Bitcoin (BTC/USD) Long Trade Setup –with Target 88,573,60Current Price: $80,724.28

Entry Point: $80,671.23 (just above current price)

Stop Loss: $78,052.44

Target Point: $88,573.60

Resistance Point: $82,260.90

📈 Trend & Moving Averages

EMA 30 (red): $80,220.87 — Short-term trend.

EMA 200 (blue): $80,788.61 — Long-term trend.

The price is currently between the EMAs, indicating potential indecision or a shift in trend. A break above both EMAs with momentum would confirm bullish strength.

🔑 Trade Setup Summary

Element Level

Entry 80,671.23

Stop Loss 78,052.44

Target (TP) 88,573.60

Resistance 82,260.90

Risk-Reward ~1:2.7 (approx)

📊 Analysis & Expectations

Bullish Bias: The chart suggests a long trade with a breakout strategy.

Volume and momentum confirmation will be key above resistance.

Resistance at 82,260.90 may cause a brief pullback before continuation to the target.

The stop loss is well-placed below a support zone and the most recent swing low.

✅ What to Watch For

Break and close above EMA 200 and resistance at 82.2K.

Bullish volume increase on breakout.

Price action around the entry zone (wait for confirmation candle if unsure).

Btcusdtrade

BTC/USD) Bullish reversal analysis Read The ChaptianSMC Trading point update

This is a bullish reversal analysis on BTC/USD (Bitcoin to USD) on the 4-hour chart, suggesting a potential long opportunity after a sharp corrective move.

---

Key Breakdown of the Chart:

1. Strong Downward Move with Potential Reversal:

Bitcoin experienced a sharp drop from the 88k region to ~74,387.50, now hitting a key demand zone (marked as "Orderblock").

2. Bullish Reaction Expected:

From the Orderblock support zone, a bullish reversal is anticipated.

The projected move aims to fill the imbalance and test the target zone between 87,152.94 and 88,557.14.

3. RSI Oversold:

RSI is around 32.27, indicating oversold conditions and adding confluence for a potential bounce.

4. EMA (200):

The 200 EMA lies around 85,153.85, which may act as dynamic resistance on the way up.

Mr SMC Trading point

5. Price Target:

The expected upside move is approximately +13,722.85 points (+18.75%), aiming for the supply zone above 87k.

---

Conclusion / Trade Idea:

Entry Zone: Near 74,387.50, the orderblock/demand area.

Target Zone: 87,152.94 – 88,557.14

Bias: Bullish short- to mid-term reversal.

Confluences: Oversold RSI, clean support zone, potential trendline bounce, and price inefficiency above.

---

Pales support boost 🚀 analysis follow)

BITCOIN MAY DROP TO 74K - BEARISH STRUCTURE INTACTSymbol - BTCUSD

CMP - 84600

BTCUSD is undergoing a shift in market structure, transitioning into a bearish phase following the breakdown at 90K. A deeper correction is currently developing, which, in my view, represents a logical and technically sound progression for a healthy market. It is concerning when the market only experiences upward movement driven solely by buying pressure, such as in the case of large-scale injections of funds into high-yield investment programs (HYIPs).

A correction in Bitcoin’s price or even a trend reversal could inject vitality back into the market. From a fundamental perspective, traders have not seen the expected active support for cryptocurrencies from the US, which was previously suggested during Trump's election campaign. Additionally, issues such as crypto exchange hacks, fraudulent coins, and Bitcoin's dominance are exerting negative pressure on altcoins.

Bitcoin’s current downturn, with the possibility of a further drop to the 75K-73K range, could present an opportunity for fundamentally strong altcoins, assuming the declining Bitcoin dominance index also continues to trend downward. The simultaneous reallocation of funds from Bitcoin to altcoins, along with a rebound in Bitcoin from a strong support level, could rejuvenate the prospects for an altcoin season.

Resistance levels: 88150, 90700

Support levels: 75000, 73570, 66830

A modest retracement towards the 88100 to 90700 range is possible before the price begins its descent. While Bitcoin may attempt a deeper pullback, the current market imbalance, coupled with the absence of a clear driving force or supportive factors, suggests that the price may continue to fall in the medium term, potentially reaching the liquidity zone between 75K and 73K

BITCOIN - LIKELIHOOD OF A SHORT SQUEEZE BEFORE A DOWNWARD SLIDESymbol - BTCUSD

CMP - 84540

BTCUSD continues to exhibit a bearish trend after breaking the bullish structure on the weekly timeframe. There are no discernible bullish drivers at present, and from a technical standpoint, the price is poised to approach the imbalance zone between 75K and 73K.

Recent events, such as the crypto summit and discussions surrounding crypto asset support, have failed to provide substantial backing for the market. These events have historically been followed by further market declines.

From a technical perspective, the market remains in a downtrend, indicative of a global counter-trend. This suggests that the current price movement is contrary to broader market sentiment, which aligns with typical market behavior. On a general scale, key zones of interest include 75K, 73K, and the order block between 69K and 66K.

On a more specific level, attention should be given to the nearest liquidity zones at the higher levels, which may be tested prior to any further declines. These levels are located at 86,697 and 89,397

Key Resistance levels: 85135, 86678, 89397

Key Support levels: 79987, 78173, 73512

Following the false break of the 78K support level, there has been no significant market reaction. The market appears to be consolidating within the 84-85K range, which suggests a weakening of buying interest. Prior to any further downward movement, there may be a short squeeze within the identified liquidity zones, potentially leading to an additional decline.

Bullish Reversal Trade Setup for BTC/USD – 4H Chart AnalysisZone: Around 76,094 USD

This zone aligns with a demand/support area, highlighted by the purple rectangle.

Price has sharply dropped into this zone, suggesting a potential reversal or bounce opportunity.

⛔ Stop Loss

Level: Around 73,312 USD

Placed below the support zone to allow some volatility wiggle room.

A break below this could invalidate the bullish setup.

🎯 Target Point (Take Profit)

Level: 87,271 USD

Risk-to-reward ratio is approximately 1:3+, offering solid trade potential.

This level corresponds to a previously established resistance zone or supply area.

📊 Indicators

EMA 50 (red): ~82,106 USD

EMA 200 (blue): ~85,250 USD

Current price is below both EMAs, suggesting short-term bearish momentum, but this setup banks on a mean reversion or swing back up.

📈 Trade Idea Summary

Parameter Value

Entry 76,094 USD

Stop Loss 73,312 USD

Take Profit 87,271 USD

Risk/Reward ~1:3

Setup Type Bullish Reversal

🧠 Extra Notes

Wait for confirmation (candle reversal pattern) in the demand zone before entering.

Be cautious of fake-outs or breakdowns below support, especially with broader market weakness.

BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:10 RISK REWARD BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:5 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

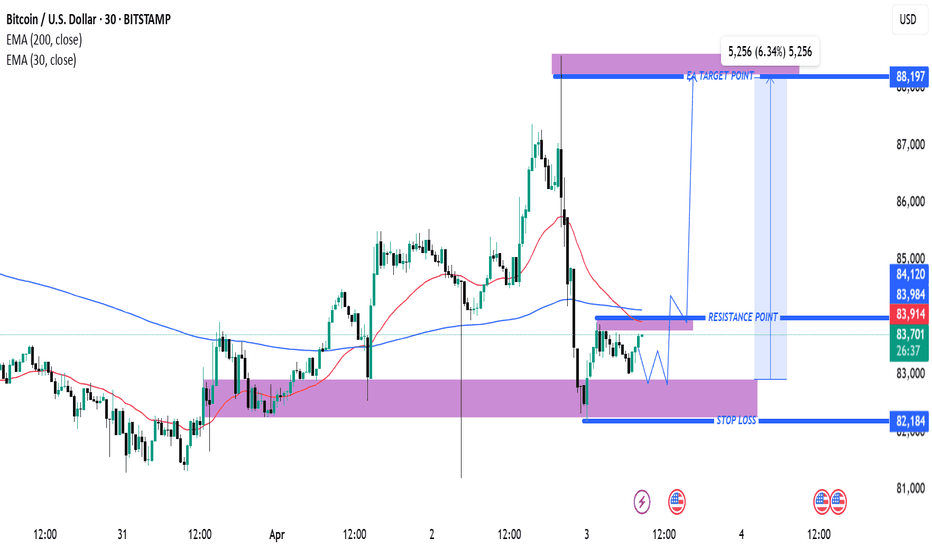

Bitcoin (BTC/USD) Technical Analysis: Breakout or Rejection at K200 EMA (Blue Line): 84,124 – This is a long-term trend indicator.

30 EMA (Red Line): 83,925 – A short-term trend indicator.

Key Levels

Resistance Point: Around 83,925 (marked in blue).

Support Zone: Around 82,184 (Stop Loss zone).

Target Point: 88,197, indicating a potential 6.34% upside.

Potential Trade Setup

Scenario 1 (Bullish Case):

If price breaks above resistance (83,925) and EMA 200, then a move towards 88,197 is expected.

A breakout confirmation might lead to an uptrend continuation.

Scenario 2 (Bearish Case):

If price rejects at resistance (83,925) and falls back below the support zone (82,184), a downward move could happen.

Pattern Analysis:

The chart suggests a potential accumulation phase before a breakout.

Possible retest of resistance before a rally.

Conclusion

Bullish above 83,925, targeting 88,197.

Bearish below 82,184, with potential downside.

Price action near the 200 EMA is crucial for the next move.

Bitcoin (BTC/USD) Short Trade Setup: Resistance Rejection & TargThis chart is a Bitcoin (BTC/USD) 15-minute price chart from TradingView, showing a potential short trade setup based on technical analysis. Here’s a breakdown of the key elements:

1. Resistance Zone & Short Setup

The purple highlighted area represents a resistance level around $85,358.

Price is consolidating within this resistance zone, suggesting a potential reversal.

The expected scenario involves a price rejection from this resistance, leading to a downward move.

2. Moving Averages

EMA (200, blue line) at $83,433: A long-term trend indicator suggesting a strong support zone.

EMA (30, red line) at $84,657: A short-term trend indicator, currently above the price, indicating a potential bearish setup if the price moves below it.

3. Target & Stop-Loss Le

BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:20 RISK REWARD BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:20 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

BTCUSD SHOWING A GOOD UP MOVE WITH 1:10 RISK REWARD BTCUSD SHOWING A GOOD

UP MOVE WITH 1:10 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

(BTC/USDT) Analysis: Supply Zone Rejection & Potential Drop Key Technical Levels:

Supply Zone (~85,296 - 84,835):

The price has reached a supply zone, which is acting as resistance. A rejection from this area could push BTC down.

Support Zone (~82,260 - 81,977):

This is a demand area where buyers might step in if the price declines.

Indicators:

EMA 30 (Red Line - 83,553.82): Short-term trend indicator.

EMA 200 (Blue Line - 83,743.52): Long-term trend indicator, currently above the price, indicating potential resistance.

Price Action & Prediction:

The price has touched the supply zone and is showing signs of rejection.

The blue projected path suggests a potential pullback followed by a drop toward the support zone (~82,260).

If price breaks below the support zone, further downside could be expected.

Potential Trade Idea:

Short Setup: If rejection at the supply zone continues, a short position could target the 82,260 support zone.

Long Setup: If price reaches the support zone and shows bullish reactions, a long position could aim for a rebound toward resistance.

Bitcoin (BTC/USD) 30-Min Analysis: Bullish Breakout Towards $87This chart represents a 30-minute timeframe of Bitcoin (BTC/USD) on the BITSTAMP exchange. Here's a breakdown of the analysis:

Key Observations:

Support and Resistance Zones:

A Fair Value Gap (FVG) support zone is marked in purple around 82,343 - 83,498, indicating potential demand.

Another resistance zone is identified near 85,000, where price might react before moving further.

The final target point is near 87,947, suggesting a potential breakout.

Exponential Moving Averages (EMAs):

The 200 EMA (blue, 83,498) is acting as a dynamic support.

The 30 EMA (red, 83,654) is closer to the current price, indicating short-term momentum.

Trend Analysis:

An ascending trendline supports the uptrend.

The price bounced from the FVG support zone and surged, signaling bullish momentum.

Projec ted Move:

The blue arrow suggests an expected bullish breakout after a retest of the resistance zone near 85,000.

A potential 6.76% gain is anticipated, targeting 87,947.

Conclusion:

Bullish Bias: The chart suggests an upward trajectory.

Key Confirmation: A clean break above 85,000 would validate the target.

Potential Risks: A drop below the FVG support may invalidate the bullish setup.

Bitcoin (BTC/USDT) Short Trade Setup | 30-Min Chart AnalysisThis chart is a Bitcoin (BTC/USDT) 30-minute timeframe trading setup from Binance on TradingView, showing a short (sell) trade setup with a stop loss, entry, and multiple take profit (TP) levels.

Key Observations:

Indicators Used:

200 EMA (blue line at 83,177.82 USDT) – Long-term trend indicator.

30 EMA (red line at 84,064.45 USDT) – Short-term trend indicator.

Trade Setup:

Entry: 84,423.01 USDT

Stop Loss: 85,315.76 - 85,330.89 USDT (Above the recent high)

Take Profit Levels:

TP1: 84,064.45 USDT

TP2: 83,953.94 USDT

TP3: 83,439.48 USDT

Final Target: 81,850.69 USDT

Market Context:

Price recently tested the 30 EMA and is potentially rejecting it.

Bearish outlook: If price fails to break higher, it may drop to TP levels.

Risk-to-Reward Ratio (RRR): Favorable

BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:30 RISK REWARD BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:30 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:10 RISK REWARD BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:10 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

BTCUSDT TRADING POINT UPDATE >READ THE CHPATIANBuddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺️ crypto Traders SMC-Trading Point update you on New technical analysis setup for BTC USDT signals 🚀. BTC list 3 months. Drop 💧. moment close below 👇 big support level now. See tow Big support level. One said close that expect it buying or selling position. 80k close below 1D candle that expect more selling position 49k. ) if not close below 1D back up trand close above 82k 83k expect it more Bullish trend 📈 📈

Key Resistance level 104k

Key Support level 80k 49k

Mr SMC Trading point

Plaes support boost 🚀 analysis follow)

BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:10 RISK REWARD BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:10 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

BITCOIN TESTING $87K - FALSE OR TRUE BREAKDOWN?Symbol - BTCUSD

CMP 87100

BTCUSD has entered a risk zone, exhibiting a breakdown of the key support level. The market's attention is now on the bulls and their ability to maintain their defense. On the daily and weekly timeframes, the price is in a phase of global consolidation following a period of significant upward movement. The focus remains on the $90-91K range, a strong support area that aligns with the broader trend. Currently, a breakdown of support appears to be unfolding.

On the local timeframes (H1 - H4), the price is testing the support of the local channel, as well as the risk zone at 87,000. If the bulls are able to sustain their defense above 86,400 level, Bitcoin could potentially strengthen. In this scenario, the primary target would be $91-92K

Key support levels: 86,400, 85,530

Key resistance levels: 89,400, 91,600

Historically, the most significant price movements tend to occur after a false breakdown. However, the critical factor here is whether the breakout is genuine or false. In this case, confirmation is required — specifically, price consolidation above the key zones and levels.

Regarding my previous BTCUSD analysis, I had projected a decline to the $90K risk zone while Bitcoin was trading around $96-97K at that time. After some consolidation, the analysis proved accurate as Bitcoin dropped to the $90K range.

I believe this recent sell-off has disrupted the previous bullish structure, and a bearish structure is now beginning to take shape. I expect a retracement to the $91-92K range before the downtrend continues.

BITCOIN IS HEADED TO 90K?Symbol - BTCUSD

BTCUSD is reflecting a shift in market sentiment, with its current price action indicating a potential continuation of the ongoing correction. BTCUSD is currently trading within a falling channel pattern, with global market consolidation providing the broader context. There is a possibility of another retest of the 90,000 risk zone. On the medium-term timeframe, Bitcoin has failed to maintain its position near its all-time high, entering the local selling zone below the 99,800 level, and is now within the upper consolidation range. This shift is accompanied by a noticeable negative sentiment within the cryptocurrency market. Altcoins continue to experience persistent declines without any signs of recovery, further highlighting the lack of positive prospects. At this stage, Bitcoin appears to be reacting to the lack of fulfillment of promises from President Trump, as well as ongoing market manipulation and geopolitical tensions. These factors are contributing to the market’s protracted correction phase. New coins created ahead of the U.S. election have siphoned liquidity from the market, adding to the bearish sentiment. This situation, combined with a global trade conflict, has led to a significant market downturn.

Support levels: 95,800, - 91,300, - 90,000

Resistance levels: 1,00,300 - 1,02,670

Technically, Bitcoin may continue its downward movement, potentially testing the 90,000 support level again. As the price approaches this level, the risks surrounding it will increase. Currently, the asset is in a consolidation phase between 95,800 and 1,00,300 which could precede a breakdown and further decline towards 90,000. However, considering Bitcoin’s sensitivity to U.S. political actions, there may be a temporary rise towards the 1,00,300 level before the asset resumes its decline. The likelihood of the price testing the 95,800 level for a breakdown and subsequent fall remains high. However, on a broader scale, the asset still maintains a bullish outlook, with strong support placed in the 90K-91K zone.

BTCUSD SHOWING A GOOD UP MOVE WITH 1:7 RISK REWARD BTCUSD SHOWING A GOOD UP MOVE WITH 1:7 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:10 RISK REWARD BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:10 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

BTCUSDENTRY TARGET SL Mention in the chart.

ALWAYS TAKE TRADE WITH CONFIRMATION

Note : Trading in any financial market is very risky. I post ideas for educational purpose only. It is not financial advice. Do not hold us responsible for any potential loss you may incur. Please consult your financial adviser before trading.

BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:7RISK REWARD BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:7 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you