EPIGRAL - BreakoutEpigral Limited, formerly known as Meghmani Finechem Ltd, incorporated in 2007, is a leading integrated manufacturer of chemicals in India. Epigral’s Dahej facility is a backward and forward integrated and automated complex with a well-planned infrastructure.

In India, Epigral is the first to set up an Epichlorohydrin plant and largest capacity plant of CPVC Resin. Epigral is also a leading manufacturer of Caustic Soda, Caustic Potash, Chloromethanes, Hydrogen Peroxide, Chlorine and Hydrogen.

Breakout from the Triangle pattern

Market Cap: ₹ 8,996 Cr.

Promoter holding: 68.8 %

FII holding: 3.06 %

DII holding: 4.78 %

Public holding: 23.3 %

Debt: ₹ 593 Cr.

Debt 3Years back: ₹ 993 Cr.

Breakout!

Range break, 1:3 Risk reward, Expecting 10% move in few daysTRITURBINE: Again coming up with swing trade idea. tight consolidation in range of 3% within last 5-6 days. Price is hovering around 10 and 20 EMA. Rejection on 27th Jun shows weak hands going away. Breaking above the pivot line could lead to significant push when crossing with good volume.

SL is somewhere around 3% (Refer the long position drawn over the chart).

One can invest 10% portfolio size as per following calculations

Position sizing and managing risk is the key.

Portfolio is: 1,00,000

Position size: 10,000

Risk 3%: 300. Which means only 0.3% of overall portfolio value is under risk.

Stay connected for commentary for coming days

Disclaimer:

The information provided herein is for educational and informational purposes only and should not be construed as investment advice. The stock analysis and recommendations are based on publicly available information, data sources believed to be reliable, and our interpretation at the time of writing.

Investing in equities involves risks, including the risk of loss of capital. Past performance is not indicative of future results. Readers and investors are advised to conduct their own research or consult a qualified financial advisor before making any investment decisions.

The author(s), affiliates, or associated entities may hold positions in the stocks mentioned, and such positions are subject to change without notice.

We do not guarantee the accuracy, completeness, or timeliness of any information presented, and we disclaim any liability for financial losses or damages resulting from the use of this content.

POL Could 3x After Breakout: Are You Buying the Right Zone?Price is consolidating above the accumulation zone ($0.19–$0.21) after multiple rejections off demand.

Now trading above this base, if price retests the zone, it could offer a high-probability entry.

Key Resistance = Targets: $0.28 → $0.41 → $0.52 → $0.70 → $1–$2

Structure remains valid above $0.150 (HTF close below = invalidation)

Break + Retest of $0.28 = Bullish continuation confirmed

Setup: Accumulation → Expansion

NFA & DYOR

LPT/USDT could 10x soon — If it breaks $8.50, it may fly to $64+LPT/USDT could 10x soon — If it breaks $8.50, it may fly to $64+

🔹 Structure: Accumulation within defined range

🔹 Volume: Gradually increasing near base – sign of quiet accumulation

🟩 Accumulation Zone: $5.00 – $7.50

Price has respected this zone for weeks, with multiple wicks and strong recoveries- suggesting buyer interest and absorption of supply.

🔻 Strong Support: $3.70

Only bullish bias is valid above this zone. A weekly close below it invalidates the bullish setup.

Key Resistances: $8.50/$22.14/$64.67

Structure Bias:

Forming a macro rounded bottom- a Bullish reversal base. Breakout above $8.50 could trigger trend expansion toward higher timeframe targets.

Observation: Breakout + Retest of Resistance 1 = Momentum confirmation. Hold bias only above weekly closes above R1.

Note: NFA & DYOR Before any Investments.

SAMBHV: IPO Base Breakout + Retest done#SAMBHV #ipostock #breakoutstock #trendingstock #swingtrading

SAMBHV : Swing Trading

>> Breakout & Retest done

>> Trending stock

>> Good Strength & Volumes

>> Low Risk High Reward Trade

Swing Traders can lock profits at 10% & Keep Trailing

Pls Comment , Boost and Follow for more such Analysis

Disc : Charts shared are for Learning Purpose and not a Trade recommendation, Consult your Financial advisor or a SEBI Registered Advisor before taking position in it.

PAYTM, BIG BULLISH BREAKOUT HAPPENINGPaytm, one9 communication 1065, has given highest weekly closing in last 30 months. Stock ready for 1250/1320/1450/1600.

Good horizontal trendline resistance taken out at 1020 levels. Volumes are supportive

Trade negates if closed below 940 levels on weekly closing basis. Bigger Stop at 860 levels.

BALAJEE - Descending Triangle Meets Multi-Pattern ConfluenceOn the daily chart of Balajee, price action has formed a descending triangle right at the lower end of the trend:

🔻 Lower highs consistently pressuring horizontal support.

🟩 Price sitting within a clear demand zone, adding significance to the structure.

📊 Volume tapering off through consolidation, a classic triangle trait.

📐 Presence of a hidden counter-trend line (dotted) hinting at a potential broadening formation — showing a rare multi-pattern overlap.

Such setups are important not for predicting price, but for understanding how multiple structures can interact.

⚠️ Purely educational observation — no buy/sell advice.

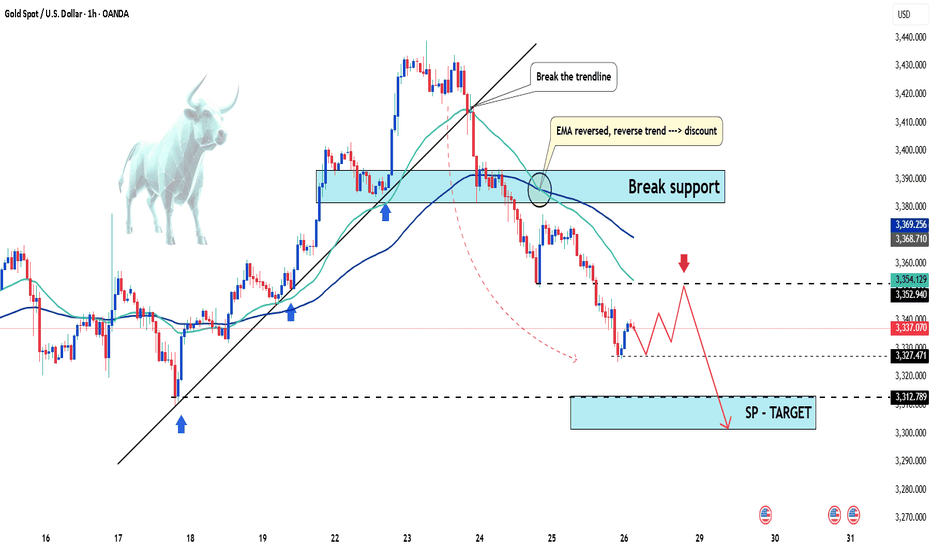

Gold dives toward 3,320 as Fed decision loomsHello everyone, what are your thoughts on gold prices?

Gold's decline is accelerating, dragging the precious metal down toward the 3,320 USD mark. A stronger U.S. dollar and further developments on the trade front following the U.S.-EU agreement have significantly impacted demand for safe-haven assets.

From a technical perspective, the break below the rising price channel could mark the beginning of a deeper correction. Oscillators on the chart have just started turning negative, suggesting that the path of least resistance for gold is now downward.

Looking ahead, Wednesday’s key FOMC decision—along with the accompanying policy statement and Powell’s press conference—will be closely scrutinized for clues on the Fed’s interest rate cut roadmap.

Additionally, investors will face several important U.S. macroeconomic data releases this week, which will play a vital role in shaping the USD’s trajectory and provide new momentum for XAUUSD.

What do you think about the precious metal? Share your thoughts below!

EUR/USD Under Pressure : Sell or Buy ? The EUR/USD pair remains under mild bearish pressure, hovering around the 1.1700 mark and extending its Thursday downtrend. Meanwhile, the US Dollar (USD) stays firm despite growing optimism over improving US-China relations. However, the ongoing tension between Trump and Powell continues to capture market attention.

In response to these developments, EUR/USD has stalled its previous rally. On the chart, the pair is forming a series of lower highs, moving within a narrowing wedge pattern. The 1.1600 level now emerges as the critical battleground between bulls and bears.

Do you think EUR/USD can successfully defend this support zone? Let us know your thoughts!

Bitcoin rebounds with strength after whale dumpAfter a surprising sell-off triggered by whale pressure, Bitcoin (BTCUSD) has shown impressive internal strength, bouncing quickly from the Fibonacci support zone between 114,488 and 116,571 USD (0.618 – 0.5 levels).

The D1 chart reveals that the bullish structure remains intact, with EMA 34 and EMA 89 acting as solid support levels. The recent "dump" did not alter the overall trend; on the contrary, it created an opportunity for reaccumulation within the price box—serving as a vital base for the next breakout.

A likely scenario is that BTCUSD will continue to move sideways for a few more sessions before targeting the 1.272 Fibonacci extension near the 128,000 USD area. If this plays out, it would be a strong confirmation of the next growth phase for Bitcoin.

Do you believe Bitcoin is ready to break all-time highs and set a new record? Share your thoughts below!

Dual Counter-Trend Zone and Market Structure Shift- This chart highlights a dual counter-trend resistance zone formed by two overlapping CT trendlines (marked in the shaded purple region).

🟡 Yellow Cup – Marks the origin base of the structure (assumed starting shift).

🔴 Red Cup – Establishes a Lower Low Base, still within bearish control.

🟢 Green Cup – Forms a Higher Low Base, showing a market structure change supported by a noticeable volume surge.

- The dotted trendline drawn through the zone acts as a hidden resistance confluence

⚠️ Disclaimer:

This post is non-forecasting in nature. It is not a buy/sell recommendation or financial advice. The chart is shared purely for educational and structural analysis purposes.

Deepak Fertilizers - Cup and Handle ContinuationAs you all can see there is a beautiful cup followed by a handle on the Weekly timeframe.

After the pattern broke out, the stock managed the market sell off pretty well by retesting its previous supply zone (now demand zone) and maintained the sideways trend without spoiling the pattern.

This sudden surge implies that the stock is ready to continue its uptrend.

Talking about fundamentals:

- High Management Efficiency with a high ROCE of 17.10%

- The company has a high Debt to EBITDA ratio of 1.88 times

- Healthy long term growth as Operating profit has grown by an annual rate 40.09%

- Positive results in Dec 24

- OPERATING PROFIT TO INTEREST(Q) Highest at 4.94 times

- NET SALES(HY) At Rs 5,325.74 cr has Grown at 24.53 %

- DEBT-EQUITY RATIO(HY) Lowest at 0.67 times

- With ROCE of 14.4, it has a Fair valuation with a 1.9 Enterprise value to Capital Employed

- The stock is trading at a discount compared to its average historical valuations

- Over the past year, while the stock has generated a return of 106.57%, its profits have risen by 0.5%

- High Institutional Holdings at 20.38%. Their stake has increased by 0.7% over the previous quarter.

Latest Gold Price Update TodayIn the most recent trading session, global gold prices dropped over 31 USD per ounce, closing at 3,337 USD. This sharp decline follows a three-day rally and reflects profit-taking by investors and a shift in capital flow.

Newly released economic indicators show that the U.S. labor market remains strong, with jobless claims falling for the sixth consecutive week — the longest streak since 2022. This helped the U.S. dollar rebound slightly, putting pressure on gold, a non-yielding asset.

At the same time, investor sentiment has tilted toward riskier assets like equities, as trade talks between the U.S., EU, and Japan show positive progress. Stock markets in the U.S. and Europe surged, drawing capital away from gold.

Although expectations remain for a potential Fed rate cut in September, gold faces short-term headwinds. The 3,300 USD zone is now a key level to watch. Traders should look for reversal signals and volume confirmation before considering long entries.

Personal view: USD strength, rising stock markets, and profit-taking are creating a short-term correction for gold. However, in the longer term, there is still upside potential if the Fed signals a policy shift in the coming months.

And you — what’s your take on gold prices today?

GLOBUS SPIRITS, POTENTIAL BIG BREAKOUT STOCKGlobus spirits (W), Buy Globus spirit above 1390 levels, add more above 1440 levels.

Stock has been consolidating from the last 24 months in range of 650 points and looking for breakout.

Potential target is 1800 to 2100

Trade negates if it falls below 1340 levels on weekly closing basis after breakout trade opens. Avoid bigger stops

PAYTM READY FOR BIG BULL RUNPaytm, one9 communication 1065, has given highest weekly closing in last 30 months. Stock ready for 1250/1320/1450/1600/1800

Good horizontal trendline resistance taken out at 1020 levels. Volumes are supportive

Trade negates if closed below 940 levels on weekly closing basis. Bigger stop at 860 levels.

455-Day Counter Trendline | From Breakdown to V-RecoveryThis weekly chart of Jio Fin Services Ltd illustrates a multi-phase price structure over 455 days:

🔹 Initial Rally — Kicks off from a defined accumulation base (grey zone), marking the start of a strong impulse leg.

🔹 Consolidation Phase — Price enters a descending triangle formation just below a historical resistance band.

🔹 Breakdown — Clean breakdown from the triangle pattern sends price sharply downward.

🔹 V-Shaped Recovery — A strong reaction off the original base zone leads to a sharp reversal.

🔹 Back to the 455-Day Counter Trendline — Price now tests the long-standing counter trendline, which has remained intact throughout.

📌 This chart demonstrates how historical price structures—especially well-defined base formations and trendline resistances—continue to act as critical reference points for future price action.

🛠️ No predictions here. Just a structured breakdown of price behavior and major decision zones traders are often drawn to.

DALBHARAT Retesting Breakout Zone Near 21 EMAThe stock DALBHARAT is currently testing the breakout region between ₹2200–₹2250, which aligns with the 21 EMA — a potential confluence zone.

Traders may observe price action near this level for signs of a bounce. If the retest holds, there could be scope for upward movement toward previous highs.

Note: The risk-reward setup appears favorable based on current chart structure.

Disclaimer

This is a personal technical analysis and not a recommendation to buy or sell any securities. Please do your own research or consult a SEBI-registered investment advisor before making any investment decisions. Trading in financial markets involves risk.

Ethereum Breakout Confirmed – Retest CompletedCRYPTOCAP:ETH has broken out Inverse Head & Shoulders on daily chart.

✅ Neckline breakout above $2,850

✅ Retest successful – strong support confirmed

✅ Targeting full move toward $6,000

Structure is bullish, momentum building. As long as #Ethereum holds above the neckline, continuation is likely.

Note: NFA & DYOR

USDCAD Bullish Setup-Shift from Accumulation to ExpansionPrice has broken above recent accumulation range marked by Liquidity Control Boxes.

SignalPro long setup activated with:

🔶 Smart accumulation zone breakout

🔁 Minor retest at 1.361 area holding

🎯 Targeting upper liquidity levels around 1.37139

Price structure shows a bullish microtrend reversal with risk capped below last demand block.

Key Elements on Chart:

📦 Leola Lens SignalPro's control zones provided context for consolidation and breakout

📈 Breakout aims toward untested supply zones above

⏳ Timeframe: 15-min

🧠 Educational Use Only – No financial advice.

Tool used: Leola Lens SignalPro

EURUSD: Bearish Breakdown in SightEURUSD is currently holding above the 1.173 support zone, but the bearish structure is becoming more evident. The downward trendline and nearby resistance have repeatedly rejected price rebounds.

If the support at 1.173 breaks, a sharp move toward the 1.168 target is likely — a key previous low.

Trend: Prefer SELL if a breakdown confirms – low risk, high potential.

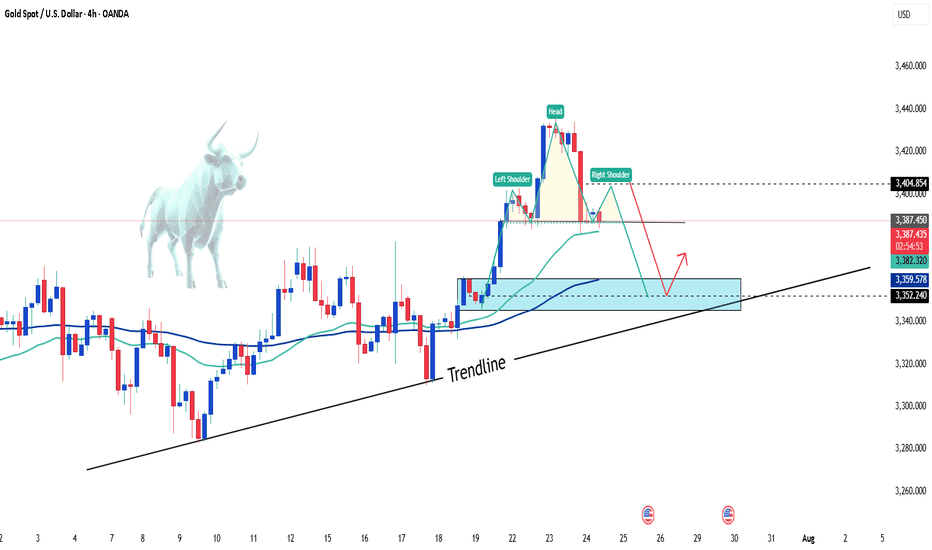

Gold holds steady—Is a breakout above $3,400 next?Gold prices have corrected exactly as we anticipated yesterday. At the time of writing, gold is hovering around $3,370 USD, showing little volatility since the start of the session.

Although the market is undergoing a short-term pullback, I still believe gold remains in a medium- to long-term uptrend. One key reason is the global shift away from the US dollar, with many countries increasing their gold reserves. Meanwhile, the USD is projected to weaken further in the long run. On top of that, if the Federal Reserve indeed begins to ease monetary policy, gold could break above the $3,400 level and potentially set a new record.

In addition, trendline support remains intact—if momentum picks up from here, the bullish trend may soon resume.

Gold takes a break – what's next?After Tuesday’s strong breakout, XAUUSD is now consolidating just as we expected yesterday. The price is hovering around 3,385 USD and is forming a head and shoulders pattern.

Technically speaking: If gold continues to hold the 3,350 USD support zone and the trendline, the bullish outlook remains intact. At this stage, gold is simply "taking a break" before its next move.

I'm still optimistic about gold’s potential — how about you?