy

✓ Consult a qualified financial advisor before trading

✓ Do your own independent research (DYOR) before investing

✓ Use strict position sizing and risk management always

✓ Interest rate changes can impact banking sector sentiment

✓ Regulatory changes affecting PSU banks can affect valuations

✓ Market liquidity and volatility can impact execution and slippage

✓ Economic indicators and quarterly earnings can invalidate technical patterns

✓ Credit growth slowdowns can impact bank profitability

✓ Extended uptrend targets may take longer to achieve or may not be fully realized

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔴 FINAL RISK ACKNOWLEDGMENT

TRADING AND INVESTING IN STOCKS INVOLVES SUBSTANTIAL RISK OF LOSS.

I am NOT a financial advisor, fund manager, or investment professional. This analysis is provided for educational purposes and personal trading observation only. Past patterns do not guarantee future performance.

BEFORE MAKING ANY INVESTMENT DECISION:

✓ Conduct your own thorough research and due diligence

✓ Understand macroeconomic factors affecting banking sector

✓ Check interest rate trends and RBI monetary policy outlook

✓ Review latest quarterly earnings and asset quality metrics

✓ Verify your risk appetite and capital availability

✓ Consult with a qualified, SEBI-registered financial advisor

✓ Only invest capital you can afford to lose completely

✓ Never follow this as a guaranteed strategy or signal

✓ Understand leverage implications if using derivatives or F&O

✓ Extended target ranges require patient capital and disciplined risk management

Your investment decisions are YOUR responsibility. Use proper risk management, stop losses, and position sizing always. Only risk capital you can afford to lose.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Trade responsibly. Risk management is paramount.

BANKINDIA Weekly Bullish Flag Breakout | Multiple Targets to 181BANKINDIA (Bank of India) – Weekly Analysis

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 TECHNICAL SETUP

Current Price: 149.22 (+1.52%)

Timeframe: Weekly (1W)

Symbol: BANKINDIA (Bank of India Limited)

Exchange: NSE

Category: Stock / PSU Banking Sector

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 PATTERN ANALYSIS

BANKINDIA demonstrates a STRONG WEEKLY BULLISH FLAG BREAKOUT pattern:

✅ Flag Structure: Clear flagpole followed by tight consolidation in the 140–148 range

✅ Breakout Confirmation: Price decisively breaking above upper flag boundary on strong weekly candles

✅ Support Levels: Strong support identified at 144.00 with SL at 131.50 for risk management

✅ Volume Profile: Visible volume participation on the breakout confirming institutional interest

✅ Momentum: Sustained bullish momentum with stock now trading above consolidation levels

✅ Risk/Reward: Well-defined multi-target setup with excellent risk-reward ratio

The stock shows textbook uptrend characteristics with proper support/resistance relationships, confirming the bullish flag breakout is a continuation pattern rather than a false move.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📈 PRICE TARGETS (Progressive Levels)

1st Target: 150.45 (+0.8% from current)

2nd Target: 156.90 (+5.2% from current)

3rd Target: 163.35 (+9.5% from current)

4th Target: 169.80 (+13.8% from current)

5th Target: 176.25 (+18.1% from current)

6th Target: 181.24 (+21.5% from current)

These progressive targets represent key resistance zones and profit-taking levels along the uptrend trajectory. Each target should be treated as a potential decision point for scaling profits while maintaining exposure to further upside. The spacing between targets provides clear decision points for systematic position management.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🛡️ RISK MANAGEMENT

Entry Zone: 144.00 (Breakout confirmation point - primary entry level after flag breakout)

Stoploss: 131.50 (Weekly support - critical invalidation level marked as "SL on WCB")

Risk/Reward Ratio:

Risk (144.00 to 131.50) = 12.50 points

Reward (144.00 to 181.24) = 37.24 points

R:R Ratio = 1:2.98 (Excellent)

Position Sizing: Risk only 1-2% of capital per trade

Stoploss is placed BELOW major weekly support level to ensure proper risk containment.

Consider scaling in on dips toward the 144.00 entry zone for better average entries.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📍 KEY SUPPORT & RESISTANCE

Immediate Support: 144.00 (Breakout/Buy zone - initial entry opportunity)

Secondary Support: 131.50 (Stoploss / Major weekly support - invalidation zone)

Resistance 1: 150.45 (1st Target)

Resistance 2: 163.35 (Mid-term resistance / 3rd Target)

Major Resistance: 181.24 (6th Target / Final Target)

Intermediate Levels: Multiple targets provide stepping stones for profit realization at each resistance level, allowing systematic position management and partial profit booking.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔍 FUNDAMENTAL BACKDROP – PSU BANKING STRENGTH

BANKINDIA benefits from strong macro tailwinds in PSU banking:

✅ Deposit Growth: PSU banks showing solid deposit growth momentum with CASA ratios stabilizing and improving

✅ Cost of Deposits: Lower-cost deposit mobilization supporting margin expansion opportunities in the sector

✅ Asset Quality: Improving asset quality metrics with NPA reduction initiatives showing consistent progress

✅ Dividend Support: PSU bank dividend yields provide downside cushion and attractive income support

✅ Policy Tailwinds: Government support for PSU banking system and continued credit expansion initiatives

✅ Valuation Appeal: Trading at attractive valuations relative to private sector banks with strong dividend yield support

✅ Credit Growth: Benefiting from broader credit growth acceleration across the economy

This macro backdrop combined with strong technical structure reinforces bullish conviction for trend-following strategies on dips.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎉 TECHNICAL OBSERVATIONS

Weekly uptrend remains intact with clear higher highs and higher lows forming

Flag breakout on volume confirms institutional participation and buying strength

Stock breaking above consolidation levels — a classic sign of strength in PSU banking space

Breakout from a tight consolidation pattern shows disciplined buying entering the stock

Multiple targets suggest strong resistance zones ahead with clear profit-taking structure

Proper risk/reward of 1:2.98 offers excellent entry/exit structure for positional traders

Support at 131.50 provides good risk management anchor with well-defined stop placement

Stock positions itself well for continued upside exploration across multiple target levels

Volume profile supports the breakout move on the technical structure

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 TRADING STRATEGY NOTES

✓ Wait for weekly close above 144.00 before committing to fresh positions (confirmation is key)

✓ Consider scaling entries — don't go all-in at once; build position gradually on any dips

✓ Trail stoploss after each target level is achieved and confirmed on weekly basis

✓ Take partial profits at each resistance level — especially at 1st, 3rd, and 6th targets

✓ Preserve capital: Use strict position sizing and risk management (1-2% risk per trade)

✓ Monitor weekly closes carefully — price action at week-end is crucial for momentum confirmation

✓ Watch for gaps and opening levels — sudden reversals or news-driven moves can invalidate pattern

✓ BANKINDIA is a PSU bank with strong dividend yield — suitable for positional traders and value-conscious investors

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ CRITICAL DISCLAIMER

🔴 THIS IS TECHNICAL ANALYSIS FOR EDUCATIONAL PURPOSES ONLY

🔴 THIS IS NOT FINANCIAL ADVICE OR AN INVESTMENT RECOMMENDATION

This analysis:

Is based on historical price patterns and technical indicators

Does NOT constitute investment advice or a buy/sell recommendation

Is a personal observation and technical analysis only

Should NOT be the sole basis for any investment decision

Stock performance depends on multiple macroeconomic factors and banking sector dynamics

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ IMPORTANT RISKS TO UNDERSTAND

✓ Past performance does NOT guarantee future results

✓ Technical patterns can FAIL and trends can reverse suddenly

✓ Market conditions can change rapidly without warning

✓ This analysis is based on historical data only

✓ Stock investments carry significant risk of loss

✓ You may lose your ENTIRE investment amount

✓ This is a technical observation, NOT a guaranteed strategy

✓ Consult a qualified financial advisor before trading

✓ Do your own independent research (DYOR) before investing

✓ Use strict position sizing and risk management always

✓ Interest rate changes can impact banking sector sentiment

✓ Regulatory changes affecting PSU banks can affect valuations

✓ Market liquidity and volatility can impact execution and slippage

✓ Economic indicators and quarterly earnings can invalidate technical patterns

✓ Credit growth slowdowns can impact bank profitability

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔴 FINAL RISK ACKNOWLEDGMENT

TRADING AND INVESTING IN STOCKS INVOLVES SUBSTANTIAL RISK OF LOSS.

I am NOT a financial advisor, fund manager, or investment professional. This analysis is provided for educational purposes and personal trading observation only. Past patterns do not guarantee future performance.

BEFORE MAKING ANY INVESTMENT DECISION:

✓ Conduct your own thorough research and due diligence

✓ Understand macroeconomic factors affecting banking sector

✓ Check interest rate trends and RBI monetary policy outlook

✓ Review latest quarterly earnings and asset quality metrics

✓ Verify your risk appetite and capital availability

✓ Consult with a qualified, SEBI-registered financial advisor

✓ Only invest capital you can afford to lose completely

✓ Never follow this as a guaranteed strategy or signal

✓ Understand leverage implications if using derivatives or F&O

Your investment decisions are YOUR responsibility. Use proper risk management, stop losses, and position sizing always. Only risk capital you can afford to lose.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Trade responsibly. Risk management is paramount.

Weekly Analysis NiftyWeekly Analysis - Weekly & daily closed all time high. Delivery changed to bullish on higher time frame.

Next delivery level on HTF is 26500.

We may witness consolidation in some session and pullback till BISI then further up move if global supports..

Please do follow me if you liked the idea💡...

Disclaimer ⚠️: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) and check with your financial advisor before making any trading decisions ⚠️⚠️.

BANKNIFTY : Trading levels and Plan for 30-Dec-2025📘 BANK NIFTY Trading Plan for 30-Dec-2025

(Timeframe: 15-min | Gap criteria considered: 200+ points)

Key Levels to Track (from chart)

Major Upside Resistance: 59,334

Last Intraday Resistance (Supply Zone): 59,179

Opening Resistance: 59,107

Opening Support / Resistance (Pivot): 58,895

Opening Support: 58,800

Last Intraday Support: 58,712

Lower Support (Extreme): 58,459

Deep Support: 58,259

🟢 1. GAP-UP OPENING (200+ Points)

If BANK NIFTY opens above 59,107, price starts near a resistance cluster.

🎓 Educational Explanation:

Large gap-ups often invite early profit booking, especially near supply zones. Sustainable upside needs acceptance above resistance or a pullback-and-hold. Chasing the first candle usually offers poor risk-reward.

Plan of Action:

Avoid the first 10–15 minutes; observe acceptance above 59,107.

If price holds above 59,107, look for pullback-based longs.

Upside hurdles: 59,179; strong acceptance can extend to 59,334.

Rejection near 59,179–59,334 may pull price back toward 59,107.

Options: Prefer ATM / ITM Calls after confirmation; avoid chasing far OTM CE.

🟡 2. FLAT OPENING

A flat open around 58,900–59,000 keeps price near the pivot (58,895).

🎓 Educational Explanation:

Flat opens signal balance. Direction usually emerges after a clean break of the opening range. Trading inside the balance zone often leads to whipsaws and theta decay.

Plan of Action:

Sustaining above 59,107 shifts bias bullish toward 59,179.

Failure to cross 59,107 keeps price range-bound.

Breakdown below 58,895 increases downside risk toward 58,800.

Watch for bullish rejection near 58,895–58,800 for bounce setups.

🔴 3. GAP-DOWN OPENING (200+ Points)

If BANK NIFTY opens below 58,895, early sentiment turns cautious to bearish.

🎓 Educational Explanation:

Gap-downs are often emotion-driven. Strong supports attract short-covering and value buying, so selling blindly into support increases reversal risk.

Plan of Action:

First support to watch: 58,800 — observe candle structure and volume.

Breakdown and acceptance below 58,800 opens downside toward 58,712.

Failure to hold 58,712 exposes 58,459, and then 58,259.

Any pullback toward 58,895 after breakdown can be used as sell-on-rise.

⚙️ Risk Management Tips for Options Trading 🛡️

Avoid trading the first 5–10 minutes on 200+ point gap days.

Don’t buy options at resistance or sell at support without confirmation.

Use a time-based stop-loss (15–20 minutes) if premium doesn’t move.

Risk only 1–2% of total capital per trade.

Prefer ATM options or defined-risk spreads to manage theta decay.

Book partial profits near marked resistance/support levels.

🧾 Summary & Conclusion

Above 59,107: Bulls active; watch 59,179 → 59,334 for continuation/rejection.

Between 58,895–59,107: Market balanced; patience required.

Below 58,895: Sellers gain control unless buyers defend 58,800 / 58,712.

Trade price behaviour at levels, not predictions.

Consistency comes from discipline, confirmation, and risk control.

⚠️ Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only and should not be considered financial or investment advice. Please consult your financial advisor before taking any trades.

BANKNIFTY : Trading levels and Plan for 29-Dec-2025📘 BANK NIFTY Trading Plan for 29-Dec-2025

(Timeframe: 15-min | Gap criteria considered: 200+ points)

Key Levels to Track (from chart)

Last Intraday Resistance: 59,364

Opening Resistance (Gap-up case): 59,211

No-Trade / Balance Zone: 58,894 – 59,108

Opening Support (Gap-down case): 58,799

Last Intraday Support: 58,661

🟢 1. GAP-UP OPENING (200+ Points)

If BANK NIFTY opens well above 59,211, price will start near a known supply area.

🎓 Educational Explanation:

A 200+ point gap-up usually reflects strong overnight sentiment. However, when price opens near resistance, early profit booking by smart money is common. Sustainable upside requires acceptance above resistance, not just a spike.

Plan of Action:

Avoid trading the first 10–15 minutes; observe acceptance above 59,211.

If price holds above 59,211, look for pullback-based long entries.

First upside hurdle is 59,364 (last intraday resistance).

Acceptance above 59,364 may open higher targets.

Rejection near 59,364 can trigger a pullback toward 59,211.

🟡 2. FLAT OPENING

A flat open near 58,950–59,050 places price inside the No-Trade / Balance Zone.

🎓 Educational Explanation:

Flat openings indicate equilibrium between buyers and sellers. In such zones, price often whipsaws and option premiums decay quickly. Direction usually emerges only after a clear break from the range.

Plan of Action:

Stay patient while price remains inside 58,894–59,108.

Sustaining above 59,108 shifts bias bullish toward 59,211.

Breakdown below 58,894 increases downside risk toward 58,799.

Trade only after confirmation; avoid overtrading the range.

🔴 3. GAP-DOWN OPENING (200+ Points)

If BANK NIFTY opens below 58,894, early sentiment turns clearly weak.

🎓 Educational Explanation:

Large gap-downs are often driven by panic. However, strong support zones attract short covering and value buying. Selling blindly into support increases the risk of sharp reversals.

Plan of Action:

First support to monitor is 58,799 (gap-down opening support).

Breakdown and acceptance below 58,799 opens downside toward 58,661.

Strong bullish rejection near 58,661 may lead to a sharp intraday bounce.

Any pullback toward 58,894 after breakdown can be used as a selling-on-rise opportunity.

⚙️ Risk Management Tips for Options Trading 🛡️

Avoid trading the first 5–10 minutes on gap days.

Do not buy options at resistance or sell at support without confirmation.

Use a time-based stop-loss (15–20 minutes) if premium does not move.

Risk only 1–2% of total capital per trade.

Prefer ATM options or defined-risk spreads to manage theta decay.

Book partial profits near marked resistance/support levels.

🧾 Summary & Conclusion

Above 59,211: Bulls stay active; watch 59,364 for continuation or rejection.

Between 58,894–59,108: Market remains range-bound; patience is key.

Below 58,894: Sellers gain control unless buyers defend 58,799 / 58,661.

Focus on price behaviour at predefined levels, not predictions.

Consistency comes from discipline, confirmation, and risk control.

⚠️ Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only and should not be considered financial or investment advice. Please consult your financial advisor before taking any trades.

BANKNIFTY : Trading levels and Plan for 26-Dec-2025📘 BANK NIFTY Trading Plan for 26-Dec-2025

(Chart reference: 15-min | Gap criteria considered: 200+ points)

Key Levels to Track (from chart)

Major Upside Supply Zone: 59,573 – 59,663

Last Intraday Resistance: 59,401

Opening Resistance: 59,296

Opening Support: 59,107

Last Intraday Support: 58,896

Lower Support (Extreme): 58,645

🟢 1. GAP-UP OPENING (200+ Points)

If BANK NIFTY opens above 59,296, price enters a resistance-heavy zone where supply may appear.

🎓 Educational Explanation:

A 200+ point gap-up usually reflects strong overnight cues. However, opening near resistance often invites profit booking. Healthy continuation typically needs acceptance above resistance or a pullback-and-hold before moving higher.

Plan of Action:

If price sustains above 59,296 for 10–15 minutes, look for pullback-based long entries.

First upside hurdle is 59,401; observe volume and candle acceptance.

Acceptance above 59,401 can extend toward the 59,573–59,663 supply zone.

Rejection near 59,401–59,663 may trigger a pullback toward 59,296.

Option buyers should avoid chasing CE at the open; confirmation improves R:R.

🟡 2. FLAT OPENING

A flat open near 59,200–59,260 keeps BANK NIFTY inside a balance area.

🎓 Educational Explanation:

Flat opens indicate equilibrium between buyers and sellers. Direction usually emerges only after the opening range is broken. Trading inside the range without confirmation often leads to whipsaws.

Plan of Action:

Sustaining above 59,296 shifts momentum bullish, targeting 59,401.

Failure to cross 59,296 keeps price vulnerable to a pullback.

Breakdown below 59,107 signals weakness toward 58,896.

Bullish rejection near 59,107 can offer a low-risk bounce trade.

🔴 3. GAP-DOWN OPENING (200+ Points)

If BANK NIFTY opens below 59,107, early sentiment turns weak.

🎓 Educational Explanation:

Large gap-downs are often emotion-driven. Strong demand zones can attract short-covering and value buying. Selling blindly into support increases the risk of sharp reversals.

Plan of Action:

First support to watch is 58,896 — observe price behaviour and candle structure.

Breakdown below 58,896 opens the downside toward 58,645.

Strong bullish reversal near 58,645 may lead to a sharp intraday bounce.

Any pullback toward 59,107 after a breakdown can be used as a selling-on-rise opportunity.

⚙️ Risk Management Tips for Options Traders 🛡️

Avoid trading the first 5–10 minutes during 200+ point gap days.

Don’t buy options at resistance or sell at support without confirmation.

Use a time-based stop-loss (15–20 minutes) if premium doesn’t move.

Risk only 1–2% of total capital per trade.

Prefer ATM options or defined-risk spreads to manage theta decay.

Book partial profits near marked resistance/support levels.

🧾 Summary & Conclusion

Above 59,296: Bulls stay active; targets 59,401 → 59,573–59,663.

Between 59,107–59,296: Market remains range-bound; patience required.

Below 59,107: Sellers gain control unless buyers defend 58,896 / 58,645.

Trade price behaviour at levels, not predictions.

Consistency comes from discipline, confirmation, and risk control.

⚠️ Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only and should not be considered financial or investment advice. Please consult your financial advisor before taking any trades.

BANKNIFTY : Trading levels and Plan for 23-Dec-2025BANK NIFTY Trading Plan for 23-Dec-2025

(Chart reference: 15-min | Gap criteria considered: 200+ points)

Key Levels from Chart

Opening Resistance / Pivot: 59,349

Last Intraday Resistance: 59,632

Major Upside Resistance: 59,746

Opening Support Zone: 59,136 – 59,192

Last Intraday Support: 59,054

Lower Support: 58,857

🟢 1. GAP-UP OPENING (200+ Points)

If BANK NIFTY opens above 59,349, price will immediately face a critical supply and decision zone.

🎓 Educational Explanation:

A 200+ point gap-up usually reflects strong overnight cues, but opening near resistance often invites profit booking by smart money. Sustainable rallies happen only when price accepts above resistance, not just spikes above it.

Plan of Action:

If price sustains above 59,349 for 10–15 minutes, look for pullback-based long entries.

Upside momentum can extend toward 59,632, the last intraday resistance.

Acceptance above 59,632 opens the path toward 59,746 (major supply).

Strong rejection or exhaustion near 59,632–59,746 can trigger a pullback toward 59,349.

Option buyers should avoid chasing CE at the open; confirmation and retest are mandatory.

🟡 2. FLAT OPENING

A flat open near 59,250–59,320 keeps BANK NIFTY inside a consolidation zone.

🎓 Educational Explanation:

Flat openings indicate balanced order flow. In such conditions, institutions wait for liquidity before committing. Direction emerges only after a clear break of the opening range.

Plan of Action:

Sustaining above 59,349 shifts momentum in favour of buyers, targeting 59,632.

Failure to cross 59,349 keeps price vulnerable to pullback moves.

Breakdown below 59,136 signals weakness toward 59,054.

Bullish rejection from 59,136–59,192 can offer low-risk bounce trades.

🔴 3. GAP-DOWN OPENING (200+ Points)

If BANK NIFTY opens below 59,136, early sentiment turns clearly weak.

🎓 Educational Explanation:

Large gap-downs are often emotional. However, strong historical supports attract buyers and short-covering. Selling blindly into support zones increases risk of sharp reversals.

Plan of Action:

First support to observe is 59,054 — watch price behaviour closely.

Breakdown below 59,054 opens the path toward 58,857.

Strong reversal signals near 58,857 may lead to a fast intraday bounce.

Any pullback toward 59,136 after breakdown becomes a selling-on-rise opportunity.

⚙️ Risk Management Tips for Options Traders 🛡️

Avoid trading the first 5–10 minutes during 200+ point gap days.

Never buy options at resistance or sell at support without confirmation.

Use time-based stop loss (15–20 minutes) if premium doesn’t move.

Risk only 1–2% of total capital per trade.

Prefer ATM options or defined-risk spreads to manage theta decay.

Book partial profits near marked resistance/support zones.

🧾 Summary & Conclusion

Above 59,349: Bulls stay active; targets 59,632 → 59,746.

Between 59,136–59,349: Market remains range-bound; patience required.

Below 59,136: Sellers gain control unless buyers defend 59,054 / 58,857.

Focus on price behaviour at levels, not prediction or emotion.

Consistency comes from discipline, not overtrading.

⚠️ Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only and should not be considered financial or investment advice. Please consult your financial advisor before taking any trades.

BANKNIFTY : Trading levels and Plan for 17-Dec-2025📘 BANK NIFTY Trading Plan for 17-Dec-2025

Key reference levels (from chart):

Opening Resistance: 59,173

Last Intraday Resistance: 59,257

Major Upside Level: 59,416

Opening Support Zone: 58,958 – 59,043

Last Intraday Support (Buyers Must Try): 58,592 – 58,712

Gap consideration: 200+ points

🟢 1. GAP-UP OPENING (200+ points)

If Bank Nifty opens above 59,173, it directly enters the supply region, where sellers may attempt profit-booking.

🎓 Educational Explanation:

A large gap-up suggests overnight optimism. However, immediate breakout trades are risky because:

Early buyers may exit at resistance

Liquidity is low in the first few minutes

Pullback to retest breakout levels is common

Professional traders always wait for structure confirmation, not emotion-driven entries.

Plan of Action:

Above 59,173, wait for a retest and a bullish candle before considering long entries.

Next target becomes 59,257. Watch for reactions here—this is a key supply zone.

Clear breakout above 59,257 with volume may extend toward 59,416.

Price rejection at 59,257 can create a good pullback trade back toward 59,173.

Option buyers should avoid chasing CE at resistance; wait for dips near retest zones.

🟡 2. FLAT OPENING

A flat open near 59,066 – 59,100 brings Bank Nifty inside the equilibrium zone, where market direction is decided after observing the early order flow.

🎓 Educational Explanation:

In a flat open, price is not influenced by gap sentiment. This is where Opening Range (ORH/ORL) becomes extremely important.

Breakout of ORH = trend strength

Breakdown of ORL = weakness

Avoid guessing direction — let structure form first.

Plan of Action:

If price sustains above 59,100–59,173, buyers may gain control, targeting 59,257.

Rejection from 59,173 can send price back into the Opening Support Zone (58,958–59,043).

If price dips into support and forms bullish rejection (pin bar / engulfing), it becomes a high-probability bounce zone.

Breakdown below 58,958 opens the path to 58,592 – 58,712 support.

🔴 3. GAP-DOWN OPENING (200+ points)

If Bank Nifty opens below 58,900, we enter the fear-zone where sellers may dominate early.

🎓 Educational Explanation:

Gap-downs typically trigger panic selling, but smart traders avoid shorting at the open. Why?

Market often gives a mean reversion bounce

Weak sellers exhaust quickly

Reversal from strong support zones is common

Patience > Speed.

Plan of Action:

First reaction zone: 58,712 – 58,592 (Buyers Must Try) — watch for reversal candles.

If price holds here, expect a recovery back to 58,958–59,043.

Breakdown below 58,592 with strong follow-through = trending bearish session. Avoid catching falling knives.

Any pullback toward 58,712 after breakdown becomes a safe shorting opportunity for option sellers.

⚙️ Risk Management Tips for Option Traders 🛡️

Never buy options within resistance zones—wait for breakout + retest.

For gap openings, avoid trading the first 5–10 minutes; volatility is unnatural.

Keep SL based on structure, not emotions.

Use time-based stop-loss: If your option premium doesn’t move for 15–20 min, exit.

Follow the 1–2% capital rule per trade.

Track IV during gap days—high IV inflates premiums; avoid chasing far OTM options.

🧾 Summary & Conclusion

Gap-Up: Watch 59,173 → 59,257 → 59,416. Avoid chasing; trade break–retest.

Flat Open: Opening Range decides trend; 58,958–59,043 remains the key support.

Gap-Down: Buyers must watch 58,592–58,712 for reversal setups. Breakdown brings deeper weakness.

Successful trading comes from confirmation-based entries, risk control, and not trading emotional spikes.

⚠️ Disclaimer

I am not a SEBI-registered analyst. This analysis is for educational purposes only and should not be considered investment advice. Please consult your financial advisor before taking any market positions.

BANKNIFTY : Trading levels and Plan for 16-Dec-2025📘 BANK NIFTY – Advanced Educational Trading Plan for 16-Dec-2025

(With 200+ points Gap Logic • Market Structure Breakdown • Institutional Trading Concepts)

🧠 Market Structure & Context Before Scenarios

Before trading any opening scenario, understand how Bank Nifty is positioned:

Price is currently inside a compression zone between

59,302 (Opening Support) and 59,590 (Opening Resistance)

This zone acts like a value area, where institutions balance orders before moving the market.

Both Last Intraday Resistance (59,869–59,931) and Last Intraday Support (59,010–59,097) are liquidity pockets where big players previously defended their positions.

A breakout from these zones generally produces faster directional moves because liquidity gets absorbed.

Educational Principle:

📌 When price consolidates, energy is building. When price breaks out, that stored energy is released.

This mindset helps you filter high-probability trades.

🚀 Scenario 1: Gap-Up Opening (200+ Points)

A strong gap-up indicates overnight bullish sentiment and institutional buying interest.

However, not every gap-up sustains — many are “exhaustion gaps.”

🎯 Educational Breakdown of Gap-Ups

1. Understand the First 15-Min Candle Behavior

If the opening candle is strong and closes near its high → buyers are committed.

If it forms a long upper wick → early profit booking or liquidity grab.

Trading Logic:

Don't chase the first candle. Let institutions reveal their hand.

2. Sustaining Above 59,590 = Trend Day Possibility

If price builds higher lows above 59,590, you’re witnessing institutional accumulation.

The market may aim for 59,869–59,931, the next liquidity zone.

Why This Works:

📌 Sustaining above resistance means short sellers are trapped, fueling further upside.

3. Breakout of 59,931 → Explosive Move towards 60,076

This area has thin liquidity; once broken, price tends to move fast.

A retest of 59,900 zone becomes an excellent add-on opportunity.

4. Gap-Up Failure Pattern

If price opens above 59,590 but quickly falls back into the range, it indicates:

Weak buyers

Profit-booking

Liquidity hunt above resistance

Avoid longs immediately — instead, watch for a drop toward 59,302.

(Three-line spacing)

⚖️ Scenario 2: Flat Opening (±100 Points)

Flat opens are the most technical and the most reliable for structured setups.

✨ Educational Breakdown of Flat Openings

1. Why Flat Opens Are Neutral

Market is waiting for data or direction

Overnight positions are balanced

No immediate imbalance between buyers and sellers

This creates a perfect price discovery phase.

2. Opening Range Matters

The first 15-minute candle becomes your guiding structure.

A breakout of the candle’s high/low with retest often creates clean entries.

Key Principle:

📌 Trade the range breakout, not the noise inside the range.

3. Break Above 59,590 → Trend Creation

Wait for a break–retest–continuation pattern, not just a breakout wick.

4. Break Below 59,302 → Weak Structure

If price breaks and sustains below this zone, sellers gain control.

Next key target becomes 59,097, then potentially 58,592.

(Three-line spacing)

📉 Scenario 3: Gap-Down Opening (200+ Points)

Gap-downs reflect overnight bearishness, but also offer the best short-covering opportunities.

🔎 Educational Breakdown of Gap-Downs

1. Identify If It's a ‘Panic Gap’ or ‘News Gap’

Panic gaps reverse quickly.

News-driven gaps (global cues, macro triggers) sustain longer.

2. Support Zone 59,010–59,097 Is Critical

If this zone breaks with volume → expect continuation towards 58,592.

If this zone holds → expect a strong bounce.

Institutional Reasoning:

📌 Big players often accumulate at previous support zones because liquidity is high.

3. Reversal Pattern After Gap-Down = Best Long Setup

Morning star

Bullish engulfing

Higher low formation

Because short sellers close positions, creating a fast upside reaction.

4. Failed Breakdown = Most Powerful Opposite Move

If price breaks below 59,010 but quickly reclaims it, this traps breakout sellers.

This results in:

Rapid short covering

Price targeting 59,302 → 59,444 → 59,590

(Three-line spacing)

🛡️ Risk Management & Option Trader Education

📌 1. Spot Levels Are for Analysis — Premium Levels Are for Trading

Premiums do not move linearly with spot. Always place SL on premiums.

📌 2. Avoid Trading Against Strong Gap Momentum

25–30% of option trader losses come from trying to fade gaps early.

📌 3. Understand Implied Volatility (IV)

Rising IV → inflated premiums → poor risk–reward

Falling IV → better pricing for buyers

📌 4. Never Take Trades Inside the No-Trade Zone

The zone 59,302 – 59,590 is filled with liquidity traps.

📌 5. Use Position Sizing Formula

Risk per trade = 1% of capital

Position size = SL distance × quantity

📌 6. For Selling Options, Use Hedged Positions Only

Especially during gap days to avoid unlimited risk.

🧾 Summary & Professional Conclusion

Above 59,590 → Bias bullish; potential target 60,076.

Between 59,302 – 59,590 → Stay out; allow market to decide.

Below 59,097 → Weakness accelerates toward 58,592.

Best trades come from break–retest–continuation, not impulsive entries.

Read the market structure first — direction is more important than prediction.

⚠️ Disclaimer

I am not a SEBI-registered analyst. This analysis is solely for educational purposes and should not be considered investment advice. Trade using your own risk assessment and consult your financial advisor before making decisions.

Weekly analysis of Nifty...Here is weekly analysis of Nifty...

Please do follow me if you liked the idea💡...

Disclaimer ⚠️: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) and check with your financial advisor before making any trading decisions ⚠️⚠️.

Bank Nifty spot 59389.95 by the Daily Chart viewBank Nifty spot 59389.95 by the Daily Chart view

- Support Zone intact at 58850 to 59375 for Bank Nifty

- Resistance Zone stands tall at 59825 to ATH 60114.30 for Bank Nifty

- Volumes keeping stable under avg traded quantity over past few days

- Falling Resistance Trendline Breakout attempts seem in the making process

BANKNIFTY : Trading levels and Plan for 12-Dec-2025📊 BANKNIFTY TRADING PLAN — 12 DEC 2025

BankNifty closed around 59,204, sitting just above Opening Support (59,179) and below the Opening Resistance Zone (59,526–59,587).

A clean trending opportunity may appear only when price breaks away from these overlapping zones.

Key Levels from Your Chart:

• Opening Support (Flat or Positive Opening Case): 59,179

• Opening Support Zone: 59,018 – 59,047

• Last Intraday Support: 58,931

• Opening Resistance Zone: 59,526 – 59,587

• Profit Booking Zone: 59,752 – 59,815

The next trading session will depend heavily on how price reacts at 59,179 and 59,526 at the open.

🚀 1. GAP-UP OPENING (100+ points)

A gap-up above 59,300–59,350 pushes price into bullish territory with early upside potential.

1. If the market opens above 59,179 and sustains

• Shows immediate buying pressure.

• Watch for a small dip toward 59,179 — if held with bullish wick rejection → Long entry activates.

• Targets: 59,350 → 59,526 → 59,587.

2. If opening is inside the 59,526–59,587 Opening Resistance Zone

• Avoid fresh longs immediately.

• Let price show whether it wants to:

– Break above 59,587 → Long toward 59,752 → 59,815 (Profit Booking Zone).

– Reject the zone → Short entries become valid only when price slips back below 59,526.

• Downside targets after rejection: 59,350 → 59,179.

3. If opening is above 59,587

• Momentum is strong; this could be a trend-day.

• A retest of 59,587 becomes a high-probability long.

• Upside targets: 59,752 → 59,815.

• Trail SL aggressively as volatility rises.

📌 Educational Tip:

Gap-ups inside resistance zones require patience. Trend confirmation happens only after breakout + retest.

⚖ 2. FLAT OPENING (near 59,150–59,220)

Flat openings allow for clean structural setups based on early price action.

1. If price holds 59,179 (Opening Support)

• Early sign of strength.

• Long entries valid upon bullish structure formation (higher-low/CHoCH).

• Targets: 59,350 → 59,526 → 59,587.

2. If price breaks above 59,526 and retests

• Confirms bullish continuation.

• Long setups activate toward 59,752 → 59,815.

3. If price rejects 59,179 and falls below it

• Intraday weakness begins.

• Short entries valid toward 59,047 → 59,018.

• Breakdown below 59,018 opens targets: Once again revisit 58,931.

📌 Educational Tip:

Flat opens reveal market intent in the first 10–15 minutes. Always allow the structure to form before entering.

📉 3. GAP-DOWN OPENING (100+ points)

A gap-down toward 59,050–58,980 brings price closer to strong support zones.

1. If the market opens inside 59,018–59,047 (Opening Support Zone)

• Avoid shorting inside support.

• Look for reversal signals (hammer, engulfing, CHoCH).

• If confirmed → Long toward 59,179 → 59,350.

2. If opening is near 58,931 (Last Intraday Support)

• This is a high-probability reversal region.

• If bullish reaction appears → Long entries can target:

→ 59,047 → 59,179.

3. If price breaks below 58,931 decisively

• Trend flips bearish.

• Wait for retest of 58,931.

• If retest rejects → Short continuation toward 58,780–58,720.

• Avoid bottom fishing until structure confirms reversal.

📌 Educational Tip:

Gap-downs often flush liquidity at major levels. Confirmation is essential — never assume reversal.

🛡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

1. Avoid trading the first 5 minutes on gap days — premiums are unstable.

2. Never chase far OTM options — they decay rapidly and are most affected by IV crush.

3. Position stop-loss based on price levels, not option premium.

4. Risk only 1–2% of trading capital per trade.

5. High IV → Prefer option selling;

Low IV → Option buying more effective.

6. Book partial profits at key levels:

59,179 / 59,526 / 59,587 / 59,752 / 59,815

7. Avoid revenge trades — protect capital first.

📌 SUMMARY & CONCLUSION

• Bullish bias above 59,526, with extension toward 59,752 → 59,815.

• Neutral zone: 59,179–59,526 — avoid aggressive trades until a breakout occurs.

• Strong supports for reversal:

– 59,018–59,047

– 58,931

• Always wait for breakout + retest or reversal confirmation before entering.

• Use disciplined risk management because volatility increases near resistance and support clusters.

⚠ DISCLAIMER

I am not a SEBI-registered analyst.

This trading plan is strictly for educational purposes and not investment advice.

Always use your own judgment, market awareness, and strict risk controls.

BANKNIFTY : Trading levels and Plan for 10-Dec-2025📊 BANKNIFTY TRADING PLAN — 10 DEC 2025

BankNifty closed near 59,212, sitting right inside the NO TRADE ZONE (59,122–59,347).

This zone is where price typically consolidates, traps traders, and lacks clean directional momentum.

Key Levels from Chart:

• Upper boundary of No Trade Zone: 59,347

• Lower boundary of No Trade Zone: 59,122

• Last Intraday Resistance: 59,608

• Last Intraday Support: 58,987

• Deep Support: 58,756

Strong trending opportunities will arrive only when price breaks out of the No Trade Zone and gives confirmation.

🚀 1. GAP-UP OPENING (200+ points)

A gap-up above 59,400–59,450 brings price immediately out of the choppy zone and near the resistance cluster.

1. If price opens above 59,347 and retests it successfully

• Avoid chasing the first green candle.

• Wait for a retest of 59,347 showing bullish wick rejection or CHoCH.

• If confirmed → Long trade activates.

• Targets: 59,500 → 59,608 (Last Intraday Resistance).

• Partial booking recommended near 59,500.

2. If price opens directly near 59,608 (Last Intraday Resistance)

• Avoid taking fresh longs at resistance.

• Watch for rejection wicks or bearish patterns.

• Short setups valid ONLY when price comes back below 59,347.

• Downside targets: 59,200 → 59,122.

3. If 59,608 breaks with strong momentum

• Possible trend day on upside.

• Next extension targets: 59,750–59,800.

• Trail stop-loss aggressively as volatility expands.

📌 Educational Note:

Gap-ups must be validated via retests before entering. Breakouts without confirmation often produce false moves.

⚖ 2. FLAT OPENING (around 59,180–59,240)

A flat open places price inside the No Trade Zone — patience is essential.

1. If price stays between 59,122–59,347

• This is a choppy region — avoid taking positions prematurely.

• Only trade once price breaks outside the zone and retests.

2. If price breaks above 59,347

• Bullish continuation begins.

• Look for a clean breakout + retest to go long.

• Targets: 59,500 → 59,608.

3. If price breaks below 59,122

• Bears gain control.

• Retest of 59,122 (from below) becomes ideal short entry.

• Downside targets: 58,987 → 58,756.

📌 Educational Note:

No Trade Zones are designed to neutralize traders emotionally. Breakout + retest ensures momentum and structure are aligned.

📉 3. GAP-DOWN OPENING (200+ points)

A gap-down into 58,950–58,900 puts price near important supports.

1. If price opens near 58,987 (Last Intraday Support)

• Buyers often react strongly here.

• Avoid shorting into support.

• Watch for hammer, bullish engulfing, or CHoCH → If confirmed → Long entries toward 59,122 → 59,200.

2. If price opens near 58,756 (Deep Support)

• This is the strongest demand area on your chart.

• Ideal for high-probability reversal trades.

• Targets on reversal: 58,900 → 59,122.

3. If price opens below 58,756 with strong selling pressure

• Trend flips bearish.

• Avoid catching a falling knife.

• Wait for a retest of 58,756 — if rejected → Short continuation toward 58,600–58,550.

📌 Educational Note:

Gap-downs often sweep liquidity. Smart money enters at support zones when traders panic. Always wait for clear reversal signals.

🛡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

1. Avoid trading in first 5 minutes — gap openings cause premium distortion.

2. Do NOT buy far OTM options after a big gap — IV crush leads to rapid loss.

3. Use price-based SL, not premium SL for consistent discipline.

4. Keep risk per trade at 1–2% of capital.

5. High IV → Consider option selling (credit spreads).

Low IV → Option buying becomes more efficient.

6. Book partial profits at key levels:

59,347 / 59,608 / 59,122

7. Avoid revenge trading — protect your capital.

📌 SUMMARY & CONCLUSION

• Bullish bias above 59,347, with targets toward 59,500 → 59,608.

• No Trade Zone: 59,122–59,347 — avoid trading inside until breakout confirms.

• High-probability reversal zones:

– 58,987

– 58,756

• Breakout + retest is the safest structure for entries.

• Risk management is more important than market direction.

⚠ DISCLAIMER

I am not a SEBI-registered analyst.

This plan is purely for educational purposes and should not be considered investment advice.

Market conditions change rapidly — always use your own judgment and proper risk controls.

BANKNIFTY : Trading levels and Plan for 09-Dec-2025📊 BANKNIFTY TRADING PLAN — 09 DEC 2025

BankNifty closed around 59,147, sitting just below the Opening Resistance (59,255) and well below Last Intraday Resistance (59,419).

Downside includes a major liquidity pocket:

Last & Important Intraday Support: 58,594 – 58,712

Tomorrow’s opening reaction at these key levels will dictate trend continuation or reversal.

Key Levels from the chart:

• Opening Resistance: 59,255

• Last Intraday Resistance: 59,419

• Major Resistance: 59,650

• Major Support Zone: 58,594 – 58,712

🚀 1. GAP-UP OPENING (200+ points)

A gap-up above 59,350–59,400 puts BankNifty directly near the resistance cluster.

1. If price opens above 59,255 and retests it successfully

• Do NOT chase the gap-up.

• Wait for a retest of 59,255 with bullish reaction (wick rejections, CHoCH, engulfing).

• Once confirmed → Long entry toward 59,419 → 59,650.

• Book partial profits at 59,419 due to historical resistance.

2. If price opens directly inside 59,419 (Last Intraday Resistance)

• High chance of rejection and profit booking.

• Avoid fresh longs here.

• Look for rejection patterns → Short entries valid only if price falls back below 59,255.

• Targets: 59,147 → 59,000.

3. If breakout sustains above 59,650

• Signals strong trending day.

• Next targets open toward 59,800–59,900.

• Trail stop-loss aggressively to protect gains.

📌 Educational Note:

Gap-ups often test nearby resistance first. Retests offer the safest way to enter trending moves.

⚖ 2. FLAT OPENING (±70 pts around 59,150)

Flat openings allow for clean structural setups.

1. If price reclaims 59,255 and sustains

• Buyers show control above this level.

• Long setups activate after breakout + retest.

• Targets: 59,419 → 59,650.

2. If price rejects 59,255

• Bearish rejection = lower-high structure.

• Short setups valid toward 59,147 → 59,000.

3. Break below 59,147 (LTP area)

• Trend pressure shifts bearish.

• Next downside targets: 58,900 → 58,712.

📌 Educational Note:

Flat opens reveal market intent through early candle structure. Let the market show its direction—avoid guessing.

📉 3. GAP-DOWN OPENING (200+ points)

A gap-down near 58,900–58,850 brings price closer to the big buyer zone.

1. If price opens near 58,900 and holds above it

• Expect initial volatility but avoid panic.

• Look for reversal patterns → If confirmed → Long toward 59,000 → 59,147.

2. If price opens inside the Major Support Zone (58,594–58,712)

• This is the strongest demand region on the chart.

• Never short inside this zone.

• Look for reversal signs (hammer, bullish engulfing, CHoCH).

• If reversal confirmed → Long toward 58,900 → 59,147 → 59,255.

3. If price breaks below 58,594 with strong momentum

• Do NOT enter immediately — wait for a retest.

• If retest rejects → Short continuation toward 58,450–58,400.

• Trend becomes bearish for the day.

📌 Educational Note:

Aggressive selling during gap-downs often sweeps liquidity before sharp reversals. Trade based on confirmation, not assumptions.

🛡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

1. Avoid trading the first 5 minutes after big gap opens.

Premiums behave erratically.

2. Do NOT buy deep OTM options after a big gap-up or gap-down.

IV crush + theta decay = rapid losses.

3. Always use price-level-based stop losses, not premium-based SL.

4. Follow strict risk-per-trade:

Risk only 1–2% of trading capital.

5. High IV → favour option selling (credit spreads, iron condors).

Low IV → option buying becomes more efficient.

6. Book partial profits near major zones:

59,255 / 59,419 / 59,650

7. Avoid revenge trading.

Protect capital before chasing profits.

📌 SUMMARY & CONCLUSION

• Bullish bias only above 59,255, with targets toward 59,419 → 59,650.

• Choppy zone expected between 59,147–59,255.

• Major downside reversal area: 58,594–58,712 (strong buyer zone).

• Always wait for breakout + retest for clean entries.

• Maintain disciplined risk management—levels are your guide.

⚠ DISCLAIMER

I am not a SEBI-registered analyst.

This plan is for educational purposes only and must not be considered investment advice.

Market behaviour can change rapidly — always use your own judgment and proper risk management.

BANKNIFTY : Trading levels and Plan for 08-Dec-2025📊 BANKNIFTY TRADING PLAN — 08 DEC 2025

BankNifty closed around 59,735, positioned inside a No Trade Zone (59,649–59,857) where price tends to whipsaw.

A decisive move outside this range will determine the trend for the session.

Key Levels from the chart:

• Opening Resistance: 59,857

• Opening Support: 59,649

• Gap-down Support: 59,519

• Last Intraday Support: 59,360

• Deep Support: 59,114

• Last Intraday Resistance: 60,252

Tomorrow’s open will shape directional conviction.

🚀 1. GAP-UP OPENING (200+ points)

A gap-up above 59,950–60,000 indicates strong bullish sentiment and immediate exit from the No-Trade Zone.

1. If price opens above 59,857 and retests the zone

• Avoid chasing the opening candle.

• Wait for a retest of 59,857 (Opening Resistance).

• If retest holds with bullish CHoCH or wick rejection → Long setups activate.

• Targets: 60,000 → 60,252 (major resistance).

• Partial booking near 60,252 advisable.

2. If price opens directly near 60,252 (Last Intraday Resistance)

• High chance of profit booking.

• Avoid fresh longs inside this zone.

• Look for bearish wick rejection → Possible short opportunity back toward 59,950 → 59,857.

3. If 60,252 breaks convincingly

• This becomes a trending session.

• Upside continuation potential beyond 60,300–60,350.

• Trail SL aggressively as volatility increases.

📌 Educational Note:

Gap-ups must be traded using retests, not emotion. Institutions test whether the breakout is genuine before pushing further.

⚖ 2. FLAT OPENING (around 59,700 ± 60 pts)

A flat open inside or near the No-Trade Zone requires patience and clarity.

1. If price stays inside 59,649–59,857 (No Trade Zone)

• Avoid trading the centre of the zone.

• Wait for breakout with retest for clean, high-probability setups.

2. Break above 59,857

• Bullish momentum begins above this level.

• After breakout + retest → Long toward 60,000 → 60,252.

3. Break below 59,649

• Indicates early seller control.

• Short setups valid after retest of 59,649 from below.

• Downside targets: 59,519 → 59,360.

📌 Educational Note:

Flat opens allow the market to reveal intentions through structure. Trading only after breakout + retest avoids chop.

📉 3. GAP-DOWN OPENING (200+ points)

A gap-down near 59,500–59,550 brings price directly into strong liquidity zones.

1. If price opens near 59,519 (Gap-Down Support)

• Do NOT short blindly — buyers often react strongly here.

• Look for bullish reversal signs (hammer, engulfing, CHoCH).

• If reversal confirmed → Long toward 59,649 → 59,735.

2. If price opens near or falls into 59,360 (Last Intraday Support)

• This is a high-probability reversal zone.

• If price forms higher-low → Long back toward 59,519 → 59,649.

• If level breaks → Sellers gain control → Next target 59,114.

3. If price opens at or below 59,114 (Deep Support)

• Avoid catching falling knives.

• Wait for a strong V-shape recovery or retest before entering long.

• If price fails retest → Short continuation possible toward 58,950–58,900.

📌 Educational Note:

Gap-downs often sweep liquidity before reversing sharply. Identify reaction, not direction, before taking trades.

🛡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

1. Avoid trading the first 5 minutes after a gap opening.

Premium volatility can trap you instantly.

2. Don’t buy far OTM options after big gaps.

Theta + IV crush = fast loss.

3. Always use price-action-based stop losses.

Premium-based SL triggers unpredictably.

4. Risk only 1–2% of your capital per trade.

5. In high IV → Prefer option selling strategies.

In low IV → Option buying becomes efficient.

6. Book profits near structural levels:

59,649 / 59,857 / 60,252.

7. Avoid averaging losers or revenge trading.

Protect capital first.

📌 SUMMARY & CONCLUSION

• Bullish bias above 59,857, with targets toward 60,000 → 60,252.

• No-Trade Zone: 59,649–59,857 → Avoid trading inside.

• Reversal zones on downside:

– 59,519

– 59,360

– 59,114

• Always wait for breakout + retest confirmation before entering.

• Respect risk management, avoid emotional decisions, and trade level-to-level.

⚠ DISCLAIMER

I am not a SEBI-registered analyst.

This analysis is purely for educational purposes and must not be considered investment advice.

Markets may behave unpredictably — use proper judgment and risk protection.