BTC Market Update – Bullish Trend RebuildingBTC Market Update – Bullish Trend Rebuilding

The market structure on Bitcoin highlights a sequence of expansion, consolidation, and sharp corrective phases. After reaching a peak around 115,000, the price shifted into a prolonged sideways phase, where liquidity built up before a decisive breakdown. This breakout introduced stronger bearish momentum, driving price toward lower ranges.

Currently, Bitcoin is stabilizing around 109,500 after the decline, with price action suggesting a potential extension into deeper liquidity zones near the lower range before regaining upward momentum. The projected flow reflects a scenario where downside movement acts as a liquidity sweep, providing the conditions for buyers to re-engage.

The broader outlook remains constructive. Even with short-term pressure favoring the downside, the long-term structure still supports recovery potential. A strong reaccumulation phase could lift Bitcoin back toward the 115,000 zone, aligning with the market’s tendency to reclaim imbalance after periods of sharp displacement.

Btcupdate

Bitcoin Testing Resistance with Potential Pullback AheadKey observations:

Range Breakout: Earlier, Bitcoin broke out of a consolidation zone (marked box), which triggered the recent upward move.

Resistance Zone: Price is hovering near the 5.15%–5.42% gain zone, where selling pressure has historically emerged.

Pullback Signal: The drawn arrow suggests a possible rejection at this resistance, pointing to a corrective move down toward the 3% zone.

Momentum Check: If BTC fails to hold above this resistance, a retracement is likely. However, a strong breakout could open the door toward 6% gains.

📌 Conclusion:

Bitcoin is at a decision point. Rejection at resistance could bring a pullback toward 2.8%–3.0%, while a breakout above 5.4% would continue the bullish momentum.

BTC Buy Zone Forming – Potential Bullish Breakout AheadAnalysis:

Trend Structure: After a corrective decline from the $124K resistance area, BTC has rebounded strongly, forming a rising channel (highlighted in blue).

Support Levels: Strong demand observed near $107,200, aligning with the 0.868 Fibonacci retracement, making it a crucial support zone.

Buy Zone: Chart highlights the $114K–$116K range as a buy zone before continuation of the upward trend.

Resistance Levels: Key resistance remains around $124K–$126K, which is the next major target if the bullish momentum sustains.

Outlook: As long as BTC stays above $114K support, the bias remains bullish, with a potential rally towards $120K–$124K. A breakdown below $112K would invalidate the bullish scenario.

✅ Bias: Bullish continuation

🎯 Targets: $120,000 → $124,000

🛑 Invalidation: Break below $112,000

“BTC/USDT at Crossroads | Key Levels to Watch🔎 Chart Analysis – BTC/USDT (45m)

Resistance Zone: Around 112,586 – 113,200 USDT. Price has tested this area multiple times but failed to break out, confirming strong selling pressure.

Support Zone: Around 107,529 – 108,400 USDT. Buyers have consistently defended this zone, making it a key demand area.

Current Price: 110,720 USDT, sitting in the middle of support and resistance.

📌 Scenarios:

Bullish Case 🟢🚀 – If BTC breaks above 112,586 USDT, momentum could push toward 113,500+ USDT.

Bearish Case 🔴📉 – If BTC fails to hold 109,349 USDT, price may retest the deeper support around 107,500 USDT.

⚖️ Trading Plan Idea:

Long Entry: Above 112,600 breakout ✅

Short Entry: Below 109,300 breakdown ❌

Target Zones:

Upside 🎯 → 113,500+

Downside 🎯 → 107,500

BTCUSDT Bearish Pattern with Key Support RetestAnalysis:

The chart shows Bitcoin (BTCUSDT) forming a harmonic pattern that signals potential bearish continuation. Price is currently retesting a critical support and resistance level around the 113,000–114,000 zone. If this level fails to hold, further downside movement is expected.

Pattern Formation: The harmonic structure (XABCD) suggests a bearish setup.

Support Zone: Around 110,900–111,000, a crucial level to watch.

Downside Target: If support breaks, the price could move toward the 99,000–100,000 strong supply zone.

Volume: A noticeable volume build-up supports potential continuation to the downside.

📉 Outlook: Bearish bias. A breakdown from current retest levels may accelerate selling pressure toward the 100k psychological zone.

BTC/USDT Technical Analysis – Key Levels & Trend Outlook📊 BTC/USDT Technical Analysis – Key Levels & Trend Outlook 🚀📉

🔹 Trend Structure

Price is currently trading above the trendline, suggesting bulls are still in control, but momentum has weakened.

🔹 Support Zones

Immediate Support: 🔵 $111,739

Price recently tested this level and bounced, showing demand from buyers.

Key Mid-Support: 🔵 $100,242

Strong historical level where buyers stepped in multiple times.

Major Demand Zone: 🟪 $95,243 – $96,500

Highlighted purple support box; this is a critical accumulation zone where bulls are likely to defend strongly.

🔹 Resistance Levels

Near-term resistance: Around $120,000 – $124,000 (recent swing highs).

A breakout above this zone could fuel a new bullish rally.

🔹 Market Outlook

✅ Bullish Bias as long as price respects the green trendline and stays above $111,739.

⚠️ If the price breaks below $111,739 and the trendline, expect a deeper pullback toward $100,242 or even the major demand zone $95,243.

🚀 A breakout above $120K will signal strong continuation to new highs.

📌 Summary:

Trend: Uptrend ✅

Key Supports: $111,739 → $100,242 → $95,243

Resistance: $120,000 – $124,000

Bias: Bullish above $111K, cautious below 🔻

"Bitcoin Eyes $100K Re-Entry: Retest, Support Zone, Then Push ?Chart Analysis

1. Price Structure & Trendlines

The chart displays a former upward trendline that has been broken, leading to a corrective pullback.

Following that, price is perched within a “retest zone” (the red-shaded rectangle), which aligns with both historical horizontal resistance—now turning into support—and an area of previous consolidation. This is a classic setup: price often retests key breakout levels before resuming its move.

2. Support Levels

The main support is clearly drawn around the $100K zone, highlighted by a grey bar below the retest zone. This is a psychological and structural area to watch for potential strong buying.

Immediate support appears near $110K–$112K, as noted by the lower edge of the red retest area—this zone has shown to catch corrections before in technical analysis and news reports

AInvest

Mudrex

Barron's

.

3. Resistance & Upside Targets

If the retest holds, the chart charts a potential bounce toward the upper rising trendline and beyond, potentially aiming for the $126K–$130K region, as marked by Fibonacci retracement levels.

This aligns with several external forecasts suggesting resistance or target zones in that range

AInvest

Mudrex

Barron's

.

4. Potential Price Path & Scenarios (Denoted by Red Arrows)

Bearish Scenario: Price may dip down into the retest zone, test support, and—if the breakdown occurs—continue lower toward $100K—a key area of interest.

Bullish Scenario: The support holds, leading to a V-shaped recovery that propels price back above $115K, potentially triggering a rally toward $122K–$130K.

Summary Table

Key Zone / Level Significance & Note

$110K–$112K Critical near-term support; breakdown risks move toward $100K

AInvest

Mudrex

Retest Zone (~$114K–$115K) Area combining horizontal support and trendline; serves as pivot for next move

Mudrex

AInvest

$120K–$123K Major resistance where a breakout could fuel continuation toward $127K–$130K

Mudrex

Barron's

Broader Context & Market Sentiment

Bitcoin is currently consolidating after setting new highs near $124K

MarketWatch

The Economic Times

Barron's

Cointribune

.

Analysts observe that sustaining above the $110K–$112K band is essential to the bullish case; falling below it could invite deeper downside

Barron's

Cointribune

AInvest

.

Conversely, a decisive move above $120K–$123K could validate continuation toward $127K–$130K, and even higher—some forecasts extend to $135K and beyond

Mudrex

Indiatimes

Barron's

CoinCodex

.

Final Thoughts

Your chart beautifully illustrates the classic “retest after breakout” dynamic:

Hold above the retest zone? Look for a rebound toward $120K+, with the potential for a full bullish revival aiming for $130K.

Break below $110K–$112K? Watch for a possible move toward $100K—a critical support level.

Stay alert to macro catalysts too—like Federal Reserve interest rate signals, institutional inflows (ETFs), and regulatory developments—which could steer the next leg substantially

Bitcoin at a Critical Support – Breakout Toward $119K or ?Ascending Channel Breakdown – Price previously respected a rising green channel but broke below, showing weakness.

Critical Support Zone: Around $111,946 – $114,000 (black trendline + yellow support area).

Resistance Levels:

Near-term: $115,100 – $115,582

Strong: $119,582 (highlighted as major upside target)

Volume Profile: Declining volume with recent dip → signals possible accumulation before the next move.

Ichimoku Cloud: Price is slightly below cloud, indicating short-term bearish bias but with potential rebound if reclaimed.

Scenarios:

Bullish Case (Blue/White Arrows): If BTC holds above $114,000 support and breaks $115,500, a rally toward $119,500+ is possible.

Bearish Case: Failure to hold $114,000 may trigger a drop toward $111,946 (major demand zone).

BTC - 15th Aug - Buy Price as shown in chart around 118 and below is 2nd wave support and buy zone for upper 3rd wave. Trend is Bullish. SPX open higher than yesterday is bullish. I am expecting BTC moving to again new ATH or at least previous high. Risk - big players may manipulate to get their liquidity ... they too need to buy before pushing price to upside.... hold 50 to 60% long in BTC and hold tight for higher levels in coming days or even for today. All US , Europe Data is +ve for US equity and BTC. Dollar Index is crashing as expected fiat money. BTC will go up for sure

BTC/USDT: Bullish Momentum and Key Support LevelsUptrend Channel: The price is trading within an ascending channel, denoted by two parallel black trendlines. This suggests a bullish trend is in play.

Support and Resistance:

A significant support zone is identified between approximately 112,000 and 114,000 USDT.

A weak supply zone is marked around 118,000 USDT. The price has recently tested this area and found some support.

A strong resistance level is visible at approximately 124,564.86 USDT.

Indicators:

Ichimoku Cloud (9, 26, 52, 26): The price is currently trading above the cloud, indicating a bullish sentiment. The cloud itself appears to be thin and slightly bullish, suggesting potential for continued upward movement.

RSI Strategy (14, 30, 70): The Relative Strength Index (RSI) is used as a strategy, with a "RSILE" signal (likely "RSI Low Entry") marked with a "+2" and a red arrow, suggesting a potential buy signal near the support zone in early August. A "-2" signal is marked near the top of the channel, indicating a potential overbought condition or reversal signal.

Price Action and Projections:

The price recently experienced a sharp decline from the upper trendline, indicating profit-taking or resistance at that level.

The price is currently near the lower trendline and the "weak supply zone," which appears to be acting as support.

A potential future price path is drawn with a blue arrow, suggesting that the price may consolidate or bounce off the current support area and move higher towards the upper boundary of the channel.

Another potential path is drawn with a red arrow, showing a possible further drop towards the lower trendline before a bounce.

BTC/USD Eyeing Breakout Toward $121.5K – Supply Zone Retest ?Current Price: ~$119,872 showing consolidation just above the 0.618 Fibonacci retracement level.

Structure: Price has bounced from the supply zone (~118.4K–118.6K) and is currently pushing upward.

Ichimoku Cloud: Price is trading within a cloud breakout attempt, indicating potential bullish momentum.

Fair Value Gaps (FVG): Two unfilled FVGs above suggest liquidity targets at ~$120.6K and ~$121.5K.

Support Levels:

Strong Support: ~$115.8K–116.5K.

Local Supply Zone Support: ~$118.4K.

Target: Main upside target sits at $121,533, aligning with a prior high and liquidity pool.

Trade Plan (Long Setup):

Entry: $119,700 – $119,900 (current consolidation zone)

Stop Loss: Below $118,400 (below supply zone)

Take Profit 1: $120,600 (first FVG target)

Take Profit 2: $121,533 (major resistance/liquidity target)

Risk/Reward Ratio: ~2.8

Notes: Wait for a bullish confirmation candle or 1H close above $119,900 before entering. Avoid chasing if price spikes without retest.

This plan follows the chart’s bullish structure and aims to ride the move into the untested liquidity areas above.

If you want, I can also give you a short scenario plan in case price rejects here. That would make this a full two-way trade setup.

"BTC Hits Premium Zone – Is $117K the Next Stop?""BTC Hits Premium Zone – Is $117K the Next Stop?"

Bitcoin has rallied into the $121,000–$123,000 resistance zone, aligning with a Fair Value Gap (FVG) and a Breaker Block, both of which are high-probability reversal points in Smart Money Concepts (SMC). This region represents a premium pricing area, where institutions often take profits and trigger retracements.

Key Observations:

Liquidity Sweep: Prior highs have been taken, potentially fulfilling buy-side liquidity objectives.

Breaker Block Resistance: Price is currently reacting to this zone, indicating sellers stepping in.

Fair Value Gap: The unfilled imbalance between $121,000–$123,000 is acting as a short-term supply area.

Projected Retracement: A move down toward $117,000 is anticipated, coinciding with prior structure support and a liquidity pocket.

Technical Levels:

Resistance Zone: $121,000–$123,000

Target Zone: $117,000 (first key support)

Major Support: $112,000–$113,000 range

Bias: Short-term bearish toward $117,000 before potential continuation, unless price closes strongly above $123,000, invalidating the reversal thesis.

BTC - will the history repeat now ? 6th Aug 2025 viewIn Bitcoin previous patterns repeat and many people refer to previous year or earlier pattern.

The price at which price took support and moving up now is similar to the move in below levels in chart as shown and explained. only difference now is in the below pattern wave 3 was much earlier and very aggressive but right now its much lower level tested and yet to move up and show signs of wave 3 to confirm whether history will repeat or not. price action this week is crucial for Bitcoin

BTC - revised TP is 130K - Logic explainedI agree two times support for completion of wave 4 got broken but due to news flow other wise logic given in previous charts are based on confirmation of support. Now this may not go wrong. First resistance is at 116K and mean revision level is 118, once we cross these two level every analyst agree we will make new ATH and that level is 130 as per my calculations for wave 5. This is minimum level and it can be more higher as well like 150 , 180K which many people talking with their logics which i agree too. I am saying 130 is minimum we will see this year 2025 by sooner for sure.

BTC - 1st Aug view - 4th wave revised and new TP - 133KBig players played a false move to shake weak hands when US data, trade deals, crypto policy etc etc favoring continuation of impulsive move. But its big players deliberate move to generate liquidations and get bigger qty of bitcoins.

Now

As per revised 4th wave shown in green line and black was earlier given wave counts.

There is no 100% accurate levels and its based on demand and supply when ever big players and algo wants to move the price either side.

In case price move above 116030 then i wish to consider 4th wave is done and we move towards 133K even if its not going to happen then also mean revision or rejection comes above 118K only and risk to reward Favours buying this dip or hold with money management.

Tariff news is not at all a impacting factor for economy as US customers going to choose the better deals and move on. every day importers and exporters compete with each other. countries compete with each other. why BTC which gets higher price due to fiat money printing get impacted now. its all big player games i think

Resistance Breakout Expected in BTC/USDBitcoin is currently testing a key horizontal resistance near the $118,600 zone. After a sharp recovery from recent lows, the price is consolidating just below this level, indicating a potential breakout.

🔍 Chart Insights:

Price action forming higher lows, showing strength.

Breakout above the marked resistance may trigger a strong bullish move.

Tight consolidation near resistance suggests bulls are preparing for a push higher.

📈 Trade Setup:

Entry: Above $118,600 breakout

Target: $119,188 and beyond

Stop-loss: Below $118,200

If price sustains above resistance with volume confirmation, BTC/USD could witness fresh momentum on the upside. Stay alert for the breakout candle.

BTC/USD Bullish Reversal Breakout Pattern BTC/USD Bullish Reversal Breakout Pattern 🚀

Technical Analysis:

🔹 Trend Reversal: The chart shows a clear inverse head and shoulders pattern highlighted with orange circles — a strong bullish reversal signal after a downtrend.

🔹 Breakout Zone: The neckline resistance around 108,000 USD has turned into support (marked as “SU00QT” due to a typo, assumed to be “SUPPORT”). Price action is consolidating just above this zone.

🔹 Trendline Support: The upward blue trendline confirms bullish structure, with price forming higher lows. Recent price action is bouncing off this trendline, showing strength.

🔹 Bullish Confirmation: Green arrows indicate strong bullish rejections from key levels, aligning with breakout retests.

🔹 Target Projection: The measured move from the inverse head and shoulders pattern projects a target towards the 114,000 USD resistance zone 📦 highlighted above, suggesting a potential 5-6% upside move 📊.

Conclusion: As long as price holds above the 108,000 support zone and the ascending trendline, BTC/USD remains bullish with potential continuation towards 114,000 USD. A breakout above minor consolidation could trigger a strong bullish rally 💥.

🛑 Invalidation: A sustained break below 106,000 USD would invalidate the bullish structure and may lead to further downside.

BTC/USD Consolidation Breakout SetupChart Overview:

The BTC/USD chart shows a strong bullish impulse followed by a consolidation phase just below a key resistance level, suggesting a potential bullish continuation.

🔹 Key Technical Zones:

📍 Support Zone:

105,368 – 106,481 USD

This area acted as a strong demand zone where price reversed aggressively.

📍 Resistance Level:

107,439 – 107,840 USD

Price is currently consolidating just below this resistance, indicating a buildup for a breakout.

🎯 Target Zone:

110,683 – 111,394 USD

A clean breakout above resistance could push price into this target area.

🔹 Technical Signals:

✅ Bullish Flag Formation:

After a strong impulse move, BTC is forming a sideways range, indicating bullish accumulation.

⬆️ Breakout Potential:

A confirmed breakout and retest above 107,840 could validate a move toward the 111K region.

⚠️ Invalidation Point:

A drop below 106,481 would invalidate the bullish bias and may trigger a deeper pullback.

📌 Conclusion:

As long as BTC holds above the 106,481 support and breaks above the 107,840 resistance, bullish momentum is expected to continue toward the 111K zone. Traders should watch for a breakout confirmation and manage risk accordingly. 💹

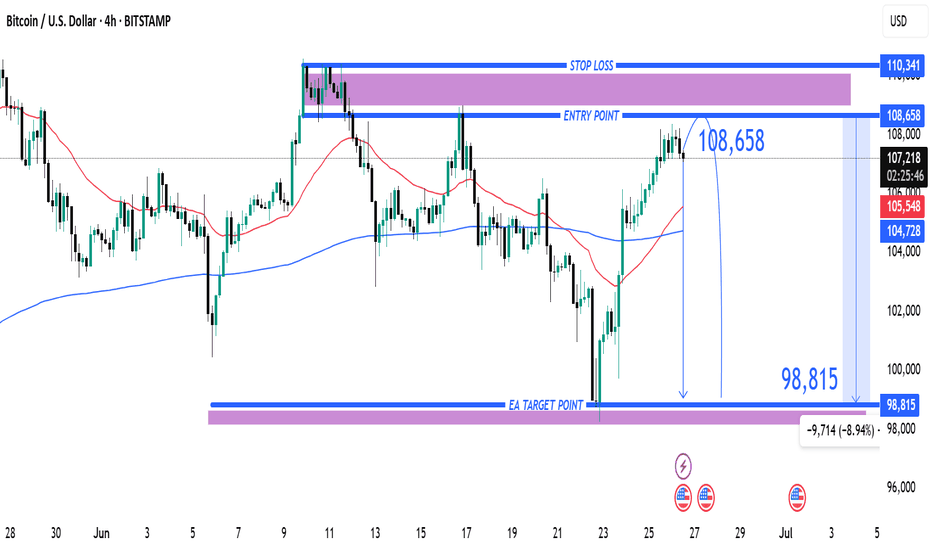

Entry at $108,658 with Target at $98,815 and Stop Loss at $110,31. Entry Point: 108,658

This is where the trader expects to enter a short position.

Price is projected to reverse near this level.

2. Stop Loss: 110,341

Located above the entry point.

If price hits this level, the short trade is invalidated, limiting losses.

3. Target (Take Profit): 98,815

This is the EA Target Point, about 9,714 points (~8.94%) below the entry.

Represents a favorable risk-reward ratio.

---

🔄 Trade Idea Summary

Trade Type: Short (Sell)

Risk: ~1,683 points (110,341 - 108,658)

Reward: ~9,843 points (108,658 - 98,815)

Risk-Reward Ratio: ~1:5.85 (which is strong)

---

📊 Technical Indicators in Use

Moving Averages:

Likely 50-period (red) and 200-period (blue) MAs.

The 50 MA is below the price, indicating short-term bullishness.

However, the trade idea goes against this short-term trend, suggesting a reversal strategy.

---

🔍 Interpretation & Strategy

This chart implies the trader expects resistance near 108,658, possibly due to historical highs or supply zones.

The bearish outlook expects a significant drop to 98,815, possibly supported by macro patterns (like head & shoulders, or bearish divergence—not shown here but could be inferred).

The purple zones highlight high-probability reversal or reaction areas (support/resistance zones).

---

⚠️ Things to Watch

Invalidation: If price closes above 110,341 on a 4H/1D chart, the trade setup fails.

Confirmation: A strong bearish candlestick at or near the entry zone would strengthen the case.

Market Context: News, economic data, or BTC ETF inflows/outflows can quickly invalidate technical setups.

Bitcoin - Interesting Price Action in 1 HTFTRADERS AND INVESTORS,

The Bitcoin chart presents an interesting setup on the 1-hour timeframe (1 HTF). Here's a breakdown of recent price action:

Initial Resistance & Downtrend : Bitcoin's chart indicated potential trend changes, with significant selling pressure at the $106,000 mark establishing a clear resistance level.

Downtrend Confirmation & Support : This was followed by a series of lower highs, confirming a downtrend. Subsequently, Bitcoin found support and bounced from the $98,000 level.

Potential Reversal Signal : The recent upward movement cleared sellers' stop-losses, which could be an early indication of a potential trend reversal.

WHAT MIGHT HAPPEN NEXT?

Currently, Bitcoin is re-testing the crucial $106,000 resistance level.

Bullish Scenario : A confirmed breakout and sustained move above $106,000 could signal the continuation of an uptrend.

Bearish Scenario : Conversely, a strong rejection from this level might lead to a decline, potentially targeting the $101,000 support.

Current Stance : At present, this area appears to be a no-trade zone due to the indecisive price action.

Disclaimer : This analysis is for educational purposes only and should not be considered financial advice. Always conduct your own research before making investment decisions.

Bitcoin Bounce Alert: Holding the $100K Fortress! 📉 Market Context & Technical Levels

Key support at ~$100K: As the chart shows and multiple analysts confirm, this level continues to act as a strong defence zone. Cointelegraph noted bulls have been “defending the $100K key support level strongly,” triggering bounces during dips

Descending channel overhead: Bitcoin has retraced into a downward channel. A clean breakout above ~107K–109K (past recent peaks) is needed to signal a bullish shift .

Liquidity target at ~106K: Plenty of orders await in that region—flipping it to support may pave the way for another push higher .

📊 Indicators & Momentum

RSI dip near 25 during the latest drop indicates oversold conditions—often a precursor to rebounds

.

Volume surge on rebounds suggests absorbing sell pressure and strong accumulation interest at lower levels.

🚩 Key Price Zones to Watch

Level Significance

$100K Crucial support; losing it risks a slide toward $95K–97K or even $92K

.

$105K–106K Liquidity zone; flipping here as support could confirm upward momentum .

$107K–109K Resistance from channel tops and prior highs; a successful break is key to next leg up .

$112K–$112K+ If breakout occurs, upside targets extend toward prior ATH near $112K and beyond .

🎯 Chart Analysis Summary

Your chart shows three distinct bounces from the $100K–100.7K supply zone (highlighted in blue) and the latest one includes a sharp wick and rebound. This aligns with broader market dynamics emphasizing support at $100K and building liquidity at $106K. The arrow projection signals a probable retest of ~106K, with room to challenge ~107–109K after consolidation.

🧭 Trade Outlook

Bullish scenario: Hold above $100K → reclaim $106K → trendline breakout → potential rally to $112K+.

Bearish risk: Fails support at $100K → breakdown toward $95K–92K region.

📌 Bottom Line

Support $100K is alive and well. Bounces have been crisp and volume-backed.

Next test lies at $105–106K. That’s the battleground—flip it, and we may see bitcoin reclaim recent highs.

Watch the channel overhead (~107K–109K). A breakout could open the door to fresh records.

✅ Conclusion: BTC is defending its psychological base firmly. If this zone holds once more, the path to $106K and beyond is in focus. Breaking above demands conviction, but it’s the pivot to watch.