How Funds Actually Make Money From Bitcoin📰 I’ve followed financial markets long enough to notice a strange paradox:

spend more than five minutes scrolling Crypto TikTok (YouTube or X isn’t much different), and you’d think the entire crypto market is run by a few whale clicks and a handful of flashy headlines.

You’re constantly told that:

📉 Someone is “buying the dip”

📈 Someone else is “selling the top”

🐋 And a major institution is “deciding the fate of the market”

It sounds reasonable.

But in reality… it’s far more complex than that.

📣 I’ve watched hundreds of videos like these. The script is always the same.

Glossy thumbnails, rushed voices, and absolute statements:

“BlackRock is buying — PRICE IS GOING UP!”

“Whales are selling — THE MARKET IS ABOUT TO CRASH!”

“Institutional money is here!!!”

🎭 But beneath the drama, what’s really there?

No nuance. No structure. And almost no understanding of how institutions actually make money.

🔍 Here’s the truth I’ve learned after years of observing the markets:

Whether BlackRock buys or sells Bitcoin has very little to do with you.

Large funds don’t trade on emotion, nor do they survive by predicting direction like retail traders do.

They don’t need Bitcoin to go up.

They don’t need Bitcoin to go down.

🎯 What they need is volatility — calculated, measured, and modeled.

🧠 This is the part most TikTok content completely ignores.

A fund can buy Bitcoin and at the same time:

🛡️ Hedge 100% of its risk

⚖️ Stay delta-neutral

📊 Maintain a neutral market view

🔒 Be protected against both upside and downside moves

👉 For them, buying BTC is not a gamble.

It’s simply the first layer of a multi-leg trading structure.

What matters isn’t how much they buy,

but what comes next — the steps most retail traders have never even heard of.

📉📈 I often ask myself:

Why do so many “TikTok analysts” talk about institutions every day, yet never mention delta, gamma, hedging, or basis?

The answer is simple:

👉 Because they don’t understand it.

If someone:

screams “bullish” and “bearish” in every video

believes institutions are “pumping prices”

but can’t explain delta-neutral hedging

then their opinion on what BlackRock is “doing” has no analytical value.

📊 To really understand this, let’s look at how a fund actually makes money.

Assume Bitcoin is trading at $100,000.

The fund doesn’t care whether price goes up or down.

They deploy a neutral options structure, betting on volatility , not direction.

When price rises:

they sell part of the position to rebalance risk

profit comes from selling at higher levels

When price falls:

they buy back at lower prices

profit comes from buying cheaper

🔁 Price up → sell high

🔁 Price down → buy low

👉 Repeat. With discipline. Without emotion.

This is gamma scalping — the quiet, persistent profit engine behind institutional trading.

💰 So where does their real profit come from?

Not from news.

Not from influencers.

Not from ETF headlines.

It comes from:

continuous hedge adjustments

realized volatility exceeding expectations

direction-neutral structures

strict mathematical discipline

⛔ The rare moment they struggle?

When the market… doesn’t move at all.

🧭 And here’s what I want to say to you directly, as a market professional:

You are not BlackRock.

You don’t have their infrastructure.

You don’t have their capital, speed, or risk models.

👉 Trying to predict or mimic their actions won’t make you a better trader — it will only make you more confused.

✍️ My conclusion is very clear:

Watching what large funds do without understanding the structure behind it

is the fastest path to losses.

BlackRock doesn’t trade narratives.

They don’t trade emotions.

And they certainly don’t trade TikTok stories.

🎯 They trade structure.

And you?

Stop watching what they do.

Start understanding what you should do.

That’s the difference between surviva l and being washed out by the market.

PS: BlackRock and TikTok are used purely as illustrative examples.

Blackrock

JioFin Viewcompany has started landing and also, it is backed by two mammoth orgs which has years of experience in finance as well as in distribution.

Worst is over for the company and IMO it should now head north only.

Possible if it catches the trend and tick all the boxes it may surprise investors on the returns side.

CMP: 325

SL: 280

TARGET: 525

Time Frame: 12 Months

Jio Financial Services (JIOFIN) at ₹316.45**Jio Financial Services (JIOFIN) at ₹316.45: Premium Play or Future Powerhouse?**

Jio Financial Services (JIOFIN) trades at ₹316.45, a massive entity with over ₹2.01 lakh Cr market cap, backed by the Reliance ecosystem. The question for traders and investors: Is its significant premium justified?

**Key Insights:**

* **Strong Backing & Shareholding:** Promoters hold 47.12%, with healthy institutional presence (DIIs 14.78%, FIIs 12.30%). This indicates significant confidence from core stakeholders.

* **Financials: Growth & Investment-Centric:** Sales saw a decent 10% growth (Mar'25 vs Mar'24), with Operating Profit jumping 27% to ₹1,977 Cr. OPM remains high at 76%. However, 2024 cash flow from operations was negative, heavily reliant on investing activities, suggesting its current model is more investment/holding company-like.

* **Staggering Valuation:** JIOFIN's P/E of 124.80 dwarfs peers like Bajaj Finance (P/E 36.10) and SBI Cards (P/E 44.50). This isn't about current earnings; it's a massive bet on future disruption.

* **Price Action & Volatility:** Despite its pedigree, JIOFIN's 1-year return is -5.45%, and it shows significant monthly volatility. This reflects the market's ongoing price discovery for a stock valued heavily on future potential.

**The Black Belt Take:**

JIOFIN is a high-conviction, high-valuation play. It's a bet on Reliance's ability to revolutionize India's financial sector.

* **For Traders:** Expect continued volatility. Short-term opportunities exist, but precise risk management is non-negotiable given the valuation sensitivity.

* **For Investors:** This is a long-term "future growth" story. Consider accumulating on significant dips if you believe in its disruptive potential. For the conservative, waiting for more established operational cash flows and a more reasonable valuation might be prudent.

Is the "Jio Factor" enough to justify this premium, or should investors wait for the fundamentals to catch up?

---

**Disclaimer:** This article is for educational purposes only. Please consult a SEBI-registered financial advisor before making investment decisions.

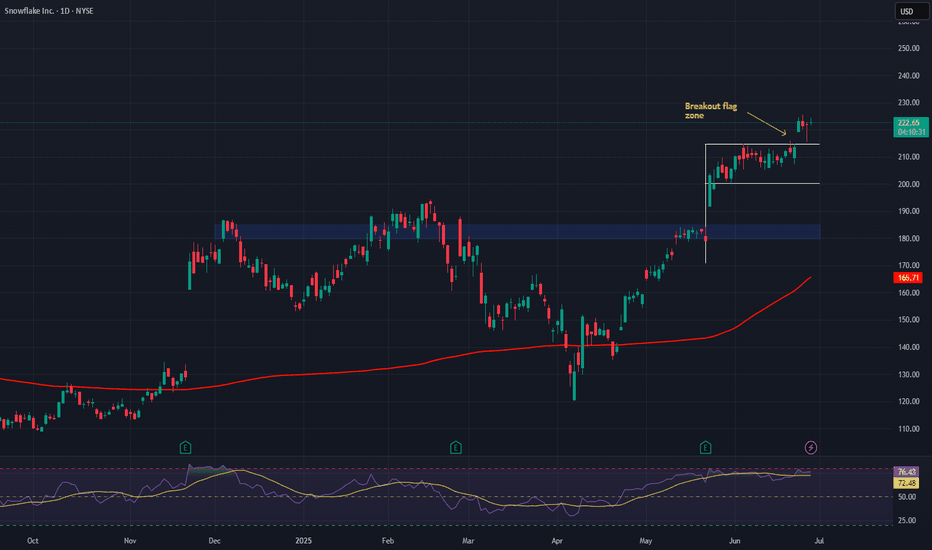

Snowflake (SNOW) – Powering the AI-Driven Enterprise Data Cloud Company Snapshot:

Snowflake NYSE:SNOW is a leading cloud-native data platform, enabling enterprises to unify, analyze, and act on data across multi-cloud ecosystems. Its expanding use cases in AI/ML workloads and real-time data collaboration make it a cornerstone in modern digital infrastructure.

Key Catalysts:

Gen 2 Performance Leap 🚀

At the 2025 Snowflake Summit, the firm launched Standard Warehouse Gen 2, delivering 2.1x faster performance.

Introduced AI-powered governance and security tools, aligning with the rising enterprise focus on data trust and compliance in AI deployments.

AI-Driven Personalization & Marketing Cloud 🎯

Deepened partnerships with Acxiom and IPG, embedding real-time audience personalization into the Snowflake platform.

Pivotal for marketers leveraging first-party data in a privacy-centric world.

Explosive Partner Ecosystem Growth 🌐

Expanded from 600 partners in 2022 to over 10,000 in 2025, enhancing the platform’s stickiness and network effects.

Fuels indirect revenue and strengthens Snowflake’s global enterprise footprint.

Institutional Support 💼

Institutional ownership exceeds 65%, with over $10B in recent inflows from Vanguard, BlackRock, and other top asset managers—reinforcing confidence in long-term prospects.

Investment Outlook:

Bullish Entry Zone: Above $180.00–$185.00

Upside Target: $255.00–$260.00, driven by AI-powered innovation, ecosystem scale, and strong institutional backing.

📊 Snowflake isn’t just storing data—it’s making data intelligent, actionable, and indispensable for the AI enterprise era.

#Snowflake #SNOW #DataCloud #ArtificialIntelligence #MultiCloud #BigData #AIAnalytics #CloudComputing #EnterpriseTech #Vanguard #BlackRock #Bullish #DigitalTransformation #AIInfra

ETHUSD now at psy. lvl & 30/03 analysis dropped 100 pts! The price of Ethereum’s Ether

ETHUSD

is up today, rising 3.5% to reach over $3,630 on March 31. ETH price is now up 18.75% from its local low of around $3,050, established over a week ago.

Capital rotation into Ether market

Ether's ongoing rise versus the U.S. dollar coincides with its equally strong gains against Bitcoin

BTCUSD

.

Notably, the widely-tracked ETH/BTC pair has gained roughly 2.5% on March 31 to reach 0.051 BTC suggesting a possible rotation of capital in the short term.

Bitcoin LTF Chart Analysis#BITCOIN LTF Bearish Update:

CRYPTOCAP:BTC Currently Trading in Bearish as per Fractals.

If this Bearish Fractals work then Next Stop will be at $36800

Current Sequence According This Fractals:

$40800 ➡️ $36800 ➡️ $38800 ➡️ $35000

Note: LTF Fractals Invalidated if #BTCUSDT 2H candle Closed above $41000

Bitcoin Bullish Triangle But High Volatile in next Few DaysAttention #Bitcoin traders!

Stay cautious, as the market is about to get super volatile. It's highly recommended to steer clear of leveraged positions to avoid potential risks.

What are your thoughts on #BitcoinETF? Share your insights and let's discuss!

Remember, always prioritize risk management in your trading strategies.