Chart Nobody Is Watching: BTC.D Could Trigger Biggest AltseasonThe Chart Nobody Is Watching: BTC.D Could Trigger The Biggest Altseason

Bitcoin Dominance (BTC.D) is currently trading at a major HTF distribution zone after printing a cycle high near 66%. Price faced a strong rejection from a Bearish Order Block + Fair Value Gap, confirming supply presence and bearish structural shift.

Technical Structure (HTF):

Cycle high formed at 66% (HTF supply zone)

Clear rejection from Bearish OB + FVG

Support trendline broken

Bearish retest completed near 60%

Structure remains bearish below 60–62%

BTC.D Downside Projection:

50–48% (first expansion zone)

44% (major HTF support)

40% (historical altseason peak zone)

A sustained move toward the 44–40% region has historically aligned with aggressive capital rotation from Bitcoin into altcoins, often marking the beginning of major altcoin expansion phases.

Invalidation: HTF close above 66%

This analysis is based purely on market structure and HTF supply/demand dynamics.

Just my personal view. Not financial or investment advice. Always do your own research.

Btcdominance

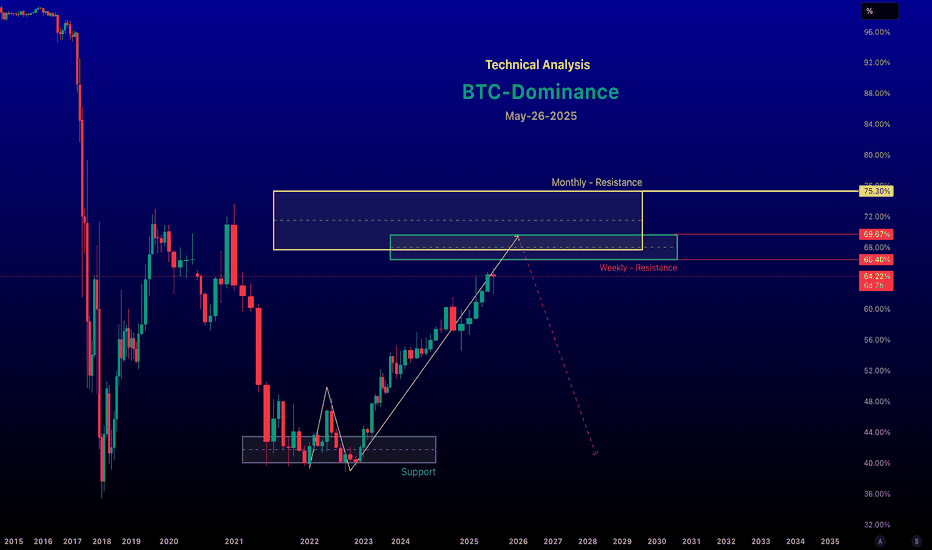

BTC Dominance (BTC.D) – Macro Structure BreakdownBTC Dominance Is Respecting A Multi-Year Symmetrical Triangle Structure That Has Been In Play Since 2017. Price Recently Tagged The Upper Resistance / Altcoins Accumulation Zone Around 64–66%, Where Strong Supply Entered The Market.

🔴 Technical Confluence:

Price Tapped A Bearish Order Block Near 65–66%

Resistance Retest Completed → Failure To Reclaim

Market Structure Turning Bearish Below 64%

Fair Value Gap (FVG) Formed At Resistance Acting As Supply

Momentum Weakness With Acceptance Below Prior Support

Downside Projection:

If This Breakdown Confirms, BTC.D Could Expand Lower Toward The Macro Support Trendline / Altcoins Take-Profit Zone Around 38–40%, Representing A Potential −25% To −36% Move Into Late 2026–2027.

Market Implication:

Bitcoin Dominance Decreasing = Big Altseason Rally Loading

Capital Rotation From BTC Into Altcoins Historically Aligns With This Phase.

Key Level To Watch:

Sustained Acceptance Below 58% Confirms Bearish Continuation.

❌ Invalidation:

Strong Reclaim And Acceptance Above 64–66% Resistance.

Bias: Bearish BTC Dominance → Bullish Altcoins

BTC Dominance Crashes Below EMA50: Altseason Countdown StartedBTC Dominance Crashes Below EMA50: Altseason Countdown Officially Started.

Bitcoin Dominance is set to close another weekly candle below the EMA50, confirming the trend shift we’ve been tracking since April–May 2025. The rejection happened exactly at the same technical point highlighted months ago and once again, BTC.D has broken its support trendline and failed the bearish retest.

This structure is:

Weekly close below EMA50 → structural weakness

Bearish retest rejection → continuation signal

Trendline breakdown → momentum shift away from BTC

If Bitcoin simply stops dumping, the setup for alts becomes explosive. The liquidity rotation is already visible under the surface and historically, this is where altcoins begin their strongest multi-month expansions.

I’ll repeat what I’ve been saying:

A massive Altseason is around the corner.

Based on the technical roadmap, Bitcoin Dominance sliding into the 48%–40% zone would mark the final leg of a full-scale altcoin cycle and likely our ideal exit region for major alt positions.

Stay ready. The next 12 months could be the biggest window for altcoin outperformance in years.

NFA & DYOR

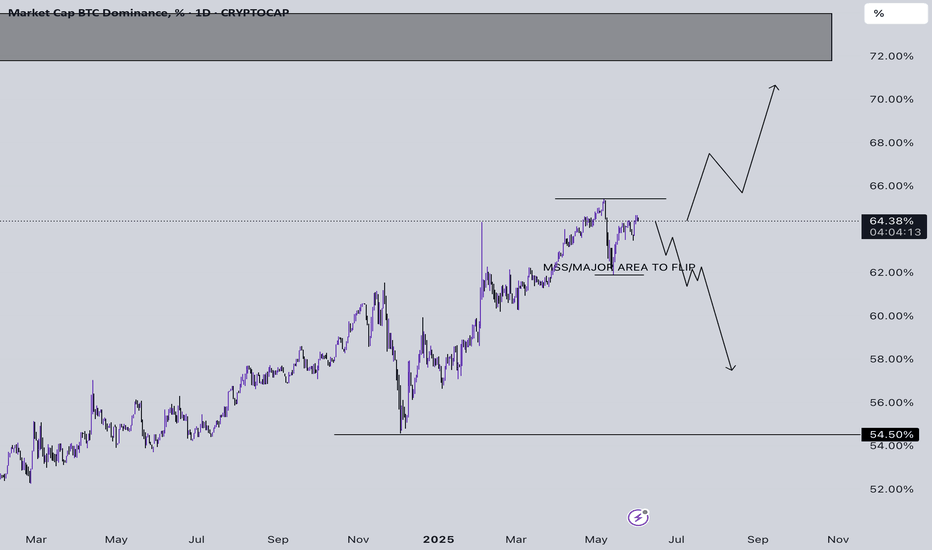

Bitcoin Dominance 1D Chart - Major Altcoins Rally Depends On Thi- BTC.D is currently trading at 64.36% and is trying to flip a bearish bias by making a Lower High

- Instead of asking everyone the same question when will we see an Altcoin Run/Rally the answer to all your questions is here

- You will only see an Altcoin run when you see BTC.D crashing and BTC either staying stable or pumping hard

- BTC D depicts the flow and rotation of money in BTC when compared to other Cryptos

- Once money starts revolving out of BTC it usually flows into major alts and other Alts

- Easy explanation: Once Bitcoin D and USDT D flips majorly bearish you will see a major rally in alts as shown in the Bearish Path if not you will see a huge dump in Alts if BTC D jumps to 72%

Bitcoin Dominance (BTC.D) about to hit the given levelBitcoin Dominance (BTC.D) measures Bitcoin’s market capitalisation as a percentage of the total cryptocurrency market cap. It’s a key metric for understanding market sentiment, reflecting whether investors favor Bitcoin (BTC) over alt coins or vice versa. Technical analysis of BTC.D involves studying its chart patterns, indicators, and levels to gauge potential market trends, such as Bitcoin strength or alt coin season.

Chart for your reference

-- Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources and X posts. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

Bitcoin Dominance Just Hit a 1,505-Day High — Are You Paying Att🚨 Bitcoin dominance has been climbing non-stop for 959 days... and it just broke a 1,505-day high, hitting 64.34%.

That’s not just a stat — that’s a clear signal.

Bitcoin is still the king. 👑

Rejection Level: 66%-72%

Be honest… do you own any?

Bitcoin Dominance 1D Setup - Bitcoin D is currently trading at 58.26%

- Bitcoin D is going to be the biggest indicator to track when Alts will bounce

- Bitcoin D has changed its market structure and can soon shift its bias to bearish once we see a weekly close below 56.18%

- 90% of altcoins are struggling to make a comeback and stay strong for long as BTC D and Bitcoin is outperforming ETH since quite long

- One thing to notice for all Trader/Investors is going to be ETH/BTC pair, ETH/BTC on a weekly TF has already bottomed out and it has recently reacted strong and at the same time TRUMP's inaugural is tomorrow where we can see that Trump has added ETH worth 5Million $

- Ethereum is going to be the biggest indicator clubbed with ETH/BTC USDT D once these start outperforming and USDT D underperforming ETH will print 50-60% and maybe purge a new high and that will lead to an altcoins rally

Bitcoin Dominance Bearish Setup for Crypto Bull Run- Bitcoin Dominance is currently trading at 60.08%

- Bitcoin Dominance is the biggest reason behind ALTCOINS dumping hard since months.

- BTC D market structure will shift bearish once we see a weekly close below 58.57%

- BTC.D under 58% will trigger an impulsive move in Altcoins and that can lead to a huge rally in alts worth 300-500%

- Bitcoin Dominance dumping might also lead to a parabolic shift in ETH/BTC.

- Ethereum and other alts will jump hard only when this dumps, 2 zones I am looking for to expect a reversal from for BTC D is 64 and 72 for a worst case scenario.

Bitcoin Dominance & Altcoins Crash/Pump Analysis Correlation- Bitcoin Dom has broken out of its long weekly consolidation supply

- Bitcoin Dominance is now making all the Altcoins bleed

- Bitcoin Dom signifies that the money is flowing more into Bitcoin and getting pulled out from other cryptos to Bitcoin

- The current situation only looks Bearish for Altcoins and Bullish for Bitcoin

- However to see an ultimate rally in Altcoins we will have to see a strong rejection in BTC DOm and USDT Dominance

- Prepare yourselves and your Fiat accordingly

Bitcoin Dominance Altcoins Update - Bitcoin Dominance is currently looking bullish on a daily timeframe

- Bitcoin Dominance bearish is a green signal for Altcoins holders

- Once you see Bitcoin Dominance getting rejected from the 56-57% level altcoins will recover the partial dump they all made recently

- Altcoins bags exposure will be right once you see dominance trading at supply

- Buying altcoins when Bitcoin dominance is trading at demand is always a bad choice

Bitcoin Dominance Analysis- Bitcoin Dominance is currently at a stage where it can either

1) Take a small pullback and let Altcoins breathe

2) Move up more from here and we might only see a reaction around 55

- Bitcoin Dominance is very underrated when it comes to following this as an Index

- I think this should be considered as a preliminary when it comes to Trading Cryptos

3) Do not take many confluences before Trading as well

$BTC.D Buckle up, Altcoin Fam!CRYPTOCAP:BTC.D Expecting the true alt season to arrive later. Bitcoin Dominance Index is currently consolidating for its last legup, potentially reaching 60% or beyond in the coming months.

This isn't a signal to sell, but a suggestion to buy more. The real altcoin excitement is still ahead. #Bitcoin #Altseason

Every Signal is Greed | Short BiasOn Week Chart

I found the same condition in the past when BTC's downed

- RSI Overbought

- ADX move up to 84, I marked the yellow line at 84 you can see on the chart

- BTC Dom has rejected at 55%

So I think BTC will pullback soon and $50K can be a support

Time will tell

Bitcoin Dominance Trade Setup- Bitcoin DOM is currently moving sideways but BTC DOM itself can help you easily predict where the money is going to flow next

- With the help of this correlation your bias becomes easier and you know where to focus instead of just technical analysis

- If BTC Dom starts moving up from here then you need to stay a little cautious about your Altcoins entries, I would suggest having patience and letting it soar until you see it getting rejected

- If BTC Dom starts to move down impulsively all you have to do is let your winners run and if you don't have any then focus on building partial SPOT Swings.

- Risk on the table shouldn't be breached or expanded if you can't handle it.

Social media outlets are good at portraying and making Trading look pleasing and flashy whereas the real meat is boring and time valued majorly

BTC DOM Bitcoin Dominance Update - Bitcoin Dominance is the major reason behind Altcoins falling badly

- Bitcoin dominance is currently rising and trading around 53.7 which looks bullish

- I expect it to retrace and fall back again from its overhead supply

- You should look to add alts once it's near the supply it might pierce it a little and then fall back too

- Do not get trapped