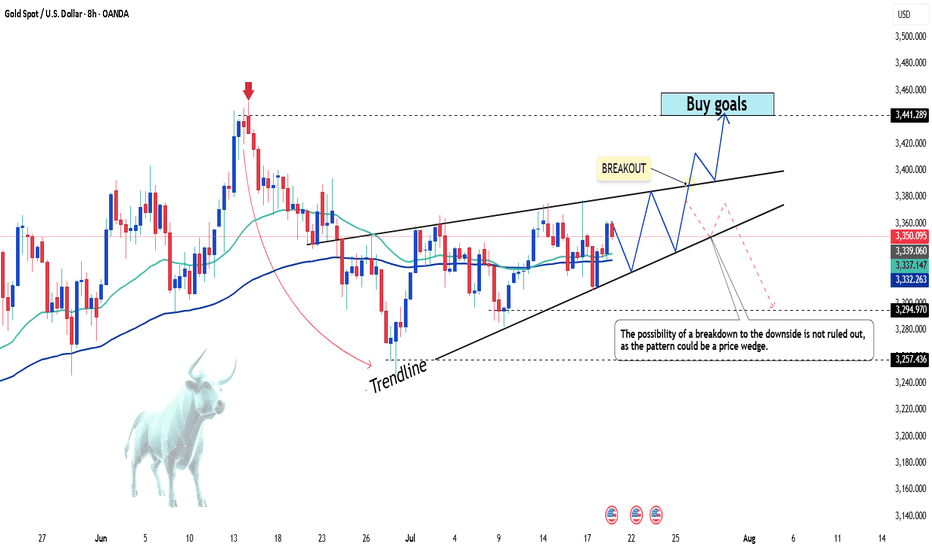

XAUUSD – final bounce before the drop?Gold is trapped in a sideways box, and the bounce from the $3,330 zone looks like nothing more than a technical reaction – with no strong buying momentum. The dense cluster of FVGs signals that selling pressure hasn’t been fully absorbed yet.

Fresh data from the U.S. strengthens the bearish case: jobless claims have hit a 3-month low, indicating a resilient labor market. This paves the way for the Fed to keep rates steady at 4.25–4.50%. Meanwhile, Trump’s tariff policies are stoking inflation risks.

If gold fails to break above $3,437 in the next few sessions, sellers may step in aggressively. In that case, the next target could be $3,280.

Buy!!

Latest Gold Price Update TodayIn the most recent trading session, global gold prices dropped over 31 USD per ounce, closing at 3,337 USD. This sharp decline follows a three-day rally and reflects profit-taking by investors and a shift in capital flow.

Newly released economic indicators show that the U.S. labor market remains strong, with jobless claims falling for the sixth consecutive week — the longest streak since 2022. This helped the U.S. dollar rebound slightly, putting pressure on gold, a non-yielding asset.

At the same time, investor sentiment has tilted toward riskier assets like equities, as trade talks between the U.S., EU, and Japan show positive progress. Stock markets in the U.S. and Europe surged, drawing capital away from gold.

Although expectations remain for a potential Fed rate cut in September, gold faces short-term headwinds. The 3,300 USD zone is now a key level to watch. Traders should look for reversal signals and volume confirmation before considering long entries.

Personal view: USD strength, rising stock markets, and profit-taking are creating a short-term correction for gold. However, in the longer term, there is still upside potential if the Fed signals a policy shift in the coming months.

And you — what’s your take on gold prices today?

BTCUSDT – Ready to Break the Resistance Wall?Bitcoin just made a perfect rebound from the $115,000 support zone and is now gathering momentum toward the $119,097 resistance. While price remains inside the descending channel, price behavior suggests a potential bullish breakout.

Latest news:

Grayscale confirmed an additional $1.2 billion investment into its Bitcoin fund.

The Fed is signaling a possible pause in rate hikes at the upcoming meeting → weakening USD → direct boost for BTC.

Technical outlook:

FVG zones have been filled → selling pressure is fading.

A “bounce – retest – breakout” formation is emerging.

The descending channel is under pressure, and buyers seem to be gaining control.

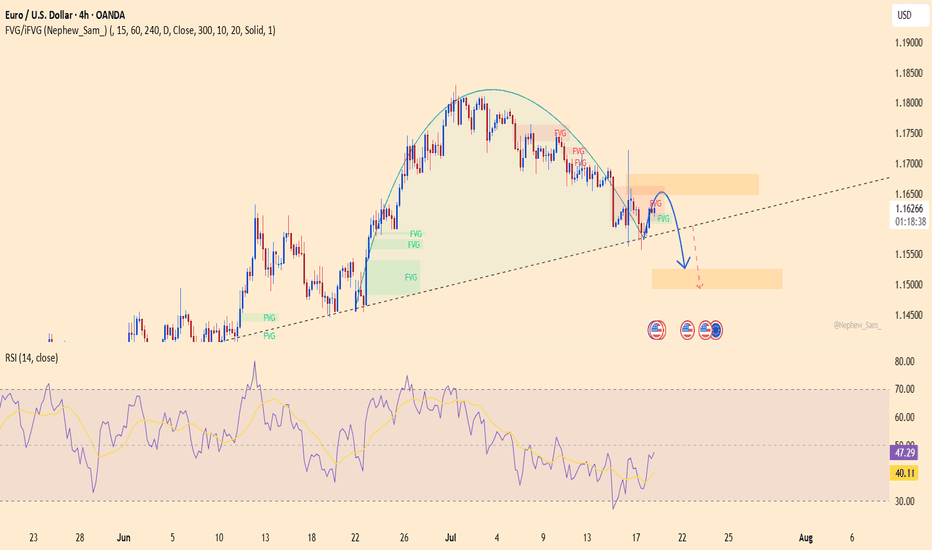

EURUSD: The Rally Was Just a Trap – Bears Are Ready to Strike!After a strong rebound toward the 1.18400 zone driven by short-term optimism, EURUSD is now facing a potential reversal as price stalls within multiple Fair Value Gap zones. The chart reveals weakening bullish momentum, with lower highs forming inside a key resistance area.

Fresh U.S. data: Jobless claims dropped more than expected, giving the USD a solid boost. Meanwhile, the ECB remains hesitant, showing little conviction as Eurozone inflation cools.

A bearish scenario is unfolding: price forms a flag pattern → breaks the ascending channel → targets 1.17300. A break below this level could send EURUSD toward 1.16500 or even lower.

Bulls, beware! This could be a bull trap — and the bears are gearing up for a counterattack.

SELL setup: Look for bearish reversal signals around 1.18300–1.18400. Stop-loss above the high, first target at 1.17300.

XAUUSD: collapse brewingU.S. data keeps hammering gold: Jobless claims dropped sharply, and manufacturing PMI beat expectations — giving the Fed even more reason to keep rates elevated. This weakens gold’s safe-haven appeal.

On the H4 chart, XAUUSD is hovering just above weak support with a clear distribution pattern. Price has been repeatedly rejected near the FVG zone at 3,390 and is trading below the previous high. If it breaks down from this confluence zone, strong selling pressure could drive it down to 3,311 — where the major trendline intersects a previous green FVG zone.

Strategy: Look to SELL if price fails at 3,390 and confirms a breakdown. Target a failed retest and a drop toward 3,311.

One sharp drop could trigger a deeper wave — are you ready?

EURUSD: Bearish Breakdown in SightEURUSD is currently holding above the 1.173 support zone, but the bearish structure is becoming more evident. The downward trendline and nearby resistance have repeatedly rejected price rebounds.

If the support at 1.173 breaks, a sharp move toward the 1.168 target is likely — a key previous low.

Trend: Prefer SELL if a breakdown confirms – low risk, high potential.

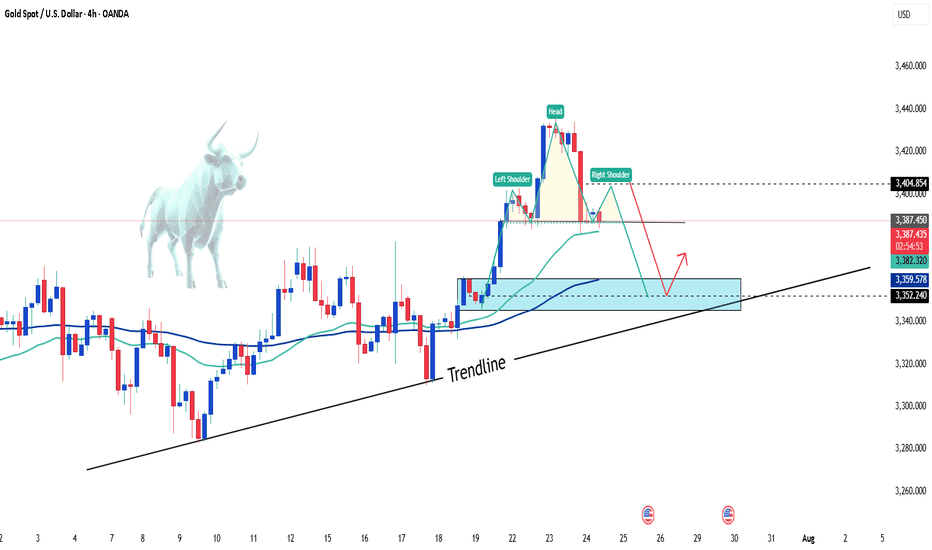

Gold holds steady—Is a breakout above $3,400 next?Gold prices have corrected exactly as we anticipated yesterday. At the time of writing, gold is hovering around $3,370 USD, showing little volatility since the start of the session.

Although the market is undergoing a short-term pullback, I still believe gold remains in a medium- to long-term uptrend. One key reason is the global shift away from the US dollar, with many countries increasing their gold reserves. Meanwhile, the USD is projected to weaken further in the long run. On top of that, if the Federal Reserve indeed begins to ease monetary policy, gold could break above the $3,400 level and potentially set a new record.

In addition, trendline support remains intact—if momentum picks up from here, the bullish trend may soon resume.

Gold takes a break – what's next?After Tuesday’s strong breakout, XAUUSD is now consolidating just as we expected yesterday. The price is hovering around 3,385 USD and is forming a head and shoulders pattern.

Technically speaking: If gold continues to hold the 3,350 USD support zone and the trendline, the bullish outlook remains intact. At this stage, gold is simply "taking a break" before its next move.

I'm still optimistic about gold’s potential — how about you?

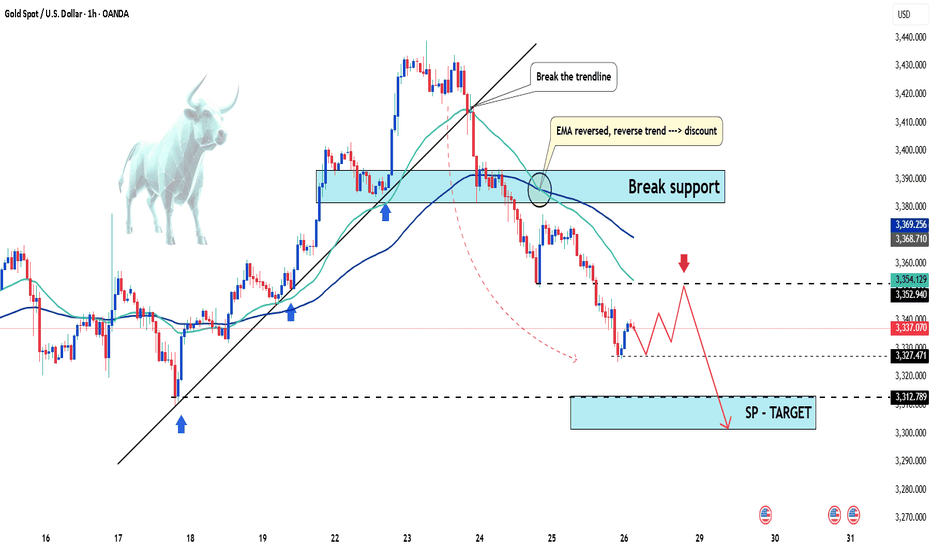

Gold Trading Strategy XAUUSD July 24, 2025Gold Trading Strategy XAUUSD July 24, 2025:

Yesterday's trading session, after rising to the 343x area, created a double-top pattern and fell sharply at the beginning of today's trading session.

Basic news: The EU is close to a 15% tariff agreement with the United States. The yield on 10-year US Treasury bonds fell more than 5 basis points to 4.332% before recovering to 4.364% but is still very low. The US real yield also fell 4.5 basis points to 1.932%.

Technical analysis: Gold prices fell sharply after forming a double-top pattern at the 343x area. RSI H1 is approaching the oversold area; RSI H4 and D1 are currently showing signs of correction to the average line. We will wait for the recovery of gold prices and continue trading at resistance areas.

Important price zones today: 3400 - 3405, 3420- 3425 and 3360 - 3365.

Today's trading trend: SELL.

Recommended orders:

Plan 1: SELL XAUUSD zone 3400 - 3402

SL 3405

TP 3397 - 3387 - 3377 - 3367.

Plan 2: SELL XAUUSD zone 3420 - 3422

SL 3425

TP 3417 - 3407 - 3387 - 3367.

Plan 3: BUY XAUUSD zone 3363 - 3365

SL 3360

TP 3368 - 3378 - 3388 - 3400.

Wish you a safe, favorable and profitable trading day.🌟🌟🌟🌟🌟

XAUUSD – Is a Deep Correction Just Around the Corner?Gold just took a brutal hit, plunging over 3,728 pips in a single session — down 1.10%, marking the sharpest drop in weeks.

Why?

Jobless claims dropped → Labor market too strong

Flash Manufacturing PMI beat expectations → U.S. economy remains resilient

The Fed is likely to keep rates higher for longer → USD strengthens → Gold gets dumped hard.

Currently, price is testing the FVG zone and the channel support. If it fails to hold above 3,363, the next target could be 3,344.5 or even lower.

Strategy: Look for SELL opportunities if price fails to reclaim 3,402.4, followed by a potential break of support and deeper drop.

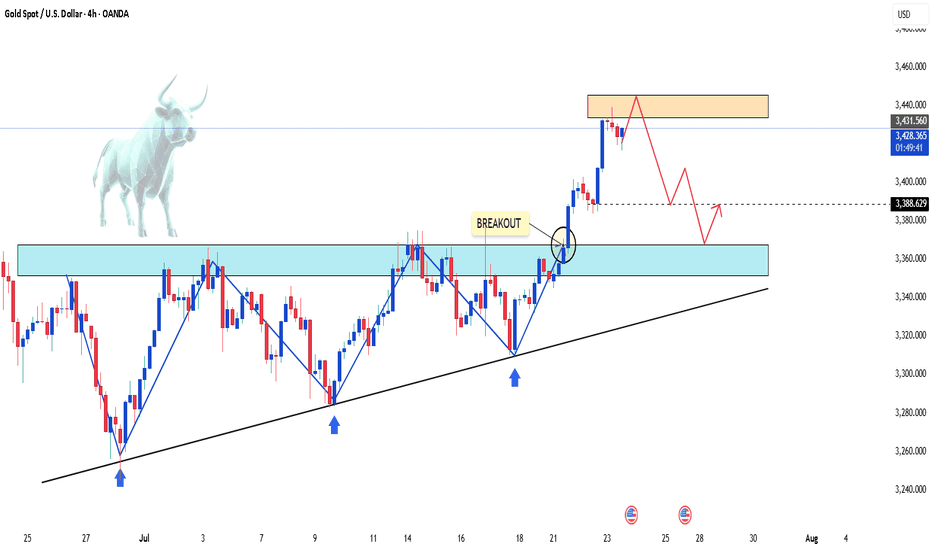

Gold Breaks $3,400 – Bullish Momentum BuildsGold is gaining strong upside momentum, breaking above the $3,400 mark to hit a fresh five-week high.

This sharp rally in the precious metal comes alongside a renewed pullback in the US dollar. Declining Treasury yields across the curve and ongoing trade tensions are also fueling gold’s recovery as a safe-haven asset.

Currently trading around $3,426, gold may see a slight pullback to consolidate before resuming its bullish run.

What’s your take on gold today?

BTCUSDT – Charging Ahead in an Ascending Channel, Eyes on 120K!Bitcoin is gliding steadily within a rising channel, consistently printing higher highs and higher lows. After tagging the 120K psychological zone, price made a healthy pullback to key support and bounced back swiftly — reaffirming buyer dominance.

Price action reveals sustained bullish momentum, especially with key U.S. economic data on the horizon. If risk-on sentiment holds, BTC is well-positioned to break past psychological resistance and unlock the next leg higher.

This pullback? It’s not weakness — it’s a setup. And the market is gearing up for another breakout move.

XAUUSD – When Buying Pressure FadesGold attempted to break above a key resistance zone but quickly lost momentum, signaling that bullish strength is weakening. Meanwhile, strong U.S. economic data continues to support the dollar: the labor market remains robust and manufacturing activity is expanding — giving the Fed more reason to keep interest rates high for longer. This has put downward pressure on gold.

Currently, the market is approaching a critical support area. If this zone breaks, the bearish trend could accelerate further. Price structure no longer shows clear bullish momentum, and any pullbacks appear to be merely technical corrections.

Given this outlook, I favor a SELL setup if price breaks below support. The downside could expand significantly if buyers fail to return. Gold is now standing on the edge — either it holds the range, or a sharp drop may follow.

EUR/USD breaks key trendline – Is a bearish reversal underway?At the start of the week, the EUR/USD pair has officially broken its months-long upward trendline, signaling a potential short-term bearish reversal.

As of now, EUR/USD is trading around 1.169, performing a retest of the broken trendline. If the pair closes below this key level, it may confirm the breakout and open the door for a deeper decline.

Do you agree with my view?

Gold surges with explosive breakoutGold prices launched into a powerful rally yesterday, soaring from $3,350 to nearly $3,400 — a stunning $50 move, equivalent to 500 pips.

This surge was supported by a weakening US Dollar and a drop in the 10-year Treasury yield, which fell to its lowest level in over a week. On the macro front, if the Federal Reserve signals an earlier-than-expected rate cut, the bullish momentum could extend further in the long term.

Technical outlook: The H2 chart reveals a strong breakout after gold successfully breached the $3,372 resistance zone ( as highlighted in yesterday’s strategy ). Price is now completing a pullback, which may serve as the base for the next bullish wave.

Do you agree with this view? Share your thoughts and let’s discuss together.

Good luck with your trades! ✨

Gold XAUUSD Trading Strategy on July 22, 2025Gold XAUUSD Trading Strategy on July 22, 2025:

Yesterday's trading session, gold prices rebounded strongly from the 3345 area to the 3402 area after the previous multi-timeframe compression.

Basic news: President Donald Trump's trade stance towards Europe became tougher; Europe plans to develop a retaliation plan.

Technical analysis: After the previous multi-timeframe compression, gold prices rebounded strongly again. The previous resistance zone of 3365 - 3370 has now become a support zone for gold prices. Currently, a strong uptrend is showing in multiple timeframes. However, the RSI on the H1 frame is currently quite overbought, we will wait for a correction to the support zone to trade.

Important price zones today: 3365 - 3370, 3347 - 3352 and 3422 - 3427.

Today's trading trend: BUY.

Recommended orders:

Plan 1: BUY XAUUSD zone 3365 - 3367

SL 3362

TP 3370 - 3380 - 3400 - 3420.

Plan 2: BUY XAUUSD zone 3347 - 3349

SL 3344

TP 3352 - 3362 - 3372 - 3400.

Plan 3: SELL XAUUSD zone 3425 - 3427

SL 3430

TP 3422 - 3412 - 3402 - 3382 (small volume).

Wish you a safe, favorable and profitable trading day.💯💯💯💯💯

XAUUSD – The bullish surge isn't over yetGold just delivered an impressive breakout of nearly 500 pips on July 21, fueled by a weakening USD as U.S. housing and manufacturing data showed signs of slowing down. With a bleaker economic outlook and growing expectations that the Fed may cut interest rates in Q4/2025, investors are flocking back to safe-haven assets – and gold is shining bright.

Technically, XAUUSD remains firmly within a clearly defined ascending channel, with price action bouncing sharply off dynamic support. The metal is currently consolidating around the 3,400 zone – if buyers can hold this ground, the door toward 3,440 and beyond could swing wide open.

As long as gold holds above 3,347, bulls remain in full control. This might just be a healthy pullback before the next leg up – don’t miss out as the market gains momentum!

BTCUSDT – Rebounding from Fair Value Zone! Is the Bull Run Back?Bitcoin is building a strong base around the FVG support zone after rejecting the resistance trendline twice in a row. The current price structure is a textbook bullish setup: pullback – retest of liquidity zone – accumulation – and now prepping for a strong breakout.

Fair Value Gaps have been consistently filled and are acting as dynamic support, signaling that buyers are still in full control. RSI remains steady and not overheated – creating perfect conditions for a breakout.

Target: The 125,910 USDT area is the next clear price objective if BTC holds above the 116,082 USDT support zone.

Fundamental Catalyst: The crypto market is regaining strength after BlackRock officially confirmed its plan to expand its crypto ETF products – investor sentiment is back on the bullish side.

Gold Price Soars Today Amidst USD WeaknessGold prices surged unexpectedly today, surpassing the 3,350 USD/ounce mark, thanks to the weakening of the USD and falling U.S. Treasury yields. Concerns over U.S. President Donald Trump's unpredictable trade policies have also fueled demand for the precious metal as a safe haven.

Despite gold dipping several times near the 3,300 USD/ounce level in recent days, the support from bargain hunters and the continued demand for gold as a safe investment has helped maintain its high price. If this upward momentum continues, gold may soon break through the next resistance level, with 3,372 USD being the immediate target.

EURUSD – Trend broken, bearish momentum accelerating!EURUSD is maintaining a clear downtrend structure within a well-defined descending channel, with consistently lower highs forming. Fair Value Gaps (FVGs) keep getting rejected, signaling that sellers are firmly in control. The current scenario points to a technical bounce toward the 1.164 zone, followed by a likely rejection back down to the lower boundary near 1.148.

Technical signals confirm the bearish bias as price respects both the trendline and the supply zones, failing to break above recent resistance levels.

On the fundamental side, the ECB has recently struck a more dovish tone due to cooling inflation, while the USD is regaining strength amid expectations that the Fed will keep rates elevated longer — all of which continue to pressure the euro lower.

XAUUSD – Breakout or Continued Accumulation?Gold continues to respect a solid bullish structure within an ascending price channel. After a healthy pullback from recent highs, the price has retested a key technical support area and is showing signs of a strong rebound.

Current price action reveals that the market is respecting both the FVG zone and the rising support line—clear signals that smart money is still leaning toward the buy side. The next bullish targets lie around the upper resistance zone.

From a macro perspective, weaker-than-expected U.S. retail sales have placed downward pressure on the dollar, fueling speculation that the Fed may soon pivot toward easing. This adds momentum to gold’s upside potential.

Gold Prices Rise Amidst USD WeaknessAmong precious metals, prices are increasing due to the weakening of the USD. There are no negative scenarios for gold in the medium term, considering the current developments: US government spending is out of control, ongoing trade tensions, uncertain inflation, and increasing criticism aimed at the Fed.

As of the time of writing, gold has risen by 0.3% in the past 24 hours, equivalent to an increase of 100 pips, currently trading at 3,350 USD.

The current environment is highly favorable for gold, especially as investors lose confidence in the stability of US monetary policy. If the Fed begins to concede to political pressure, gold prices could break previous highs and head toward 3,440 USD/ounce in the short term.

Do you agree with this view?

EURUSD on the verge – a trap waiting for the carelessThis pair has just completed a classic rounding top, with a sharp rejection near 1.16500. Buying momentum is fading, RSI is dropping, and the recent retest of the broken trendline might have been the final warning – the “kiss of death” could already be in play.

On the fundamental side, the U.S. keeps fueling the dollar: consumer spending is rising, jobless claims are falling, and the Fed shows no sign of easing up. Meanwhile, the ECB is still searching for direction, leaving the euro exposed and vulnerable.

If the current support level breaks, EURUSD could slide quickly to lower zones. This is no longer a time for hope – it’s time to choose a side and act.