BDL - Stock Analysis📢 Disclaimer:

This analysis is for educational and informational purposes only and should not be considered as financial advice. Market movements are subject to various factors, and past performance does not guarantee future results. Please conduct your own research and consult with a registered financial advisor before making any investment decisions. 📊⚖️

📊 BDL Market Overview

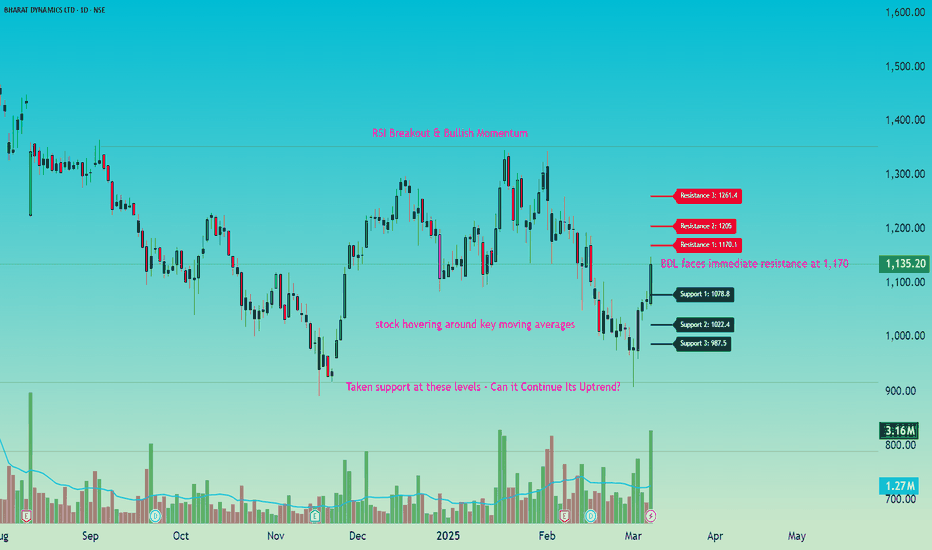

BDL opened at 1,061.9 and witnessed strong momentum, reaching a high of 1,148.6 before closing at 1,135.2 📈. The stock showed resilience, bouncing back from the day’s low of 1,057.3 and closing significantly higher than its previous close of 1,065.65 ✅. This upward movement indicates positive sentiment, with buyers showing strength throughout the session.

📌 Key Levels to Watch

BDL faces immediate resistance at 1,170 🚧, with further hurdles at 1,205 and 1,261 🔼. On the downside, support is seen at 1,079 ✅, followed by 1,022 and 988 ⚠️. A breakout above resistance could indicate continued strength, while a drop below key support levels may signal weakness. 📉

📊 Moving Averages Analysis

BDL is currently near its 50 EMA (1,124.49) 📉, with the 100 EMA at 1,151.01 and the 200 EMA at 1,138.21. The stock hovering around these levels suggests a crucial zone where further movement could decide the trend. A breakout above the 100 EMA may indicate strength 🚀, while dipping below the 50 EMA could bring caution ⚠️.

📊 RSI Breakout & Bullish Momentum

BDL has witnessed an RSI breakout 📈, signaling increasing buying strength. The presence of a strong bullish candle 🔥 further confirms momentum, indicating that buyers are in control. If this momentum sustains, the stock could test higher resistance levels 🚀. However, traders should watch for follow-through buying to confirm the trend ✅.

📊 Market Sentiment Overview

BDL is trading near key moving averages, indicating a crucial decision zone ⚖️. The stock has shown strong bullish momentum, closing well above its previous day’s level ✅. However, resistance at 1,170 🚧 may create short-term hurdles, while support at 1,079 is key for stability. The sentiment remains cautiously bullish, with a need for confirmation at higher levels.

🎯 Market Observation

If BDL breaks above 1,170, it could gain further strength toward 1,205 – 1,261 🚀. On the downside, a slip below 1,079 may lead to a test of 1,022 – 988 ⚠️. Moving averages suggest a critical juncture, where sustained buying could fuel an uptrend, while rejection near resistance may cause consolidation.

📢 Conclusion

BDL has strong momentum, but key levels must be watched for confirmation. A break above resistance could drive further upside 📈, while holding above support will be crucial for maintaining strength ✅. Market participants should stay alert to price action near moving averages and plan accordingly. 🚀

Bdlview

Bharat Dynamics Ltd. - Breakout OpportunityDate : 11-Dec-2024

LTP : Rs. 1,212.05

Targets: (T1) Rs. 1,350 --> (T2) Rs. 1,496 --> (T3) Rs. 1,662 --> (T4) Rs. 1,794

SL : Rs. 1,049

Technical View:

• NSE:BDL was going through it's primary downtrend since Jul-2024.

• After touching a lifetime high of 1,794.70 on 5-Jul-2024, it has retraced 50% to 890 level.

• NSE:BDL has recently breakout from it's primary downtrend with higher than average volume.

• NSE:BDL is trading above 20 DEMA and 50 DEMA since last few sessions. 20 DEMA has crossed over 50 DEMA.

• RSI is in buy zone and trading at 64.58. MACD has crossed 0 line and trading at 40.98

• Both RSI and MACD are showing positive divergence, indicating trend reversal.

• Looking strong to start an upward journey from here.

Liked the analysis? Boost/Like this idea and follow my ID.

Disclaimer: I am not a SEBI registered analyst/consultant and not recommending anyone to take any BUY or SELL position in stock market. Investing in stock market is risky and one should do a self analysis and validation before investing in stock market. My ideas are published for learning purpose only and are available to everyone at no cost/charge.

Bharat Dynamics Ltd - Breakout OpportunityDate : 7-Jun-2024

Rating : Buy - Positional Trade

LTP : Rs. 1,430.95

Targets: (1) Rs. 1,662 --> (2) Rs. 1,891 --> (3) Rs. 2,261

SL : Rs. 1,293 on daily close basis

Technical View:

• NSE:BDL is in its primary uptrend and was recently going through it's secondary downtrend.

• After touching the high of 1,662.95 on 3-Jun-2024, it has retraced 22% to 1,293.20 level and taken support at 20 DMA.

• On 7-Jun-2024, NSE:BDL has broke out from its secondary down trend with high volume.

• Prices are trading above 20 DMA, 50 DMA and 21 DEMA.

• RSI is trading at 59.84 and MACD is trading at 114.27.

• Looking good to start a new swing from here.

• All the above observations are noted in Daily Timeframe.

Disclaimer : I am not a SEBI registered analyst/consultant and not recommending anyone to take any BUY or SELL position in stock market. Investing in stock market is risky and one should do a self analysis and validation before investing in stock market. Ideas are published for learning purpose only.

Bharat Dynamics Ltd - Breakout OpportunityDate : 16-May-2024

Rating : Buy - Positional Trade

LTP : Rs. 2,069.60

Targets: (1) Rs. 2,098 --> (2) Rs. 2,278 --> (3) Rs. 2,571

SL : Rs. 1,938 on daily close basis

Technical View:

• NSE:BDL is in its primary uptrend and was recently going through it's secondary downtrend.

• After touching the high of 2,097.95 on 25-Apr-2024, it has retraced 14% to 1,805.55 level.

• On 16-May-2024, NSE:BDL has broke out from its secondary down trend with higher than average volume.

• NSE:BDL is already trading above 20 DMA, 50 DMA and 21 DEMA.

• Both RSI and MACD have formed bullish crossover and are trading at 66.32 and 41.62 respectively.

• Looking strong to start a new swing from here.

Key Events:

• 2/1 stock split. Record Date: 24-May-2024

• Quarterly Result and Dividend announcement: 29-May-2024

Disclaimer : I am not a SEBI registered analyst/consultant and not recommending anyone to take any BUY or SELL position in stock market. Investing in stock market is risky and one should do a self analysis and validation before investing in stock market. Ideas are published for learning purpose only.

Bharat Dynamics Ltd - Breakout OpportunityDate : 27-Mar-2024

Rating : Buy - Positional Trade

LTP : Rs. 1,755

Targets: (1) Rs. 1,810 --> (2) Rs. 1,984 --> (3) 2,252

SL : Rs. 1,625

Technical View:

• NSE:BDL is in its primary uptrend since long time and was recently going through it's secondary downtrend.

• After touching the life time high of 1,984.80 on 27-Feb-2024, it has retraced 22% to 1,552.10 level.

• NSE:BDL has broke out from its secondary down trend on 26-Mar-2024 with higher volume.

• RSI has crossed 50 on 26-Mar-2024.

• On 27-Mar-2024 it has closed above both 20 DMA and 50 DMA.

• Looking strong to start a new swing from here.

Disclaimer: I am not a SEBI registered analyst/consultant and not recommending anyone to take any BUY or SELL position in stock market. Investing in stock market is risky and one should do a self analysis and validation before investing in stock market.