Supply-Demand Flip Play with Volume Spike📈 BHARAT DYNAMICS LTD | Supply-Demand Flip Play with Volume Spike

📅 Date: May 09, 2025

📈 Timeframe: 15-Minute

🔍 Stock: BDL (NSE)

📊 **Price Action Update (Today):**

BDL opened strong at 1455 and rallied till 1595 before slipping down from a previously tested **Supply Zone (1547.40 – 1576.00)** The intraday move witnessed a sharp bullish rally from sub-1,455 levels, only to reverse sharply from the overhead supply. This creates a textbook example of **supply rejection after a demand-driven impulse**. The candle near close reflects a high-wick bearish rejection.

🧠 **Technical Overview:**

Today’s session was a high-volatility play showcasing both demand and supply dynamics. A **Possible Demand Zone (1447.30 – 1460.90)** emerged from a sharp buying reaction, indicating strong institutional interest. The price shot up almost ₹100 points in a short span with surging volumes, testing the overhead **Retested Supply Zone**, which held firm — confirming sellers’ presence. This makes the area between **1547 and 1576** a critical resistance for future rallies. Until broken decisively, traders should remain cautious about fresh longs at higher levels.

🧩 **Chart Pattern Insight:**

BDL’s 15-min chart displays a classic **Demand-to-Supply Flip** — a rally from demand, quick run-up, and sharp rejection at a pre-marked supply. This is often referred to as a “trap move” where late buyers are caught at highs. The clean volume spike at the breakout and immediate rejection within the supply zone is a common pattern seen in smart money distribution phases. Traders can look for potential **shorting setups** if the price re-enters the supply with weak momentum or **buying opportunities near the demand zone**, only with volume confirmation.

🧱 **Support & Resistance Analysis:**

* 🔼 **Resistance (Supply Zone):** 1547.40 – 1576.00

* 🔽 **Support (Demand Zone):** 1447.30 – 1460.90

A breakout above 1576 with strong volume can invalidate the supply zone. Until then, this remains a selling area. On the downside, if the price revisits the demand zone, it may offer a low-risk buying opportunity — but only if it holds with bullish candles and rising volume.

🔍 **Volume Analysis:**

The volume surged dramatically on the rally towards the supply zone, showing panic buying or aggressive short covering. The final rejection candle also saw elevated volume, which adds weight to the **supply zone rejection thesis**. Prior candles had lower volume, indicating absorption near lows and sudden spike into resistance. This is a signature behavior of “liquidity grabs.”

📌 **Educational Insight:**

This chart provides a clean **example of how price reacts to supply and demand zones**, especially intraday. Demand zones are best used for potential long setups only after a bullish confirmation, while supply zones can be used for shorts or to exit longs. These zones act as emotional points — where institutions look to trap retail traders. For intraday traders, this scenario shows why waiting for confirmation is key before entering trades around such zones.

⚠️ **Disclaimer:**

This analysis is for educational purposes only and does not constitute any investment advice or stock recommendation. Please consult with your financial advisor before taking any trading decisions. This post complies with SEBI regulations and is intended to promote financial literacy.

Bdltechnicalanalysis

BDL - Stock Analysis📢 Disclaimer:

This analysis is for educational and informational purposes only and should not be considered as financial advice. Market movements are subject to various factors, and past performance does not guarantee future results. Please conduct your own research and consult with a registered financial advisor before making any investment decisions. 📊⚖️

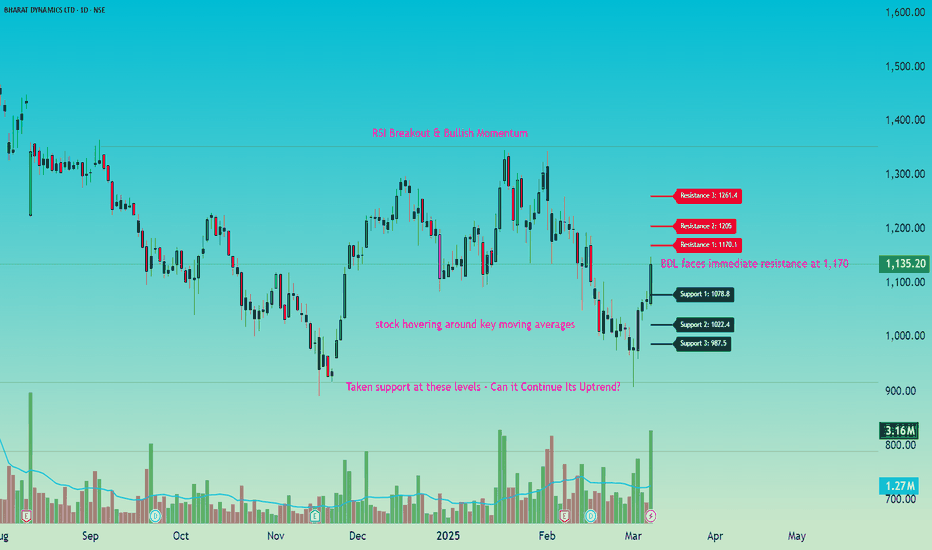

📊 BDL Market Overview

BDL opened at 1,061.9 and witnessed strong momentum, reaching a high of 1,148.6 before closing at 1,135.2 📈. The stock showed resilience, bouncing back from the day’s low of 1,057.3 and closing significantly higher than its previous close of 1,065.65 ✅. This upward movement indicates positive sentiment, with buyers showing strength throughout the session.

📌 Key Levels to Watch

BDL faces immediate resistance at 1,170 🚧, with further hurdles at 1,205 and 1,261 🔼. On the downside, support is seen at 1,079 ✅, followed by 1,022 and 988 ⚠️. A breakout above resistance could indicate continued strength, while a drop below key support levels may signal weakness. 📉

📊 Moving Averages Analysis

BDL is currently near its 50 EMA (1,124.49) 📉, with the 100 EMA at 1,151.01 and the 200 EMA at 1,138.21. The stock hovering around these levels suggests a crucial zone where further movement could decide the trend. A breakout above the 100 EMA may indicate strength 🚀, while dipping below the 50 EMA could bring caution ⚠️.

📊 RSI Breakout & Bullish Momentum

BDL has witnessed an RSI breakout 📈, signaling increasing buying strength. The presence of a strong bullish candle 🔥 further confirms momentum, indicating that buyers are in control. If this momentum sustains, the stock could test higher resistance levels 🚀. However, traders should watch for follow-through buying to confirm the trend ✅.

📊 Market Sentiment Overview

BDL is trading near key moving averages, indicating a crucial decision zone ⚖️. The stock has shown strong bullish momentum, closing well above its previous day’s level ✅. However, resistance at 1,170 🚧 may create short-term hurdles, while support at 1,079 is key for stability. The sentiment remains cautiously bullish, with a need for confirmation at higher levels.

🎯 Market Observation

If BDL breaks above 1,170, it could gain further strength toward 1,205 – 1,261 🚀. On the downside, a slip below 1,079 may lead to a test of 1,022 – 988 ⚠️. Moving averages suggest a critical juncture, where sustained buying could fuel an uptrend, while rejection near resistance may cause consolidation.

📢 Conclusion

BDL has strong momentum, but key levels must be watched for confirmation. A break above resistance could drive further upside 📈, while holding above support will be crucial for maintaining strength ✅. Market participants should stay alert to price action near moving averages and plan accordingly. 🚀

BDL cmp 1108.25 by Daily Chart viewBDL cmp 1108.25 by Daily Chart view

- Support Zone at 880 to 920 Price Band

- Resistance Zone at 1348 to 1400 Price Band

- Bullish Double Bottom at 890 to 910 Price Band

- Volumes are syncing in closely with the avg traded quantity

- Daily Support at 1001 > 890 > 785 with the the Resistance at 1205 > 1301 > 1400

- Bullish Cup and Handle followed by the Bullish Rounding Bottom in the making process