BTR Indicator Option Trade | 24 Dec 2025 |+17 Points in BSE PUT Today 24 Dec 2025, the BTR Indicator did not generate any signal in BSE LTD (Cash Market).

Does that mean it was a No Trading Day?

❌ NO. The market never stops.

When the cash market stays silent, professional traders shift focus to OPTIONS.

In this video, I demonstrate:

✔ How to apply BTR Indicator correctly

✔ Why no signal = no trade in cash market

✔ How to identify PUT option opportunity after a bearish bias

✔ BTR-generated BUY entry at 65–66 in BSE PUT

✔ Clean EXIT at 82

✔ +17 points profit using only BTR Indicator

📌 Same Indicator

📌 Same Rules

📌 Different Instrument

⏱️ Timeframe Note

• Recommended for Options using BTR: 5-Minute Chart

• Used in video: 15-Minute (for clarity & learning)

🔑 Key Lesson

Discipline creates consistency.

No force trades. No noise. Only high-probability setups.

📍 Where to Find BTR Indicator

👉 Visit my TradingView Profile

👉 Go to Scripts / Indicators

👉 Add BTR Indicator to your chart

💬 Comment “SCALP” if you want a separate BTR Scalping Guide Video

📊 Follow for more clean intraday & option trades

Follow BTR. Trade Smart. Stay Profitable. 📈🔥

Bseltd

BSE LTD Intraday| 23 Dec 2025| +45 Points Clean Short Setup23 Dec 2025 | Simple & Easy BTR Indicator Setup

Consistency comes from simplicity — and today BTR proved it again.

Another smooth intraday short trade executed perfectly in BSE LTD, with clear entry, logical stop-loss, and disciplined exit.

🔍 Trade Overview

• Stock: BSE LTD

• Date: 23/12/2025

• Timeframe: 15-Minute

• Indicator Used: BTR Indicator ONLY

🔴 Entry Logic (Short)

✔ BTR generated a clear BEARISH signal

✔ Breakdown after rejection from higher levels

✔ Momentum shifted completely in sellers’ favor

🔻 SHORT ENTRY: 2755

🛑 Stop-Loss (Risk First)

📌 SL placed above recent Swing High

📌 Clean structure-based stop

📌 No guesswork, no emotional SL movement

🎯 Exit Execution

✔ Follow the system, follow the exit

✔ Price continued lower smoothly

🟢 EXIT BOOKED: 2715

📉 TOTAL PROFIT: +45 POINTS

🧠 Why This Trade Was Easy

✔ Clear BTR signal

✔ Strong bearish follow-through

✔ Proper SL placement

✔ No over-trading, no indicator clutter

📌 Strategy Rule

❌ No prediction

❌ No noise

❌ No multiple indicators

✅ Only BTR Indicator

✅ Follow entry & exit rules

✅ Trade becomes effortless

🔥 Final Thought

Trading is not about being right every time —

it’s about executing the same edge repeatedly.

BTR continues to deliver high-probability intraday setups in both directions.

📊 Follow for daily BSE intraday trades

💬 Comment / DM if you want to trade using BTR Indicator

Simple Rules. Clean Charts. Consistent Profits. 📉📈 NSE:BSE

📌 You can find the BTR Indicator in my TradingView profile → Scripts section

👉 Open my profile

👉 Go to Scripts / Indicators

👉 Add BTR Indicator to your chart

👉 Trade with zero noise & clear signals

Follow BTR. Follow Discipline. Trade Simple. ✅

If you want, I can also give you:

• A pinned profile bio line

• A comment reply template for followers

• A step-by-step “How to use BTR” post

Just tell me 👍

BSE Intraday Trade — 18 Dec 2025BTR Bullish Setup + Fibonacci Precision | +30 Points Booked

Once again, BTR Indicator delivered a clean bullish intraday opportunity in BSE Ltd, proving the strength of rule-based trading over emotions.

This trade was further refined using Fibonacci Retracement, which helped in defining clear entry confidence, precise stop-loss, and a high-probability exit zone.

🔍 Trade Details

• Stock: BSE Ltd

• Timeframe: 15-Minute

• Setup Type: Bullish (BTR Confirmed)

• Market Condition: Pullback into Demand Zone

🟢 Entry Logic

✔ BTR generated a bullish signal inside a strong demand zone

✔ Price respected 0.5 – 0.618 Fibonacci retracement

✔ Strong bullish candle confirmed buyer presence

🟢 Buy Entry: Near 2670 zone

🎯 Exit & Target Planning

📌 Fibonacci Extension Used for Exit

• 1.618 Fib Level acted as a high-probability exit zone

• Price reacted immediately from this level

🔴 Exit Booked Near: 2700 zone

📈 Net Gain: +30 Points (Intraday)

🧠 Why This Setup Worked

✔ BTR provided directional clarity

✔ Fibonacci gave structure for SL & Exit

✔ Demand zone ensured low-risk entry

✔ System-based exit avoided overtrading

📌 Key Takeaway

Profitable trading is not about prediction.

It’s about alignment:

Signal + Structure + Risk Control

BTR does exactly that — again and again.

📊 Follow for daily intraday trade ideas

💬 DM for BTR Indicator & complete trading rules

Trade what you see. Exit where the system tells you. Stay disciplined. 🔥📈

#BSE #NIFTY #INTRADAY #BULISH #BUY #BSESTOCK #BSEINDIALTD

BSE Long Trade SetupBSE is looking good for a short term long trade. Got hold of this while I was looking through stocks thrown up by my scanner. The Stop Loss levels are indicated in the video. If you find it breaching the higher levels as indicated in the video, a long position can be taken and then trailed. Happy Trading.

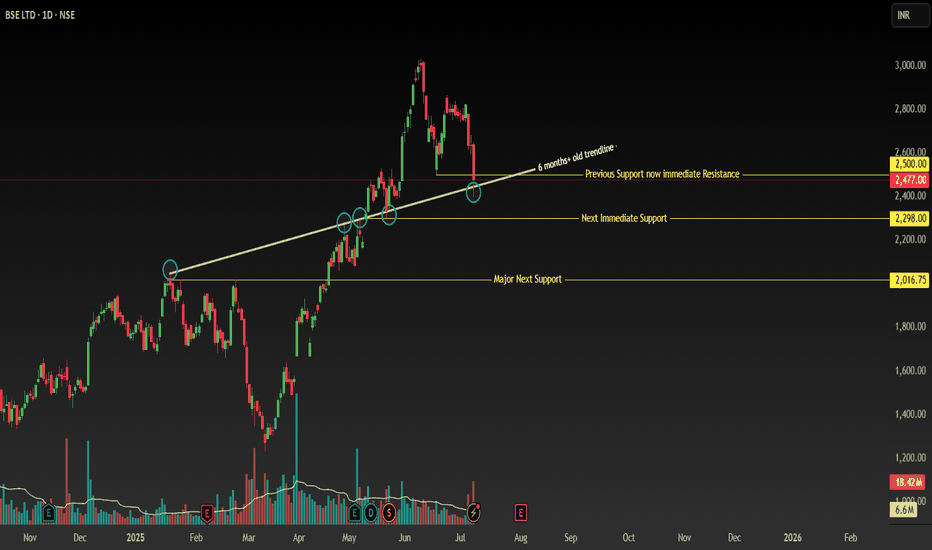

BSE - Support Break with Bullish Recovery SetupSymbol: BSE (Bombay Stock Exchange)

Timeframe: Daily

Key Levels:

✅ Breakdown: 2500 (closed below) → Next support: 2300 → 2000 (major).

✅ Bullish Anchor: Price > 200 MA + ascending trendline (Jan 20, 2025 breakout now support).

📊 Technical Structure

Critical Support Break:

-Daily close below 2500 (confirmed breakdown of key support).

-Next supports: 2300 (immediate) → 2000 (major swing low).

Bullish Anchors:

-Price above 200-day MA (long-term uptrend intact).

Ascending Trendline Support:

-Originating from Jan 20, 2025 (resistance until May 13 breakout).

-Now acting as dynamic support (resistance-turned-support).

Key Reversal Signal: Watch for reclaim of 2500

-Requires strong bullish candle + above-average volume.

-Confirms failed breakdown and resumption of uptrend.

🎯 Trading Plan

Scenario 1: Buy Dips (Conservative)

Entry Zone:

-Layer 1: 2300 (trendline + horizontal support confluence).

-Layer 2: 2000 (swing low + 200 MA reinforcement).

-Stop Loss: 1950 (below 2000 structure).

-Targets: 2500 → 2700 → 2900.

Scenario 2: Breakout Re-entry (Aggressive)

Trigger: Daily close above 2500 with: Bullish candle (preferably >1.5% gain).

-Volume ≥ 20% above 10-day average.

-Stop Loss: 2450 (below breakout level).

-Targets: 2700 → 2900 (measured move).

⚠️ Risk Management

Position Size: ≤3% capital per trade.

Invalidation Conditions:

-Close below 2000 (invalidates bullish thesis).

-Failed 2500 reclaim (weak volume/rejection candle).

Disclaimer: Not financial advice. Conduct your own due diligence. Past performance ≠ future results. Risk capital only.

🔥 Boost if this analysis helps your strategy!

💡 Comment below any stocks you want me to analyse next!

Bombay Stock Exchange cmp 5631 by Daily Chart viewKeep stock on radar for probable New Lifetime High Milestone in the making

Bombay Stock Exchange cmp 5631 by Daily Chart view

- Support Zone at 4885 to 5055 Price Band

- Resistance Zone at 5810 to 6030 Price Band

- Technical Indicators EMA, MACD, RSI seem positive

- Triple Bottom made at the Support Zone Price Band

- Stock majorly trading within Price Range 5050 to 6030

- Back to Back Rounding Bottoms within the Trading Range

- Daily Support 5055 > 4560 > 4050 Resistance ATH 6133.40

BSE Retesting BO Levels with King CandleNSE:BSE aggressive Short trade as it made a king candle and is close to the previous BO levels and closing below 20 DSMA today.

About:

NSE:BSE is an Indian Stock Exchange at Dalal Street in Mumbai. The Co. facilitates a market for trading in equity, currencies, debt instruments, derivatives, and mutual funds.

F&O Activity:

Short Buildup in Futures with 6000 CE Gaining Significant OI.

Trade Setup:

It looks like a good 1:2 trade setup, with the recent swing high as a strong resistance zone, the RSI is Trending Down and closed below 20 DSMA, If levels are broken Can test 200 DSMA.

Target(Take Profit):

Around 200 DSMA Levels for Swing & Positional Trader.

Stop Loss:

Entry Candle Low for Swing Trader and Recent Swing High or 20 DSMA for Positional Trader.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FLLOW for more

👍BOOST if useful

✍️COMMENT Below your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes only and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

BSE Bombay Stock Exchange Technical👉🇮🇳As per recent data on chart of #BSE #BombayStockExchange has shown significant trading volumes, especially in derivatives like options and futures, indicating active technical trading. The Sensex has been noted for setting new records, suggesting bullish trends that technical analysts would interpret through various indicators. but in my view top has been made please find the 📉chart for your reference.

#bseltd ❣️ #renderwithme #stockmarketsindia #ShareMarket #Nifty #Nifty50 #MarketNews

BSE Broke Major LevelsNSE:BSE broke today's Cup and Handle Pattern, although the Handle Was the same size as the cup. Good price action continues as per my previous idea.

🙋♀️🙋♂️If you have any questions about this stock, feel free to reach out to me.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FLLOW for more

👍BOOST if useful

✍️COMMENT Below your views.

Meanwhile, check out my other stock ideas below until this trade is activated. I would love your feedback.

Disclaimer: This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

BSE Possible Cup and Handle aheadNSE:BSE Possible Cup and Handle ahead a Close above 4990 to 5000 Will Confirm it.

🙋♀️🙋♂️If you have any questions about this stock, feel free to reach out to me.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FLLOW for more

👍BOOST if useful

✍️COMMENT Below your views.

Meanwhile, check out my other stock ideas below until this trade is activated. I would love your feedback.

Disclaimer: This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

BSE LTDBSE LTD Make Pall & Flag Flag Pattern But not confirm now ,

BSE Breakout 901 and sustained above 900 than confirm Pall & Flag Pattern Confirmation,

BSE Breakout and sustained above 901-10 than next move 955-60 Sustained above 955 than next move on 1024 and than open the sky of pall and flag pattern Target Move 1300 possible ,

But Now the time market Stay in Negative so,

Breakdown also possible,

If 340-38 Breakdown also possible,

Than Next Support 780-85 Possible

so be Careful and trade according your analysis and market view

Simple Trade Setup | BSE | 01-11-2021 [ INTRADAY]NSE:BSE

Observations:

1) On daily time frame, we can see that it has made bullish spinning top candle.

Also it closed below 21DMA and it is trading above 50DMA.

50 DMA which is placed at 1240.07 level which will work as major immediate support.

and 21DMA which is placed at 1330.53 level which will work as immediate resistance.

Sustainable breakout of 21DMA will make it bullish again.

Please refer below chart : 1day Time Frame.

2) Also On 1day time frame, we can see it is forming cup and handle pattern. Major breakout level is 1400 level.

Please refer below chart : 1 day Time Frame.

-------------------------------------

Trade Setup for Date 01-11-2021:

1) Don't Jump in to trade at the beginning of the market. Let it get settle for 15-20min first and judge the price action.

2) Everything is mentioned on the chart. I hope it is easy to understand.

3) All the levels will work as support, resistance, entry and exit w.r.t price action near that level.

4) Avoid gap up or gap down chase. Wait and trade between levels.

Please refer below chart for levels.

Hope I made it easy to understand it.

Do comment your doubt or suggestion.

Note: Trade with Strict SL. It may or may not hit all the levels. So one can book profit / loss at respective level considering how price action works near that level.

SELF EXPLANATORY SERIES : QUICK ANALYSIS ON BSE LTD.In this self explanatory series I will be posting charts with pure technical analysis only without full length explanations , Traders can ask their in comments section, Happy trading.

Disclaimer : This idea was to just give you an insight about my own view and personal observations. Please do your own research or consult an investment advisor before doing any investment or trading.