Bitcoin Long-Term Channel Analysis | BTCUSD to $163K Target |Bitcoin is currently respecting a multi-year ascending channel on the weekly chart. The price recently touched the lower trendline support, suggesting that the long-term structure is still intact.

This setup highlights a classic “higher highs and higher lows” pattern within the parallel channel, showing that BTC continues to follow its historical rhythm of expansion and correction phases.

Observations :

• Channel support: around $90,000 – $95,000 zone

• Channel resistance: projected near $160,000 – $165,000

• 200 EMA on the weekly chart near $66,000 providing long-term trend support

• RSI showing signs of recovery from the mid-zone

Technical Outlook:

If Bitcoin maintains the current channel support and forms a bullish reversal candle on the weekly close, the next leg of the rally could target $160K+ within the same channel structure.

Invalidation occurs on a confirmed weekly close below $90K, which would signal a potential trend shift.

Market Sentiment : Bullish (Long-Term)

Timeframe: Weekly

Style: Positional / Long-Term Analysis

Disclaimer: This is a personal technical view for educational purposes, not financial advice.

Btcsignals

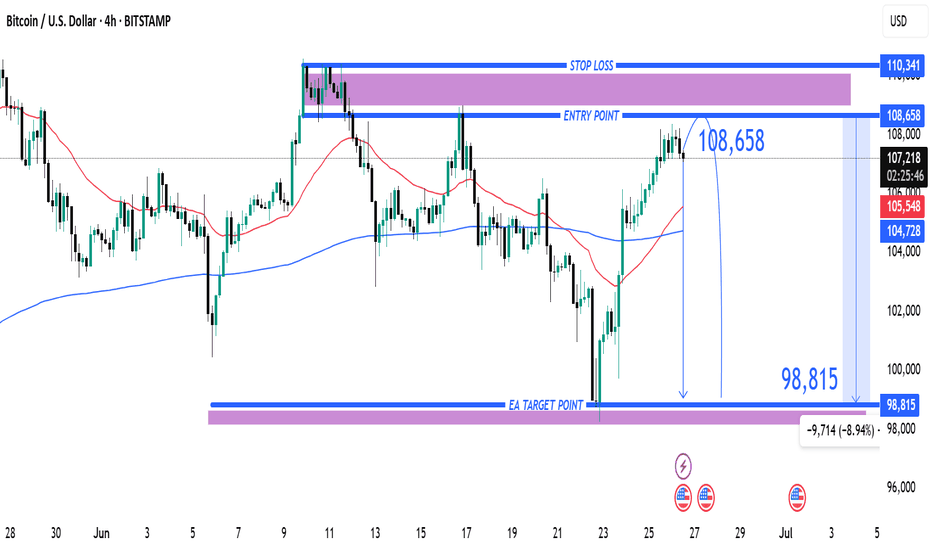

Entry at $108,658 with Target at $98,815 and Stop Loss at $110,31. Entry Point: 108,658

This is where the trader expects to enter a short position.

Price is projected to reverse near this level.

2. Stop Loss: 110,341

Located above the entry point.

If price hits this level, the short trade is invalidated, limiting losses.

3. Target (Take Profit): 98,815

This is the EA Target Point, about 9,714 points (~8.94%) below the entry.

Represents a favorable risk-reward ratio.

---

🔄 Trade Idea Summary

Trade Type: Short (Sell)

Risk: ~1,683 points (110,341 - 108,658)

Reward: ~9,843 points (108,658 - 98,815)

Risk-Reward Ratio: ~1:5.85 (which is strong)

---

📊 Technical Indicators in Use

Moving Averages:

Likely 50-period (red) and 200-period (blue) MAs.

The 50 MA is below the price, indicating short-term bullishness.

However, the trade idea goes against this short-term trend, suggesting a reversal strategy.

---

🔍 Interpretation & Strategy

This chart implies the trader expects resistance near 108,658, possibly due to historical highs or supply zones.

The bearish outlook expects a significant drop to 98,815, possibly supported by macro patterns (like head & shoulders, or bearish divergence—not shown here but could be inferred).

The purple zones highlight high-probability reversal or reaction areas (support/resistance zones).

---

⚠️ Things to Watch

Invalidation: If price closes above 110,341 on a 4H/1D chart, the trade setup fails.

Confirmation: A strong bearish candlestick at or near the entry zone would strengthen the case.

Market Context: News, economic data, or BTC ETF inflows/outflows can quickly invalidate technical setups.

Trade Idea: SELL BTCUSD at 78,200 – 78,500🧠 Technical Analysis (1H Chart):

Key Resistance Zone: 78,200 – 78,500 USD

Price has consistently failed to break above this area.

Multiple rejections from this zone suggest a strong supply zone.

This area aligns with historical resistance + EMA confluence.

Trend Structure:

Price formed a lower high and shows signs of a short-term bearish reversal.

Breakdown from minor support at 77,800 confirms weak momentum.

Current price action shows hesitation with reduced buying volume.

Volume Analysis:

Large red volume bars signal strong seller presence near resistance.

Weak green candles near resistance imply exhausted buying interest.

🎯 Trade Setup:

Entry Zone: SELL from 78,200 – 78,500 USD

Stop Loss: Above 79,600 USD (just beyond strong resistance zone)

Take Profit:

TP1: 70,000 USD – major support & volume node

TP2: 68,000 USD – high probability support zone from recent base

📊 Risk-to-Reward (R:R): Approximately 1:3 to 1:4 – ideal for swing or short-term positional trades.

🚀 Follow me for more high-probability trading opportunities! 🚀

Bitcoin Analysis Yesterday, we didn’t get a clear breakout and the market remains stuck between two level like forming red green pattern.

This chart shows the Bitcoin-to-USD (BTC/USD) price action, likely on the 1-hour timeframe, with indications of a potential bearish movement. Here’s a quick analysis based on the provided image:

Key Observations:

1. Current Price: The price is around $94,921, showing a slight decline (-0.23%).

2. Ascending Channel: The chart indicates a rising channel (black trendlines) that is nearing its upper boundary, suggesting potential exhaustion of the upward momentum.

3. Resistance Zone: A purple rectangle marks a resistance area where the price has struggled to break through.

4. Bearish Rejection and Projection:

• The price appears to be consolidating near the upper trendline but lacks strong bullish momentum.

• An arrow indicates a potential breakdown from the channel, aiming toward lower levels around $93,000.

5. CCI Indicator:

• The Commodity Channel Index (CCI) shows a decline from overbought territory (above 100), indicating bearish momentum could be building.

Potential Scenario:

• Bearish Breakdown: If the price breaks below the ascending channel, it could test the $93,000 level or even lower to the $92,000 support zone.

• Invalidation: If the price breaks above the resistance zone and holds, the bearish outlook would be invalidated, leading to further upward movement.

Trading Suggestion:

(Don’t follow me blindly as I am not a certified trader)

• Consider short positions if the price breaks below the channel and confirms with volume or candlestick patterns.

• Monitor support zones near $93,000 and $92,000 for potential profit-taking or reversal signals.

• Place a stop-loss above the resistance zone to manage risk.

BTCUSD 4 HR ANALYSIS | SHORT TRADE🚀 Bitcoin (BTC) Price Analysis - 4-Hour Timeframe 📊

Chart Overview:

Current Price: $96,935.44

Timeframe: 4-Hour chart

Date Published: December 20, 2024

Key Features:

Trend Channe l: The chart illustrates a red ascending channel that represents the previous upward trend in Bitcoin’s price.

Support and Resistance Levels:

Resistance Level : Identified at $99,612.38

Support Level : Identified at $89,438.39

Price Movement : Recently, there has been a significant price drop depicted on the chart.

Potential Drop: A green arrow indicates a potential price drop of 9.30%, equating to -$9,171.21.

Discussion Point : The chart poses the question, “Can Bitcoin drop 10% from next week (23 Dec 2024)? Comment what you think?

Analysis :

The ascending trend channel suggests that Bitcoin has been in an upward trend.

The recent price action shows a breach of this channel, hinting at a possible trend reversal.

Key support at $89,438.39 needs to be monitored, as a break below this level could confirm further downside.

The potential 9.30% drop indicates market uncertainty, potentially leading to a larger correction.

Conclusion: Monitor the key support and resistance levels closely. The breach of the ascending channel and the significant price drop could suggest a trend reversal, warranting caution for bullish positions. Stay tuned for updates as we approach the critical date of December 23, 2024.

Note - This is Only for education purpose.

Follow and give Like

BITCOIN BELOW 50K❗❗❗❗SELLWorst case scenario it will go below 50K.

As you guys already knew the geopolitical tension.

Middle East getting worsen.

Oil is about to explode up because oil supplies can't transfer properly

through ships and so asset will move to safe haven.

BITCOIN is consider risky as of now by the market.

And halving is on the way .but this time is different.

Learn to analysis by yourself.

BTC/USDT: Anticipating a Correction from Key Resistance Zone?In this BTC/USDT technical analysis, we analyze the current price action and market trends to identify potential trading opportunities. The analysis suggests that BTC/USDT might experience a corrective phase from a significant resistance zone.

Analysis :-

BTC/USDT is currently facing a crucial resistance zone in the range of 30200 to 30400.

Historical price data indicates that this area has acted as a Point of Interest (POI) in the past, causing price reversals. Consequently, there is a likelihood that BTC/USDT could experience a bearish pullback from this critical level.

Considering the prevailing market conditions, we anticipate a corrective move in the BTC/USDT pair. Our analysis points to potential support levels at 29000 and 27500.

Traders should closely monitor price action around these areas as they might present buying opportunities if BTC/USDT respects these support levels.

Examining the micro and macro trend:-

The micro-trend, based on short-term price movements, is currently bearish, indicating the potential for a downside correction.

However, the macro trend, considering the broader market perspective, remains bullish, suggesting that the long-term bullish sentiment is still intact.

In conclusion, our BTC/USDT technical analysis indicates that the cryptocurrency pair is likely to encounter resistance in the 30200-30400 range, potentially leading to a corrective phase.

We expect the price to correct towards support levels at 29000 and 27500. Traders should exercise caution and closely monitor price action at these levels for potential buying opportunities.

Remember to stay informed, manage risks wisely, and trade responsibly. Happy trading!