Bitcoin Dominance Just Hit a 1,505-Day High — Are You Paying Att🚨 Bitcoin dominance has been climbing non-stop for 959 days... and it just broke a 1,505-day high, hitting 64.34%.

That’s not just a stat — that’s a clear signal.

Bitcoin is still the king. 👑

Rejection Level: 66%-72%

Be honest… do you own any?

Btc-e

Bitcoin (BTC/USDT) – Full Technical Breakdown - Timeframe: 1DBitcoin (BTC/USDT) – Full Technical Breakdown - Timeframe: 1D

Market Structure & SMC (Smart Money Concepts)

✅ CHoCH (Change of Character) confirmed from $105K top → current lower high around FWB:88K zone.

📉 Break of Structure (BOS) to the downside occurred at $91K.

🟠 Bearish Order Block (OB): $86K– FWB:88K (price currently reacting here).

Liquidity Levels:

Sell-side: Swept at $76K

Buy-side: Sitting above FWB:88K

Fair Value Gap (FVG): Unfilled zone between $81K– GETTEX:82K may act as magnet for price.

ICT Model Alignment

Judas Swing: Sharp liquidity grab below $76K → followed by rebound — classic manipulation before real move.

PD Array Setup:

Resistance: FWB:88K (bearish OB + buy-side liquidity)

Support: $81K (discount zone + FVG)

Elliott Wave Outlook

Wave 1: July–Sept 2024

Wave 3: Nov–Feb rally to $105K (extended wave)

Wave 4: Correction to $76K likely complete

Wave 5 Target: Potential $115K+ if structure holds

Fractal Observation

🔹 Current price structure is mimicking Nov 2023–Jan 2024 pattern

🔹 If history rhymes: consolidation → breakout → retest → parabolic rally

Key Levels to Watch

🔼 Bullish Confirmation: Daily close above FWB:88K → targeting GETTEX:92K –$100K

🔽 Bearish Rejection: Drop below $81K → next support at $74K–$76K

Strategy Summary

🔹 Short-Term Bias: Cautiously Bullish

🔹 Entry Zone: Retest near GETTEX:82K (FVG + OB)

🔹 SL: Below $79.5K

🔹 TP Zones: FWB:88K → GETTEX:92K → GETTEX:98K

📈 R:R = Minimum 1:5 (High confluence)

Keep your eyes on HTF closures and manage risk. Liquidity traps are in play.

Will Bitcoin Test $65000 level soon ?🚨 #BTC/USDT SMC Update and Fresh Analysis 🚨

Our previous short setup played out perfectly with a solid -21% move from the $94,000 region, catching the local top and dumping all the way to $75,000.

What’s next?

From a Smart Money Concepts (SMC) perspective, current PA suggests another local top might be in.

🔹 Bearish Order Block just got tapped

🔹 Strong Resistance seen near the $86,000 level

🔹 Price forming LL (Lower Low) and LH (Lower High) structure

If this setup plays again, we may see a new low below $75,000.

Key Level to Watch:

If a HTF candle closes above $88,200, the short thesis is invalidated — and in that case, we may be looking at a bullish continuation toward the $100,000 zone.

Reminder:

Don’t enter blindly. Wait for confirmations and respect risk management—protect your capital at all costs.

PENDLE Long Setup – Key Support Retest at $3PENDLE is pulling back into the $3.00 zone, a key level that previously acted as resistance and is now being retested as support. This classic support-resistance flip often marks the foundation for a bullish reversal, especially if price holds with strength.

📌 Trade Setup:

Entry Zone: Around $3.00

Take Profit Targets:

🥇 $3.41

🥈 $3.80

Stop Loss: Daily close below $2.80

#Bitcoin 30 Minutes Chart Scalp profit Update:#Bitcoin 30 Minutes Chart Scalp Profit Update:

That quick scalp move delivered a clean +3.60% — just as planned. Scalp trades are meant for small, fast targets, and this one hit perfectly. ✅

But If Still holding?

🔹 Move SL to Break Even to protect capital

🔹 Structure looks fine for now, but don’t get greedy — manage your risk.

Always trade with a plan.

Bitcoin trading at Resistance level so What Next?🚨 Bitcoin 4H Chart Update

CRYPTOCAP:BTC is now trading right at the trendline resistance on the 4H chart

So what’s next?

1️⃣ Breakout and blast toward $100K?

2️⃣ Or another rejection down below $70K?

The decision point is HERE.

This breakout could change the game.

👇 Drop your thoughts –

Gold’s New All-Time High Could Be #Bitcoin Signal🚨 Gold’s New All-Time High Could Be #Bitcoin Signal 🟡

And if history repeats, Bitcoin could be next.

Every time #Gold moves first, Bitcoin usually follows with a major rally. If that happens again, we could see a new Bitcoin ATH in Q2-Q4 of 2025.

Are you ready for the next big move? 🚀

CRYPTOCAP:BTC #BullMarket

BTC/USDT – 30-Min Chart Technical BreakdownBTC/USDT – 30-Min Chart Technical Breakdown

🔺 Pattern Formation:

Price action is currently developing a rising wedge, generally considered a bearish continuation pattern. However, the ongoing Higher High (HH) and Higher Low (HL) structure suggests short-term bullish momentum is still intact.

Key Resistance Levels:

* $84,700 – Major horizontal resistance

* $83,600 – Local supply zone / recent rejection point

Key Support Levels:

* $81,200 – Trendline + structure support (wedge base)

* $78,400 – Secondary structural support

* $74,900 – High-confluence demand zone

Long Setup (High-Risk Trade – Counter to Pattern Bias):

* Entry Zone: $82,500 – $83,000 (wedge support retest zone)

* TP1: $83,900

* TP2: $85,200

* TP3: $87,000 (upper wedge boundary)

* SL: Below $81,100 (wedge break + structural invalidation)

Confirmation Needed:

Watch for bullish engulfing or a strong bounce from the wedge support (red dashed trendline) with solid volume influx.

Risk Note:

Despite current bullish flow, wedge patterns often resolve bearishly. If price breaches below $81,100, invalidate longs and reassess for possible shorting opportunity.

Trade Idea: BUY GOLD (XAUUSD) at 2,993 – Target 3,035🔍 Technical Analysis (1H Chart):

Strong support zone at 2,993 – 2,984 USD:

This area has held well multiple times in recent sessions.

Confluence with the EMA33 low (2,998 USD) acting as dynamic support.

Price previously rebounded from this zone with a noticeable increase in volume.

Structure:

After a pullback to 2,993, the price rebounded to 3,017, indicating bullish demand.

A retracement back to 2,993 would offer a good entry point for a trend continuation buy.

Resistance / Profit Target at 3,035 USD:

This is the most recent local high and aligns with the downtrend line and higher EMA levels.

If price breaks above 3,035, the next potential target zone would be around 3,045–3,050 USD.

🧾 Trade Setup:

Entry: Buy Limit @ 2,993 USD

Stop Loss: Below 2,984 USD

Take Profit:

TP1: 3,031 – 3,033 USD (minor resistance)

TP2: 3,035 USD (major resistance)

🎯 Risk-to-Reward Ratio (R:R): ~1.8 to 2.5 – suitable for intraday or short swing trade setups.

⚠️ Risk Management Tips:

If price doesn't pull back to 2,993 and breaks 3,035 directly, wait for a retest of 3,031 for a breakout-entry strategy.

Keep an eye on upcoming U.S. economic news or Fed events, which could bring volatility.

Adjust stop-loss or secure partial profits during U.S. session for safety.

The Market Looks Brutal Right Now... But Stay With MeThe Market Looks Brutal Right Now... But Stay With Me

It feels like a bloodbath out there… but here’s the truth:

A fast and brutal dump is honestly better than a slow, painful bleed. It shakes out the weak hands quickly—and sets the stage for stronger recoveries.

We've seen this movie before:

▪️ The Covid flash crash

▪️ War shocks like Russia vs Ukraine

▪️ Black swan events like FTX blowing up

▪️ The chaos of the LUNA death spiral

➡️ Each time, fear dominated the feed.

➡️ Each time, the "This time it's different!" crowd got louder.

➡️ And each time, those who stayed calm and DCA’d into real projects walked away with massive wins.

So why should this time—just because of tariffs or macro FUD—be any different?

It’s not.

Zoom out.

The long-term trend is built on strong fundamentals, not headlines.

Stick to the plan: accumulate multi-cycle, high-cap coins. Ride the wave.

The short-term noise fades, but smart strategy compounds.

BITCOIN BULLISH POTENTIALPrice has entered the discount zone near a weak low, signaling a potential reversal as smart money may be accumulating after a liquidity sweep. This area often serves as a launchpad for bullish moves, especially when sell-side liquidity has been taken.

Short-term sentiment is shifting bullish, suggesting momentum could be building for a move upward. With key bearish targets already met, the downward pressure may be fading, setting the stage for a corrective move or full reversal.

If bullish structure forms—such as a break of structure or a bullish order block holding—price could begin climbing toward equilibrium and possibly into premium territory. Look for confirmation through price action and volume shifts.

Bitcoin - 140 K in 2025 - 5th wave targetPrice is at technically buying zone - Fib buy zone and also breakout zone and right now double bottom. at any price around this price based on big players buying orders fourth wave will get completed and 5th wave will start. Breakout of resistance red line is confirmation of 5th wave progress. previous resistance areas could give selling pressures due to tax fears and global recession fears. Supporting reasons - Strategic reserve and US Govt is one new player now. what ever buying happening during bear trend will be visible only in data about who is buying like Black Rock, Strategy - Saylor etc. As and when positive mood comes in market BTC will keep bouncing back and price is accumulation area for sure for big players. This is not a time to sell but to accumulate BTC for sure. All tax war will only slowdown the BTC up move but will not fall further much. But still hold long qty with required margins and to be safe keep liquidation levels as 73 at least to be safer to avoid any big liquidation candle in case any exchange liquidate retail people's holdings. US Strategic reserve data is awaited. Every Monday Saylor in his X profile posting his purchases and Black Rock too seen buying BTC last several days or weeks, Price is dropping since loose hands sell in fear. As per data, spot buyers didnt sell at all. Its only traders with 50x or 100x moving the market.

Will $ETH Drop Below $1,000 Before Heading to $7,000+? Will CRYPTOCAP:ETH Drop Below $1,000 Before Heading to $7,000+?

🟣 Historically, #ETH respected the 0.5 Fib retracement in bull markets – In the last bull run, ETH retraced to 0.5 Fib at $89 — then exploded to $4,867

🟣 That’s +56,000% in just 1.5 years!

This cycle, the 0.5 Fib level sits around $661. With the monthly trendline breakdown, the big question is:

Will #Ethereum dip below $1,000 and test $700 before making a new ATH?

If ETH reaches sub-$1,000 zones, I'm personally buying heavy and holding for 1–2 years. No FA – just Fib, patience & conviction.

ETH will reward those who ride the wave, not fear the dip.

Hold strong. Next 1–2 years = massive opportunity.

Bitcoin Short played out perfectly and Down 7%Bitcoin Short played out perfectly.

Price respected the SMC chart structure — 4H candle failed to close above FVG + -OB zone.

Post Trump Tariff news, market triggered high-leverage stop hunts with a fake pump before a sharp dump.

📉 Entry: $88,440 ✅

📈 Exit: $82,200 ✅

✅ ~7% move captured. Trade closed in profit.

BTC - 3rd April 2025 At Support now - Good to buy long qty nowBTC looks good to buy long qty at previous support zone of 82200 to 81300 zone. In 2 days US Govt going to announce how much crypto they have now and what they did last few days after announcing strategic reserve. At least for again 88 or 89 K levels looks possible from there. By next week or this april month all tax fears will fade. And good change for this weekend NFP and other data could take importance for new trend. Use this view for educational purpose and consult ur advisor or take your own decision for taking trades.

EOS Broke Out After Months — But Is This Just the Beginning?NYSE:EOS Broke Out After Months — But Is This Just the Beginning?

#EOS was once a top-tier asset, trading above $15. However, due to consistent development delays and unmet commitments, the price structure gradually broke down, eventually bottoming near the $0.40 zone — a key historical demand area.

Recent Development: EOS witnessed a sharp rally of +94% in the last month, with a strong +26% daily candle, backed by bullish news:

✅ Formation of Vaulta Banking Advisory Council (includes ex-Binance Canada CEO)

✅ CMO Tristan Dickinson teased a major upcoming announcement

Current Market Structure:

▶️ Price broke out of a long-term accumulation range

▶️ Volume spike confirms genuine interest

▶️ However, one FVG (Fair Value Gap) is still unfilled between $0.60–$0.50 zone on the 4H chart

Ideal Entry Zone (Pullback Play):

▶️ Watch for a retest near $0.60–$0.50

▶️ FVG fill + potential bullish OB (Order Block) = Confluence zone for long setups

🛑 Invalidation / Stop-Loss:

▶️ Breakdown below $0.43 on high volume will invalidate the structure

▶️ SL is wide, but RR (Risk-Reward) setup is favorable for swing traders

Long-Term Upside Targets:

First target: $0.95–$1.10 (range high breakout)

Mid-term target: $1.45+

Long-term potential if fundamentals sustain

⚠️ Manage your position size. NFA | DYOR | Risk Management is Key

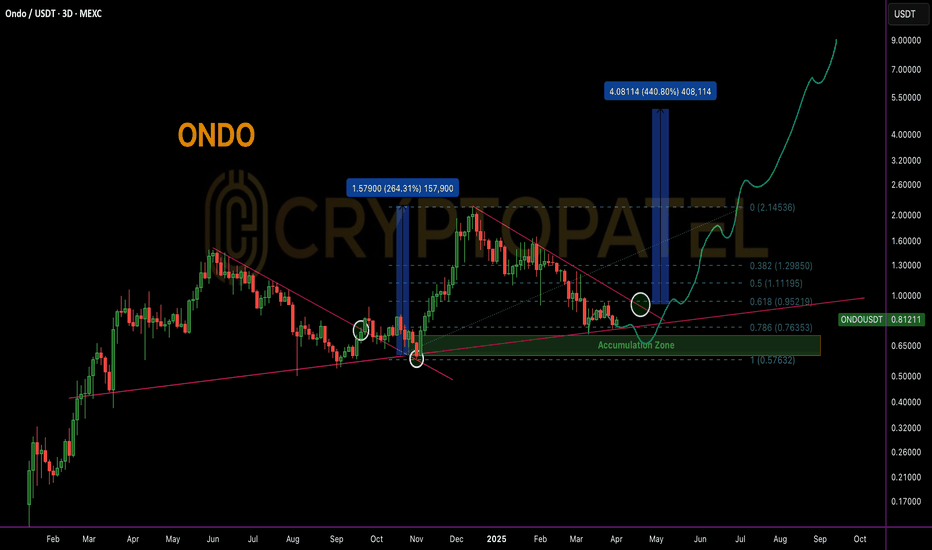

$ONDO Near Golden Entry Zone: Is $ONDO Ready for a 5x Move?LSE:ONDO Technical Analysis & Bull Market Outlook

LSE:ONDO is currently trading near a key accumulation zone, aligning with the 0.786 Fibonacci retracement level, which historically signals a high-probability bounce area in strong trending markets.

Accumulation Strategy

Ideal accumulation zone lies between $0.80 - $0.60. DCA (Dollar-Cost Averaging) approach recommended on major dips for optimal positioning before the breakout confirmation.

Historical Breakout Behavior

In the last HTF (High Time Frame) breakout, ONDO delivered a +200% move post-breakout. Based on current consolidation and market structure, a potential 400%-500% upside is anticipated if similar breakout structure plays out.

Upside Targets in Bull Case: $2/$5/$10

Why Still Bullish?

* Clean structure on daily and 4H TFs.

* Strong demand near 0.786 FIB.

* Institutional interest confirmed:

Trump’s World Liberty Finance acquired 342,002 LSE:ONDO , investing $505,218 at an average entry of ~$1.47 — current price is trading ~45% lower, indicating strong long-term conviction.

Not financial advice. Strictly TA-based view. Manage risk accordingly.

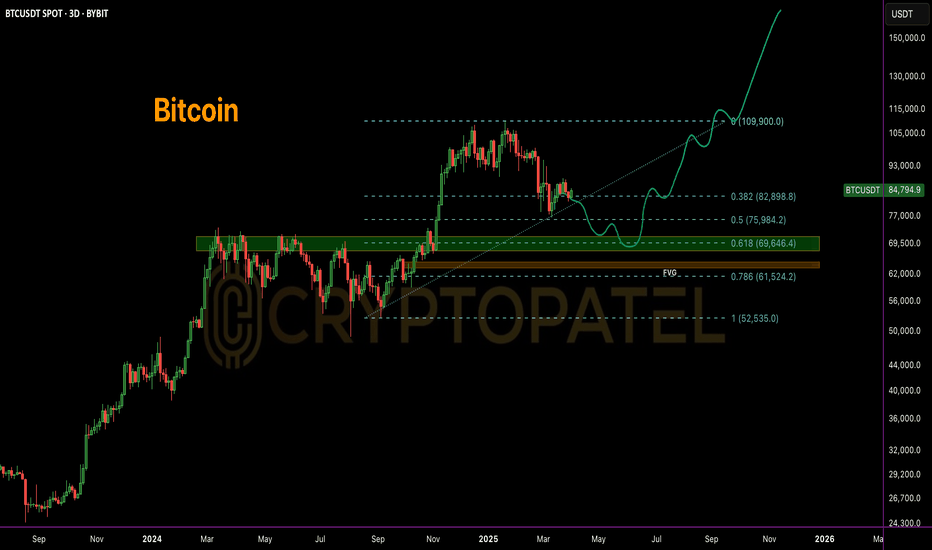

Bitcoin Next move?#Bitcoin reclaimed $85,000, but structurally a deeper retrace remains possible.

Classic TA suggests sustainable rallies often revisit key Fib levels:

1⃣ 0.618 Fib: $69,646

▪️ FVG: $75,582 – $69,916

2⃣ 0.786 Fib: $61,524

▪️ FVG: $64,789 – $63,435

A sweep of these zones could fuel the next leg toward $150K–$180K.

#BTC CRYPTOCAP:BTC

$TON Alert: FVG, Accumulation Range & Bullish Roadmap ExplainedCRYPTOCAP:TON Traders Alert: FVG Zone, Accumulation Range & Bullish Roadmap Explained!

#TONCOIN is currently trading around $3.90, up +27% from our earlier entry near $3.20.

🔹 Scalpers may consider booking partial profits at current levels due to short-term resistance zones.

Key Levels:

🔹 Support: $2.50, $2.95–$3.33 (FVG zone), $2.50 (major demand zone)

🔹 Resistance: $4.15 – $4.50 (next breakout levels)

FVG Zone (Daily TF): $3.33 – $2.95

If price revisits this imbalance zone, it may offer a high-probability entry opportunity.

Long-Term View: As the native token of Telegram’s TON blockchain, #TON has strong utility. If adoption continues, potential upside targets could be:

Targets: Mid-Term: $10+ | Long-Term: $50 – $100

Accumulation Zone (for long-term investors): $3.50 – $2.50

Price bounced strongly from $2.50, confirming it as a solid base.

⚠️ This is not financial advice. Always DYOR before investing.